[ad_1]

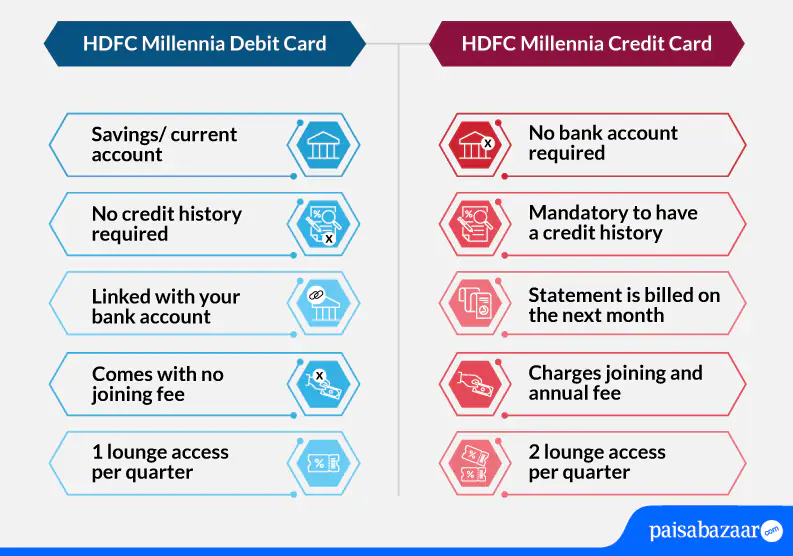

HDFC Millennia Debit Card and HDFC Millennia Credit score Card, each are in style for his or her rewarding options like cashback, lounge entry, insurance coverage protection, eating low cost and rather more. Identical to bank cards, HDFC debit playing cards additionally help you earn respectable rewards in your transactions and later redeem them in opposition to a number of classes. Selecting the most suitable choice between these two relies on your necessities and relationship with the financial institution. Here’s a detailed comparability between each of them that will help you make an knowledgeable choice:

Key Highlights: HDFC Millennia Debit Card Vs. Credit score Card

Specific

HDFC Millennia Debit Card

HDFC Millennia Credit score Card

Becoming a member of Payment

Nil

Rs. 1,000

Renewal Payment

Rs. 500

Rs. 1,000 (Waived off on spending Rs. 1 lakh in a yr)

Welcome Advantages

NA

1,000 CashPoints after the fee of becoming a member of charge

Reward Advantages

5% CashBack Factors on buying through PayZapp & SmartBuy

2.5% CashBack Factors on on-line spends

1% CashBack Factors on offline spends

5% CashPoints on Amazon, BookMyShow, Cult.match, Flipkart, Myntra, Sony LIV, Swiggy, Tata CLiQ, Uber & Zomato

1% CashPoints on all different spends, together with EMI & pockets transactions

Journey Advantages

4 complimentary home lounge entry yearly

8 complimentary home lounge entry yearly

Paisabazaar’s Ranking

★★★ (3/5)

★★★ (3/5)

Standard HDFC Financial institution Debit Playing cards | Standard HDFC Financial institution Credit score Playing cards

Notice: Debit playing cards are issued everytime you open a financial savings account with the financial institution. In case you wouldn’t have a debit card, you can even apply for it individually by filling out the appliance kind. It’s necessary to have a financial savings/ present account with the financial institution to avail of a debit card.

On the subject of welcome advantages, HDFC Millennia Debit Card rewards you with 1,000 CashPoints after the fee of becoming a member of charge, which is equal to Rs. 1,000 should you redeem them in opposition to cashback. Alternatively, Millennia Debit Card doesn’t cost a becoming a member of charge, therefore no welcome advantages are supplied on the debit card.

General, not offering any welcome advantages can’t be a disadvantage for Millennia Debit Card because it comes with no becoming a member of charges. Additionally, Millennia Credit score Card compensates for it by offering advantages definitely worth the becoming a member of charge.

Which one to decide on?

After contemplating the above-mentioned factors, you may select any of the playing cards primarily based in your necessities. If you don’t want to pay a becoming a member of charge and are usually not inclined in direction of welcome advantages, then you may apply for Millennia Debit Card. If you’re able to pay a becoming a member of charge of Rs. 1,000 and wish to earn higher advantages, you may think about making use of for Millennia Credit score Card.

