[ad_1]

DollarBreak is reader-supported, if you enroll by way of hyperlinks on this publish, we might obtain compensation. Disclosure.

The content material is for informational functions solely. Conduct your personal analysis and search recommendation of a licensed monetary advisor. Phrases.

We check other ways to make cash on-line weekly and supply real-user critiques so you may resolve whether or not every platform is best for you to earn facet cash. Thus far, we’ve reviewed 600+ platforms and web sites. Methodology.

Acorns is a US-based monetary know-how and providers firm that gives micro-investment providers. The corporate was based in 2012 and is predicated in California. The Acorns app will hyperlink to your checking account, debit card, or bank card, and robotically spherical up purchases to the closest greenback. It then takes the spare change distinction and invests it at a excessive annual return price of as much as 7%

Execs

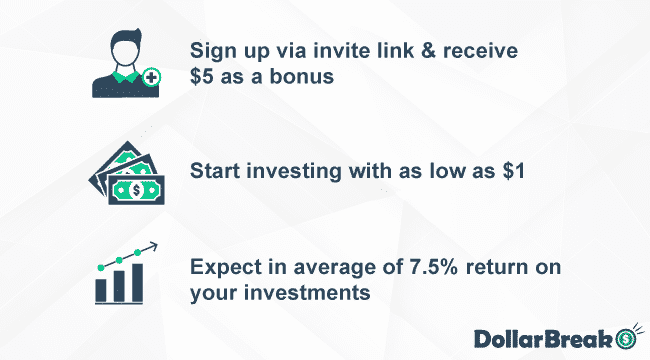

Low account charges – month-to-month charges begin from simply $3 per thirty days for a private account and simply $5 per thirty days for a household account with limitless children.Referral bonus – get $5 in your Acorns funding account totally free if you invite a good friend to hitch the platform utilizing your private enroll hyperlink.Comparatively low threat – you can begin investing from as little as simply $5, so there may be restricted threat concerned in your investments as a result of low worth.Excessive common annual return on investments – earn a mean of seven.5% curiosity (based mostly on historic efficiency) on all of your investments with Acorn.

Cons

Lengthy ready interval to money out – if you wish to withdraw your investments, you could want to attend for as much as 11 days earlier than you obtain your funds.Excessive account switch charges – if you wish to swap to a different funding platform, you will want to pay $50 per ETF to switch your shares over.

Soar to: Full Evaluate

Examine to Different Funding Apps

Fundrise

Put money into actual property properties with a $10 minimal preliminary funding

Historic annual return varies from 8.8% to 12.4% (2019 – 9.47%)

Low annual charges: advisory – 0.15%; administration payment – 0.85%

Public App

Handle your portfolio of shares, ETFs, and crypto investments – multi functional place

Over 5000 shares and ETFs to select from (dividend shares out there)

Observe different traders, see their portfolios, and change concepts

Acorns

Make investments your spare change in a diversified portfolio constructed by consultants

Anticipate as much as 7.5% yearly returns with plans ranging from $3 a month

Earn bonus investments from 350+ Acorns Earn companions

How Does Acorns Work?

Acorns is a complete monetary administration platform that focuses on providing micro-investing providers. The corporate has over 9 million lively customers utilizing its app to take a position their funds. It additionally has over $3 billion in property beneath administration.

This program works by rounding up your purchases with a linked bank card or debit card to the closest greenback. Acorns will accumulate the distinction and reserve it in your account. After getting at the very least $5 in financial savings, the corporate will robotically make investments it for you.

The platform will then construct your portfolio and diversify your investments throughout over 7,000 shares and bonds.

How A lot Can You Earn With Acorns?

Your earnings with Acorns will rely on how steadily you spend. Assuming you save a mean of $0.50 per transaction and make one buy a day, it can save you round $15 per thirty days. Thus, it can save you as much as $180 per 12 months. In case you earn a ten% return in your investments, you may earn round $18 per 12 months.

In case you select to deposit further funds into your account, you would possibly be capable to earn much more in returns.

Nevertheless, word that each one investments carry threat, and also you would possibly make a loss in your investments. Furthermore, your returns might also range relying on components reminiscent of market situations.

Who Is Acorns Finest for?

Acorns is most fitted for freshmen who need to make investments with out committing a big sum. It doesn’t require customers to make any upfront investments. As an alternative, you may accumulate funds over time by way of the Spherical-Up function.

Acorns can be appropriate for people who need to save whereas incomes greater returns than their financial institution gives.

Acorns Charges: How A lot Does It Price to Make investments With Acorns?

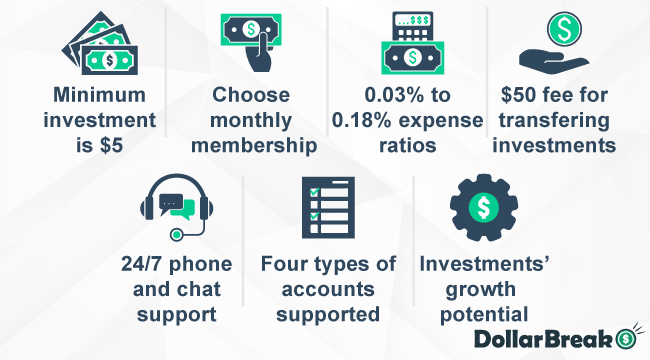

Acorns requires customers to select from two totally different plan choices. The Private plan lets you add your particular person retirement and checking accounts. In distinction, the Household plan allows you to make investments on behalf of your children.

