[ad_1]

Over the previous two years, revolving bank card balances have grown greater than 25% and are actually above $1.2 trillion. Moreover, private financial savings charges are stubbornly holding close to 65-year lows, and mixed with larger rates of interest driving larger minimal funds, shoppers are clearly feeling the stress. On the identical time, delinquency charges on these larger balances have elevated over 45%, placing important pressure on financial institution credit score losses.

So what can lenders do? Let’s begin by taking a look at what shoppers need, and what outbound calling brokers want to see as effectively.

What do Prospects Need? And What do Brokers Need?

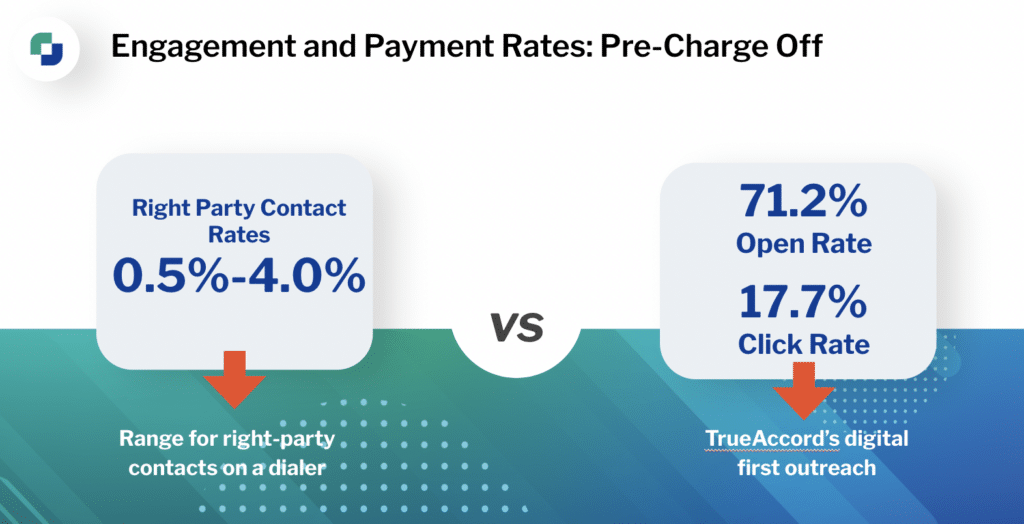

For companies executing outbound name methods and leveraging dialer applied sciences, the vary of proper celebration contact charges are anyplace from a struggling 0.5% to 4%. With these diminished returns of connection charges, calls change into dearer and fewer impactful.

It’s no secret that shopper preferences are altering quickly and youthful generations particularly don’t need to reply telephone calls—and it’s essential to bear in mind these youthful debtors would be the clients companies might be servicing for the subsequent 30 to 40 years, particularly in a delinquent atmosphere.

Basically, shoppers need to repay their money owed, however they need to have the ability to accomplish that when it’s most handy for them, which is commonly exterior the “presumptively handy occasions” between 8am and 9pm. In actual fact, 25% of funds are available after 9pm or earlier than 8am. At TrueAccord, outcomes present that greater than 96% of shoppers resolve money owed with none human interplay when digital choices are supplied.

However what does that imply for the people dialing telephones for conventional call-and-collect strategies?

When companies deploy an outbound name technique earlier than digital, typically brokers are taking pictures at the hours of darkness regardless of good intentions and devoted efforts—which may have an effect on outbound agent morale, making it a troublesome atmosphere to rent and retain prime expertise. And given in the present day’s financial panorama, it’s difficult to name and gather from people who find themselves behind on their payments or funds when so many different monetary obligations are competing for {dollars}.

The important thing: let brokers do what brokers are good at—the human contact—however leverage digital as the primary touchpoint. Let digital get the client to grasp the place they’re in delinquency. If and once they need to discuss to a human, brokers are there to do what brokers do finest: empathize and resolve any points that digital can not.