Urged learn: Credit score Playing cards with Finest Welcome/ Signup Advantages

HDFC debit card and bank card presents cashback by means of CashPoints or CashBack Factors, which you’ll later redeem in opposition to cashback or every other class as per your necessities. Under talked about are the small print concerning the cashback provided on these playing cards:

HDFC Millennia Debit Card

HDFC Millennia Credit score Card

5% CashBack Factors on buying through PayZapp and SmartBuy

2.5% CashBack Factors on all on-line spends

1% CashBack Factors on all offline spends and pockets reloads

5% CashPoints on Amazon, BookMyShow, Cult.match, Flipkart, Myntra, Sony LIV, Swiggy, Tata CLiQ, Uber and Zomato

1% CashPoints on all different spends, together with EMI & pockets transactions

Urged learn: Methods to Optimize Credit score Card Reward Factors

Illustration: Suppose you will have made the below-mentioned transactions:

Amazon: Rs. 5,000 | Myntra: Rs. 5,000 | Swiggy: Rs. 2,000 Pockets Reload: Rs. 5,000 | Offline Purchasing: Rs. 10,000

Contemplating that you’ll redeem the earned reward factors in opposition to cashback at a price of 1 CashPoint/ CashBack Level = Re. 1.

How a lot you’ll save through debit card?

Whole Financial savings: Rs. 125 (2.5% CashBack Factors of Rs. 5,000) + Rs. 125 (2.5% CashBack Factors of Rs. 5,000) + Rs. 50 (2.5% CashBack Factors of Rs. 2,000) | Rs. 50 (1% CashBack Factors of Rs. 5,000) + Rs. 100 (1% CashBack Factors of Rs. 10,000) = Rs. 450

How a lot you’ll save through bank card?

Whole Financial savings: Rs. 250 (5% CashBack Factors of Rs. 5,000) + Rs. 250 (5% CashBack Factors of Rs. 5,000) + Rs. 100 (5% CashBack Factors of Rs. 2,000) | Rs. 50 (1% CashBack Factors of Rs. 5,000) + Rs. 100 (1% CashBack Factors of Rs. 10,000) = Rs. 750

Which one to decide on?

From the above illustration, it’s clear that HDFC Millennia Credit score Card permits you to save extra in your bills. Nonetheless, that is relevant provided that you continuously store on-line as a result of each playing cards supply comparable cashback on offline transactions. With the Millennia Credit score Card, you may earn as much as 5% CashPoints in your transactions, whereas the debit card rewards you with 2.5% CashBack Factors in your on-line transactions. So, should you use your bank card for many of the on-line transactions or on manufacturers like Amazon, Swiggy, BookMyShow, Flipkart, and so forth., HDFC Millennia Credit score Card can be the fitting selection for you.

Urged learn: Finest Credit score Playing cards for Reward Factors in India

Get Free Credit score Report with month-to-month updates.

Test Now

In case you continuously go to inside the nation, then lounge entry is one thing that may assist you to maximize your advantages. Each HDFC Millennia debit and bank cards supply home lounge entry at a number of lounges. Listed here are the small print concerning the identical:

HDFC Millennia Debit Card: 4 complimentary home airport lounge entry yearly (Max. 1 per quarter)

HDFC Millennia Credit score Card: 8 complimentary home lounge entry per calendar yr (Max. 2 in 1 / 4)

Which one to decide on?

At an annual charge of Rs. 500, the Millennia Debit Card presents 4 complimentary home lounge entry yearly, whereas Millennia Credit score Card presents 8 complimentary lounge entry to home lounges in a yr at an annual charge of Rs. 1,000. So, each playing cards justify the lounge entry advantages provided on them. You’ll be able to select any of the playing cards primarily based in your necessities. Nonetheless, you should keep in mind that each playing cards are appropriate just for home journey as none of them presents worldwide lounge entry. This is perhaps a disadvantage for Millennia Credit score Card as playing cards with comparable annual charges often supply worldwide lounge entry.

Urged learn: Finest Credit score Playing cards for Airport Lounge Entry

Other than cashback and journey advantages, each playing cards additionally supply further advantages like gasoline surcharge waiver, insurance coverage protection and extra. Particulars concerning the identical are as follows:

Gasoline Surcharge Waiver: With HDFC Millennia Credit score Card, you will get a 1% gasoline surcharge waiver in any respect gasoline stations throughout India in your transactions between Rs. 400 to Rs. 5,000. Equally, no gasoline surcharge shall be relevant in your gasoline transactions through Millennia Debit Card.