There are additionally different miscellaneous charges, together with ETF expense ratios and switch charges. ETF expense ratios are charges you’ll incur in case you put money into an ETF. Switch charges are one-time charges you have to pay if you wish to switch your investments to a different dealer.

Price TypeAmountPersonal Plan Price$3 per monthFamily Plan Price$5 per monthETF Expense Ratios0.03% to 0.18percentTransfer Charges$50

Acorns Options: What Does Acorns Supply?

Signal Up Bonus

You’ll be able to earn a $5 sign-up bonus if you create a brand new account with Acorns. You should hyperlink a credit score or debit card to your account to qualify for this bonus.

Acorns Spend

You’ll be able to create an Acorns Spend account to get a web based checking account and an unique tungsten steel debit card. Everytime you use this card, you’ll take pleasure in a further 10% bonus in your Spherical-Up investments.

Acorns Later

If you wish to create a retirement account, it’s also possible to achieve this utilizing the Acorns Later function. The Acorns Later function lets you arrange recurring contributions, serving to you save for retirement.

The platform may even suggest an funding plan relying in your targets, employment info, and revenue.

Acorns Early

The Acorns Early function lets you open an funding account on your kids and make investments on their behalf. As soon as your children come of age, they’ll entry the funds of their accounts.

Acorns Discovered Cash

The platform additionally companions with over 350 corporations throughout the nation. Everytime you store at any of those companion shops, you may earn cashback in your purchases through the Acorns Discovered Cash function.

Some examples of the money again you may earn embody:

Walmart: 1% of the acquisition (as much as $40 per thirty days)

Mattress, Tub & Past: 2% of the acquisition

Airbnb: 1.8% of the reserving payment

Blue Apron: $30 for brand spanking new clients

T-Cell: $30 for brand spanking new service members

Sephora: 3% of the acquisition (as much as $40 per thirty days)

And plenty of extra

In contrast to different cashback web sites, the cashback you earn with Acorns is robotically credited to your funding account.

You’ll be able to maximize your investments by purchasing at one of many firm’s companions.

Acorns Necessities

To create an Acorns account, you should be a United States resident and have a legitimate social safety quantity. You need to even be at the very least 18 years previous to start out a Private or Household account. If you wish to open an Acorns Early account on your baby, you are able to do so on the day they’re born.

There may be additionally no minimal funding essential to open an account. Nevertheless, the platform will solely begin investing your financial savings after you have at the very least $5 in your account.

Acorns Payout Phrases and Choices?

You’ll be able to withdraw funds out of your Acorns account through the iOS, Android, or internet app. The platform lets you withdraw your funds to a US checking account.

In case you place a withdrawal request earlier than 11 am PST on a market day, the corporate will often course of it on the identical day. In any other case, Acorns will course of your request the subsequent day that the market is open.

Relying in your financial institution, it could actually take between three to 6 days to obtain your funds.

Acorns Dangers: Is Acorns Secure to Make investments With?

Acorns is a secure and legit platform that you should utilize to take a position. The platform has been round since 2012 and at present manages over $3 billion of property for its clients. It additionally has over 8.2 million clients, highlighting that it’s a legit funding platform.

Nevertheless, like all monetary investments, investing with Acorns will carry threat. You could lose cash in your investments because of different components reminiscent of unhealthy financial situations. Thus, do your analysis and due diligence earlier than investing with Acorns.

As well as, Acorns can be registered with the Securities and Alternate Fee (SEC), that means it’s a legit dealer.

How Does Acorns Defend Your Cash?

Acorns is a member of the Securities Investor Safety Company (SIPC). Thus, your investments are insured for as much as $500,000, together with as much as $250,000 in money. Even when the corporate have been to go bankrupt, your funds will not be in danger.

Acorns Evaluations: Is Acorns Legit?

Acorns has acquired many constructive critiques from its customers, with many customers praising the platform for being straightforward and safe to make use of. As well as, many customers have been additionally glad with the number of totally different account choices that they may choose from.

Nevertheless, there have been some unfavourable critiques from customers. Some customers have complained that the platform’s charges make it unsuitable for people who don’t spend steadily utilizing their credit score or debit playing cards. There have been additionally some complaints that the platform was unable to course of withdrawals through examine.

What Are the Acorns Execs & Cons?

Acorns Execs

The Spherical-Up function lets you put money into the inventory market with none upfront money investments.

You’ll be able to earn a further 10% bonus in your spending if you use the platform’s unique debit card.

You’ll be able to select from 5 totally different ETF portfolios to put money into.

There’s a low month-to-month payment of simply $3 for the Private plan.

