[ad_1]

Funding Thesis

The Mosaic Firm (NYSE:MOS) is likely one of the most secure firms within the sector of fertilizer producers as a consequence of its excessive share of the worldwide fertilizer market and distinctive positioning within the quickly rising Brazilian market. Nevertheless, the present market scenario leaves a lot to be desired. Costs for phosphorous and potash fertilizers proceed to say no, which can even put strain on gross sales costs and the corporate’s already low margin. We imagine that it’s too early to spend money on the corporate’s shares. Ranking for The Mosaic Firm is HOLD.

Macroeconomic image

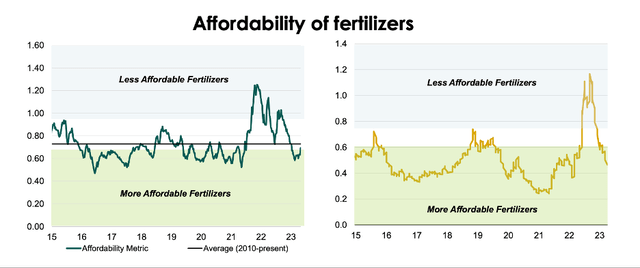

In accordance with MOS, the decline of costs for the fundamental sorts of fertilizers stimulates purchases. The nutrient affordability index for North and South American farmers has descended into the ”extra inexpensive” space for the primary time since 2021.

ronstik Mosaic

As fertilizer costs stabilize and fertilizer inventories in Brazil and India are set to run low, the corporate expects demand for phosphate and potash fertilizers to bounce again as quickly as 2023.

Mosaic Mosaic

Outlook

Phosphate fertilizers

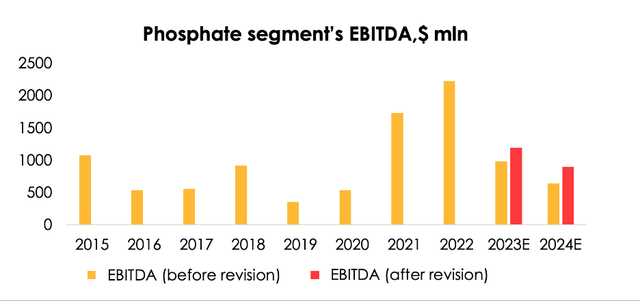

The phosphate section ended 1Q 2023 with a income of $1382 mln (-11% y/y), consistent with our forecast for $1401 mln.

The section’s EBITDA totaled $382 mln (-40% y/y), in contrast with our forecast of $272 mln. The discrepancy was pushed by the next:

Ammonia costs fell quicker than we had anticipated following the decline of pure gasoline costs. We had anticipated that ammonia prices per ton of finish product could be $627, whereas the truth is they have been $605; A quicker decline of costs for sulfur. We had anticipated that sulfur prices per ton of finish product could be $332 per ton, whereas the truth is they have been $236 per ton as new capacities went into operation in China and demand weakened in anticipation of worldwide recession.

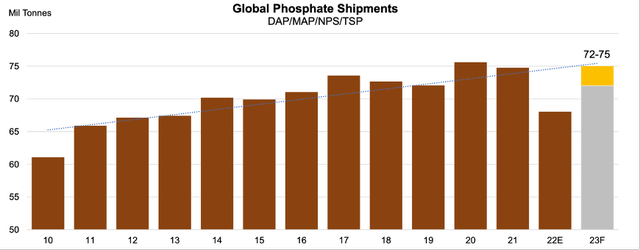

Now we have maintained our expectations for capability utilization over the forecast interval at 80% as a result of demand from farmers is steadily recovering as their inventories run decrease. We nonetheless imagine that phosphate fertilizer gross sales will attain ~7.8 mln tons (+18% y/y) in 2023.

However now we have lowered the outlook for the common realized worth of phosphate fertilizers over the forecast interval from $709 a ton to $654 a ton as a consequence of a decreased forecast for DAP/MAP costs till 2024 as China might doubtlessly carry the restrictions for fertilizer exports whereas the rhetoric relating to Russian fertilizers is softening and international costs for pure gasoline are declining. On account of a better provide of sulfur in the marketplace, now we have lowered expectations for the price of sulfur per ton of fertilizer output (a part of the prices) from $305 a ton to $217 a ton for 2023, and from $289 a ton to $205 a ton for 2024 .

As a result of mixture of those components, now we have raised expectations for the section’s EBITDA from $982 mln (-56% y/y) to $1195 mln (-46% y/y) for 2023, and from $642 mln (-46% y/y) to $896 mln (-25% y/y) for 2024.

Make investments Heroes

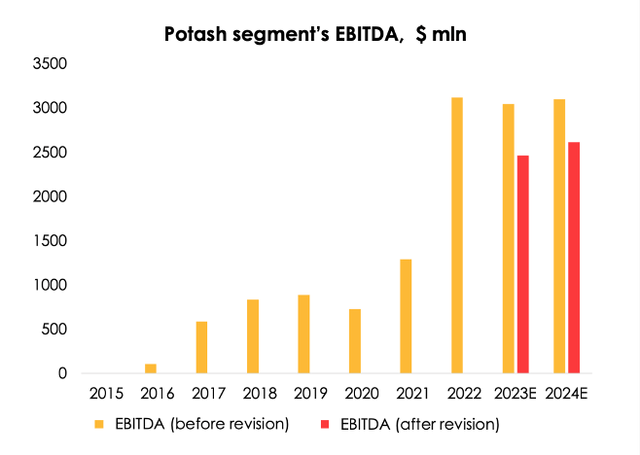

Potash fertilizers

Income of the potash fertilizers section totaled $907 mln (-14% y/y) in 1Q 2023, down 17% from our forecast of $1094 mln. The distinction is attributable to:

lower-than-expected promoting costs ($475 a ton versus our estimate of $599 a ton).

