[ad_1]

In case you are an HDFC Bank card consumer, you will need to have heard of ‘SmartBuy’. Nevertheless, you probably have not been utilizing your card right here, you’re most probably dwelling below a rock by not maximizing the excessive rewards awaiting you!

HDFC Financial institution is in style for providing among the finest bank cards in India. You might discover a card appropriate in your spending patterns throughout journey, procuring, premium advantages, or a card with distinctive worth again through rewards or cashback. Nevertheless, moreover the rewarding options and advantages, what’s extra worthwhile, is the issuer’s rewards redemption portal- SmartBuy. By utilizing an HDFC card on SmartBuy customers can earn accelerated rewards as much as 10X factors, and a redemption worth as excessive as 1 rupee per level.

In easy phrases, SmartBuy is a rewards market, the place you should use your card to both earn or redeem reward factors. The advantages on the portal are prolonged throughout a number of classes like procuring, journey, eating, and so forth, related to main day-to-day and luxurious manufacturers. By way of SmartBuy, the issuer has simplified maximizing reward advantages for customers, by providing all ongoing offers and reductions at a single platform.

Options corresponding to exponential rewards, distinctive product catalog, tie-up with sensible manufacturers and simplified redemption course of, marks HDFC SmartBuy as among the finest rewards incomes and redemption portals. By utilizing the HDFC card on SmartBuy, one can derive the utmost worth again on their bank card transactions. However how? Learn on to know extra.

Unique Card Affords from India’s high banks are only a click on away

Edit

Error: Please enter a legitimate quantity

Test Affords

Whereas SmartBuy is in style for rewards redemption, it’s also possible to earn accelerated rewards right here to double up your financial savings. With some playing cards, largely premium ones like Infinia, Regalia, and so forth, chances are you’ll earn direct accelerated rewards by making procuring and journey transactions on SmartBuy. Alternatively, some may require an extra effort to make a voucher buy through Gyftr, and earn rewards on the voucher.

Gyftr is an extension of the SmarBuy portal, you should buy an on the spot voucher as per your model preferences, and earn accelerated rewards.

Direct Accelerated Rewards: Should you personal any of the playing cards listed under, you’ll be able to instantly store or make journey bookings through the cardboard and earn as much as 10X factors for the transactions.

HDFC Credit score Card

Normal Reward Function

Reward Function on SmartBuy

HDFC Diners Membership Privilege Credit score

4 reward factors on each Rs.150 spent

Earn as much as 10X reward factors on spends through SmartBuy

HDFC Infinia Credit score Card

5 reward factors on each Rs.150 spent together with spends on Insurance coverage, Utilities and Schooling

As much as 10 occasions reward factors in your journey and procuring spends on SmartBuy

HDFC Diners Membership Black

5 reward factors for each Rs. 150 spent

As much as 10X reward factors through SmartBuy

IRCTC HDFC Financial institution Credit score Card

5 reward factors per Rs. 100 spent on IRCTC Ticketing Web site/ Rail Join App

Further 5% cashback on Practice ticket reserving through HDFC Financial institution SmartBuy

As an alternative of common purchases, making purchases on SmartBuy may help you earn most rewards. For example, let’s assume you utilize your HDFC Infinia Credit score Card for a journey reserving of Rs. 30,000, through a web-based journey portal MakeMyTrip. Right here, as per the bottom reward construction provided on the cardboard, you’ll earn 5 reward factors on each Rs. 150 spent, thus, you’ll earn 1,000 factors right here. Nevertheless, using the identical card for journey reserving on SmartBuy might fetch you 10x reward factors, thus, 10,000 reward factors as per 50 factors on each Rs. 150 spent.

