[ad_1]

Dr_Microbe/iStock by way of Getty Photos

Syndax Prescribed drugs, Inc. (NASDAQ:SNDX) is a late-stage developer of most cancers therapies. Its lead asset is a Menin inhibitor referred to as revumenib, which is focusing on varied acute leukemias in three pivotal trials that are enrolling sufferers. 5 years in the past, when I first lined SNDX, that they had a lead molecule referred to as etinostat focusing on breast cancers. SNDX inventory is up 250% since then, nonetheless, etinostat is now virtually out of the pipeline after a number of failures to show a survival profit. Nevertheless, the 2 different candidates, revumenib and axilitinib, additionally in a pivotal trial in GvHD, have fared higher for the corporate.

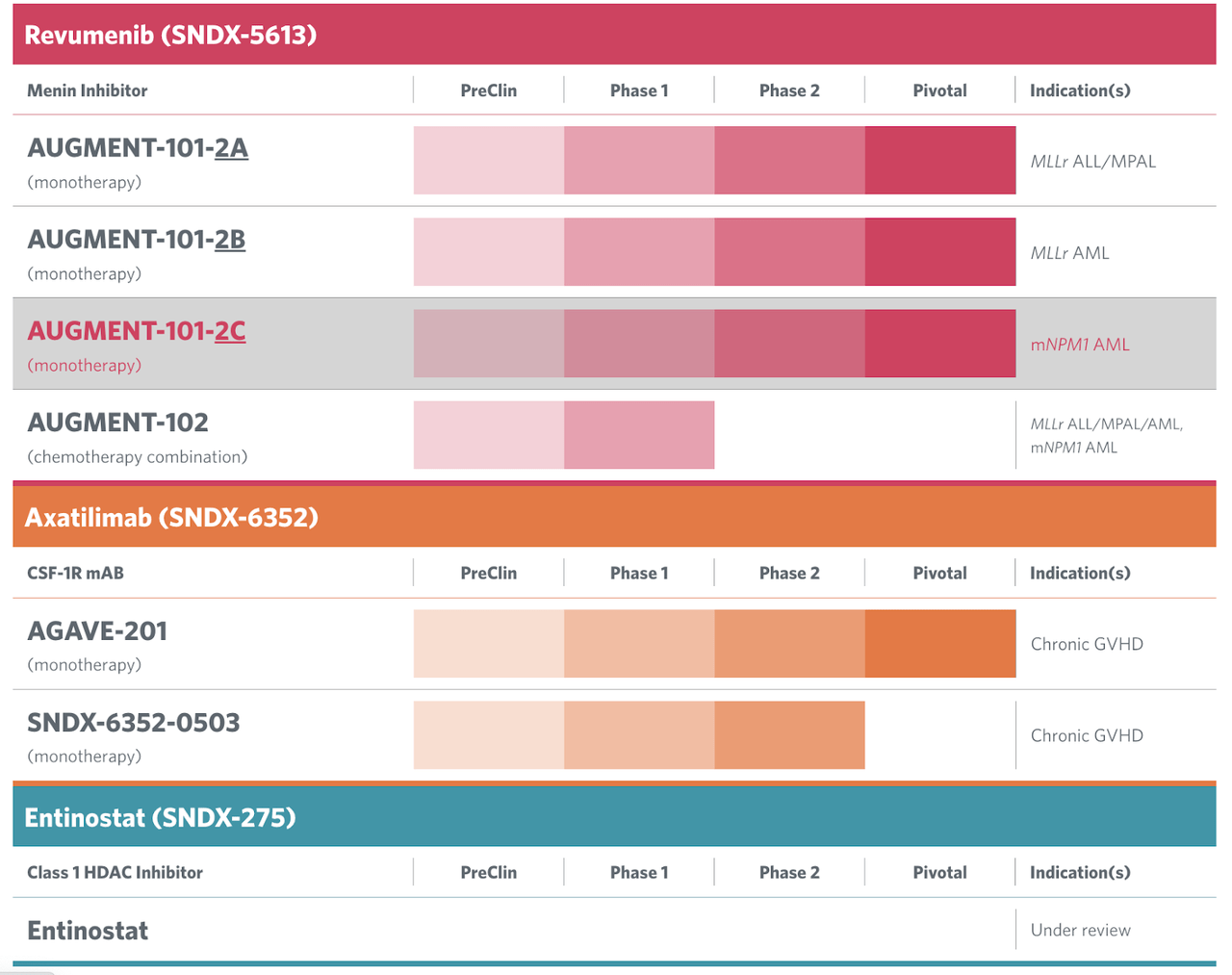

Right here’s the pipeline:

SNDX pipeline (SNDX web site)

Lead asset revumenib is a menin inhibitor. Menin inhibitors are a brand new class of therapeutics being studied extensively for leukemias. Preclinical research have proven that inhibition of the Menin-MLL1 interplay induced apoptosis. In 2020, section 1 knowledge was printed. Knowledge confirmed that “SNDX-5613 [revumenib] turns off leukemic transcriptional packages by binding to Menin and displacing MLL complexes.” There have been two arms with completely different dose ranges, and dose proportional publicity was achieved in each arms. There have been no discontinuations as a result of remedy associated antagonistic occasions. The corporate says the remedy was well-tolerated throughout all doses. Nevertheless, there have been various sufferers reporting grade 3 or above ECG QTc prolongation at varied doses, which is at all times a trigger for fear.