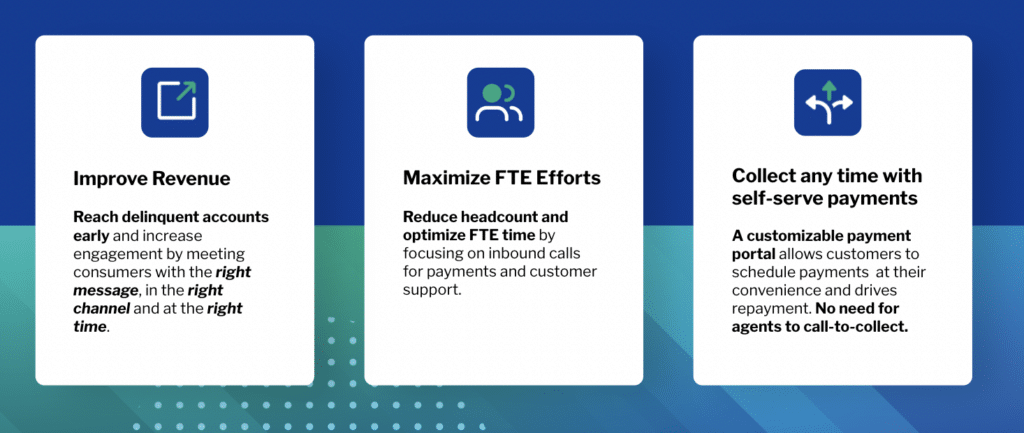

Brokers are in a position to attend to higher-value inbound calls when digital, self-serve choices can be found for many who simply need to make a cost—and it permits these clients to take action in a extra handy, most well-liked method.

Digital-First, Save Extra

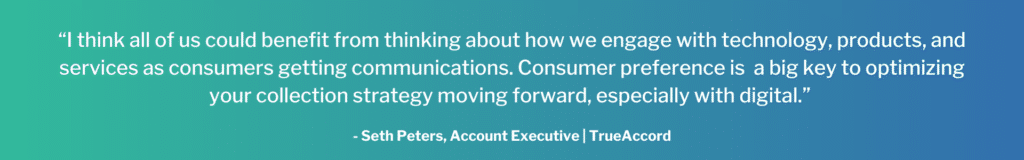

Digital early stage options scale back collections prices for main organizations throughout industries by making full-time staff (FTEs) extra impactful (and even reducing FTE headcount) and decreasing total bills whereas maximizing reimbursement charges.

Corporations that do rely closely on an outbound name technique should notice how costly every name turns into. The longer that an account is in delinquency, each name turns into dearer as a result of the probability or the propensity to pay diminishes because the money owed become old in age. So having the ability to automate and discover these proper channels on the proper time with a digital technique will assist these telephone calls get higher outcomes.

Plus, the digital first technique is infinitely scalable—it doesn’t matter how quickly a enterprise grows on the frontend for lending or on the backend with new accounts that fall into delinquency. This digital-first method permits corporations to mitigate towards turnover or having to compete for expertise available in the market. And once more, FTEs can now be simpler within the delinquency cycles the place telephone calls are preferable, particularly as accounts get additional into delinquency.

Making outbound telephone calls completely serves an important a part of a enterprise’s omnichannel technique, however deploying digital first will make these calls less expensive. It additionally delivers a stronger connection price by figuring out these preferences via suggestions from leveraging a digital-first communication technique.

Take into consideration how this information can assist companies not solely from a efficiency and liquidation perspective, however by studying from which clients are opening communications versus which of them aren’t. People who don’t reply to digital ought to go to the highest of the decision queue as a result of the info factors in the direction of a possible desire for person-to-person calling.

TrueAccord Distinction

Studying from these digital engagements is significant for optimization, but when a corporation is new to digital communications or has solely been sending mass-blast, one-size-fits-all emails, it will probably really feel like an uphill trek to begin getting insights to drive higher outcomes.

However by partnering with TrueAccord, who’s been mining shopper engagement information for over 10 years, companies get plugged in and begin benefiting from our information from the get-go. Having the ability to automate with TrueAccord permits your organization to give attention to inbound human interactions whereas concurrently, TrueAccord’s first-party, client-labeled platform sends efficient digital communications to your entire past-due accounts.

The underside line advantages of working with TrueAccord:

Maximize the productiveness of your corporation’s assets with a managed, digital-first method that enhances the efforts of your FTEs and total collections operations. Begin with a session in the present day!

[ad_2]

Source link