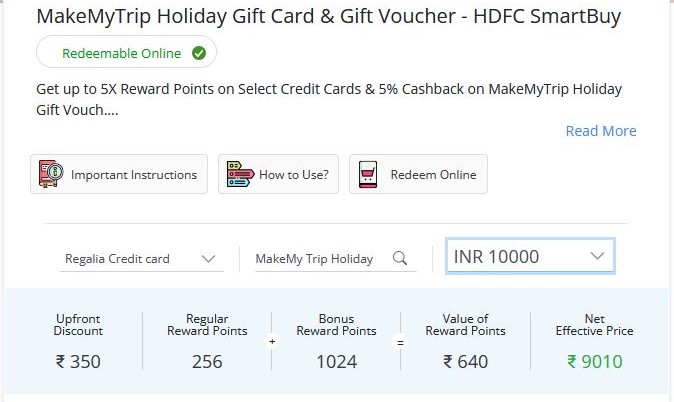

Accelerated Rewards through Voucher buy by way of Gyftr

If you don’t personal a card providing direct rewards on SmartBuy, you’ll be able to nonetheless earn accelerated rewards in your HDFC card through Gyftr. Right here, you’ll be able to entry a variety of on the spot vouchers from high manufacturers throughout electronics, magnificence, leisure, vogue, journey, eating, house and furnishings and so forth. On buying a voucher you get an upfront low cost, common reward as provided in your card, plus the bonus rewards provided on making a Gyftr buy. The bonus rewards provided can vary as much as 10x rewards. Nevertheless, not like most often, the reward factors should not credited to your card account, however are adjusted by providing you an on the spot voucher at a reduced value. For example, a voucher value Rs. 10,000 might price you Rs. 9,010, after relevant upfront low cost, and worth of common and bonus reward factors.

For higher understanding, contemplate the instance acknowledged under, as derived from an actual time supply on Gyftr for HDFC Regalia Credit score Card.

Right here be aware that with HDFC Regalia you get 4 reward factors on each Rs. 150 spent, thus, for Rs. 9,650 (10,000 – upfront low cost of Rs. 350), you get 256 factors. Nevertheless, on this transaction, you additionally earn 1024 bonus reward factors through SmartBuy for buying a voucher at Gyftr. Thus, you clearly earn 4X reward factors right here, as 1024 bonus rewards on this class. In whole you earn 1280 rewards, which might be collectively redeemed at a price of 1 reward level=Rs. 0.50 in providing you a decrease discounted value.

Notice: Rewards and redemption worth might differ from card to card, and supply to supply.

HDFC Playing cards has an edge over different bank cards available in the market, resulting from its versatile and extremely useful rewards redemption course of. You get to redeem your collected reward factors throughout a number of choices corresponding to model vouchers, airmiles, cashback, flight and lodge bookings and so forth. When you have premium playing cards like Infinia, Regalia, Diners Membership Black or Privilege; together with the direct accelerated rewards it’s also possible to entry distinctive redemption catalogs, corresponding to Eating catalog for Diners Membership Privilege or Gold Catalog for Regalia Gold.

You will get a excessive redemption worth as excessive as Rs. 1 for every reward level, however it might differ from card to card, as listed within the desk under:

Worth of 1 HDFC Reward Level towards Various Redemption Choices

Credit score Card

Product Catalog (in Rs.)

Unified SmartBuy (in Rs.)

Cashback (in Rs.)

Airmiles

Unique Catalog

(in Rs.)

HDFC MoneyBack Credit score Card

As much as 0.25

0.2

0.2

0.25

–

HDFC MoneyBack+ Credit score Card

0.25

0.25

0.25

0.25

–

HDFC Millennia Credit score Card

As much as 0.30

0.30

1

0.30

–

IndianOil HDFC Financial institution Credit score Card

As much as 0.20

–

0.20

–

–

HDFC Regalia Credit score Card

As much as Rs 0.35

0.5

0.20

0.5

–

HDFC Regalia Gold Credit score Card

As much as Rs. 0.35

0.5

0.20

As much as 0.5

Unique Gold Catalog on choose Premium manufacturers at a worth of 1 RP = Rs 0.65

HDFC Diners Membership Privilege Credit score Card

As much as Rs 0.35

0.5

0.20.

–

Unique Privilege Eating Catalog on choose Eating places at a worth of 1 RP = Rs 0.50.

HDFC Infinia

As much as Rs 0.50

1

0.30

1

Apple merchandise and Tanishq vouchers at a worth of 1RP = Rs. 1

HDFC Freedom

0.15

0.15

0.15

0.15

–

HDFC Diners Membership Black

As much as 0.50

1

0.30

1

–

HDFC Diners ClubMiles

As much as 0.35

0.50

0.20

1

–

IRCTC HDFC Financial institution Credit score Card

–

1 (for practice ticket bookings)

–

–

–

Notice: SmartBuy redemption shouldn’t be relevant on sure co-branded HDFC Bank cards like Intermiles HDFC Credit score Playing cards, Tata Neu HDFC Playing cards, Swiggy HDFC Credit score Playing cards, and HDFC IndiGo Credit score Playing cards.

