[ad_1]

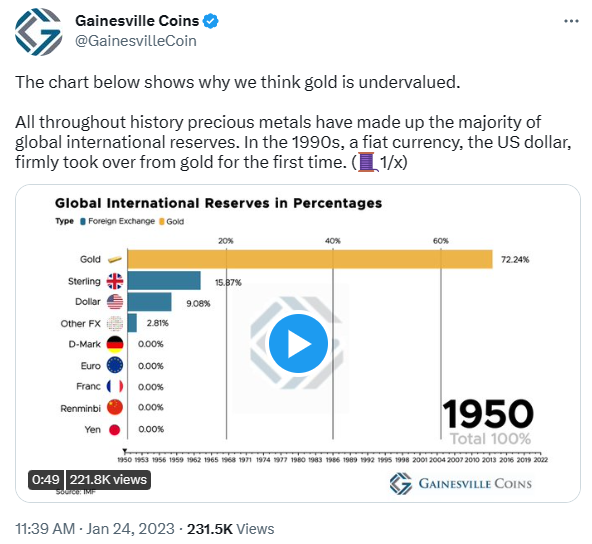

Within the hierarchy of cash gold is superior to fiat cash. From an historic perspective the previous many years have been characterised by belief in fiat cash, whereby fiat made up the lion share of worldwide worldwide reserves. The battle between Russia and Ukraine (and by extension West and East), inflation, and systemic dangers are reversing this pattern. An extended-term gold valuation mannequin, which assumes gold will account for almost all of worldwide reserves, suggests the gold worth to exceed $8,000 within the coming decade.

The pattern of central banks growing gold reserves is more likely to proceed.

