[ad_1]

I’ve stated for awhile that we might use some short-term promoting to unwind overbought situations and even unfavourable divergences in some instances. I used to be on the lookout for maybe 4-5%, however it’s actually tough to foretell the type and depth of promoting that we’ll see when secular bull markets face a downturn. Personally, I would be shocked if this latest weak point morphs right into a bear market. I am not saying that it is not potential, however my key indicators recommend it’s extremely, not possible.

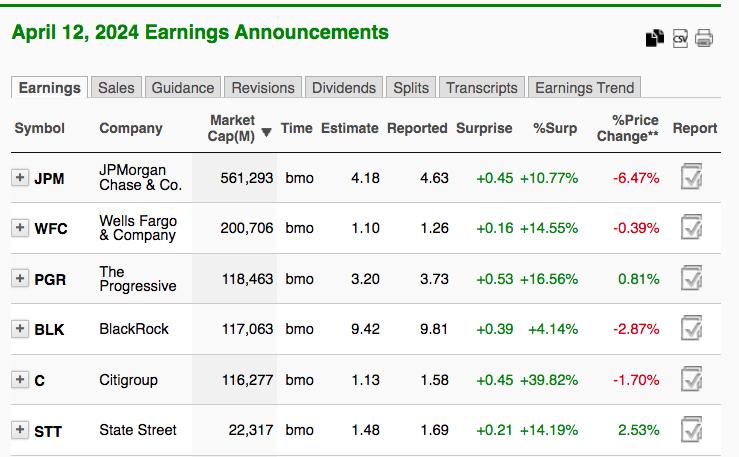

We have seen some draw back strikes previously of simply 1-2% and others, just like the correction final summer time, that stretched to 10%. I consider earnings can be robust, however the enormous transfer off the October 2023 low could have in-built that constructive information. You’ve got most likely heard that previous Wall Avenue adage, “purchase on rumor, promote on information”, proper? Nicely, that is precisely what we noticed Friday, with respect to the main financials that reported quarterly outcomes Friday morning. The earnings numbers seemed fairly good on Zacks:

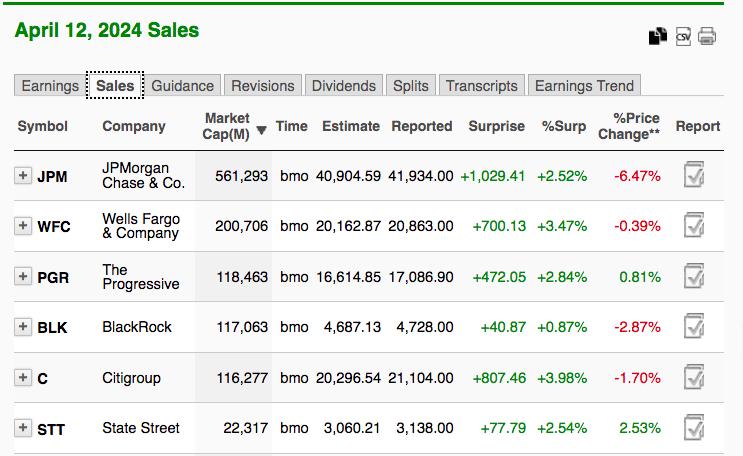

Reported EPS was considerably greater than estimates in each case. Citigroup (C), specifically, crushed estimates, blowing them away by almost 40%. There have been income beats by all 6 firms as properly:

Once more, it was C that posted the very best income beat – almost 4% greater than expectations. From these super numbers, it is simple to NOW see why financials had carried out so properly.

