[ad_1]

The persevering with results of the pandemic, rising prices of residing and skyrocketing vitality prices put sharp stress on family budgets in 2022. These elements and others led our consultants in debt assortment to deal with ways in which lenders can handle the rising variety of folks within the collections queue. Listed here are the highest 5 posts from 2022 on debt assortment traits.

1. Digital Debt Assortment and Early Collections

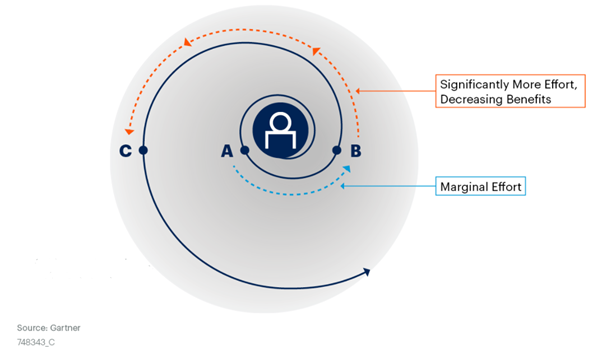

Ulrich Wiesner famous that prospects underneath monetary stress needs to be spoken to sooner fairly than later, so that there’s adequate time to resolve the issue and forestall accounts from rolling to later levels of delinquency. Ideally, minimal operational effort is spent on prospects which are probably going to pay, in order that costly debt assortment assets could be centered on these prospects the place agent intervention makes a distinction. This can be a good alternative for digital debt assortment.

Self-service choices have confirmed to ship nice outcomes each in early collections and even put up charge-off restoration. This frees up human collectors to spend extra time with prospects in forbearance conditions that require empathy and session.

Threat-Based mostly Segmentation and Digital Debt Assortment

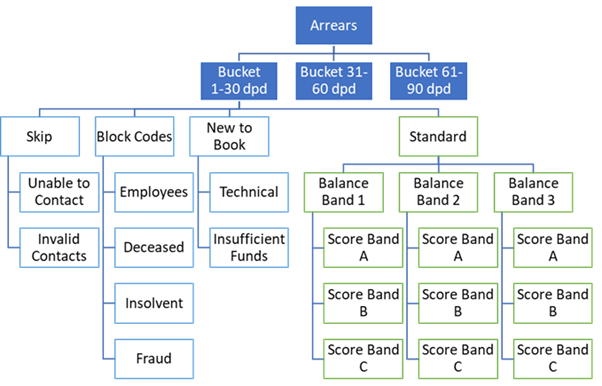

contact technique for early collections usually separates out particular circumstances which require a particular therapy, recognized by one or few information attributes. Such circumstances may embrace staff, deceased prospects, fraud, first-payment defaulters or prospects with out legitimate contact information. The majority of the remaining accounts needs to be segmented by arrears bucket (days overdue), stability and a danger indicator, ideally propensity to roll. The segmentation tree could be evaluated every day, or alternatively at cycle date, when the account stability modifications, and ultimately when cost agreements are made or damaged.

A typical risk-based segmentation strategy separates out non-standard accounts like staff, and the majority of the usual accounts are segmented to permit for tailor remedies).

Mini Workflows Outline the Buyer Expertise

The ensuing segments can then be topic to easy mini-workflows applicable to their danger, with a variation in communication timing, channel, and tonality, e.g., a textual content message on day 2 adopted by a name on day 7 adopted by a letter on day 15. Utilizing champion/challenger testing, the suitable therapy for every phase could be decided, balancing buyer expertise, phase efficiency and operational effort. In a extra superior strategy, choice optimisation can be utilized to analytically derive the optimum therapy for every buyer, minimizing a enterprise goal like stability roll price while honouring capability constraints and various enterprise targets.

Therapies paths ought to stay easy and never comprise pointless conditional logic. This lets you maintain these workflows in current case administration techniques, like legacy assortment techniques or CRM options.

Agility Is King in Digital Debt Assortment

Efficient communication methods can’t be designed on a whiteboard and carried out in a waterfall strategy — they must be examined and regularly tailor-made to buyer preferences and behavior.

