[ad_1]

Fears of a recession within the financial system have been floating round for months. In keeping with the Nationwide Bureau of Financial Analysis, we aren’t in a recession. Nevertheless, 1000’s of employees had been laid off by their employers in 2022. Because the pattern of layoffs trickles by the financial system, it’s essential to take steps to safeguard your funds towards a possible layoff.

In case you are involved concerning the potential affect of a layoff in your funds, you’re in the proper place. We are going to discover the way to shield your credit score rating from the fallout of a layoff.

How a Layoff Can Impression Your Credit score Rating

If you end up laid off out of your job, that received’t instantly affect your credit score rating. In any case, your employment standing isn’t an element your credit score rating considers. However the sudden lack of earnings may trigger your funds to get messy, which may lead your credit score rating to take successful.

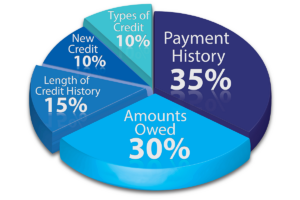

There are 5 components that make up your credit score rating. These embody:

Fee historical past. Fee historical past accounts for 35% of your credit score rating, which makes it an important issue. In the event you not have an earnings, you may find yourself lacking a cost. Missed funds can have a extreme destructive affect in your credit score rating.

Debt: How a lot you owe accounts for 30% of your credit score rating. One issue within the debt class is your revolving credit score utilization ratio. A decrease revolving credit score utilization ratio is best to your credit score rating. When your earnings drops, you may rely extra closely in your bank cards. As your credit score utilization ratio rises, you may see your credit score rating fall.

Size of credit score historical past: The size of your credit score historical past accounts for 15% of your credit score rating. The older your accounts, the higher off your credit score rating will probably be. A layoff shouldn’t affect the age of your accounts. If doable, chorus from closing your older credit score accounts.

Credit score combine: A mixture of revolving and installment credit score accounts for 10% of your credit score rating. Until you’re taking out new loans or strains of credit score, a layoff shouldn’t affect this a part of your credit score rating.

New credit score: New credit score accounts for 10% of your credit score rating. In the event you apply for brand spanking new bank cards or take out new loans after a layoff, this might negatively affect your credit score rating.

A job loss received’t instantly trigger destructive impacts in your credit score rating. However dropping your job is commonly an enormous shakeup to your private funds. If the adjustments push you to overlook funds or tackle extra debt, you may see your credit score rating fall after a job loss.

5 Methods to Defend Your Credit score Rating From a Layoff

Nobody desires to expertise a layoff. However you’ll be able to diminish the monetary aftershocks of a layoff by selecting to create a security web earlier than getting a pink slip. Even in case you are not involved about potential layoffs at your organization, it’s nonetheless a good suggestion to arrange your self for an surprising lack of earnings.

Search for Methods to Minimize Your Spending

In case you are involved concerning the fallout of a layoff, it’s a very good time to contemplate spending cuts. Whenever you shrink your bills, you’ll want much less to get by if a layoff all of the sudden cuts off your earnings.

Listed below are some methods to slash your spending:

Comb by your bills: Begin by having a look at your financial institution or bank card statements. Whenever you undergo your spending on a line-by-line foundation, you is perhaps shocked to seek out loads of room for cuts. For instance, you may cull pointless subscriptions or reduce on consuming meals exterior of the house.

Attempt a no-spend problem: Inside a no-spend problem, you remove all discretionary spending for a set time frame. For instance, you may select to remove spending on extras for a whole month. You can also make a no-spend problem so long as you’d like.

Attempt a no-spend problem: Inside a no-spend problem, you remove all discretionary spending for a set time frame. For instance, you may select to remove spending on extras for a whole month. You can also make a no-spend problem so long as you’d like.

Monitor down financial savings: When it’s essential to make a purchase order, there isn’t any purpose to overspend. Contemplate searching for gross sales and clipping coupons to restrict your spending.

Skip consuming out: It’s very simple to overspend on consuming out. In case you are spending greater than you need to on restaurant meals, then contemplate upgrading your cooking abilities.

Negotiate your payments: Many invoice suppliers are prepared to barter your value level. For instance, you may be capable to save in your web prices when you give your supplier a name and ask for a extra fundamental plan.

As you reduce in your bills, you’ll make it simpler to outlive financially after a layoff. Plus, all of those cuts might help you make progress towards different monetary objectives whereas your earnings is steady.

Beef Up Your Emergency Fund

An emergency fund is a key piece of any steady private finance plan. It acts as a security web to your funds. If one thing goes incorrect, like when you get laid off out of your job, you’ll have some funds readily available to cowl bills whilst you discover a new supply of earnings.

When it comes to your credit score rating, an emergency fund might help you proceed to make on-time funds to your debt obligations after a job loss. Plus, you should use these funds to cowl your residing bills as a substitute of taking out debt to get by this tough time.

Basically, private funds consultants suggest having between three to 6 months’ price of residing bills in your emergency fund. For instance, when you spend $2,000 monthly, you’d ideally save between $6,000 to $12,000 in your emergency fund. Nevertheless, you may determine to save lots of extra when you see a layoff coming your manner.

After all, saving up this chunk of change isn’t simple. In the event you aren’t in a position to construct up this measurement of an emergency fund, begin by tucking away what you’ll be able to. Even having a couple of hundred {dollars} readily available could make a distinction after a layoff.

