[ad_1]

Dilok Klaisataporn

The case for the Assertion of Money Flows

Many traders start inspecting an organization with the earnings assertion. In spite of everything, this can inform us if the corporate is worthwhile. And that is crucial factor, proper?

Bear in mind, money is a truth; revenue is an opinion. – Al Rappaport, economist identified for his concepts on furthering shareholder worth.

Web earnings comprises a number of accounting measures, corresponding to asset write-downs, amortization of intangible property, a number of estimates and assumptions, and unrealized positive factors and losses, amongst others. And accounting requirements are continuously evolving. This is the reason I all the time go to the assertion of money flows first – particularly money flows from working actions.

Nothing exists in a vacuum, in fact. It’s doable to have constructive money circulation in 1 / 4 resulting from timing and nonetheless be a failing enterprise. However steadily growing money from operations over time is the best measure of a improbable enterprise – and a successful long-term inventory. Relaxation assured, the cash-flow juggernauts under are worthwhile as properly.

Money-producing corporations are additionally inclined to place a whole lot of that money in your pocket by means of steadily growing dividends and share buybacks.

That is the case with Texas Devices (NASDAQ:TXN) and Analog Units, Inc (NASDAQ:ADI).

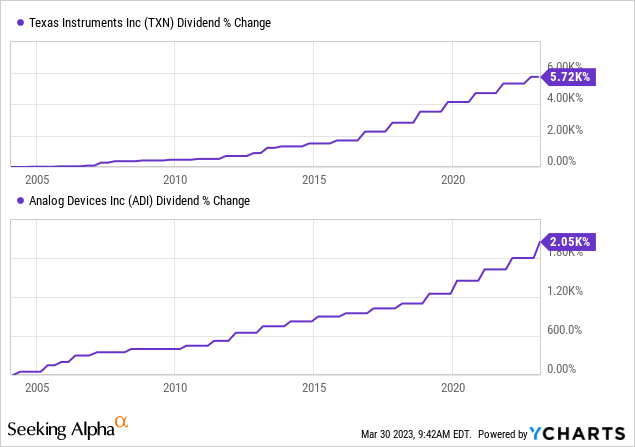

These corporations have raised their dividends yearly since 2004, as proven under, and there are extra to return.

All substance, no flash

TI and ADI do not name to a large swath of retail traders. When was the final time we noticed an article about them on the trending record? Even the product identify “analog semiconductors” is snooze-inducing.

However long-time shareholders know this: cash made the boring means spends simply the identical. High quality sleep is a precious intangible asset. And occurring trip with “boring” cash is simply as fulfilling, am I proper?

Investing needs to be extra like watching paint dry or watching grass develop. If you need pleasure, take $800 and go to Las Vegas. – Paul Samuelson, Economist, and Nobel Prize winner.

Analog semis are vital to expertise.

Analog chips are enablers. They take real-world information (suppose temperature, pace, place, and many others.) and translate the info to be used by units or high-tech digital semiconductors. They’re in all the things from thermostats to medical gear to electrical automobiles. We might not know once we are utilizing them, however our lives would change drastically in the event that they have been to vanish instantly.

The great thing about analog chipmakers is that they’re important and fewer depending on (1) risky markets, like NVIDIA (NVDA) and Intel (INTC), and (2) a small buyer base, like Skyworks (SWKS).

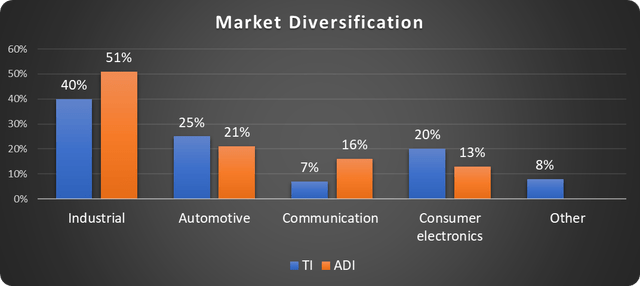

Contemplate that they don’t seem to be solely utilized in finish merchandise but in addition within the manufacturing facility that makes the merchandise. As proven under, ADI and TI get the overwhelming majority of income from the commercial, automotive, and communications markets.

Information supply: Analog Units and Texas Devices. Chart by writer.

As well as, each corporations have a buyer base of over 100,000 and over 75,000 SKUs. That is vital to withstanding financial downturns – like recessions. Each TI and ADI raised dividends through the Nice Recession fallout, albeit at a slower tempo.

What are the very best dividend shares?

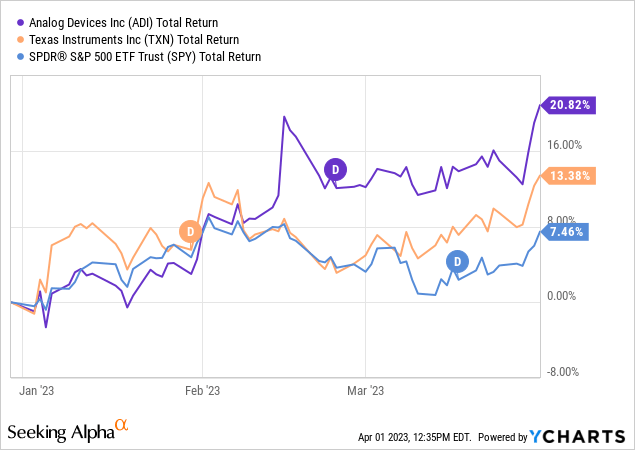

I have been on the bandwagons of those cash-flow kings for some time now and even included them as high 2023 long-term picks in articles that may be discovered right here and right here. To date, so good.