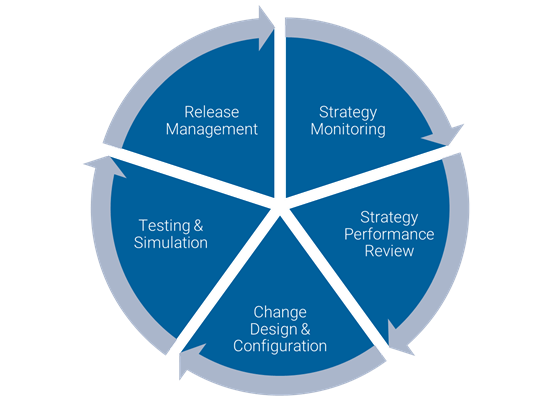

In consequence, the underlying choice providers want to permit for versatile technique administration and configuration, and technique efficiency must be repeatedly reviewed, mentioned, and improved. Good choice platforms will help technique model administration, enterprise end result simulation, technique staging from growth to check and manufacturing, and champion/challenger testing.

In an agile atmosphere, the technique lifecycle includes steady monitoring and measurement of technique outcomes, usually undertaken by the technique administration crew. In joint conferences with enterprise stakeholders, technique outcomes are periodically reviewed, and result in the design and configuration of technique modifications. These modifications are configured by the technique administration crew and usually carried out as challengers to the prevailing baseline (“champion”) technique, in order that the impression of the change could be quantified. Earlier than deployment, the modified technique undergoes applicable high quality assurance measures earlier than launch into manufacturing. Aside from the final step, all elements of the technique lifecycle are managed between the technique administration crew and enterprise stakeholders and shouldn’t require any involvement of IT assets.

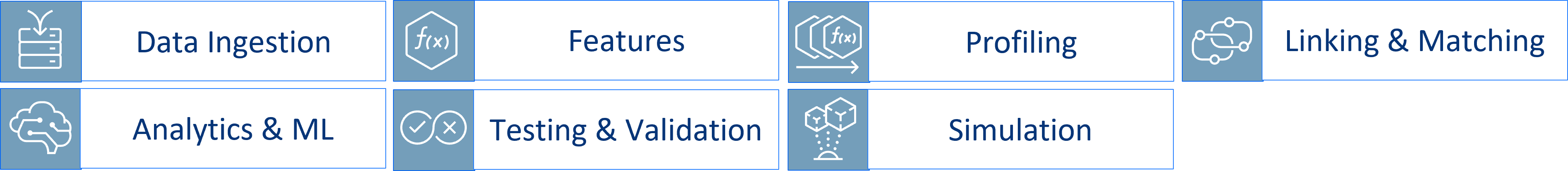

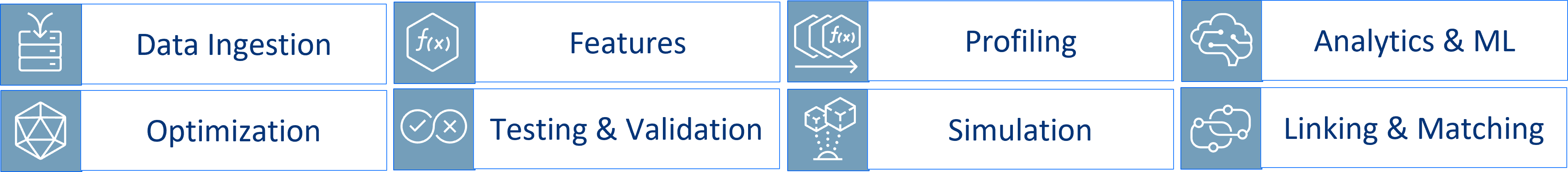

FICO Platform brings all these parts collectively. Analytics, segmentation, technique administration, technique execution and buyer engagement are all supported by the platform, and could be built-in with current system stacks or legacy debt assortment options.

Learn the total put up

2. Debt Assortment and Debt Decision in 2022

Bruce Curry appeared ahead close to the beginning of the 12 months and noticed plenty of challenges in debt assortment for lenders sifting by the pandemic’s inevitable monetary fall-out.

The flexibility to cost-effectively take care of persistent indebtedness whereas providing prospects respiratory house is significant, notably as revenue help schemes are wound down. There may be additionally unease round BNPL as a aggressive providing to conventional credit score markets, its impression on shoppers and the power to efficiently spot over-indebtedness.

