[ad_1]

As 2023 begins, it’s clear many lenders are at a metaphorical fork within the highway in relation to devising sensible, agile collections methods that can safeguard their clients and cement long-term loyalty, just by serving to them journey out the affect of the continuing squeeze on family incomes.

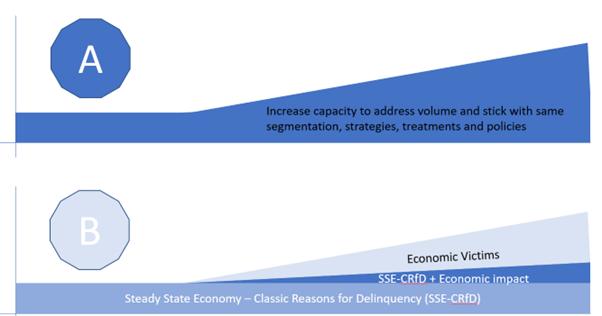

Let’s take a look at the 2 paths many lenders are taking:

Route A will take lenders down a dead-end highway to mass collections and buyer insolvency. It is a mounted and unyielding lending technique based mostly on merely growing back-office capability to deal with excessive volumes of pre-set segmentations, methods, therapies and insurance policies. It is also a quick path to sizeable delinquency, losses and write-offs.

Route B gives a much more agile and holistic route, it really works by easing clients out of the present spending crunch. By analysing, calling out and catering for the differing ‘return to good’ profiles of the three headline cohorts, lenders can adapt therapies to greatest swimsuit every section.

For the 2 cohorts which have fallen foul of the present financial headache, sensible therapies embrace adjusting default and write-off insurance policies to make sure they get an opportunity to return to kind, altering the phrases and goals of debt sale and contingency placement contracts, whereas additionally reviewing and aligning assortment and forbearance options.

Managing expectations across the completely different impairment time collection for every cohort buys extra time to allow them to get again to a stable monetary footing, quite than forcing them down a delinquents’ path of no return.

Expertise additionally reveals that setting targets for the retention of future good clients is a helpful method to safeguard portfolios and win long-term shopper loyalty. In truth, near-term outcomes ought to converse for themselves, with a well timed contribution to profitable mitigation of the price of dwelling and financial crises, suitably excessive ongoing steadiness sheet yields and a rising market share of happy clients.

Intuitive And Good Collections Methods to Provide Buyer Safeguards

None of this considering is revolutionary. There are actually 4 elements shaping analytic insights, technique, coverage and execution in relation to profitable and agile collections.

Over the past recession, we discovered that clients who went into collections completely as a consequence of the financial downturn, had a dramatically completely different return to monetary good (RtFG) of 9 months, in comparison with the two.5 years it took typical collections clients. It’s an space FICO has already analysed.

Customers hit completely by an financial downturn – so-called financial victims – usually are embarrassed, involved and object to being in an arrears’ scenario. In truth, they are going to do no matter it takes to get again to their definition of ‘regular’. As soon as a path to creditworthiness is redefined, they’re typically reluctant to compromise on their pre-agreed monetary plans.

Proper now, it’s honest to say the overwhelming majority of shoppers swelling the collections queue will even be financial victims. There’s an obligation to ask whether or not sufficient is being accomplished to optimize assortment methods whereas placing within the work to assist clients in a time of want. As an example, are you able to:

Precisely profile and establish financial victims?

Regulate insurance policies, assortment methods and remedy paths to swimsuit accordingly?

Apply the fitting stage of tolerance to constantly drive the fitting outcomes?

Don’t Let Credit score Coverage Turn into a Driver of Delinquency

There’s all the time been a necessity for insurance policies, however they will also be used as a handy cowl for ignorance. If a lender is sufficiently well-informed about their buyer, a greater and extra acceptable remedy must be out there past the stringent guardrails imposed by an historic coverage. Collections insurance policies usually impose a mixture of any of the next circumstances:

The shopper should be in a position pay not less than one full arrears instalment.

Any promised fee should be made inside 10 days.

Reimbursement plans can’t exceed six months or multiple plan per yr.

A most three-month extension can solely be supplied as and when it’s acceptable.

Just one fee vacation per yr is allowed.

A brief settlement of a most 20% is appropriate.

