[ad_1]

After a 3-year COVID pause, scholar mortgage curiosity will resume beginning on Sept. 1, 2023, and funds can be due beginning in October,” in response to the Division Of Training. “We’ll notify debtors nicely earlier than funds restart.”

Given the pandemic was formally declared over on Could 11, 2023, it is smart that scholar mortgage debt ought to begin to be paid again. However in fact, not everybody agrees.

Some individuals consider {that a} 3-year pause in paying again scholar loans isn’t ok. As an alternative, they really feel entitled to have their debt forgiven. Such a entitlement mentality is a big crutch which will forestall them from turning into financially unbiased.

Let’s take a look at an instance of entitlement mentality in motion from a Twitter person.

Shocked To Have To Pay Again Pupil Loans

Under is a tweet by a lady who lives in New York Metropolis. I’ve greyed out the title to deal with the message. Let’s name her Patty and the way having entitlement mentality can destroy her wealth-building potential.

Paying $1,298.83 a month in scholar loans is loads! However on the intense aspect, not less than her lease is reasonably priced for New York.

Patty’s remark about “how do you count on Individuals to pay this” is unusual since she is the one who took out the loans. After all she is the one who ought to pay again the lender. Who else?

If I borrow cash from a financial institution to purchase a home, I am not going to behave shocked that I’ve to pay the cash again after a pause. I’d really feel lucky I used to be capable of get a mortgage within the first place to reside in a brand new home. And once I lastly repay my mortgage, I’ll really feel proud to have fulfilled my obligation.

The identical logic goes for taking out scholar loans. College students ought to really feel grateful an establishment lent them cash to go to school. In any other case, they would not be capable to go to school! In keeping with a Lumina Basis report, roughly 54% of Individuals have faculty levels as of 2021.

Training is an extremely beneficial asset as you will note from the information beneath.

A Faculty Diploma Is A Invaluable Asset

A school diploma is effective as a result of the typical lifetime revenue for a university graduate is much increased than the typical lifetime revenue for a excessive school-only graduate.

In keeping with 2022 information from the Federal Reserve Financial institution of New York, the median annual wage for a full-time employee aged 22 to 27 with a highschool diploma is $30,000. For a full-time employee with a bachelor’s diploma, it is $52,000. That is a $22,000 a yr, or 73% distinction!

In keeping with The Affiliation Of Public & Land-Grant Universities, the lifetime earnings for an individual with a Bachelor’s diploma is $2,268,000 versus solely $1,304,000 for an individual with a highschool diploma. Due to this fact, we are able to estimate the worth of a school training is price hundreds of thousands.

Costly Non-public College Tuition

Given Patty’s scholar mortgage month-to-month fee is $1,298.83, she should have taken out between $100,000 – $200,000 in scholar loans.

Though $100,000 – $200,000 is loads to borrow for a university training, as long as Patty finishes faculty, the return on her faculty funding ought to be better with sufficient time.

Given this logic, I naturally appeared up the place she went to high school and what she studied. The college(s) should be fairly fancy to rack up a lot scholar debt!

