[ad_1]

On this article

There’s been loads of alarm in the true property funding group these days over a newly enacted Federal Housing Finance Company rule for Fannie Mae and Freddie Mac loans relating to mortgage charges.

The gist of the grievance is that homebuyers with good credit score will now must subsidize these with adverse credit. Technically, that is true. Nonetheless, the way in which it’s being framed is sort of deceptive. The overall argument goes one thing like this: These with a 620 FICO rating will get a 1.75% low cost, and people with a 740 FICO rating can pay 1%.

Or one other instance can be this notably standard tweet:

?

Homebuyers with credit score scores of 680 or increased can pay ~$40 per thirty days extra on a house mortgage of $400,000.

Patrons with down funds of 15% to twenty% will get socked with the most important charges.

Patrons with riskier credit score scores and decrease down funds will get decrease charges and costs. pic.twitter.com/yVEp3btNJg

— Wall Avenue Silver (@WallStreetSilv) April 19, 2023

Whereas what is alleged is technically appropriate, it sounds a lot worse than it’s.

Before everything, this may solely have an effect on Fannie Mae and Freddie Mac loans. This accounts for many loans made to owners however wouldn’t have an effect on FHA and VA loans nor the non-conforming loans that many buyers get.

The payment being mentioned right here is known as the Mortgage-Degree Value Adjustment or LLPA, which predominantly takes under consideration the borrower’s FICO rating and the LTV of the mortgage. To a lesser extent, it additionally takes under consideration whether or not the property is owner-occupied or not, if it’s a apartment or single-family residence, whether or not it’s a second or first mortgage, and if there may be any cash-out on a refinance.

The LLPA payment is then successfully added to the mortgage. So, for instance, if the mortgage is $100,000 and has a 1% LLPA, the LLPA can be $1,000. This could possibly be paid as a payment however is extra typically absorbed by the lender in alternate for a better rate of interest on the mortgage.

This added value on the mortgage is to cowl Fannie Mae and Freddie Mac from the added threat of lending to riskier debtors.

Riskier Debtors Are Nonetheless Paying Extra

The error being made by many right here is that the odds given are the modifications, not the totals. Effectively, not fairly even that. The 1% payment talked about is what somebody with a 740 FICO rating would pay if they’re taking out an 80-85% LTV mortgage. The 1.75% “low cost” is just not the payment somebody with a 620 FICO rating would pay, however as a substitute the discount in that payment from earlier than. And on this case, it’s for somebody taking out a 95% LTV mortgage or increased.