A mass of digital options and fintech improvements providing real-time Open Banking information alongside transactional perception into buyer affordability and vulnerability are being touted to Tier-1 lenders. The headache is realizing the place to make the large bets for the very best return.

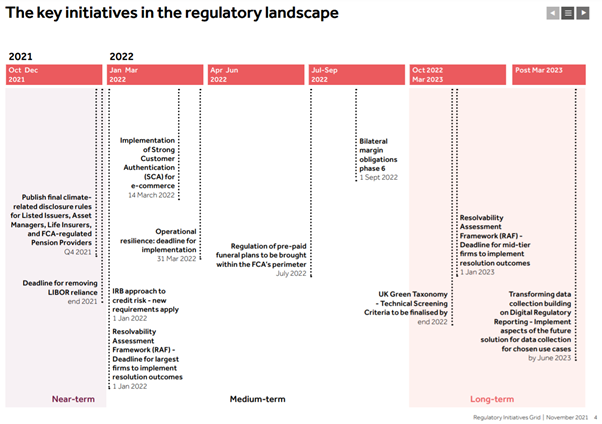

Regulation additionally continues to pose calls for on already stretched back-offices juggling restricted budgets, manpower and bandwidth challenges.

Within the UK, for instance, the FCA’s Regulatory Initiatives Grid particulars the in-flight and pending regulatory and industry-driven modifications. In September 2020 there have been 111 initiatives listed. In November 2021 there have been 134 lively initiatives listed.

https://www.fca.org.uk/publication/company/regulatory-intitiatives-grid-november-2021.pdf

Constructive Indicators for Debt Decision

However past the challenges of regulatory change, it’s not all doom and gloom for lenders. Many shoppers have been paying down money owed; excellent bank card debt decreased 3.7% within the 12 months to Oct 2021 (The Cash Charity, Dec 2021). there’s loads of capital accessible and comparatively modest collections portfolios, with most collectors reporting decrease collections volumes than anticipated. Regardless of the challenges posed by the previous three years, the broader financial outlook is optimistic. Lenders can take benefit by making a well timed shift from a collections and restoration mindset to the supply of extra holistic buyer help and debt decision schemes. It’s a win-win for all events, as I mentioned in a latest webinar with McKinsey on digital-first collections.

Altering the Working Mannequin in Debt Assortment

Know-how and information sources are quickly driving an ever-evolving again workplace for collections. Actual-time entry to ‘conventional’, new and rising datasets continues at tempo. Explainable AI, digital platforms and automation are all serving to scale back overheads. However they’re all vital investments that may be complicated and time-consuming to arrange. In addition they require expertise and manpower to successfully ship. Success hinges on the power to parachute in experience as wanted in the case of seamless set up and optimising operations.

Proper now, high performers are focussed on constructing agile, versatile and scalable capabilities. They’re much less involved concerning the accuracy of financial and behavioural forecasts than they’re about making certain they’ve the power to deal with no matter could are available in a wise, expedient and applicable method.

Learn the total put up

3. How To Enhance Collections Efficiency with Predictive Analytics

Bruce Curry returned to a perennial theme in debt assortment: the alternatives offered by superior analytics. These included the next.

Reducing Prices

Predictive fashions forecast, with a excessive diploma of accuracy, the circumstances which are almost certainly to pay – and the assigned circumstances more likely to return the best yield. The magic occurs when fashions precisely predict the probably lower-yield circumstances. These could be categorised, put within the arms of a set company, or despatched for various, decrease value remedies.

Enhancing Buyer Service

Predictive fashions also can assist improve customer support by providing lower-risk prospects the chance to self-cure. If the mannequin predicts a buyer will reply and pay through a light-touch, high-return technique, then it is smart to offer them extra time to pay. Regardless of the favoured channel, tone of voice is all the things. Cellphone calls, letters, SMS texts could be much less insistent and fewer intrusive, usually leading to fewer complaints and fewer embarrassed prospects.

Bettering Technique Efficiency Over Time

Analytics might help frequently enhance operations by measuring and informing the impression of particular person modifications to collections approaches. So-called adaptive management or champion / challenger testing, for instance, has highlighted how as much as 80% of delinquent accounts are sometimes prepared to adapt to current assortment methods, whereas 10% could favour an alternate technique and the opposite 10% want one other approach.