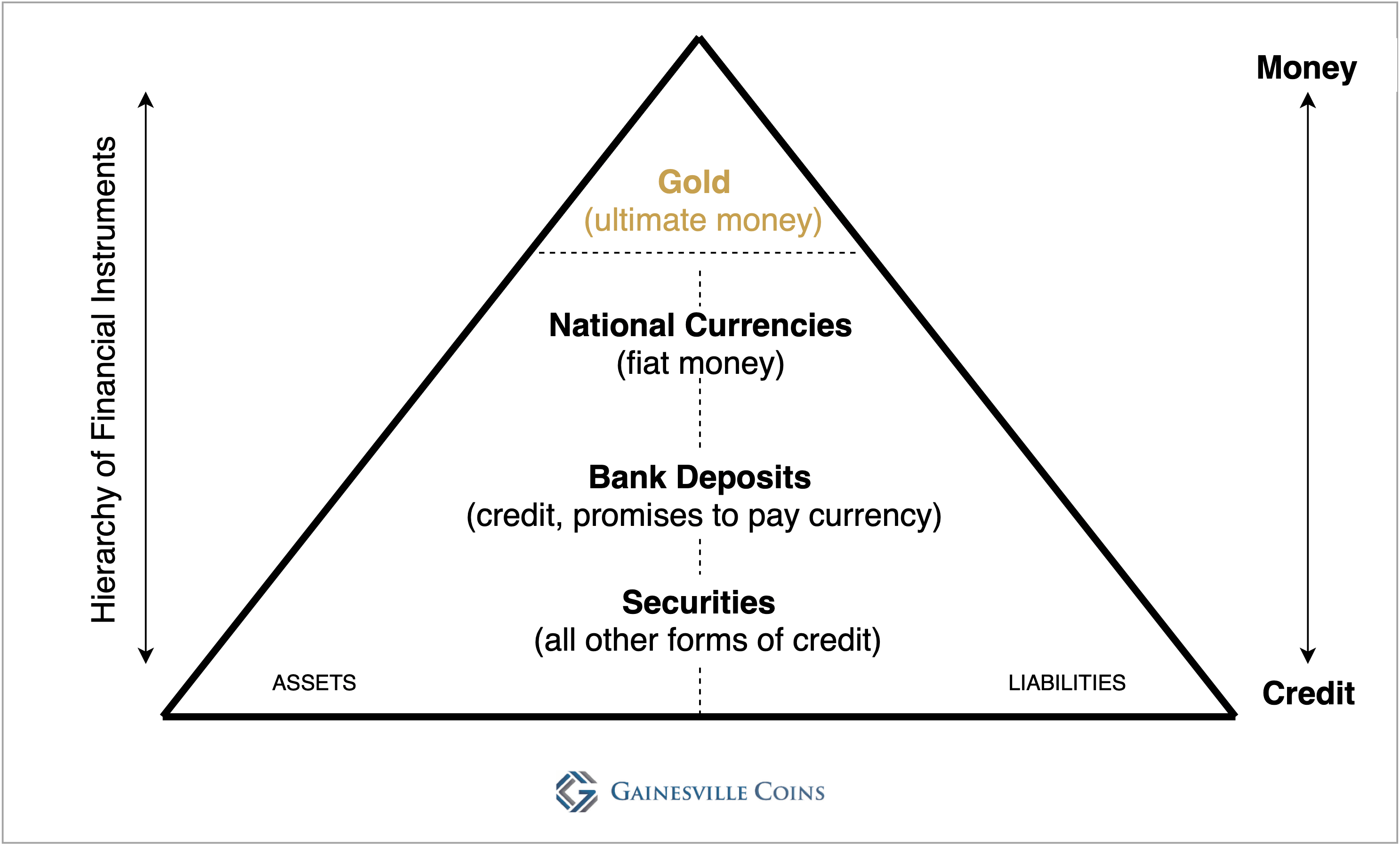

The Hierarchy of Cash

Studying Zoltan Pozsar’s analyses for a couple of years led me to learn books and comply with lectures by his mental mentor Perry Mehrling, Professor of Worldwide Political Financial system. In response to Mehrling there’s a pure hierarchy of cash, to be visualized as a pyramid.

Pyramid of the hierarchy of cash.

On the high of the pyramid sits the final word cash, which is scarce, universally accepted, and has no counterparty danger as a result of it’s nobody’s legal responsibility: gold. Beneath gold are nationwide currencies issued by central banks. Then come deposits which are created by business banks. Securities, similar to bonds and fairness, are on the backside.

As a result of the whole lot beneath gold could be created out of skinny air, the bottom of the pyramid could be simply widened. All through the enterprise cycle stability sheets (property and liabilities) are prolonged—credit score is created—inflicting an financial growth. Throughout a recession, stability sheets contract and the form of the pyramid is transformed.

Horizontally, the pyramid is all about amount and leverage. Vertically, the pyramid is about high quality: the upper up the higher the standard of cash. From Mehrling:

In a growth, credit score begins to appear like cash. Types of credit score change into way more liquid, they change into way more usable to make funds with. And in contraction, you discover out that what you will have will not be cash, it is credit score truly. In a contraction, you discover out that gold and forex should not the identical factor. That gold is best. You discover out that deposits and forex should not the identical factor. That forex is best.

Now my interpretation…

A Lengthy-term Gold Valuation Mannequin

What has occurred prior to now many years, after severing the gold customary in 1971, is an enormous enhance in provide of fiat cash, credit score, and securities. The pyramid is off form with a tiny tip and a fats debt stomach. International debt to GDP is close to its all-time excessive established in 2020.

Coverage makers received’t enable the debt to default—a contraction of credit score—as a result of the worldwide monetary system has grown too massive and intertwined. One default an excessive amount of may danger the soundness of all the association. The one technique to restore the form of the pyramid is by a rise within the worth of gold.

