[ad_1]

You might already bear in mind that your credit score utilization is a serious element of your credit score rating, however do you know that this class encompasses multiple sort of utilization ratio?

On this article, we are going to discuss the distinction between your total credit score utilization ratio and particular person utilization ratios and why it issues to your credit score.

What Is Credit score Utilization?

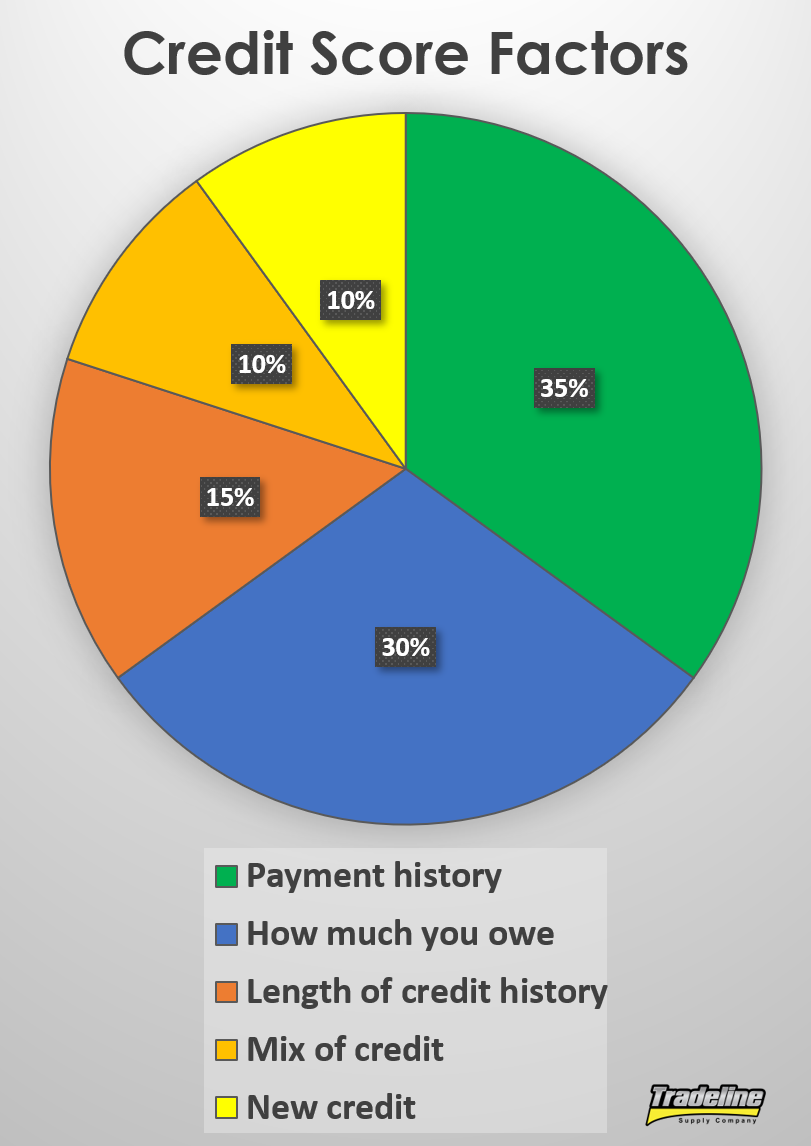

Credit score utilization makes up 30% of a FICO rating.

Your credit score utilization is just the quantity of debt you owe in comparison with the quantity of obtainable credit score you’ve got. In different phrases, it’s the quantity of your obtainable credit score that you’re truly utilizing.

By way of your credit score rating, credit score utilization makes up 30% of your rating, which suggests it’s second in significance solely to your fee historical past.

The rationale why credit score utilization is such an essential a part of your credit score rating is that the ratio of debt somebody has is very indicative of whether or not they may default on a debt sooner or later. The extra debt you owe, the more durable it turns into to repay all that debt on time each month, which makes you a riskier funding for lenders.

Parts of Credit score Utilization

In accordance with FICO, there are a number of parts that fall inside the class of credit score utilization, corresponding to:

The overall quantity you owe on all accounts (your total utilization ratio)

The utilization ratios of every of your revolving credit score accounts (particular person utilization ratios)

The variety of your accounts which have balances or the ratio of accounts with balances to accounts with no stability

The quantity of debt you continue to owe in your installment loans (e.g. mortgages, auto loans, scholar loans), though that is identified to be much less essential than the utilization of your revolving accounts

What Is the Distinction Between Particular person and Total Utilization?