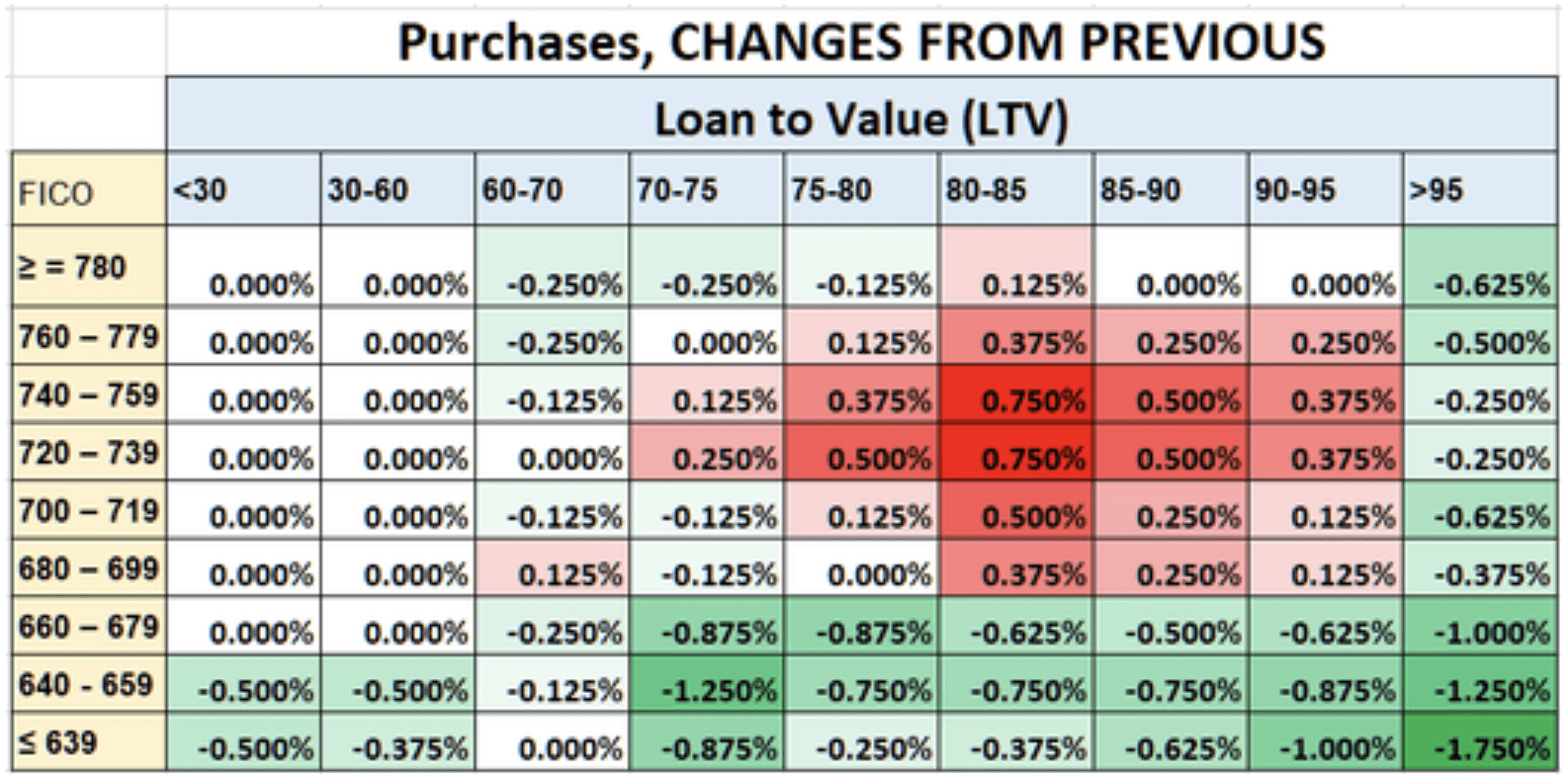

Earlier than this rule was handed, the LLPA payment for somebody with a 620 FICO rating taking out a 95% mortgage was 3.5%. Now it’s 1.75% (a 1.75% discount). Here’s a chart from Mortgage Information Day by day displaying the consequences the modifications of this rule would have on loans for debtors relying on the LTV and FICO rating.

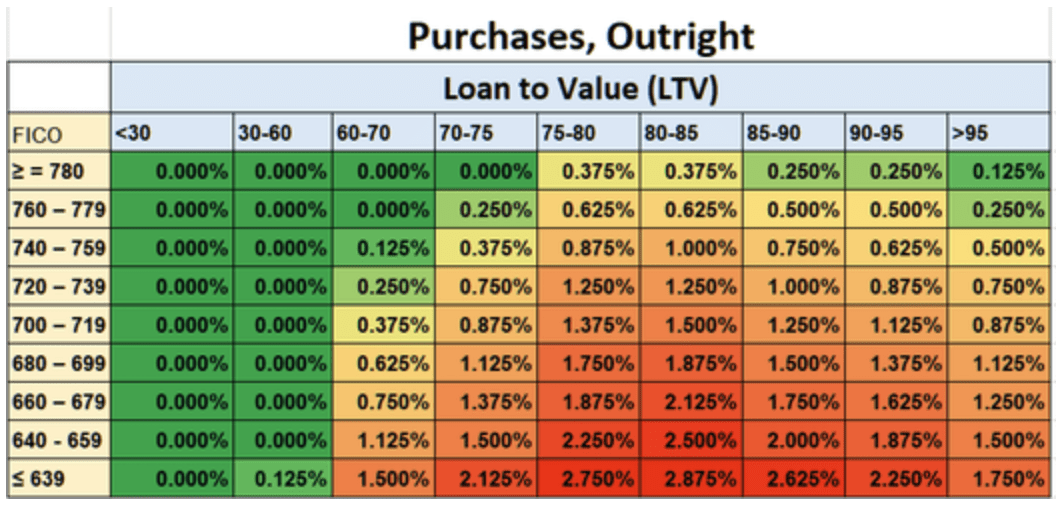

And listed below are the precise charges individuals would pay.

