[ad_1]

Consistent with what was anticipated within the earlier weekly technical observe, the Indian fairness markets witnessed profit-taking bouts from increased ranges together with spikes within the volatility that’s hovering round certainly one of its lowest ranges of current months. It was additionally anticipated that the present uptrend would possibly stand disrupted and the markets might slip underneath corrective consolidation. The buying and selling vary once more bought narrower; towards 499 factors within the week earlier than this one, the NIFTY oscillated in a 232.75 factors vary. Although the directional bias on both facet was not dominant, the general transfer stayed with an inherently destructive bias. The headline index closed with a web lack of 88.70 factors (-0.45%) on a weekly foundation.

Regardless of sluggish retracements from the excessive level, from a technical perspective, the degrees of 19991 have now turn out to be a short lived prime for the markets. The VIX additionally spiked; regardless of the on-and-off nature of the transfer, the volatility as represented by INDIAVIX surged by 8.99% to 11.52. Regardless of the surge, it stays at one of many lowest ranges seen in current months and continues to depart the market susceptible to corrective strikes and violent profit-taking bouts from increased ranges. Following this corrective transfer, the NIFTY has dragged its resistance decrease to 19700-19750 ranges; any technical pullbacks will discover resistance on this zone.

We’ve a truncated week developing with August fifteenth can be a buying and selling vacation on account of Independence Day. The markets are prone to begin the week on a quiet observe and exhibit tentative habits all through the week. The degrees of 19580 and 19650 are prone to act as potential resistance factors; the helps will are available in at 19350 and 19200 ranges.

The weekly RSI is 65.69; it stays impartial and doesn’t present any divergence towards the worth. The weekly MACD is bullish and stays above the sign line. An inside bar occurred; the present bar has a decrease excessive and a better low as in comparison with the earlier bar.

Going by the sample evaluation and searching from a short-term perspective, a directional transfer ought to happen above 19750 or under 19300 ranges. Till both of those ranges is taken out, anticipate the markets to proceed to consolidate in an outlined vary.

All and all, some risk-off sentiment is prone to prevail within the markets. The historically defensive pockets like Pharma, Consumption, IT, PSE, and many others., are prone to show resilient efficiency. It’s strongly really helpful to keep away from aggressive exposures and keep extraordinarily stock-specific whereas approaching the markets. Whereas holding leveraged positions at modest ranges, a cautious and selective strategy is suggested for the approaching week.

