[ad_1]

On this article

Business actual property is dealing with stress from a number of instructions. The first stress is rising rates of interest, that are placing upward stress on cap charges (which pushes down asset values), making refinancing prices more and more troublesome and costly to come back by. However there’s one other danger arising, particularly to the multifamily area of interest of business actual property: oversupply. Latest knowledge means that there could also be a short-term glut of multifamily models hitting the market at an inopportune time.

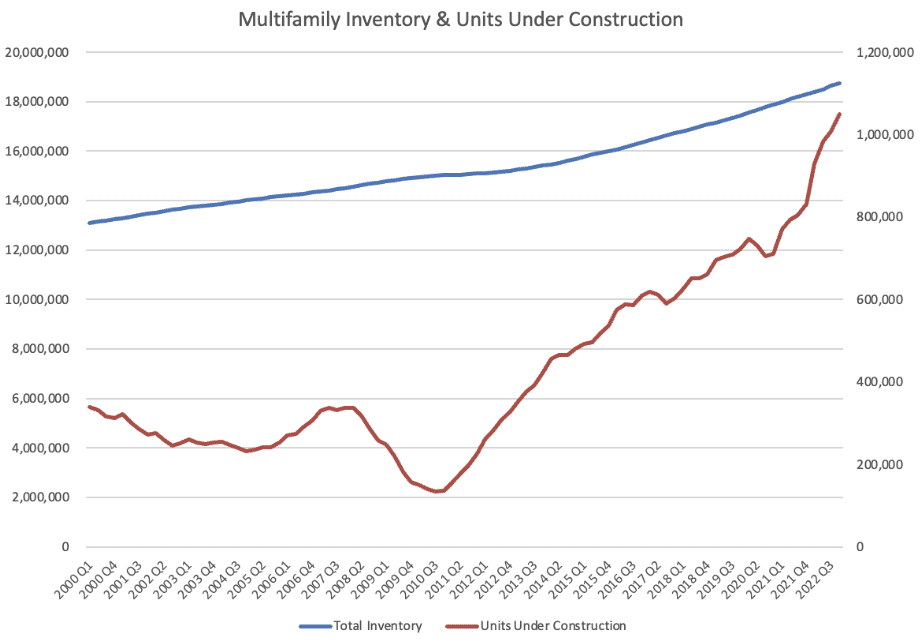

To completely clarify this concern, let’s have a look again at building traits for multifamily properties (outlined as properties with 5 or extra models) during the last a number of a long time. As you possibly can see within the graph under, after extreme declines within the variety of multifamily models from 2008-2014, multifamily building and the overall variety of multifamily models have picked up significantly.

For the reason that starting of the pandemic, the upward development of elevated multifamily constructing exploded even additional, and as of This fall 2022, surpassed a million models beneath building for the primary time (no less than based on CoStar’s knowledge).

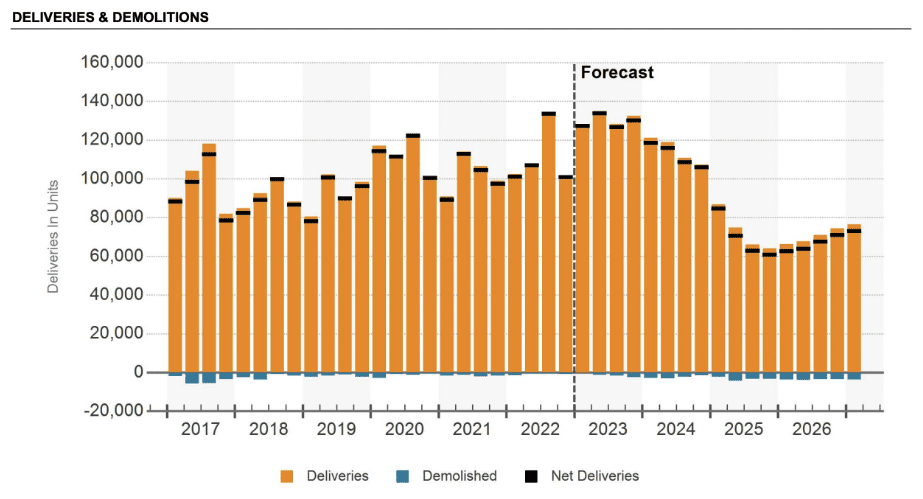

After all, it takes a number of months, if not years, to construct multifamily models, even in good instances. However latest years haven’t been straightforward on builders—no less than when it comes to supply schedules. With provide chain points and labor constraints, building has taken longer. This development is leading to an enormous glut of stock that has but to hit the market. Wanting on the chart under, you possibly can see CoStar’s forecast for delivered models reveals 2023 being the best on information, with 2024 coming down a bit however nonetheless excessive. Sure, forecasting is troublesome, however forecasting building deliveries is a bit simpler than different datasets. Because of the truth that builders and builders have to get permits for building, there’s stable knowledge about tasks which are deliberate and within the pipeline. Personally, I take this forecast a bit extra severely than I do different forecasts.