Analytics can precisely measure the impression of modifications from every technique, as a result of all the opposite elements might be saved in sync. It’s a very efficient strategy for efficiently evaluating differing contact timings, differing channels, messaging, name campaigns and cost agreements. Nearly any technique change could be precisely in contrast and analysed. Take a look at and be taught permits continuous enchancment to operations, or the implementation of hybrid approaches, when debtors obtain differing remedies relying on the probably success of their respective buyer phase.

Optimizing Collections Methods with Prescriptive Analytics

It’s additionally also known as optimization. Crucially, it takes predictive analytics even additional by trying throughout a complete enterprise course of to search out the one technique, or group of methods, which are more likely to outcome within the highest stage of success. Targets could be easy corresponding to maximising sums collected or maximising potential returns inside a set timeframe. Optimization algorithms also can account for employees, price range, authorized prices and different constraints.

Prescriptive analytics additionally permits organisations to stability employees towards their respective workloads. They’ll spotlight the chance value of transferring employees between particular workloads, or particular actions on circumstances. Crucially, they’ll present when to cease working a case and cease chasing a misplaced trigger in face of budgetary and useful resource limits.

Prescriptive analytics also can use a studying loop to repeatedly guarantee outcomes are fed again into collections fashions, permitting automated fine-tuning of methods. If buyer behaviour, or financial circumstances abruptly change, fashions could be re-calibrated to remain constant over time.

Learn the total put up

4. 9 Steps to Enhance Contact Knowledge High quality in Debt Assortment

Ulrich Wiesner offered this recommendation on how one can enhance contact information high quality.

1. Get Contact Knowledge Earlier than You Want It

It’s a lot simpler to get legitimate contact information out of your prospects than from a 3rd occasion. And updating contact information when it is advisable contact a buyer as a part of a collections course of is usually a lot more durable than in originations or account administration. Therefore managing contact information needs to be an enterprise process.

Knowledge seize at buyer acquisition shouldn’t be restricted to information that’s required to finish the originations course of. Particularly, cell phone quantity and electronic mail addresses needs to be captured along with the bodily handle each time potential, as they facilitate digital engagement and hand-off to self-service processes.

2. Take a look at Your Knowledge High quality

Each time contact information is acquired, it needs to be checked for syntactical plausibility – two-digit cellphone numbers and electronic mail addresses with out an @ or and not using a legitimate high stage area won’t be of a lot use later. And ideally, contact information needs to be examined. At originations, such assessments could be branded as a buyer satisfaction survey, which is a wise factor to do anyway. Change channels should you can — for instance, if emails are used to replace your buyer on progress throughout the originations course of, use cellphone or textual content for a follow-up survey.