Sector Evaluation for the approaching week

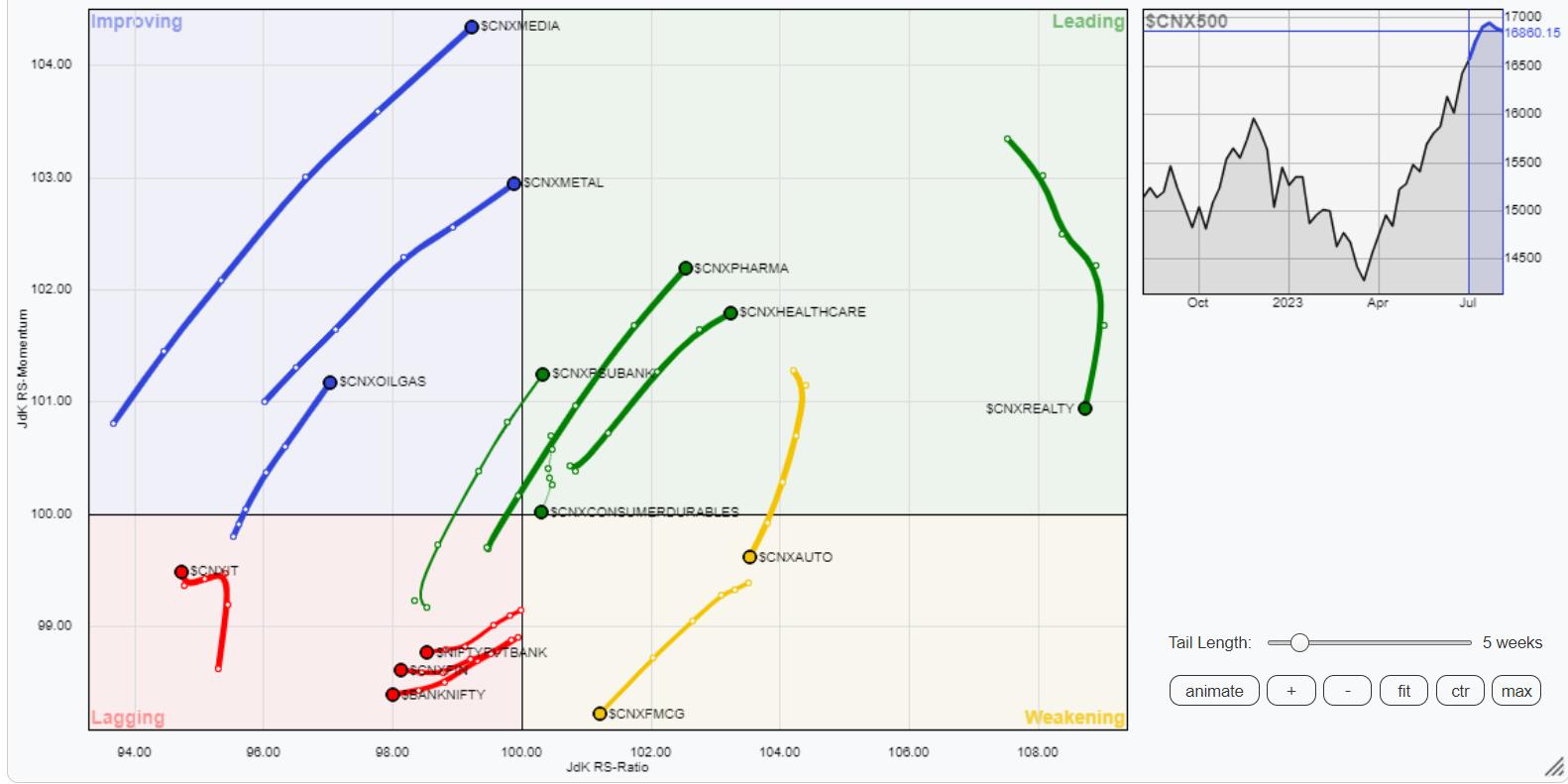

In our have a look at Relative Rotation Graphs®, we in contrast varied sectors towards CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all of the shares listed.

The evaluation of Relative Rotation Graphs (RRG) reveals that Infrastructure Index and PSU Financial institution Index have rolled contained in the main quadrant. In addition to this, the Midcap 100, Realty, and Pharma indices are additionally positioned contained in the main quadrant. These teams are prone to comparatively outperform the broader NIFTY500 Index.

NIFTY Auto, Consumption, and FMCG indices are contained in the weakening quadrant. The PSE Index can be contained in the weakening quadrant however it’s seen bettering on its relative momentum.

Nifty Monetary Providers and Nifty Financial institution index are seen languishing contained in the lagging quadrant. The commodity, IT, and Providers sector indices are additionally contained in the lagging quadrant however they look like bettering on their relative momentum towards the broader markets.

The Media, Metallic, and Power indices are contained in the bettering quadrant; they’re seen rotating favorably within the northeast route and will proceed to raised their relative efficiency towards the broader markets.

Vital Be aware: RRG™ charts present the relative energy and momentum of a gaggle of shares. Within the above Chart, they present relative efficiency towards NIFTY500 Index (Broader Markets) and shouldn’t be used instantly as purchase or promote indicators.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

www.EquityResearch.asia | www.ChartWizard.ae

Milan Vaishnav, CMT, MSTA is a capital market skilled with expertise spanning near 20 years. His space of experience contains consulting in Portfolio/Funds Administration and Advisory Providers. Milan is the founding father of ChartWizard FZE (UAE) and Gemstone Fairness Analysis & Advisory Providers. As a Consulting Technical Analysis Analyst and together with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Impartial Technical Analysis to the Purchasers. He presently contributes every day to ET Markets and The Financial Occasions of India. He additionally authors one of many India’s most correct “Every day / Weekly Market Outlook” — A Every day / Weekly Publication, at the moment in its 18th yr of publication.

Study Extra

[ad_2]

Source link