[ad_1]

FICO just lately hosted an Auto MasterMind occasion on the Ritz Carlton in downtown Dallas, Texas. The day was an enormous success, with skilled audio system and attendees from lots of the nation’s high automotive finance corporations.

Listed below are the main matters coated and key takeaways from this auto finance business occasion.

2023 Auto Finance Business Survey Outcomes

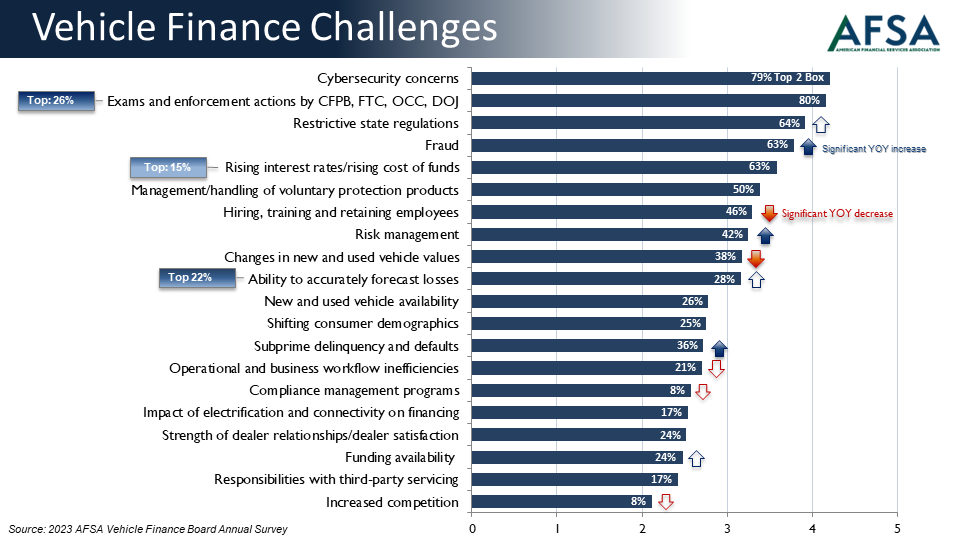

Current findings from the 2023 AFSA Automobile Finance Board Annual Survey present that the highest challenges for the auto business and auto finance embody: cybersecurity issues, exams and enforcement actions (by the CFPB, FTC, OCC, and DOJ), restrictive state rules, fraud, and rising rates of interest.

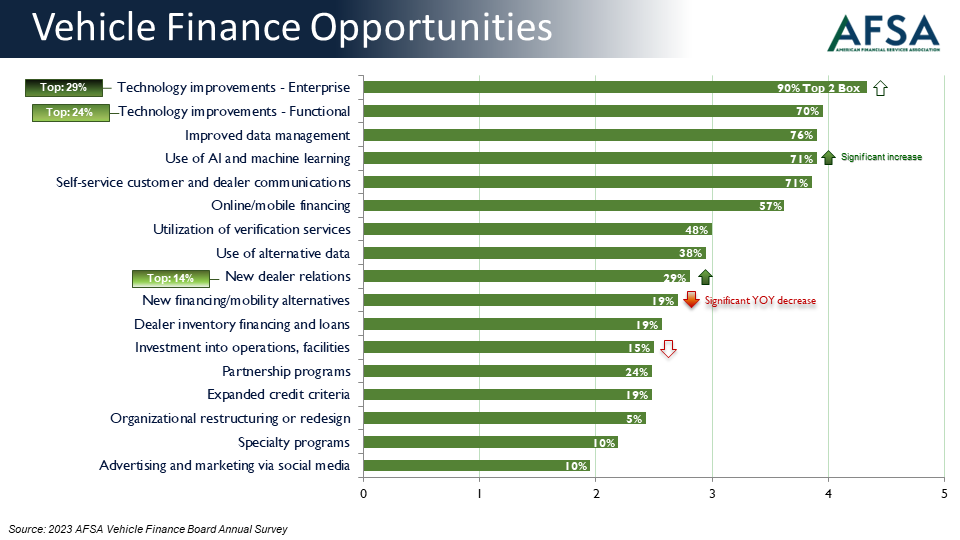

Regardless of the risky economic system and political uncertainty, there are a variety of alternatives inside the auto mortgage financing business, together with: expertise enhancements (enterprise and useful), higher information administration, using AI and machine studying, and self-service buyer and seller communications.