Insurance coverage Advantages: HDFC Financial institution Millennia Debit Card additionally supply insurance coverage advantages like unintended insurance coverage protection, private loss of life cowl, fireplace & housebreaking safety, baggage insurance coverage and rather more. You’ll be able to avail of worldwide air protection of Rs. 1 crore on buying air tickets.

Milestone Advantages: HDFC Millennia Credit score Card presents present vouchers value Rs. 1,000 on spending Rs. 1 lakh in every quarter. This can be a good profit particularly should you continuously store as you may redeem these present vouchers in opposition to your purchases.

Eating Advantages: You’ll be able to rise up to twenty% low cost on companion eating places in your bookings through HDFC Millennia Credit score Card. Nonetheless, that is relevant solely on bookings and funds vis Swiggy Dine Out.

Notice: It’s simple to avail of a debit card as a substitute of a bank card because it doesn’t require any credit score rating. Nonetheless, it’s worthwhile to have a financial savings or present account with the financial institution to use for an HDFC Debit Card.

When it comes to charges and prices, positively HDFC Millennia Credit score Card is pricey as in comparison with the debit card. However, it additionally presents higher advantages and extra privileges. The charges and prices relevant to each playing cards are as follows:

Kind of Payment/ Cost

HDFC Millennia Debit Card

HDFC Millennia Credit score Card

Becoming a member of Payment

Nil

Rs. 1,000

Annual Payment

Rs. 500

Rs. 1,000 (Waived off on spending Rs. 1 lakh within the previous yr)

It’s clear that the bank card comes with the next becoming a member of or annual charge. Nonetheless, it compensates the becoming a member of charge by offering advantages definitely worth the quantity. In addition to this, it additionally presents an annual charge waiver on reaching the spending milestone of Rs. 1 lakh yearly. It’s simple to attain the spending milestone of roughly Rs. 8,300 monthly should you put most of your bills in your bank card. General, there isn’t any doubt that Millennia Credit score Card comes with increased charges and prices but it surely additionally justifies the charge by offering higher advantages as in comparison with the debit card.

Urged learn: Credit score Card Charges and Costs You Should Be Conscious of

Certainly, each playing cards supply respectable advantages as in comparison with the charges charged by them. You’ll be able to store and get a very good worth again by means of CashBack Factors or CashPoints. The nice factor is you may redeem the earned rewards in opposition to cashback at a price of 1 CashBack/ CashPoint = Re. 1. You’ll be able to apply for any of those playing cards primarily based in your relationship with the financial institution and your necessities. Listed here are the elements that can assist you to resolve which card to decide on:

Take into account making use of for HDFC Millennia Debit Card if:

You have got a financial savings/ present account with the financial institution

You don’t want to pay a excessive annual charge

You’re extra inclined towards rewards

You wouldn’t have a very good credit score rating

You wish to earn fundamental advantages

Take into account making use of for HDFC Millennia Credit score Card if:

You have got a credit score historical past

You’re inclined towards rewards as a substitute of direct cashback

You continuously journey throughout the nation

You’re able to pay becoming a member of and annual charges

You wish to earn fundamental eating advantages

Based mostly on the above-mentioned comparability, it’s clear that each playing cards supply respectable advantages and justify the charges charged by them. Nonetheless, Millennia Credit score Card is unquestionably a winner as in comparison with the Millennia Debit Card because it presents higher cashback, extra lounge visits and advantages on different classes as nicely. So, if you’re able to pay an annual charge of Rs. 1,000, you need to positively go for Millennia Credit score Card. Nonetheless, if you have already got an account with the financial institution and wish to earn rewards at a nominal annual charge, you may think about making use of for Millennia Debit Card.

Additionally have a look at Finest Cashback Credit score Playing cards | Finest Journey Credit score Playing cards | Finest Eating Credit score Playing cards

The submit HDFC Millennia Debit Card Vs. HDFC Millennia Credit score Card appeared first on Examine & Apply Loans & Credit score Playing cards in India- Paisabazaar.com.

[ad_2]

Source link