Picture by way of www.SeniorLiving.Org

Want some recommendations on constructing an emergency fund? Try Easy methods to Construct an Emergency Fund.

Pay Down Excessive-interest Debt

Money owed which have a excessive rate of interest hooked up are a drain in your funds. Every month, you’re caught with a month-to-month cost that may suck the life out of your finances and make it tough to remain afloat after a layoff.

If doable, work on paying down your high-interest debt. For instance, you probably have a bank card stability with a sky-high rate of interest, paying off that stability is perhaps the proper transfer to guard your credit score rating. Decreasing what you owe now might help hold your funds decrease after a possible layoff.

Unsure the way to sort out your money owed? In case you are anxious concerning the rates of interest, then the avalanche methodology is perhaps the proper match. Inside this debt reimbursement technique, you’ll repay the debt with the best curiosity cost first. After you’ve eradicated the debt with probably the most curiosity, you’ll sort out the debt with the following highest curiosity cost. Eliminating your high-interest debt first is probably the most mathematically environment friendly path to changing into debt-free.

Study extra in Snowball vs. Avalanche: What Is the Finest Technique to Pay Off Debt?

Earlier than paying off your money owed, contemplate constructing a small emergency fund. For instance, you may save up a couple of hundred {dollars} earlier than throwing the remainder of your earnings towards debt reimbursement.

Construct Additional Streams of Earnings

As an worker, the paycheck you obtain out of your employer is probably going your principal supply of earnings. For a lot of People, their paycheck is their solely type of earnings. In the event you lose that principal supply of earnings, it may be difficult to guard your credit score rating after a layoff. Fortunately, there are numerous methods to construct additional earnings streams.

With additional earnings streams, you should use the funds to sort out your monetary objectives. For instance, you may use the funds to construct up your emergency fund or pay down high-interest debt. Both motion might help you shield your credit score rating after a job loss.

However when you lose your job, these new earnings streams supply a technique to hold paying all your payments on time. With the power to maintain up along with your bills, you’ll be able to shield your credit score rating within the occasion of a layoff.

Listed below are some additional earnings streams to contemplate:

Ship meals: You may earn cash by delivering groceries or takeout. A number of providers you may be capable to work for embody Instacart, DoorDash, and Shipt.

Rideshare: As a rideshare driver, you choose up passengers and transport them round city.

Discover a part-time job: Many bodily retailers have part-time job alternatives, which may function an additional earnings stream.

Provide providers in your city: You may supply to stroll canines, home sit, babysit, deal with chores, and extra. Contemplate trying out TaskRabbit to get began or unfold the phrase by household and associates.

Construct an internet aspect hustle: You may earn cash by freelance writing, running a blog, managing social media channels, and extra. In case you are tech-savvy, an internet aspect hustle is perhaps the proper match.

After all, that is simply a place to begin for constructing additional earnings streams. Don’t be afraid to get inventive when looking for a brand new earnings supply that fits your wants and pursuits.

Make a Plan for After a Layoff

In the event you expertise a layoff, it is going to seemingly include a wave of feelings. It’s usually tough to make the proper choices amidst an emotional rollercoaster experience. With that, it’s a good suggestion to map out your post-layoff plans earlier than you obtain a discover.

Listed below are some steps to contemplate in your layoff plan:

Contemplate your healthcare choices: After a layoff, your healthcare is likely one of the greatest points that involves thoughts. Take a while to analysis your healthcare choices. You may join COBRA (Consolidated Omnibus Price range Reconciliation Act), nevertheless it’s an costly choice. Different healthcare plans is perhaps extra reasonably priced.

Apply for unemployment advantages: Perform a little research on the way to apply for unemployment advantages in your state. Discover the applying’s web site and decide what data you’ll have to have readily available.

Apply for unemployment advantages: Perform a little research on the way to apply for unemployment advantages in your state. Discover the applying’s web site and decide what data you’ll have to have readily available.

Attain out to your community: Collect an inventory of contacts to succeed in out to about new job prospects. After all, you don’t have to succeed in out till after the layoff. But it surely’s often good to have a few of your high contacts lined up.

Have an emergency expense-cutting plan: If you end up laid off, it’s good to tighten your belt considerably. Make an inventory of additional gadgets that you may stay with out till you will have shored up your earnings state of affairs. This may contain reducing all discretionary spending on a brief foundation.

A layoff received’t be a enjoyable expertise. However with just a little little bit of planning, you’ll be able to stroll into the state of affairs as ready as you may be.

The Backside Line

Whereas a layoff received’t instantly affect your credit score rating, the monetary implications of a layoff may push your credit score rating down.

In the event you anticipate a possible layoff in your future, contemplate taking motion to create a easy monetary journey. Growing your financial savings and constructing additional earnings streams could make all of the distinction to your credit score rating after a layoff.

Even when you don’t foresee a layoff, you by no means know what life may throw your manner. Working by the steps above might help you shield your credit score rating from many sorts of emergencies. Whether or not you expertise a brief hole in work or must cowl a significant surprising expense, the following pointers might help you keep afloat.

What did you consider this text? In the event you discovered this data on getting ready for a doable layoff useful, or you probably have any suggestions you’d add, remark under to tell us!

[ad_2]

Source link