As Mortgage Information Day by day sums up,

“As now you can plainly see, if in case you have a rating of 640, you’ll be paying considerably greater than if you happen to had a 740. Utilizing an 80% loan-to-value ratio for instance, your LLPA at 640 is 2.25% versus 0.875% for a 740 rating. That’s a distinction of 1.375%, or simply over $4000 on a $300k mortgage. That is virtually half the earlier distinction, and that’s actually an enormous change.”

In reality, this rule change was made again on January 1, 2023, and solely got here into impact now. Right here is the announcement from the Federal Housing Finance Company, and right here is the full loan-level worth adjustment matrix from Fannie Mae itself.

The lengthy and quick story of it’s, nonetheless, that these with low credit score will nonetheless pay greater than these with excessive credit score. The true property world has not been put fully the other way up.

Is it Nonetheless a Subsidy for These with Low Credit score?

At first of this text, I stated this new rule nonetheless concerned these with good credit score subsidizing these with unhealthy. Given these with good credit score nonetheless pay much less, how is that so?

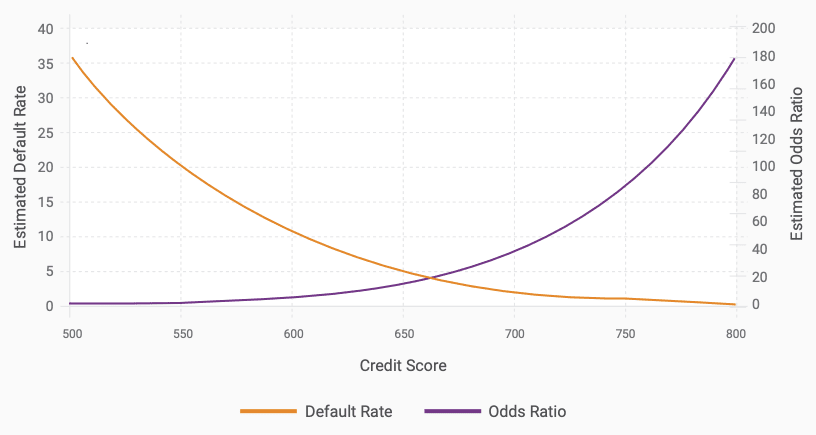

The reason being that these with low credit score scores are more likely to enter default than these with good credit score. And the distinction might be greater than most individuals understand.

For instance, a white paper from FICO concluded their mannequin confirmed that “at a rating of 800, we count on roughly 180 debtors to persistently pay their loans on time for each one borrower that defaults. This compares fairly favorably to shoppers with a rating of 600, the place one out of each 11 debtors is anticipated to have fee issues.”

Total, this was the connection they discovered between FICO scores and mortgage default charges was as follows:

One other paper discovered that between 2000 and 2002, these with a FICO rating of 750 or extra had a chance of default of simply 1%, whereas these with a rating of 600-649 had a default charge of 15.8%, and people beneath 500 had a default charge of a whopping 41%. Comparable outcomes had been present in one other examine by the SEC of mortgages taken out between 1997 and 2009.

The overall outcome shouldn’t be shocking, though the dimensions of the discrepancy may be too many (Does the 2008 monetary disaster make a bit of extra sense now?).

The LLPA is supposed to cowl a few of this added threat. However from simply eyeballing the chart above, it might seem that even the outdated LLPAs had been a bit beneficiant (particularly given the common loss a financial institution takes on a mortgage that will get foreclosed on is one thing like 40%). Lowering the LLPA for dangerous debtors is probably going going to extend the prices to Fannie and Freddie much more so. And as primary economics would point out, that loss would should be made up for by growing charges throughout the board, together with on debtors with excessive credit score scores.

Thus, it’s true this rule is more likely to imply that debtors with excessive credit score scores might be subsidizing these with low scores.

However no, the outrage clickbait headlines are false. Debtors with low credit score scores won’t be paying lower than debtors with excessive credit score scores. And it’s vital to be exact about what precisely is occurring.

Discover a Lender in Minutes

An awesome deal doesn’t sit round. Rapidly discover a lender who makes a speciality of investor-friendly loans which can be best for you and your funding technique.

Notice By BiggerPockets: These are opinions written by the writer and don’t essentially symbolize the opinions of BiggerPockets.

[ad_2]

Source link