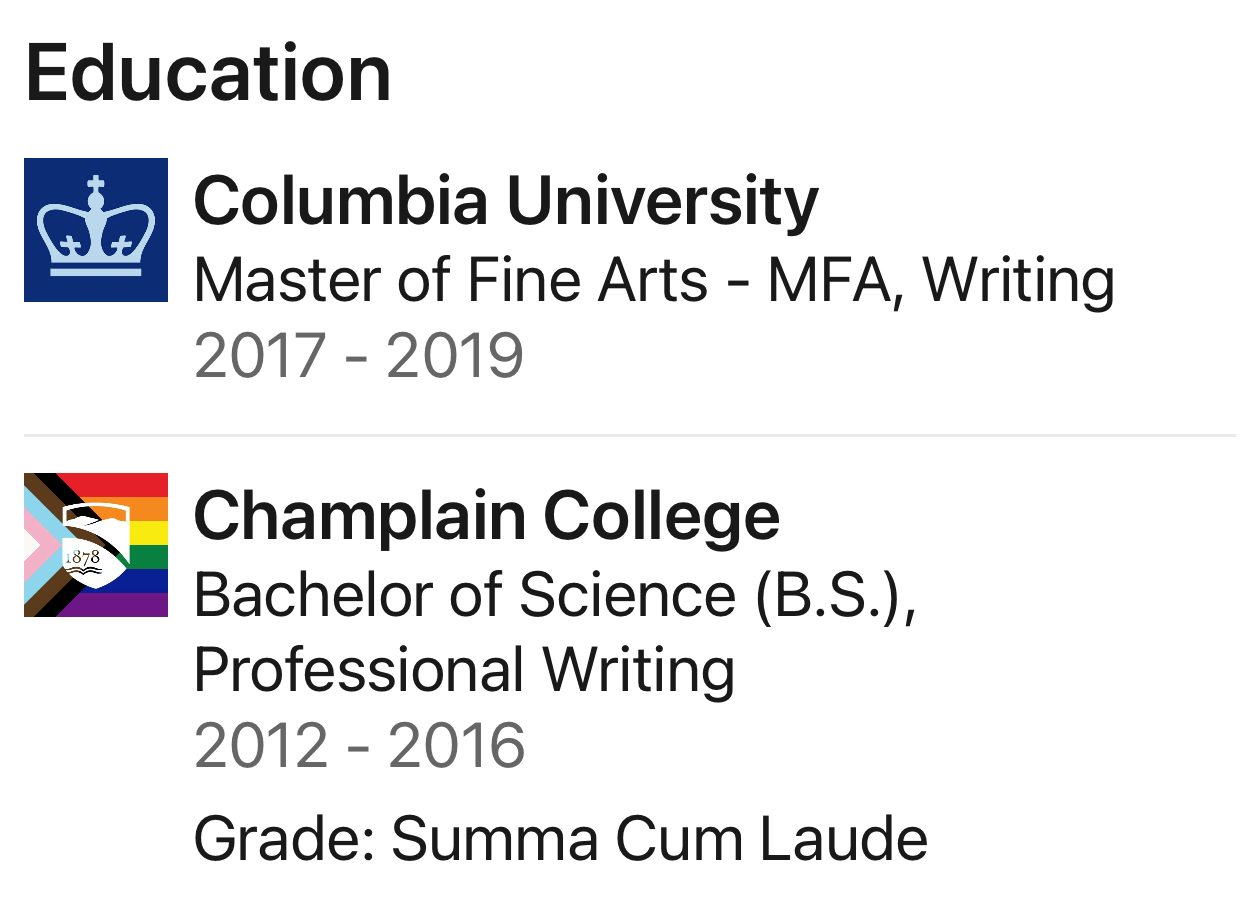

Ah hah! Patty received a B.S. from Champlain Faculty, a non-public faculty I’ve not heard of. She then received a Grasp of Positive Arts in Writing from Columbia College, an Ivy League college.

Champlain Faculty’s tuition this yr is $45,100, which is definitely $10,000 – $15,000 a yr cheaper than different non-public schools. Nonetheless, getting a Writing MFA from Columbia prices $76,177 for tuition and costs alone this yr.

Given her scholar mortgage month-to-month fee quantity, we are able to assume she didn’t get lots of grants or scholarships.

Going to personal faculty is one factor. However to then tackle debt to check writing is a suboptimal monetary transfer. The median revenue earned by Ivy League graduates already is not a lot increased than non-Ivy League graduates.

Your Career Issues Extra If You Take On Pupil Debt

After fourteen years of writing on-line and publishing a few books, I do know that being an expert author is difficult. The pay is low and the rejection charge is excessive.

If I had no different sources of revenue, it could be extraordinarily tough to supply for a household of 4 right here in San Francisco.

It could have been higher if Patty had gone to a less expensive state college, received a higher-paying day job, and wrote on the aspect. However what’s completed is completed. We are able to solely study from this instance to assist future faculty goers make higher choices.

Low Return On Funding

As a mother or father who went to a public college, such a scenario Patty faces is a fear for my kids.

What if my youngsters go to personal grade college for 13 years after which get shut out from a high 50 college? What in the event that they then insist on taking up scholar debt to attend an costly non-public college, solely to finish up being underpaid or underemployed? This appears to occur on a regular basis.

As a Monetary Samurai, I am unable to assist however deal with the Return On Funding (ROI) of most monetary expenditures. Paying for faculty and spending all that point getting levels are two of the largest investments one could make.

Except your loved ones is already wealthy otherwise you obtain scholarships, it is extra prudent to go to a less expensive faculty with out taking up debt.

The Concern Of Parental Failure

Parenting is hard since you do not totally understand how good of a mother or father you’re till after your youngsters go off on their very own.