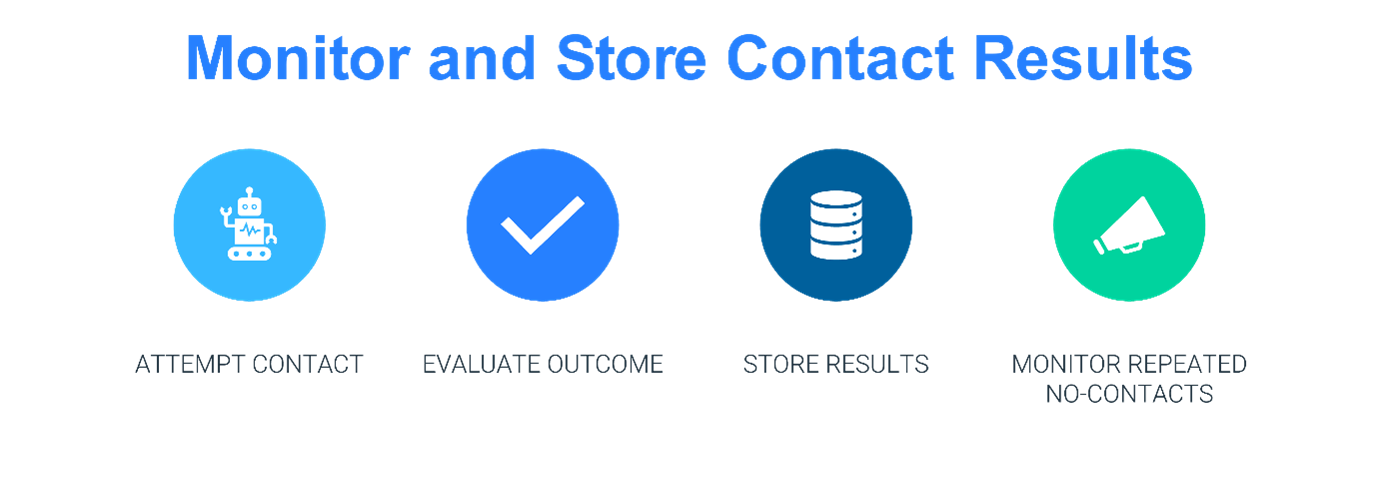

3. Consider Your Communication Outcomes

For each outbound buyer contact, the bodily end result needs to be evaluated; failures needs to be logged and will set off a respective rectification course of. Damaging outcomes embrace undeliverable emails and textual content messages, invalid cellphone numbers and returned bodily mail. Addressing the issue when it first happens will increase the chance that prospects can nonetheless be reached on one other channel.

4. Periodically Affirm Contact Knowledge

Over time, prospects will change their contact particulars, and particularly for low-interaction, long-term merchandise like mortgages or bank cards, you will need to periodically validate contact information with the client. This may be achieved by pop-ups on the client portal or cell app or as a part of the decision script throughout customer support contacts. For an inexpensive buyer expertise, the date of the final validation needs to be saved, and the subsequent affirmation needs to be triggered based mostly on that date.

5. Course of Contact Modifications

Whereas it may be applicable to insist on a written affirmation for modifications to the first authorized handle, contact modifications offered by the client ought to by no means be disregarded simply because they don’t meet sure formal necessities. As a substitute, such contact information needs to be captured and flagged as unconfirmed. The place required, affirmation could be gained through pop-ups in buyer portals or through pre-filled types which are despatched to the client.

6. Outline a No-Contact Technique in Debt Assortment

In extremely automated assortment environments, it’s much more vital to maintain monitor of consumers you haven’t been in a position to contact. Such prospects must be faraway from commonplace processing and assigned to a devoted no-contact technique, the place the rationale for the failed makes an attempt will get evaluated and addressed.