Nevertheless, security indicators have been good with 55% ORR and 24% CR. Broadly, the section 1 trial was capable of affirm the therapeutic worth of the molecule’s mechanism of motion.

Up to date knowledge from this identical trial confirmed a slight enchancment in ORR and CR and a proportion decline in QTc prolongation. 30% of sufferers attained CR/CRh with a median period of 9.1 months. This knowledge, printed in December 2022, compares favorably with menin inhibitor rival Kura Oncology (KURA), who additionally printed knowledge on the identical time. A pivotal portion of the AUGMENT101 examine is enrolling relapsed/refractory (R/R) sufferers throughout distinct trial populations: sufferers with nucleophosmin mutant (mNPM1) acute myeloid leukemia (AML), sufferers with KMT2Ar AML, and sufferers with KMT2Ar acute lymphocytic leukemia (ALL). Every of those indications might result in regulatory filings.

Overlaying Kura final month, I wrote the next about Syndax which covers the state of affairs:

Thus the SNDX knowledge appeared a lot better than Kura’s, and traders punished Kura with a 14% drop on that day, whereas SNDX gained 14%. Two years earlier, too, SNDX was the chief that was capable of pull the menin inhibition area up. At the moment, SNDX posted constructive knowledge that helped pull up KURA inventory, not simply SNDX. Nevertheless, as the 2 belongings have gotten more and more differentiated, that form of “sympathetic detonation” is just not occurring any longer. Syndax has its personal issues with cardiac toxicity, however revumenib targets a broader inhabitants.

Second asset is axatilimab focusing on GvHD and partnered with Incyte (INCY). About this molecule, the corporate states:

Donor-derived, pro-inflammatory macrophages are depending on CSF-1R signaling and have been proven in preclinical research to be chargeable for signs related to continual graft versus host illness (cGVHD). Syndax believes that CSF-1R blockade with axatilimab (SNDX-6352) might scale back the variety of these pro-inflammatory macrophages and play a significant position within the remedy of continual graft versus host illness.

This asset is presently operating the AGAVE trial, described thus:

A Pivotal Trial to Consider the Efficacy, Security and Tolerability of Axatilimab at 3 Completely different Doses in Sufferers With Recurrent or Refractory Energetic Persistent Graft Versus Host Illness Who Have Acquired at Least 2 Strains of Systemic Remedy

This molecule has been trialed in a number of indications together with stable tumors, covid-19 and now GvHD. A section 1 trial has proven proof of idea in GvHD within the second line setting the place few therapies exist; ibrutinib is presently used however has a number of limitations.

2023 is a crucial yr for Syndax as a result of it plans to publish knowledge from two pivotal trials, AUGMENT101 starting 3Q 2023 for leukemias, and AGAVE-201 in mid 2023 for GvHD. The corporate could also be granted facility for rolling NDA and BLA submission, during which case count on a number of functions this yr. Revumenib comes with a breakthrough remedy designation. As the corporate famous yesterday:

For revumenib, we’re on observe to start reporting topline knowledge from the AUGMENT-101 pivotal trial within the third quarter of this yr, with the primary knowledge anticipated to be in sufferers with KMT2A rearranged (KMT2Ar) acute leukemia and count on to file a New Drug Software (NDA) by year-end 2023. For axatilimab, we additionally stay on observe to report topline outcomes from our pivotal AGAVE-201 trial in continual graft versus host illness (cGVHD) in mid-2023, with a Biologics License Software (BLA) submitting anticipated to comply with by year-end 2023. We look ahead to offering updates on all of our progress as we proceed to try towards our mission of realizing a future during which individuals with most cancers dwell longer and higher than ever earlier than.

Financials

SNDX has a market cap of $1.73bn and a money stability of $481mn after elevating $150mn in December by a secondary providing. Fourth quarter 2022 analysis and growth bills have been $31.8 million, whereas common and administrative bills have been $10.2 million. At that fee, the corporate is well-funded for 10 extra quarters.

Bottomline

Syndax Prescribed drugs, Inc. is well-funded and is a frontrunner in its area. It has two upcoming pivotal knowledge drops after which regulatory filings this yr. Whereas Syndax Prescribed drugs, Inc. inventory is buying and selling close to 52-week highs, the goal markets are giant sufficient to advantage additional upside for SNDX inventory if the corporate is ready to do effectively in its pivotal trials. As such, I may be a Syndax Prescribed drugs, Inc. purchaser even at these costs.

Concerning the TPT service

Thanks for studying. On the Complete Pharma Tracker, we provide the next:-

Our Android app and web site contains a set of instruments for DIY traders, together with a work-in-progress software program the place you may enter any ticker and get in depth curated analysis materials.

Our Android app and web site contains a set of instruments for DIY traders, together with a work-in-progress software program the place you may enter any ticker and get in depth curated analysis materials.

For traders requiring hands-on help, our in-house specialists undergo our instruments and discover one of the best investible shares, full with purchase/promote methods and alerts.

Join now for our free trial, request entry to our instruments, and discover out, for gratis to you, what we are able to do for you.

[ad_2]

Source link