How Will AI Evolve for the Automotive Finance Business?

There’s been quite a lot of hype round AI currently and lenders throughout industries have been making large investments in any such expertise. However how will the event of AI have an effect on the auto mortgage financing business particularly?

The most important areas the place AI will possible affect auto lenders are in coverage, automation, and fraud. Nonetheless, there are a number of the way that we are going to see AI evolving inside the lending area – together with operational effectivity, buyer communications, and digital collections methods.

Applied correctly, AI will be capable to assist auto mortgage corporations make smarter lending choices relating to danger and compliance, in addition to determine prospects earlier than they default. Ahead-thinking auto lenders are integrating AI with their legacy programs and incorporating AI into decisioning fashions to optimize their buyer administration, care, and improvement.

The aggressive auto finance panorama is rising fiercer as everyone seems to be now competing for a similar AI assets (e.g., AI-trained suppliers, IT employees). With the more and more recognition of AI, it’s vitally vital to make it possible for it’s being applied safely. Which means addressing and eliminating bias, and making certain AI governance throughout the board.

The Future AI in Auto finance.

Whereas AI helps us clear up issues in methods we by no means thought doable, it’s additionally rising with out boundaries in some areas, which is harmful. All corporations, together with these in auto finance, should be cautious of the moral points that encompass AI, which is why the idea of Accountable AI is so essential. We should make it possible for AI is being applied safely with interpretability, accountability, and ethics.

Furthermore, use of interpretable machine studying algorithms is driving accountable use of AI in areas involving credit score danger and decisioning. These interpretable machine studying fashions allow human-in-the-loop machine studying improvement the place discovered relationships that drive extra prediction are uncovered for palatability, bias, and stability functions enabling accountable and protected use of AI/ML to drive incremental efficiency and furthermore put together auto finance for using alternate information mixed in ways in which improve detection with out creating moral points.

AI in Omni-Channel Communications

Because of advancing expertise, personalization is getting used as a technique for client communications. Main auto finance corporations are going even additional by implementing hyper-personalization methods. Hyper-personalization makes use of buyer information and understanding to border, information, lengthen, and improve interactions primarily based on that particular person’s historical past, preferences, context, and intent.

Shoppers’ wants are always altering, so to make personalization related, organizations should analyze buyer stage information in actual time to know their journey and predict future wants. This has the facility to affect the auto mortgage financing business on many ranges – together with collections communications, deteriorating contact lending charges, buyer pressures (e.g., affordability), inconsistent communications methods that elevate flags with regulators, and extra.

The underside line is: If you happen to’re not leveraging digital channels and offering hyper-personalized experiences, you’re not assembly prospects the place they need to be met.

Methods That Energy Hyper-Personalization for the Automotive Finance Business

There are a selection of methods that assist lenders energy hyper-personalization for auto financing shoppers, together with:

Pure Language Processing (NLP)Personalization algorithmsReal-time content material

Hyper-personalization includes mapping every buyer’s journey and information sources, and with the ability to transfer prospects to totally different channels (e.g., telephone to textual content or e-mail) at their request. It means leveraging two-way communications/functionality to assist drive self-service and permit the patron to determine what sort of expertise they need.

At this time’s auto mortgage shoppers need extra humanized, contextual lending experiences that show empathy – and expertise is making this doable. Think about this instance:

Earlier than: Auto mortgage buyer sorts “I hate this expertise” and firm chatbot responds “Thanks for being a buyer…”

Now: Firm chat responds with “Sorry you’re upset. What can I do to assist?”

AI is shifting towards problem-solving mode, which suggests we are able to steadiness machine intelligence with human experience. This provides us the chance to intervene when essential and let people win again the client.

Extra Info on Auto Lending and Hyper-Personalization

[ad_2]

Source link