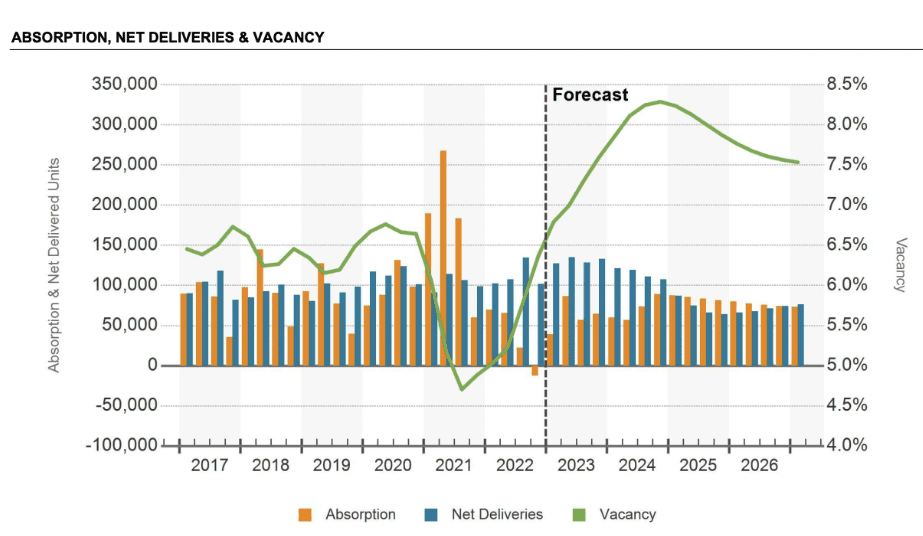

A rise in provide is just not an issue if there’s proportionate demand to “take in” the brand new models—however there isn’t. Demand is falling off.

The chart under tells a really compelling story. First, have a look at the blue bars. That’s the identical as what we checked out above—excessive unit deliveries over the subsequent two years. However then have a look at the orange bars that present “Absorption” (a industrial actual property metric that measures demand). It’s not maintaining.

After a banner yr for demand in 2021, “web absorption” (absorption – demand) turned destructive, that means extra provide is coming onto the market than there’s demand. That was in 2022! In 2023, much more models are anticipated to come back on-line, and as this graph reveals, demand is just not anticipated to maintain tempo. After all, some builders might cancel or pause their tasks, however it’s an costly proposition that builders are likely to keep away from if in any respect attainable.

What occurs when provide outpaces demand? Emptiness will increase, as you possibly can see forecasted on this CoStar projection. This ought to be a priority to anybody within the multifamily house and to any actual property investor. A rise in provide and a commensurate improve in emptiness can lower earnings and push down rental charges. The info I’m displaying, and my evaluation, is relating to industrial properties, however downward stress on rents and rising emptiness in multifamily has the potential to spill into the residential market in sure areas.

After all, this national-level knowledge doesn’t inform the entire story. I took a have a look at a number of particular person markets to see how that is taking part in out on a regional stage. What I discovered is that sure markets are at vital danger of overbuilding. I picked a sampling of 5 markets that I believe are at excessive danger of rising emptiness and lease declines for multifamily: Santa Fe, New Mexico; Punta Gorda, Florida; Myrtle Seashore, South Carolina; Colorado Springs, Colorado; and Austin, Texas.

These markets all have vital building pipelines, with a excessive variety of models scheduled to hit the market relative to present provide and relative to anticipated demand.

Alternatively, many cities, which I discovered to be smaller cities, are nonetheless doing comparatively nicely.

Missoula, Montana; Athens, Georgia; Midland, Texas; Provo, Utah; and Topeka, Kansas, all have stable web absorption, and their building pipelines are very affordable relative to present stock ranges. To me, these cities have a a lot smaller danger of emptiness and lease declines.

Each market is exclusive, and I’m simply displaying a couple of examples of markets in danger and never in danger. However I encourage you to do a little analysis your self and determine how your market is doing when it comes to building. You could find a number of good knowledge totally free on the St. Louis Federal Reserve web site or simply by googling absorption knowledge in your native space.

Conclusion

Multifamily properties are seeing a provide glut hit the market at an inopportune time, the place rising rates of interest are already placing downward stress on costs and money circulation stress on operators. As such, 2023 and 2024 might form as much as be troublesome years within the multifamily house for present operators.

The vital factor to notice right here is that the availability glut and demand scarcity will doubtless be short-term. Lengthy-term constructing and demographic traits help sturdy demand for multifamily rental models nicely into the longer term, which bodes nicely for buyers. For instance, a latest research reveals that the U.S. wants 4.3 million extra multifamily models within the coming 12 years to fulfill demand. Family formation is probably going down proper now as a result of short-term financial circumstances. Inflation is negatively impacting renters’ spending energy, and financial uncertainty is stopping younger Individuals from forming their very own households. It’s unclear when this financial problem will finish, however when it does, demand will doubtless decide again up.

Given this, buyers might have good shopping for alternatives within the coming months and years. With cap charges prone to rise, costs for multifamily ought to go down. If NOI additionally drops as a result of oversupply points, that can push costs down even additional. This might enable inventors with some dry energy to get into multifamily at enticing costs, however keep in mind—it is a dangerous time. Watch out to not purchase simply something and to grasp the market dynamics in your native space intimately.

Construct your wealth with multifamily homes

Learn to change into a millionaire by investing in multifamily homes! On this two-volume set, The Multifamily Millionaire, Brandon Turner and Brian Murray encourage and educate you into turning into a millionaire.

Be aware By BiggerPockets: These are opinions written by the creator and don’t essentially symbolize the opinions of BiggerPockets.

[ad_2]

Source link