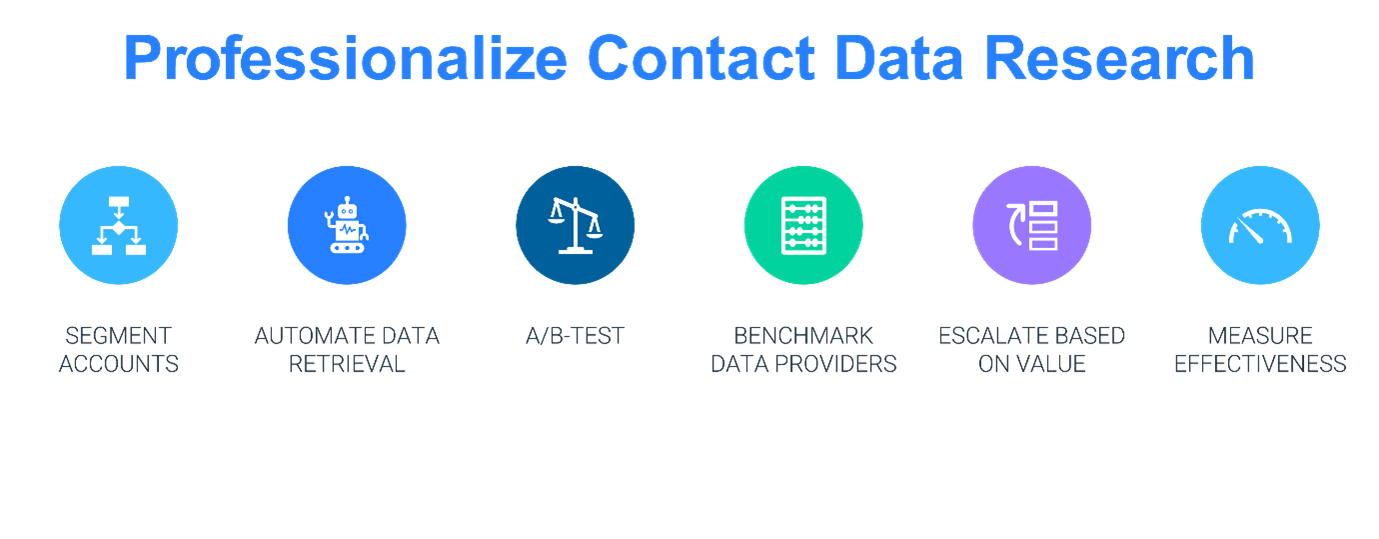

7. Professionalize Knowledge Analysis

Even should you observe the above suggestions, you may find yourself with out legitimate contact information. Then it’s time for information analysis.

Leaving contact information analysis to the person collector might be the costliest strategy. Analysis needs to be a specialist process, executed by devoted assets. That is the one technique to get a grip on which strategies work greatest, and to achieve an understanding of prices and advantages of different approaches. In smaller organizations that don’t have a devoted crew, contact information analysis ought to nonetheless be dealt with by specialised assets, even when this isn’t their sole duty.

8. Automate and Escalate

Even when accounts lacking contact information needs to be the exception, they usually result in high-volume processes. Because of this, automation of information retrieval is vital.

Wherever potential, preliminary information retrieval makes an attempt needs to be undertaken in bulk, e.g., by contacting the client on an alternate channel and asking for up to date contact particulars. In lots of geographies, handle analysis providers present up to date contact info and cost on successful foundation solely. The place a number of suppliers exist, you may pit suppliers towards one another in champion/challenger assessments, or rotate failed makes an attempt from one supplier to the subsequent. Implementing processes in your choice engine can present the construction and agility to dramatically speed up the take a look at and be taught.

For purchasers with none legitimate contact information, bigger establishments have inside mini hint groups and outsource the certified Gone Away for Hint and Accumulate to specialist businesses. Smaller organisations may go straight to Hint and Accumulate. What’s vital is that Gone Away accounts should not instantly assumed to be a a lot larger danger if they’re simply traced and contacted. A Gone Away tag or label shouldn’t dismiss the necessity to validate the monetary vulnerability of the client.

9. Measure What You Do to Enhance Your Knowledge High quality

No matter your strategy to contact information retrieval is, actions ought to observe a structured course of, needs to be logged, and needs to be monitored for effectivity and effectiveness. That is the one means to enhance your processes and information high quality over time, to grasp what works for which kind of buyer, and to get essentially the most out of your analysis efforts.

Learn the total put up

5. Assembly Debt Assortment Challenges Amid a Squeeze on Revenue

Bruce Curry reviewed some classes realized throughout the monetary disaster of 2008, and the way they could possibly be utilized now. He requested, “Do you have got the best instruments and capabilities to do these six issues properly?” He additionally shared the parts of the built-in FICO Platform that may shut the hole between the place collectors are at present and there they need to be.

1. Perceive the differing profile of collections prospects given irregular financial scenario – Leverage various information sources, utilizing buyer analytics to drive deep insights, tailoring therapy methods and engagement approaches to debtors based mostly on rising insights.

2. Believe in profile refinement – Dynamically replace profiles as new info is acquired, together with streaming buyer interplay and transactional information, enriching with exterior sources -including credit score bureaux and Open Banking information – to supply wealthy 360-degree view.

3. Pre-determine outcomes forward of executing the remedies – Perceive how one can develop, deploy and monitor motion impact fashions, driving from predictive to prescriptive analytics and mathematical optimization.

4. Encourage round the clock buyer collaboration – Enabling two-way buyer dialogue at any time through the channels of their alternative.

5. Safe assured assurance of a proper end result – By means of auditable, clear and moral AI at every level of choice and execution.

6. Always monitor triggers and indicators of adjusting circumstances – Instigating applicable buyer therapy and motion weighted in direction of one thing that has occurred as a substitute of by one thing that hasn’t occurred, or just the passage of time.

Learn the total put up

How FICO Can Enhance Your Collections Efficiency

[ad_2]

Source link