[ad_1]

The exchange-traded fund (ETF) you’re occupied with shopping for—VWCE—is the Vanguard FTSE All-World UCITS ETF. It trades in Euros on three inventory exchanges: the NYSE Euronext, the Deutsche Börse and the Borsa Italiana S.p.A. You possibly can possible purchase it via most European low cost brokerage accounts.

Though it trades in Euros, the bottom foreign money for the ETF is definitely U.S. {dollars}. The fund seeks to trace the efficiency of the FTSE All-World Index—about 4,000 massive and mid-sized shares in developed and rising markets. Roughly 60% of the ETF is allotted to U.S. shares and the opposite 40% is non-U.S. shares.

It bears mentioning, Nick, that Vanguard affords related ETFs in Canada and the U.S. that could be simpler for a Canadian investor to buy via a Canadian brokerage account. Vanguard FTSE International All Cap ex Canada Index ETF (VXC) trades on the Toronto Inventory Change (TSX) and Vanguard Whole World Inventory ETF (VT) trades on the New York Inventory Change (NYSE). They observe an analogous mixture of worldwide shares. I take advantage of these ETFs as examples of extensively held, massive ETF options from Vanguard in North America, however when you do some digging, you might be able to discover an ETF that’s much more much like VWCE.

Does the foreign money you purchase a international funding in matter?

Until foreign money hedging is employed, the foreign money you purchase a global ETF in does probably not matter. If an ETF owns Samsung shares, for instance, and people shares rise in worth in South Korean received, their worth additionally rises in Euros, U.S. {dollars} and Canadian {dollars}.

While you purchase an ETF in a international foreign money or nation, there’ll usually be withholding tax on the dividend revenue. The speed is usually between 15% and 25%. While you purchase an ETF in a taxable non-registered account, the revenue is taxable in Canada. A Canadian taxpayer can usually declare a international tax credit score for any tax already withheld to scale back their Canadian tax payable. So, you may keep away from double taxation.

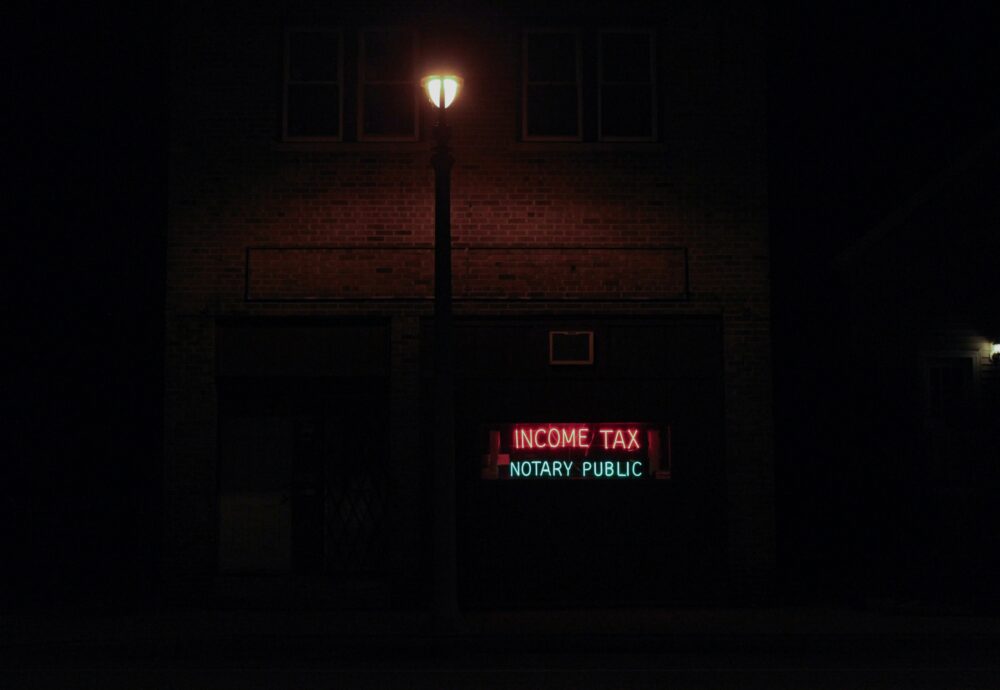

Easy methods to deal with your tax return

Shopping for international investments in a taxable funding account might lead to extra complexity if you file your tax return, Nick. The international nation’s tax reporting is probably not set as much as report revenue and capital features simply in your Canadian tax return, so it’s possible you’ll have to calculate them manually. It’s essential convert the revenue into Canadian {dollars}. If you happen to promote a taxable funding in a international foreign money, it’s worthwhile to calculate the acquisition worth and the sale worth in Canadian {dollars} primarily based on the international trade charges on the time of buy and sale.

In case your taxable international investments have a cumulative price base in extra of $100,000 Canadian, it’s possible you’ll have to file kind T1135 Overseas Earnings Verification Assertion. This kind needs to be accomplished and submitted as a part of your annual revenue tax submitting. Failure to take action can lead to penalties.

It may be less complicated to purchase the Vanguard FTSE International All Cap ex Canada Index ETF (VXC) or an analogous Canadian-listed ETF. The annual revenue and capital features could be reported on T3 and T5008 slips in Canadian {dollars}, making it simpler to report in your tax return. You’d keep away from the T1135 submitting requirement. And you’ll personal an analogous funding to the VWCE ETF you’re contemplating.

[ad_2]

Source link