Entitlement mentality could have a means of sneaking up on kids who develop up in safe properties. Nonetheless, if my kids can’t perceive the significance of honoring their debt obligations, I really feel like I’ll have failed as a FIRE mother or father.

Most individuals should not have such privileges to attend two non-public universities and pursue a profession in writing in one among America’s costliest cities. To not be appreciative of such luxuries after which to count on another person to pay for them is fallacious.

Having this entitled angle may have meant that each one the steerage we gave our youngsters rising up did not stick. It implies that all of the journeys we took to present them perspective did not matter. And all the cash we spent on their training simply saved them sheltered.

Nevertheless it’s arduous to seek out shelter in the true world. All people is on the market preventing to get forward!

Feeling Entitled To Free Cash Will Harm Your Wealth

I perceive that everyone likes to get one thing at no cost. Even I generally have a tough time saying no to a rubber rooster lunch till I calculate the worth of my time.

However relating to borrowing cash, whether or not from a buddy or an establishment, not paying a lender again is dishonorable. Our whole banking system would collapse if all people felt this manner as a result of rates of interest would surge even increased. Solely the wealthy and linked would be capable to get loans.

As an alternative, we should honor the contract. One other occasion determined to take a danger on us. We learn and understood the phrases of the mortgage. If we obtained a three-year reprieve, then we ought to be grateful. And when it is time to pay again our debt, we should always achieve this in earnest.

When you undertake an entitlement mentality, it would rob you of a brighter and wealthier future. In case you preserve anticipating the whole lot to be given, you’ll ultimately be dissatisfied as a result of not all people will agree along with your entitlement.

Examples Of How Entitlement Might Lead To Suboptimal Outcomes

Not finding out as arduous in highschool since you count on to get into a university primarily based in your id and legacy standing. However the yr you apply the admissions workplace decides to focus extra on benefit.

Not practising your interview expertise as a result of your mother was once a Senior VP on the firm. However the yr you apply the hiring coverage strikes away from nepotism.

Not constructing a powerful community of supporters at work since you suppose your work is great sufficient to land you an enormous promotion. However you get handed over as a result of no one needs to advertise a chilly, uncollaborative colleague.

Not saving sufficient for retirement since you count on Social Safety to pay for all of your retirement bills. However in your 60s the federal government pushes again the full-retirement age by 5 years.

Not constructing passive funding revenue streams since you count on your job to at all times be there. However a recession hits and your boss decides to save lots of his secret crush and allow you to go.

Not advertising and marketing your product since you count on all people to assist you’re employed as soon as it is launched. However your product flops as a result of the world is an extremely noisy place the place even the most effective works go unnoticed with out lots of promotion.

Nothing Is Given, All the things Is Earned

“Nothing is given, the whole lot is earned” is a greater mentality to have. In case you undertake this mentality then you’ll method life from a place of energy.

When entitlement mentality takes maintain, you may find yourself doing curious issues reminiscent of complaining about having to pay again your scholar mortgage debt whereas posting on Twitter the way you turned down 5 job affords, wrote a bestselling ebook, and constructed a devoted library in your NYC house! Sure, this is identical entitled Patty from above.

Entitlement mentality reduces self-awareness. Or perhaps individuals who lack sufficient self-awareness have a better sense of entitlement. It could be the identical cause why irrespective of how wealthy some individuals get, they’ll at all times consider they’re a part of the center class.

With out feeling entitled, if no one offers you a leg up, no drawback. You by no means anticipated any assist in the primary place. As an alternative of at all times ready for one thing to occur to you, you are taking motion to get what you need.

Within the off probability one thing fortuitous occurs, reminiscent of getting a 3-year reprieve from paying again your scholar loans, you’ll extremely grateful. And the extra grateful you’re, the happier and richer you may really feel.

Reader Questions And Options

How will we scale back entitlement mentality? Is entitlement mentality the explanation why future generations are likely to squander the arduous work and luck of earlier generations? What goes on in privileged individuals’s heads why they count on extra issues at no cost?

Decide up a duplicate of How To Engineer Your Layoff if you wish to learn to negotiate a severance and be free with cash in your pocket. Negotiating a severance was my #1 catalyst to depart a well-paying job in 2012 and by no means return. Use the code “saveten” to save lots of $10 at checkout.

For extra nuanced private finance content material, be a part of 60,000+ others and join the free Monetary Samurai publication and posts through e-mail. Monetary Samurai is among the largest independently-owned private finance websites that began in 2009.

[ad_2]

Source link