[ad_1]

Defending private and monetary info is essential in at the moment’s digital age. The place information has its personal intrinsic worth and the place information breaches and cyberattacks are a threat for each enterprise, the Safeguards Rule beneath the Gramm-Leach-Bliley Act (GLBA) offers monetary establishments, together with these within the accounts receivable administration business, with steerage on the best way to safeguard buyer info.

The present Safeguards Rule offered monetary establishments with a lot flexibility and discretion when figuring out what sorts of safeguards had been greatest for his or her organizations and dangers. With the amendments which go into impact on June 9, 2023 monetary establishments now have a extra prescriptive recipe for what these safeguards should be.

What’s the Gramm-Leach-Bliley Act (GLBA)?

The Gramm-Leach-Bliley Act, or GLBA, is a federal regulation to regulate how monetary establishments gather, retailer, and transmit client info. Though GLBA was enacted by the Federal Commerce Fee (FTC) in 1999, adjustments have been anticipated for the previous couple of years.

In October 2021, the FTC introduced new amendments coming to the Requirements for Safeguarding Buyer Data, referred to as the “Safeguards Rule,” and an issuance of a remaining rule, referred to easily because the “Last Rule.” Initially set to enter impact in 2022, monetary establishments—a designation that has additionally been up to date—now want to organize for the adjustments or threat non-compliance and its penalties earlier than they go into impact on June 9, 2023.

What’s the Safeguards Rule?

The Safeguards Rule took impact January 10, 2021, and its necessities had been first set to enter impact starting December 9, 2022, however the FTC introduced it will lengthen the deadline for monetary establishments to develop, implement, and preserve a complete info safety program by June 9, 2023.

There are 5 overarching modifications to the prevailing Safeguards Rule:

Gives lined monetary establishments with extra steerage on the best way to develop and implement particular features of an general info safety program

Improves the accountability of those safety applications, akin to requiring monetary establishments to designate a certified particular person liable for overseeing, implementing and implementing this system

Exempts monetary establishments that gather info on fewer than 5,000 customers from the necessities of a written threat evaluation, incident response plan, and annual reporting to the board of administrators

Expands the definition of “monetary establishment” inside the scope of the Safeguards Rule – see the expanded definition within the subsequent part beneath

Contains a number of different definitions and associated examples within the amended Safeguards Rule itself in an effort to make it extra self-contained and to allow readers to grasp its necessities with out referencing the FTC’s Privateness of Shopper Monetary Data Rule

Together with these updates to the Safeguards Rule, let’s study a couple of different specs of the updates.

What are different updates to the Safeguards Rule?

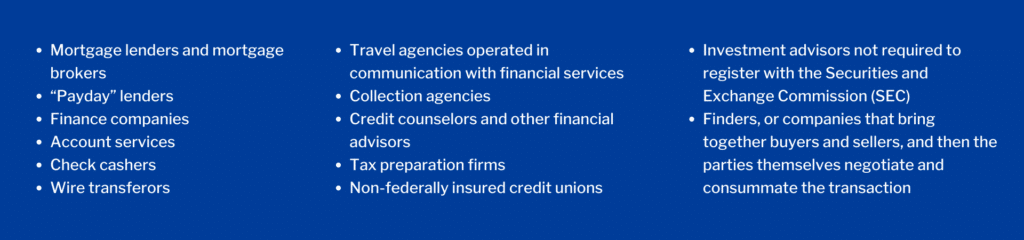

The expanded scope of monetary establishments which can be topic to the Safeguards Rule is critical. Beneath the brand new Last Rule, “monetary establishments” now embrace entities engaged in actions that the Federal Reserve Board determines to be incidental to monetary actions, akin to:

You will need to be aware that the Last Rule doesn’t apply to nationwide banks, financial savings and mortgage establishments, and federal credit score unions, as these establishments are usually not topic to the FTC’s jurisdiction.

The Last Rule requires these lined monetary establishments to adjust to particular new necessities, akin to:

Encrypt all buyer info held or transmitted in transit over exterior networks and at relaxation

Multi-factor authentication for any particular person accessing any info system, until using moderately equal or safer entry controls has been permitted in writing by a certified particular person on the monetary establishment

Conduct periodic written threat assessments, and the outcomes of such threat assessments ought to drive the data safety program

Create procedures for evaluating, assessing or testing the safety of externally developed purposes used to transmit, entry or retailer buyer info

Set procedures for safe disposal of buyer info no later than two years after the final date the data is used

Implement insurance policies, procedures, and controls designed to watch and log the exercise of approved customers and detect unauthorized entry or use of, or tampering with, buyer info by such customers

Present personnel with safety consciousness coaching, and supply info safety personnel with coaching to deal with related safety dangers; and that key info safety personnel take steps to take care of data of fixing info safety threats and countermeasures

Written incident response plan designed to promptly reply and get better from any safety occasion affecting the confidentiality, integrity, or availability of buyer info

Certified particular person to recurrently, and at the least yearly, report in writing to a company’s governing physique (e.g., board of administrators) concerning the standing and materials issues of the data safety program

Usually take a look at or in any other case monitor the effectiveness of the safeguards’ key controls, and conduct required penetration testing yearly and vulnerability assessments at the least each six months and each time there are materials operational or enterprise adjustments

Given the expanded definition of “monetary establishments,” a few of these organizations could also be unfamiliar with the extent of those necessities, and even these aware of GLBA beforehand have to be able to comply or face the implications.

What are the penalties for non-compliance with GLBA?

Whether or not it’s GLBA, Regulation F, or any of the quite a few state legal guidelines, corporations can face critical penalties for compliance failures—financial, reputational, and even felony. In terms of GLBA, non-compliance penalties embrace:

Part 5 of GLBA grants the FTC the authority to audit insurance policies to make sure they’re developed and utilized pretty—all of the extra purpose to comply with the Safeguards Rule’s provisions of self-audits and testing.

Study Extra About Compliance and Collections

Now that you’ve the breakdown of the Gramm-Leach-Bliley Act updates to the Safeguards Rule, are you aware of the opposite legal guidelines and laws governing debt assortment? Take a look at our Collections & Compliance sources to see what different regulatory pointers could affect your enterprise or schedule a session to get began»»

[ad_2]

Source link