[ad_1]

Unique Card Provides from India’s prime banks are only a click on away

Edit

Error: Please enter a legitimate quantity

Examine Provides

UPI funds and bank cards each include numerous advantages. Whereas UPI permits hassle-free, fast, and handy choices, bank cards include rewards, reductions, and most significantly, entry to rapid funds. Thereby, to give you the very best of each worlds, HDFC Financial institution has initiated linking your bank cards with UPI.

As per this function, HDFC RuPay Credit score Card prospects can now instantly hyperlink their bank cards with the UPI app of their selection, equivalent to Google Pay, PhonePe, Paytm, and BHIM UPI. Thus, it is possible for you to to make UPI funds, even while you wouldn’t have ample funds at that time limit. It will make it simpler for each bank card and UPI customers, providing wider accessibility and the Purchase Now Pay Later facility, respectively.

Learn on to know the advantages, course of to hyperlink, and prime bank cards through which you’ll avail of this function.

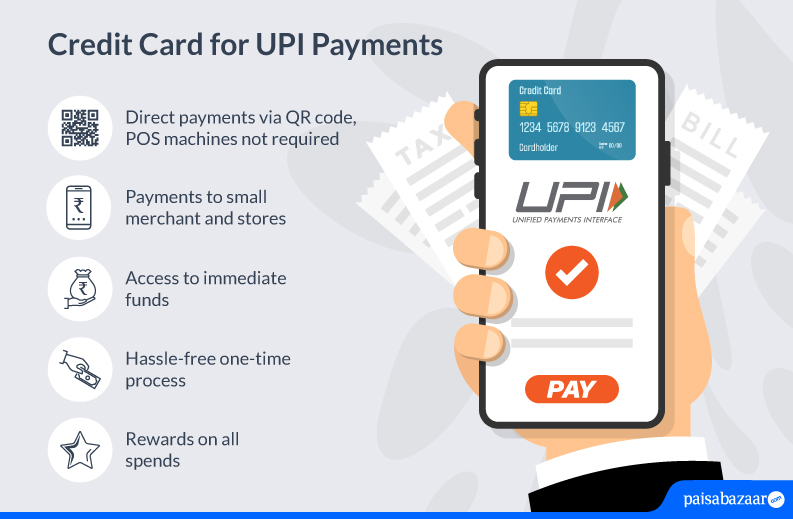

Advantages of Linking Credit score Playing cards with UPI Apps

Linking a bank card together with your UPI app provides you wider accessibility to buy and buy. It is because, whereas it may very well be difficult to seek out POS machines for funds, yow will discover UPI QR codes even at smaller retailers and companies.

Linking your bank card to UPI is hassle-free, as it’s only a one-time course of. For making funds through this technique, you don’t want prolonged passwords or login particulars.

Contactless funds have been an rising bank card function for a very long time. Nevertheless, UPI-linked bank card funds have added extra to the contactless function, by dismissing the position of ‘faucet’, ‘contact’, and punch buttons. Thus, your bank card funds are extra contactless than they’ve ever been.

Compared to an everyday UPI fee linked to your financial savings account, bank card UPI funds are extra rewarding. It is because bank cards come alongside rewards and cashback, and utilizing them often helps you earn extra. Thus, quick access to UPI funds, and rewards on bank cards, may help you save extra.

Prime HDFC RuPay Credit score Playing cards which you can hyperlink with UPI Apps

Credit score Card

Annual Price

Greatest Characteristic

HDFC MoneyBack+ Credit score Card

Rs. 500

10X CashPoints on Amazon, BigBasket , Flipkart, Reliance Good SuperStore & Swiggy

IRCTC HDFC Financial institution Credit score Card

Rs. 500

5 reward factors for each Rs. 100 spent on IRCTC ticketing web site and Rail Join App

HDFC Financial institution UPI RuPay Credit score Card

Rs. 250

3% Cashpoints on groceries, superMarket & sining spends & PayZapp transactions

Indian OIL HDFC Financial institution Credit score Card

Rs. 500

5% of your spends as gasoline factors at IndianOil shops

HDFC Bharat Credit score Card

Rs. 500

5% month-to-month cashback on railway ticket bookings, groceries and invoice funds

Steps to hyperlink your HDFC RuPay Credit score Card to a UPI App:

To hyperlink your HDFC RuPay Credit score Card with a UPI app, observe the steps as talked about under:

Obtain the UPI app from the app retailer or play retailer

Register your account or Login together with your passcode and choose your checking account

Now, navigate to your profile and click on on checking account after which select ‘Add account’

Right here, choose choice ‘Credit score Card’ after which Credit score Card Supplier Financial institution (HDFC Financial institution on this case)

To proceed, choose your HDFC Financial institution Bank card and click on on ‘Verify’

Subsequent, click on to view accounts and enter HDFC Financial institution RuPay Credit score Card particulars equivalent to final 6 digits, expiry date, OTP obtained in your registered cell quantity, and Bank card PIN

Lastly, set your UPI PIN

The way to make funds with a RuPay Credit score Card linked on a UPI app:

To make a fee with the bank card linked to your UPI app, observe these steps:

Scan service provider UPI QR code

Enter the required quantity and choose the bank card account

Choose your linked HDFC RuPay bank card account after which enter the UPI PIN

Backside Line: Whereas bank cards include a variety of conveniences, it’s essential to all the time guarantee utilizing them rigorously. Perceive that, it’s only the accountable utilization of a bank card, that may enable you to maximize the advantages it provides. Wider accessibility or entry to rapid funds usually comes with a threat of overspending, thus, it’s essential to guarantee utilizing your bank card, solely as per your reimbursement functionality.

The publish HDFC RuPay Credit score Playing cards can now be Linked to UPI Apps appeared first on Evaluate & Apply Loans & Credit score Playing cards in India- Paisabazaar.com.

[ad_2]

Source link