Acorns Cons

There’s a excessive payment of $50 for each time you need to switch your investments to a different dealer.

You’ll be able to solely withdraw your funds to your checking account.

How Good Is Acorns Assist and Data Base?

Acorns gives 24/7 cellphone and chat help, with a response time of as much as 48 hours. As well as, there may be additionally an FAQs part on the Acorns web site that you would be able to go to if in case you have any questions on easy methods to use the platform.

Acorns Evaluate Verdict: Is Acorns Value It?

In case you are new to investing and are on the lookout for a beginner-friendly funding app, Acorns is likely one of the greatest choices out there. The platform lets you begin investing with a low month-to-month payment of simply $3 and no upfront funding.

You need to use the Spherical-Up function to save lots of your free change. Acorns will then make investments your free change for you with none further effort. Additionally, you will have the choice so as to add funds on to your Acorns account if you wish to enhance your investments.

There are additionally a wide range of totally different account varieties that you would be able to join, reminiscent of a retirement account or a spending account. Thus, Acorns is an app that you should utilize if you wish to put money into the inventory market.

Tips on how to Signal Up With Acorns?

Step 1: Create an Account

Earlier than you may make investments your free change with Acorns, you will want to create an account. You are able to do so by visiting the Acorns web site.

You will have to offer some private and authorized info. On common, it would take between 24 to 48 hours for the corporate to confirm your account.

Step 2: Hyperlink a Card

After your account is verified, you will want to hyperlink a credit score or debit card to start out utilizing the Acorns Spherical-Up function. You may also hyperlink a checking account to the platform. Linking a checking account will permit you to make withdrawals and deposit funds instantly into your account.

Step 3: Select a Portfolio

You’ll be able to then select a portfolio that you just need to put money into. Relying in your preferences and threat urge for food, you may select from the totally different portfolio choices that the platform gives.

Websites Like Acorns

Acorns vs. Stash

Stash Abstract

Begin investing with any greenback amountBuy fractional shares from simply $0.05Low month-to-month payment beginning at $3Insurance protection of as much as $10,0001

Stash is a superb various platform that you should utilize if you wish to make investments. In comparison with Acorns which has simply 5 portfolios out there, you may select from over 100 shares and ETFs to customise your Stash portfolio.

Each platforms cost charges for members to make use of them. Nevertheless, in contrast to Acorns, Stash charges vary from $1 to $9 per thirty days relying on the worth of your investments. Thus, newbie traders would possibly profit from the decrease charges out there on Stash.

Acorns vs. Fundrise

Fundrise Abstract

Low minimal beginning funding of $10High historic returns of 8.8% to 12.4percent1% of administration feesDiverse portfolios of as much as 16 investments

In contrast to Acorns, Fundrise is an funding platform that focuses on actual property investments. The corporate operates privately-owned actual property funding trusts (REITs) that you would be able to put money into. Investing in REITs lets you earn each capital positive aspects and dividends.

Fundrise pays dividends to its traders utilizing the earnings that its properties earn. Acorns doesn’t pay dividends to its customers. Thus, Fundrise is an effective various platform that you would be able to make investments with if you wish to have a supply of passive revenue from actual property investments.

Acorns vs. Public

Public App Abstract

Put money into shares, ETFs, and crypto$0 fee charges for any inventory tradesOver 100 articles to find out about investingLow 1-2% fee for crypto trades

Public is likely one of the greatest funding web sites in the marketplace. It’s well-known for providing commission-free buying and selling, making it a fantastic various to Acorns. If you make investments with Public, you may choose from a variety of shares and ETFs to purchase or promote.

Furthermore, Public additionally permits customers to put money into numerous cryptocurrencies. It gives numerous instructional sources that may enable you to learn to commerce as nicely.

Nevertheless, word that Public is just out there as a cellular app.

Different Websites Like Acorns

Acorns FAQ

What Is Acorns?

The corporate’s mission is to assist people defend their monetary greatest pursuits utilizing micro-investing. Acorns has been round since 2012, and its headquarters are in Irvine, California.

How a lot ought to I put money into Acorns?

All funding carries threat and also you won’t make cash for a while. Thus, it is best to solely make investments an quantity that you’re snug with.

Is Acorns a great funding?

Acorns is an effective funding because it makes it straightforward for freshmen. It’s handy and worthwhile to take a position your spare change with Acorns. It additionally has a low month-to-month membership payment in comparison with the options it gives.

Does Acorns truly make you cash?

Acorns is an funding platform that may make you cash. Other than earning money from investments, it’s also possible to earn cashback if you use your linked card at one of many platform’s companions.

In case you use the unique Acorns debit card, additionally, you will be capable to get a further 10% bonus in your investments.

Are you able to lose cash with Acorns?

You’ll be able to lose cash with Acorns. Nevertheless, Acorns helps you decrease threat by diversifying your investments in over 7,000 shares and ETFs. Thus, in the long term, there’s a decrease probability of you dropping cash.

Is Acorns good for freshmen?

Acorns is right for freshmen due to how straightforward it’s to make use of the platform and the low preliminary dedication required.

[ad_2]

Source link