Essential Issues to Notice:

All playing cards should not eligible for incomes accelerated rewards on SmartBuy.

Should you personal an HDFC cashback bank card, you’re provided cashback as ‘cashpoints’, which perform the identical as reward factors.

Reward redemption choices on HDFC co-branded playing cards are particular to the related manufacturers, and should differ from common SmartBuy choices.

Product vouchers on Gyftr, might supply various worth for various HDFC bank cards. An identical voucher might earn you 4X rewards on one card, and 2X rewards on one other.

The suitable playing cards record for a Gyftr voucher might differ occasionally, and voucher to voucher.

Earlier than incomes or redeeming reward factors, you will need to maintain a verify on the utmost rewards capping for a day or month, and minimal transaction worth requirement for incomes rewards.

For journey bookings through SmartBuy, verify the utmost restrict on fee through rewards. Most often, it’s 70% of the reserving quantity, that means you’ll be able to pay 70% through reward factors redemption, and relaxation to be paid through your bank card.

(i) Give attention to reward depend and most reward worth: Spend essentially the most on the accelerated class, and redeem the place you earn the utmost worth again. For example, for those who personal a HDFC Millennia Credit score Card, make the most of the cardboard for optimum spends at related associate brands- Amazon, BookMyShow, Cult.match, Flipkart, Myntra, Sony LIV, Swiggy, Tata CLiQ, Uber and Zomato, to earn 5% cashback (provided as cashpoints.) Now for those who spend Rs. 20,000 on these manufacturers collectively, chances are you’ll earn round 1,000 money factors in a month. These can give you an equal worth again at a ratio of 1:1, when redeemed towards assertion stability.

(ii) Give attention to the spending class: Use your card to spend for classes that earn you the utmost worth again. For example, it’s higher to make use of your HDFC Infinia bank card for journey bookings, than every other card you personal, as a result of (i) you earn accelerated rewards (ii) you get a excessive redemption worth for direct journey bookings and flight conversion into air miles.

Let’s assume you spent Rs. 30,000 for direct journey bookings on SmartBuy. Right here you get 10,000 factors. Now for those who redeem these 10,000 factors for airline conversion, you get a 1:1 profit. Assuming you change the airways to Membership Vistara loyalty factors, you’ll be able to ebook direct flight tickets from Mumbai to Bangalore by using particular factors , as follows:

Financial system Class- 4,500 CV factors

Premium Financial system- 7,000 CV factors

Enterprise Class- 15,000 CV factors

Thereby, with 10,000 factors in your Infinia card, you’ll be able to avail as much as 2 economic system class flight tickets, or 1 premium economic system ticket, or 1 Enterprise Class ticket (by paying the remaining stability).

The redemption worth of CV Factors is taken from Vistara Airways web site as of October 12, 2023. That is topic to vary on the airline’s discretion. Furthermore, we now have given the instance based mostly on Mumbai to Bengaluru one-way flights; the purpose requirment might differ on selecting different locations or for connecting flights.

(iii) Avail as many bonus reward factors as attainable: Strive placing most of your bills in your bank card to satisfy the milestone profit standards that might fetch you bonus reward factors. Some playing cards may additionally give you bonus factors through card activation, topic to spend based mostly situation, inside a sure variety of days.

(iv) Select the Proper Credit score Card: You possibly can solely derive the utmost worth again along with your bank card, once you earn rewards on most of your spends. For that, you will need to select a card that matches finest along with your spending patterns and preferences.

Let’s assume , you store quite a bit at Marks & Spencers and Myntra, thus, selecting a card that may give you accelerated rewards right here, may help you earn the utmost rewards in your main spending class. Thus, HDFC Regalia Gold might be the most effective suited card right here. As per you wants and preferences, you’ll be able to examine a number of playing cards, shortlist the most effective suited ones, and in the end select the fitting card that matches all of your necessities associated to charge costs, complimentary options, rewards on accelerated class and so forth.

The publish HDFC SmartBuy: Probably the most rewarding platform for HDFC card customers appeared first on Examine & Apply Loans & Credit score Playing cards in India- Paisabazaar.com.

[ad_2]

Source link