[ad_1]

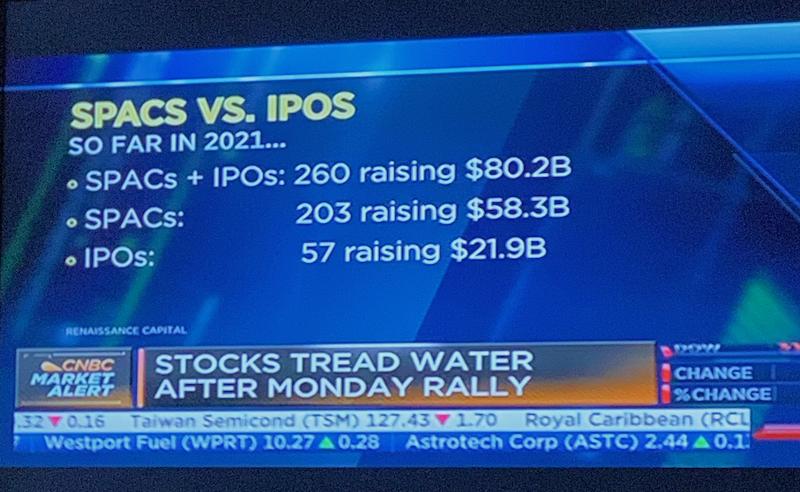

At any time when we get media photographs marking an excessive in sentiment, it is best to be prepared for the exits. Oil after the Russia/Ukraine conflict was an instance. Keep in mind when SPAC’s had been an enormous factor? This picture was from March 02, 2021. Chamath was bringing his Enterprise Capital investments to market at a relentless charge. He noticed the chance for him as buyers had been clamouring to purchase the newest progress factor.

A number of years in the past, CNBC had a Bitcoin tracker working on the display screen, monitoring Bitcoin’s each transfer. Bitcoin was climbing easily and the height euphoria gave the impression to be upon us as technicians. Bitcoin was at $69,000 and there was no finish in sight. After 2022, the momentum swung decrease and the chart dropped meaningfully. However in November 2022, after the FTX drop, the chart primarily based. It continued to climb in a brand new uptrend, clearly interrupting the downtrend of 2022. As lately as April twenty fourth, the Bitcoin proponents had been again with an interview at CNBC with $BTCUSD going to $100,000. The place is that this chart going?

After the April twenty fourth sunshine of Bitcoin going to $100,000 from the extent of $27,000; Bitcoin surged for two days. Now Bitcoin has bought off for 3 weeks and has damaged under a small topping formation. The relative energy pattern has been broken as proven in purple. I ignored the 4 day transfer down on the banks collapsing because it did not appear to be a part of any pattern on the chart. It did bounce properly off the 200 DMA in March.

The quantity has been declining because the January surge. So curiosity is waning somewhat. Lastly, the PPO has a sequence of rising lows. Proper now, the PPO is pointed down and should break that pattern.

After we have a look at the weekly chart, the pattern is somewhat totally different. Initially, there’s a double off the November lows to this rally. That is superior! Technically, there are another alerts kicking in.

The relative energy in purple is breaking for the primary time since November. The Elder candle has turned purple for the primary time because the November rally began. Quantity is declining, and the Full Stochastic has rolled over on a promote sign. PPO continues to be above the sign line, however beginning to gradual its advance.

Will Bitcoin go to $100,000? It would, however proper now the chart is weakening. If we glance left on the weekly chart, how necessary was $30,000 for help? Now it has turn into resistance. For technicians, it’s not a shock that Bitcoin stalled attempting to get via $30000 as what was help turns into resistance. Now there can be fib retracements and ‘maintain on for expensive life -HODL’ investing types popping out of the twitter world endlessly. However a very powerful factor to acknowledge is that the chart presently appears like a base must type and it could be smart to respect the value motion till it does. Not predicting doom and gloom. Simply suggesting to respect the present value motion.

Greg can be presenting on the Moneyshow on Wednesday Could 17 at 3:20 PM ET. You possibly can comply with this hyperlink to register! Thanks prematurely on your curiosity!

https://bit.ly/3BiXPQ1

Greg Schnell, CMT, MFTA is Chief Technical Analyst at Osprey Strategic specializing in intermarket and commodities evaluation. He’s additionally the co-author of Inventory Charts For Dummies (Wiley, 2018). Primarily based in Calgary, Greg is a board member of the Canadian Society of Technical Analysts (CSTA) and the chairman of the CSTA Calgary chapter. He’s an lively member of each the CMT Affiliation and the Worldwide Federation of Technical Analysts (IFTA).

Be taught Extra

Subscribe to The Canadian Technician to be notified each time a brand new submit is added to this weblog!

[ad_2]

Source link