The section’s EBITDA reached $474 mln (-27% y/y), in contrast with our estimate of $528 mln. The discrepancy of 10% was pushed by a decrease income in 1Q 2023 than we had anticipated.

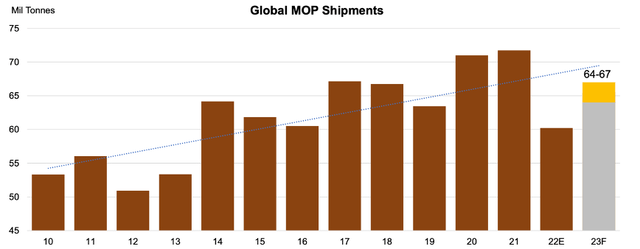

As with phosphate fertilizers, farmers are steadily depleting their inventories of potash fertilizers. The corporate expects that international demand for potash fertilizers will return to the extent of 64-67 mln tons in 2023, following a 15% y/y drop to 60 mln tons in 2022.

We proceed to see the corporate’s capability utilization at ~83%, and gross sales quantity at 9 mln tons (+11% y/y) in 2023, and preserve the forecast of 9.8 mln tons (+9% y/y) for 2024.

Regardless of the unchanged expectations for shipments, now we have minimize expectations for the section’s EBITDA from $3046 mln (-2% y/y) to $2461 mln (-21% y/y) for 2023 and from $3097 mln (+26% y/y) to $2611 mln (+6% y/y) as a consequence of decreasing the expectations for promoting costs from $585 a ton to $463 a ton for the valuation interval till 2024.

Make investments Heroes

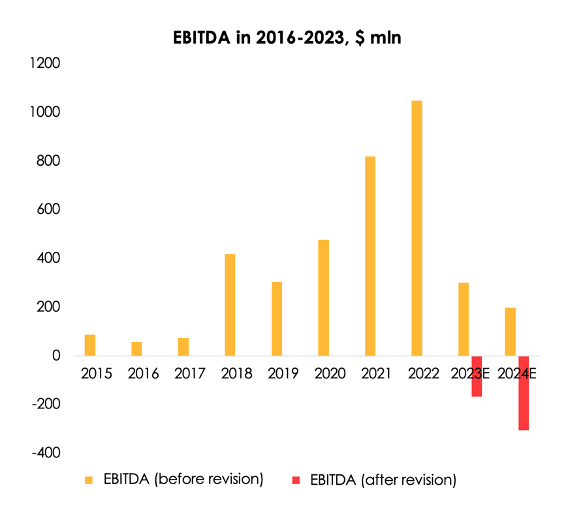

Fertilizer gross sales in Brazil

The section of fertilizer gross sales in Brazil completed 1Q 2023 with a income of $1343 mln (-10% y/y), consistent with our forecast of $1313 mln.

Gross sales quantity rose by 14% y/y to 2080 thousand tons, in contrast with our estimate of 1720 thousand tons. The bodily quantity of gross sales is rebounding quicker than we anticipated amid an ongoing correction of fertilizer costs, which makes them extra inexpensive for farmers.

The section’s EBITDA totaled $3 mln (-99% y/y), in contrast with our estimate of $44 mln. The discrepancy was pushed by increased gross prices, which got here to 100% of income, versus expectations of 95%, in gentle of upper costs for sulfur and ammonia on the Brazilian market.

Now we have lowered the forecast for the section’s EBITDA from $299 mln (-71% y/y) to ($167) mln for 2023 and are setting it at ($305) mln for 2024 as promoting costs are declining quicker than manufacturing prices, which is partially offset by a better quantity of gross sales.

Make investments Heroes

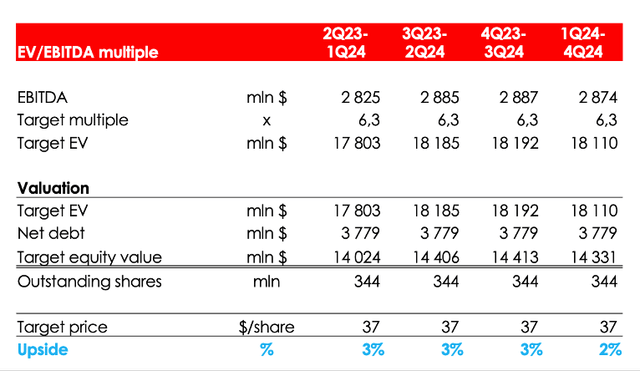

Valuation

The truthful worth worth of the inventory is $37. The goal worth of the shares was obtained by averaging estimates for 4 quarters forward.

Make investments Heroes

Conclusion

We imagine that The Mosaic Firm just isn’t an ideal inventory to achieve additional alpha in a bearish market because of the situation of declining phosphate and potash costs. Nevertheless, Mosaic has publicity to phosphate and potash markets that separates it from its closest friends. Additionally, The Mosaic Firm goes to reap the achieve of recovering market in Brazil and India. Ranking for The Mosaic Firm inventory is HOLD.

[ad_2]

Source link