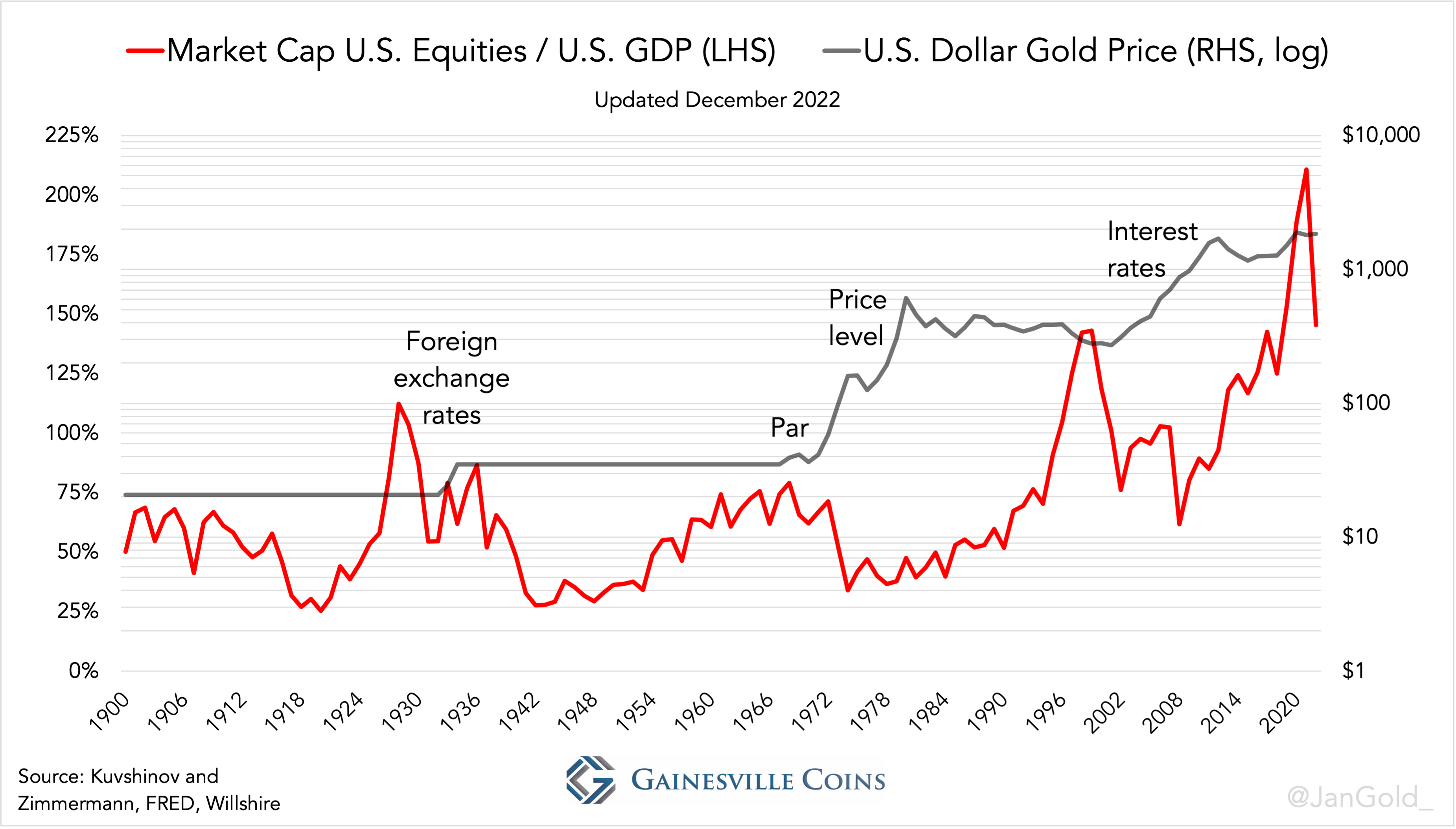

In a earlier article we mentioned the connection between the worth of gold and equities over the previous 100 years. These are dynamics between the highest of the pyramid and the underside. We concluded that the present decline of the fairness market capitalization, relative to GDP, is signaling a brand new gold bull market.

In an financial downturn the US fairness market cap to GDP ratio falls, and the greenback is debased by means of one of many 4 costs of cash (par, rates of interest, international change charges, worth degree) to spice up the economic system. In consequence, the worth of gold denominated in {dollars} will increase.

In as we speak’s article, we are going to use Mehrling’s hierarchy of cash framework, and look at the connection between nationwide currencies and gold to get a way of the place the worth of gold is headed.

Central banks have created a lot “cash” since 2008 that from an financial perspective the relation with financial institution deposits has weakened. Measuring the worth of official gold reserves versus the financial base (central financial institution cash) could not fulfill to foretell the longer term worth of gold.

