[ad_1]

BlackJack3D

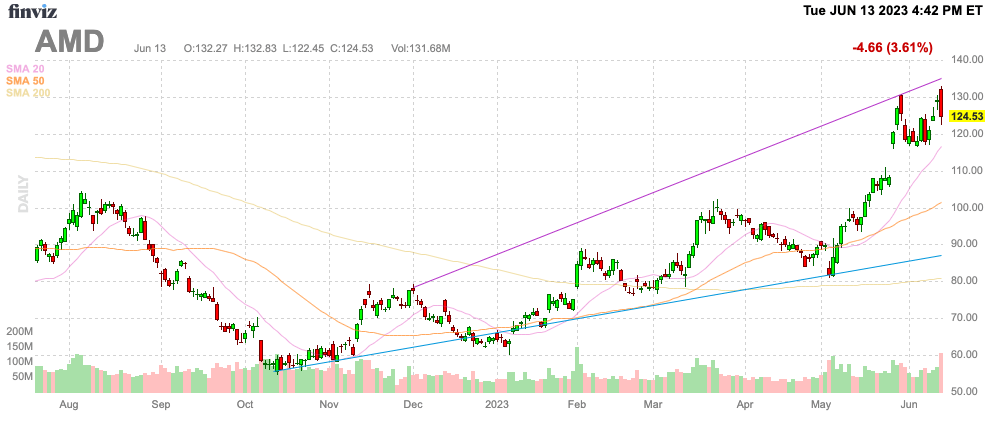

The thrill over AI chips had Superior Micro Units, Inc. (NASDAQ:AMD) buying and selling again to $130 heading into the Knowledge Middle and AI occasion on June 13. The inventory swooned following the occasion, with the chip firm not asserting any shock new chips or partnerships to speed up the shift to AI. Regardless, my funding thesis stays extremely Bullish on AMD inventory, which is now buying and selling $40 under all-time highs in late 2021 whereas Nvidia Company (NVDA) inventory is already far above these ranges.

Supply: Finviz

Extra Than Hype

AMD fell after the AI presentation as a result of occasion not essentially matching the hype main as much as the occasion. The chip firm offered some common particulars relating to the brand new AI chips heading to the market, however the administration crew did not present any boosts to the financials to draw extra buyers to push the inventory larger.

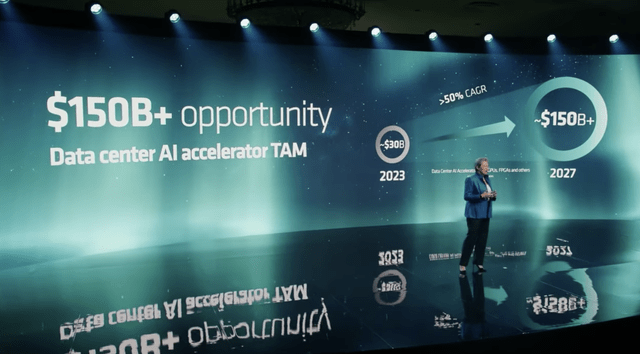

What issues is that AMD has the Knowledge Middle chips to play within the surging demand for AI. The corporate forecasts the Knowledge Middle whole addressable market (“TAM”) hitting $150 billion by 2027, up from $30 billion now, for large 50% annualized development for the following 5 years.

Supply: AMD Knowledge Middle & AI presentation

AMD had beforehand introduced a $300 billion whole TAM alternative over the following 5 years with solely $125 billion assigned to Knowledge Middle. The one massive income enhance on the AI occasion was the suggestion this TAM jumps to $150 billion now in 2027.

What considerations buyers probably the most is that this evaluation of the swing in CPU demand with the implementation of AI chips. The product requires an enormous shift to spending on GPUs (highlighted by Nvidia numbers) whereas not essentially utilizing extra CPUs within the course of.

MI300 Monster

As SemiAnalysis highlights, AMD is the one different firm with a monitor document of delivering a chip for top efficiency computing. Intel Company (INTC) is nowhere to be discovered within the dialogue with failed AI {hardware} acquisitions and no GPU coming to market to compete with the Nvidia GPUs. The information leaves the MI300 from AMD as the one competitor to Nvidia in a GPU chip the place the corporate is estimated at charging 5x the manufacturing value.

On the AI occasion, CEO Lisa Su talked prominently concerning the new MI300 chips. The MI300A (CPU+GPU) is sampling to prospects now with the MI300X (GPU solely) sampling in Q3. Each chips will see manufacturing ramps in This fall with the next configurations:

MI300A – 6 XCDs (Up To 228 CUs), 3 CCDs (Up To 24 Zen 4 Cores), 8 HBM3 Stacks (128 GB) MI300X – 8 XCDs (Up To 304 CUs), 0 CCDs (Up To 0 Zen 4 Cores), 8 HBM3 Stacks (192 GB).

The market actually wished to see much more particulars from AMD on the manufacturing ramp in This fall to supply a sign if the chip firm may seize materials market share from Nvidia. The GPU firm simply introduced a forecast for document gross sales in FQ2, with a income estimate $4 billion above the analyst estimates for the quarter.

AMD once more quoted that the MI300 presents an 8x enhance in AI efficiency and a 5x AI efficiency enhance per watt over the present Intuition MI250. Since this chip hasn’t gained plenty of traction with the HPC crowd, what in the end issues is the comparability to the H100 from Nvidia garnering the entire present AI chip gross sales.

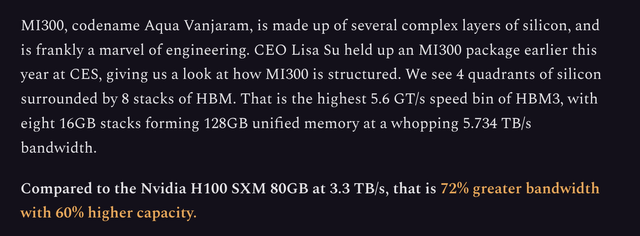

As SemiAnalysis highlights once more, the MI300 is a marvel of engineering providing an enormous 72% higher bandwidth than the H100 with a 60% larger capability.

Supply: SemiAnalysis

The MI300X is predicted to be the actual quantity mover with all GPUs to maximise efficiency in AI. Contemplating the extreme prices of Nvidia chips, AMD ought to present a TCO benefit over Nvidia just like how the corporate beginning gaining share in opposition to Intel within the CPU market.

The inventory is down as a result of lack of any materials enhance to expectations within the quick time period. AMD did not actually launch any new AI chips, nor did the corporate present any particulars on any gross sales transfer from a possible partnership with Microsoft (MSFT) on AI chips.

In essence, AMD has a possible monster AI lineup, however the chip hasn’t been launched but, and the success of Nvidia whereas using Intel CPUs blocks AMD from that marketplace for now. The corporate faces the last word danger of not taking part in a phase that would drive a big majority of Knowledge Middle development over the following 5+ years.

As mentioned in prior analysis, AMD has a path to a $5+ EPS within the subsequent few years. Successful product within the AI area will present substantial upside to those estimates contemplating the massive income soar at Nvidia.

Takeaway

The important thing investor takeaway is that Superior Micro Units, Inc. seemingly pauses over the following few weeks or months till the corporate gives something extra substantive relating to AI chip gross sales. The catalyst may very well be 2H steering following the Q2 earnings report in late July or it may very well be one other occasion for the launch of the MI300. The hot button is that buyers do not know when the AI hype will return to the inventory, however AMD is extremely prone to see a big bump within the yr forward as a result of enormous potential of the MI300 AI chip line up.

[ad_2]

Source link