In truth, most of those insurance policies merely fail to precisely match the circumstances many shoppers discover themselves in. Whereas one buyer would possibly be capable of afford half a contractual instalment, one other can afford one and a half occasions their instalment. One other buyer could solely want a two-month extension, however one other might have 4 months. One buyer may be on the finish of their credit score time period however haven’t any future supply of revenue whereas having different repayments totally updated. One other would possibly solely have one product however be at the start of a long-term credit score settlement — a 20% settlement for both of those is more likely to be fully mistaken in each situations.

Agility, Flexibility and Well timed Communications Are Keys to Unlocking Success

With out correct insights to find out the fitting outcomes insurance policies merely change into the default decision-maker. However insurance policies drive the mistaken final result far too typically.

Leveraging current capabilities that drive the info and analytic insights wanted for customer-centric decisioning is by far the simplest method to maximise the worth of an agreed final result for each the shopper and creditor and to the satisfaction of the regulator. Well timed, omni-channel communications will provide assist to at-risk and burdened clients.

No matter whether or not a regulator desires to see proof of proper final result, or the corporate’s boardroom desires to make sure the constructive worth of acceptable buyer remedy, it is going to all the time be essential to leverage the perfect knowledge, analytics, insights, choice execution and reporting capabilities that exist right this moment. If it’s not attainable to precisely establish and strategize for the remedy of financially burdened clients, then in all probability they’re being misplaced at scale.

Dangerous Forbearance Prices

The worldwide pandemic has clouded the readability round buyer threat that was anticipated to be offered partially by way of reporting beneath IFRS 9. In most markets, the response hinged on monetary safety to each society and enterprise. It ran for the primary full interval of reporting beneath IFRS 9, prompting many discussions about the actual diploma of threat.

However the broadly predicted tidal wave of debt didn’t materialise, because of the monetary protections that have been granted to customers, whereas collections portfolios have been lowered as lockdowns restricted discretionary spending, permitting a larger stage of debt servicing.

Now, the rising financial downturn is being aggravated by a mixture of inflation, rates of interest and rising vitality prices. The fiscal safety is not going to be the identical as offered in the course of the pandemic. In consequence, lenders’ collections’ books are already rising.

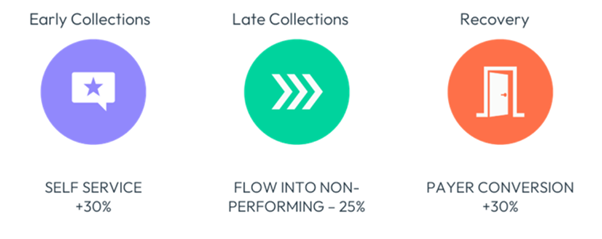

Collectors that don’t have scalable and agile orchestrated digital channels will wrestle to handle the excessive quantity of exercise already rising on the pre-delinquency and early collections’ levels. In truth, some clients will get pushed to Stage 2 and Stage 3, just because the amount of late-payers merely can’t be successfully managed, quite than as a result of the danger is larger for these clients.

Situations of shoppers being given the mistaken collections or forbearance resolution on the outset are more likely to have a big knock-on impact with increased volumes defaulting. It’s a scenario that may solely be resolved by way of the dynamic, acceptable and sensible use of information, analytics and insights to assist inform therapies. People who fail to allow the required capabilities is not going to establish high-quality clients, will deal with all consistent with pre-set insurance policies and shall be unable to proof or provide the fitting therapies.

Two-way digital dialogue is important to serving to clients keep away from default and delinquency

Price-Efficient Collections Ways

Volumes are unlikely to be well-managed at an affordable value if pre-delinquency and early collections are predominantly handled by name centres. The supply of bi-directional, omnichannel platforms and the very clear proof of adoption by society actually name into query any collections store that also has a heavy reliance on an inbound line and outbound dialler; sure, they’ve their place, however they need to be seen as serving a tiny minority of shoppers, with digital auto-resolution / self-service taking care of the overwhelming majority.

Organisations which can be in a position to apply insights and decide acceptable motion to make sure the fitting final result for the quite a few buyer segments could have or be on the lookout for extra capabilities to make sure they’ll place collections as a aggressive benefit.

When contemplating the go-forward segmentation, methods, vary of forbearance options and means to find out the fitting outcomes, reflecting on the previous classes discovered will guarantee extra success.

How FICO Can Assist with Pre-Collections and Knowledgeable Collections Methods

[ad_2]

Source link