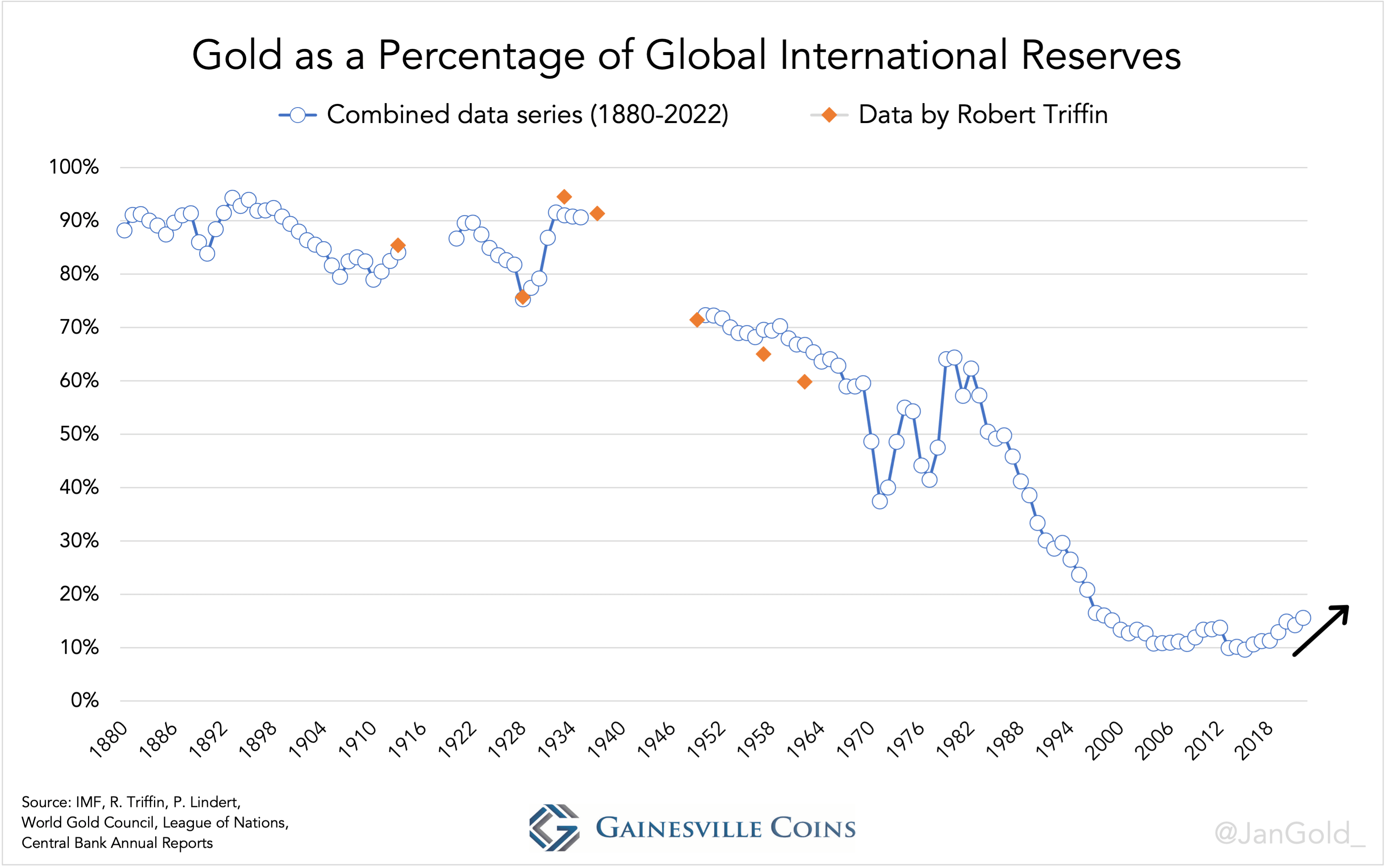

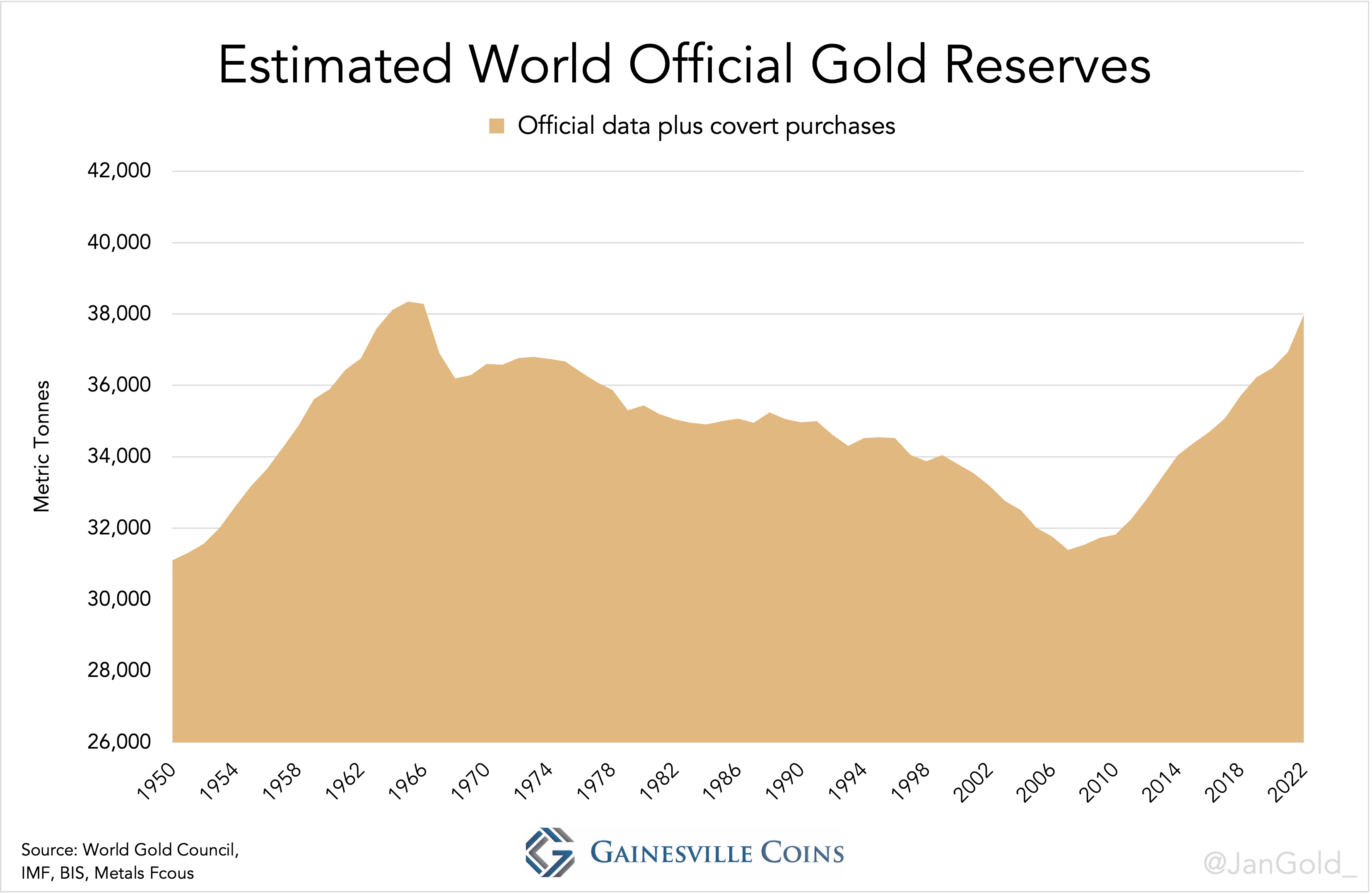

As a substitute, we are going to consider how a lot gold central banks are keen to carry relative to international nationwide currencies. In different phrases, the composition of worldwide reserves (international change and gold), which underpin their stability sheets. By going by means of the archives, I’ve been capable of conceive a long term information collection of gold as a share of worldwide reserves from 1880 till current*.

The chart reveals world official gold reserves as a share of official worldwide reserves.

Central banks in combination have an uncommon religion in international change, as gold’s share of whole reserves accounted for 16% in 2022, in opposition to a historic common of 59%. These central banks, nonetheless, are beginning to lose confidence within the currencies issued by their friends. In 2022 official gold reserves went up by a document 1,136 tonnes, whereas international change reserves went down by a document $950 billion. Massive purchases by central banks on all continents lately point out how central banks assume the system will stabilize, by a rising gold worth, confirming they haven’t any intention in designing a brand new pyramid.

International gold reserves.