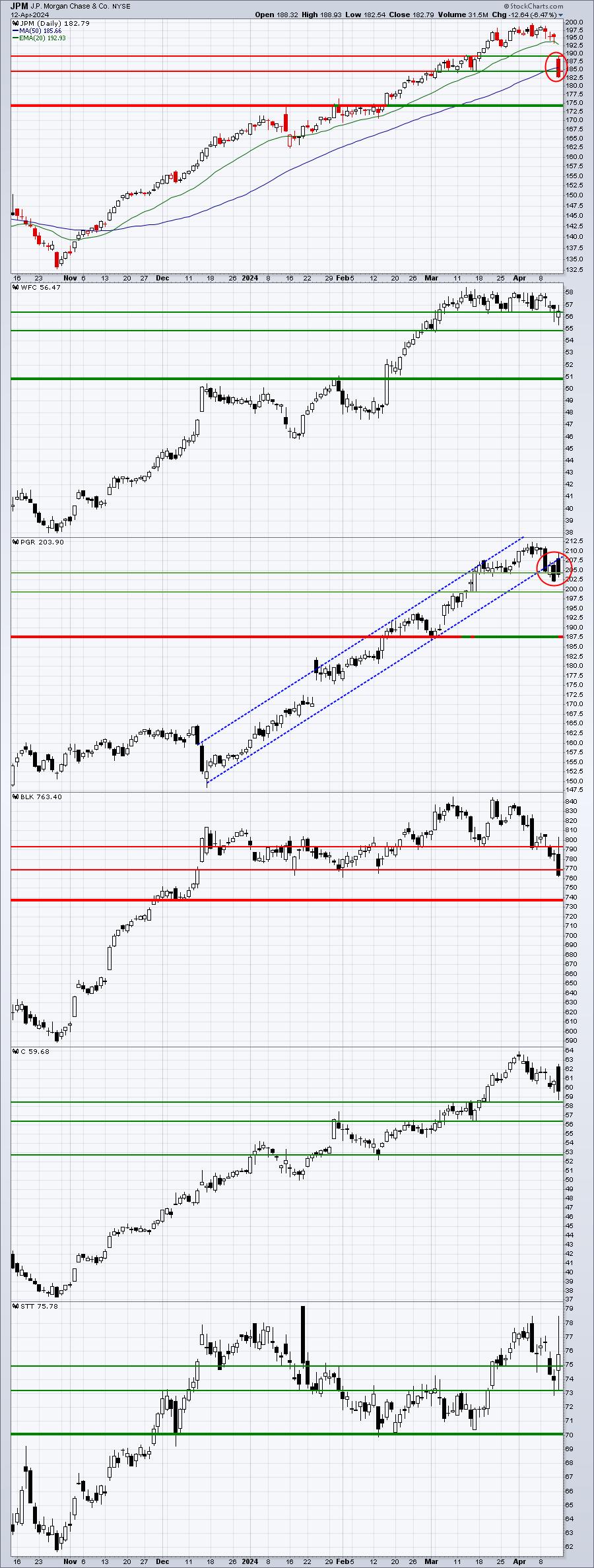

However one factor that confuses many retail merchants is that robust outcomes don’t at all times translate into greater inventory costs. Take a look at the quarterly earnings worth reactions on these 6 shares:

Is such a market response justified after seeing these quarterly outcomes? I do not suppose so, however the inventory market would not care what I feel. Market makers have a job to do – construct positions for his or her institutional purchasers at our expense. The short-term is NOT environment friendly. Costs do not do what you suppose they’re going to do. Then you definitely get confused, believing monetary shares are useless. After they drop for awhile, you panic and promote and, after market makers get all of the shares they want, financials regain their power. That is what the inventory market does. The short-term inefficiencies put on on merchants, inflicting them to surrender, and that creates provide for market makers to construct their stock. Then rinse and repeat. Because the late nice Yogi Berra would say, “it is deja vu another time!”

I mentioned why we won’t belief this promoting in my newest EB Weekly Market Recap VIDEO, “Scorching CPI Stokes Inflation Fears”. The secular bull market stays completely intact. Test it out and depart me a remark. Additionally, please “LIKE” the video and “SUBSCRIBE” to our YouTube channel, if you have not already. It’s going to assist us construct our YouTube group and I will surely recognize it.

On Monday, April fifteenth, I will be offering one other monetary inventory that’s poised to report wonderful quarterly outcomes. This firm has been an enormous chief amongst its friends, suggesting a blowout report forward. If financials reverse their present weak point, I might not be stunned to see a really POSITIVE market response to this firm’s report. To obtain this firm and take a look at its chart, merely CLICK HERE to subscribe to our FREE EB Digest publication. There isn’t a bank card required to affix the EB Digest, simply your identify and e mail tackle!

Completely happy buying and selling!

Tom

Tom Bowley is the Chief Market Strategist of EarningsBeats.com, an organization offering a analysis and academic platform for each funding professionals and particular person buyers. Tom writes a complete Every day Market Report (DMR), offering steerage to EB.com members daily that the inventory market is open. Tom has contributed technical experience right here at StockCharts.com since 2006 and has a basic background in public accounting as properly, mixing a singular ability set to strategy the U.S. inventory market.

Study Extra

[ad_2]

Source link