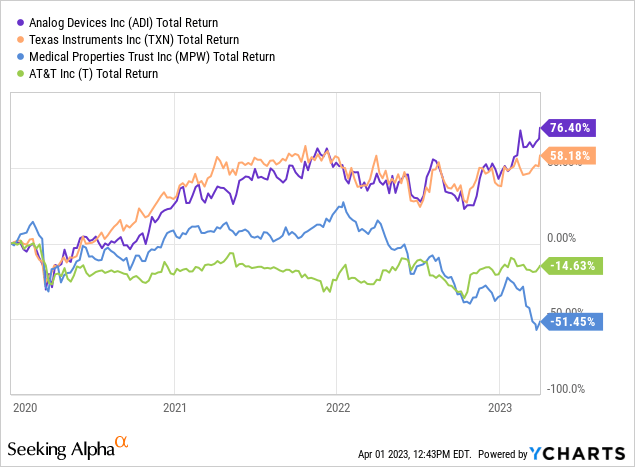

Many traders deal with dividend yield when dividend progress and cash-flow enlargement are sometimes higher long-term indicators of whole inventory efficiency.

Whereas many draw battle strains round high-yield favorites like AT&T (T) or dangerous performs like Medical Properties Belief (MPW), ADI and TI shareholders proceed to see long-term outperformance, as proven under.

Is Texas Devices a very good dividend inventory?

Texas Devices has grown free money circulation per share by 11% CAGR since 2004. It has used this cash to cut back the share rely by 47% and enhance the dividend by 25% CAGR throughout that point.

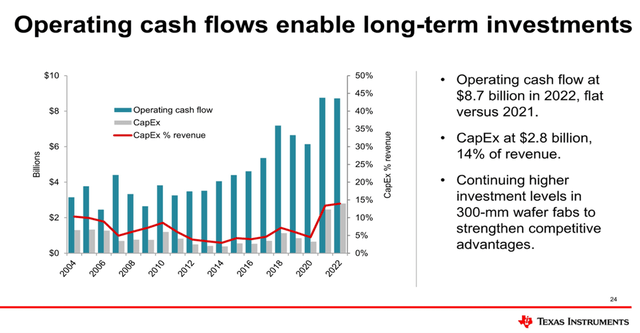

The corporate is investing in its future by increasing manufacturing capabilities, which has raised CapEx not too long ago. However the firm is doing so intelligently, utilizing the post-pandemic increase in working money, as proven under.

Information supply: Texas Devices. Chart by writer.

Even with the numerous manufacturing investments, the free money circulation margin was close to 30% in 2022, and the working money circulation margin was improbable at 44%.

Demand is robust, secular tendencies are constructive, margins are distinctive, and Texas Devices is a terrific dividend progress inventory.

Is Analog Units a very good dividend inventory?

To not be outdone, ADI has pledged to return 100% of future free money circulation to shareholders by means of buybacks and dividends with a goal of 10% CAGR dividend raises.

The financial system is difficult, but ADI’s Q1 fiscal 2023 outcomes have been encouraging. Gross sales rose 21% yr over yr, the working money circulation margin was 43%, and the free money circulation margin was distinctive at 38%.

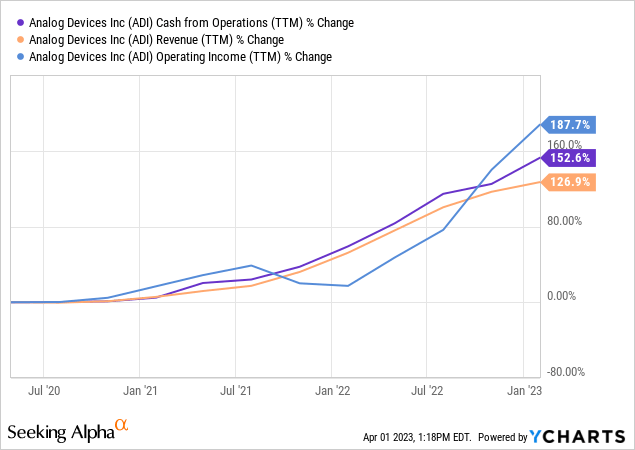

ADI could be very properly run. Money and working earnings are rising sooner than income, exhibiting excellent effectivity.

In the meantime, ADI is ready to capitalize on tendencies corresponding to cloud and edge computing, infrastructure investments, electrical and autonomous automobiles, and digital healthcare.

Texas Devices and Analog Units have many issues in widespread, together with super administration, important merchandise, recession resistance, secular progress, and wonderful margins. In addition they worth their shareholders and are improbable shares for traders to earn earnings and long-term market-beating returns.

And there’s nothing boring about that.

[ad_2]

Source link