In mild of the battle, which precipitated the US to freeze the Russian central financial institution’s greenback holdings, inflation, and systemic dangers, the pattern of gold growing its share of whole reserves is logical.

Ought to we prolong this pattern and assume gold to make up a conservative 51% of worldwide worldwide reserves, the worth of gold would must be $10,000 per troy ounce. Naturally, within the technique of elevating the gold worth central banks enhance the load of their gold and promote international change, leading to a cheaper price of gold required to make up the vast majority of whole reserves. Then again, over time central financial institution stability sheets develop and so does their demand for worldwide reserves, presumably revaluing gold in urgency.

I exploit central banks as a proxy for all the economic system. The non-public sector is in an identical boat as central banks: they’ve little publicity to gold versus credit score property as nicely. It’s positively not simply central banks that may drive up the worth. Let’s say $8,000 per ounce, a ballpark determine, would make gold’s share of whole reserves exceed 50%.

Click on the picture to view the animated chart!

Conclusion

All through the ages the worth of gold at all times rises as the quantity of bodily metallic out there is inadequate to satisfy mankind’s liquidity wants. Nationwide currencies devaluing in opposition to gold to extend liquidity is a reality of life.

Within the outdated days, cash have been debased by decreasing their bullion content material, leading to extra models of nationwide forex. Because the gold customary was deserted in 1971, fiat cash could be created by the stroke of a key, geared toward boosting progress, or revitalizing the bottom of the pyramid. However the high inevitably follows. The value of gold has to go as much as reset the form of the pyramid. Now—given battle, inflation, and systemic danger—can be a type of moments for the gold worth to regulate.

*For this text I’ve excluded Particular Drawing Rights, IMF Tranche Positions, and silver from worldwide reserves, for the consistency of the information collection and since they make up solely a small a part of whole worldwide reserves. Knowledge from 1880 till 1913 is especially sourced from Peter Lindert and Timothy Inexperienced. The numbers embrace official gold and international change reserves, not international change held by non-public banks or gold cash in circulation. Knowledge from the interwar interval is sourced from a number of publications by the League of Nations, Central Financial institution Annual Experiences, the World Gold Council, and the Federal Reserve. Knowledge since 1950 is sourced from the IMF, the World Gold Council, Metals Focus, and the BIS. Knowledge from Robert Triffin is used as a test on my calculations. The numbers from 1880 till 1935 have to be seen as estimates.

Sources

Financial institution for Worldwide Settlements (BIS), Annual and Month-to-month Experiences.

Banca D’Italia (1987). Gold Within the Worldwide Monetary System.

Bloomfield, A. I. (1963). Brief-Time period Capital Actions Below the Pre-1914 Gold Normal.

Board of Governors of the Federal Reserve System (1943). Banking and Financial Statistics 1914-1941. Half 1.

Eichengreen, B. & Flandreau, M. (2009). The rise and fall of the greenback (or when did the greenback exchange sterling because the main reserve forex?)

Inexperienced, T. (1999, for the World Gold Council). Central Financial institution Gold Reserves. An historic perspective since 1845.

Worldwide Financial Fund. Worldwide Monetary Statistics.

League of Nations, a number of publications.

Lindert, P. H. (1967). Key Currencies and The Gold Trade Normal, 1900-1913.

Lindert, P. H. (1969). Key Currencies and Gold 1900-1913.

Mehrling, P. (2012). Economics in Cash and Banking.

Triffin, R. (1961) Gold and the Greenback Disaster, The Way forward for Convertibility.

Triffin, R. (1964). The Evolution of the Worldwide Financial System: Historic Reappraisal and Future Views.

World Gold Council, Gold Demand Traits experiences and Datahub.

Learn extra about gold’s function as worldwide reserves from the creator:

Zoltan Pozsar, the 4 Costs of Cash, and the Coming Gold Bull Market

Estimating the True Measurement of China’s Gold Reserves

Europe Has Been Getting ready for a International Gold Normal. Half 2

Turkish Central Financial institution Sends Gold To London. In Want for FX?

Governor of Dutch Central Financial institution States Gold Revaluation Account Is Solvency Backstop

What Occurred to the $650 Billion in SDRs Issued in 2021?

[ad_2]

Source link