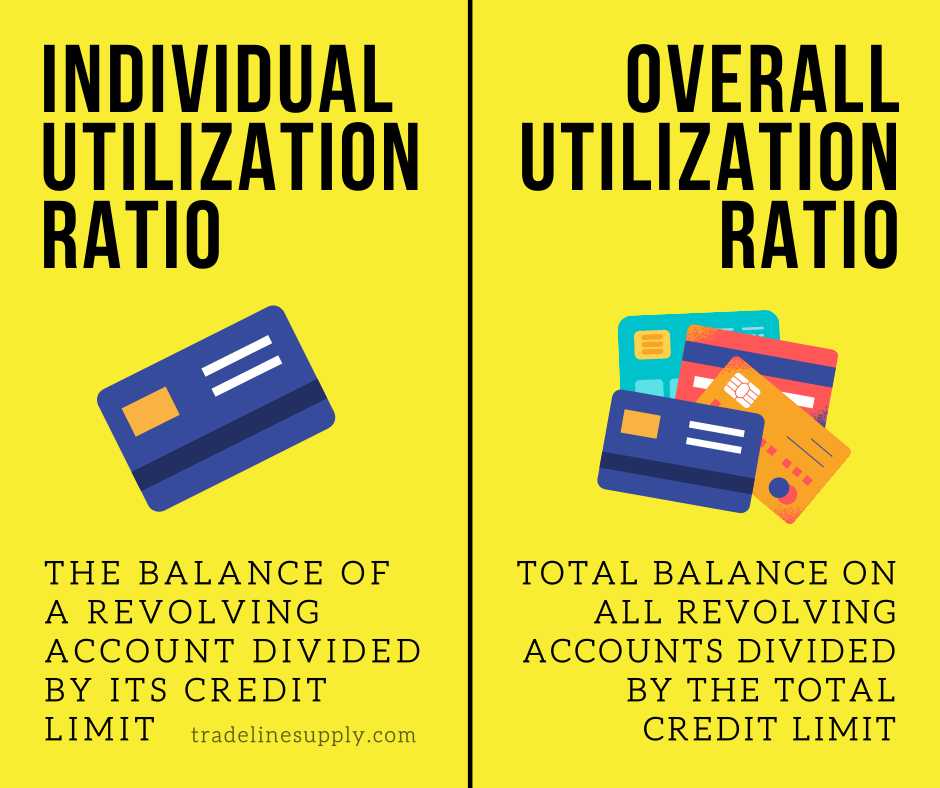

Your total utilization ratio is the quantity of revolving debt you’ve got divided by your complete obtainable revolving credit score.

For instance, if in case you have one bank card with a $450 stability and a $500 restrict and a second bank card with a $550 stability and a $3,500 restrict, your total utilization ratio could be 25% ($1,000 owed divided by $4,000 obtainable credit score).

Nevertheless, the person utilization ratios of your respective bank cards are 90% ($450 stability / $500 credit score restrict) and 16% ($550 stability / $3,500 credit score restrict).

Since credit score scores contemplate particular person utilization ratios, not simply total utilization, having any single revolving account at 90% utilization goes to weigh negatively on the credit score utilization portion of your rating.

A person utilization ratio refers back to the utilization of a single revolving account, whereas the general utilization ratio contains the balances and credit score limits of your whole revolving accounts.

Video: Did You Know There Are 2 Kinds of Credit score Utilization Ratios?

Total Utilization Could Not Be as Essential as You Assume

Usually, when individuals consider the impact that credit score utilization has on credit score scores, they usually assume that total utilization is the one essential variable.

By this assumption, it could be advantageous to have particular person accounts which might be maxed out so long as the general utilization continues to be low.

The person utilization ratios on every of your accounts could also be extra essential than the general utilization ratio.

Nevertheless, we now have usually seen instances the place this isn’t true.

For instance, generally a shopper who has maxed-out bank cards might assume that in the event that they cut back their total utilization ratio, their credit score will enhance, however as soon as they accomplish this objective, they don’t see the outcomes they have been hoping for.

This means that the person accounts with excessive utilization ratios are nonetheless weighing closely on the patron’s credit score rating, even if the patron has improved their total credit score utilization ratio. In different phrases, the lower on this individual’s total utilization ratio didn’t have a big impression on their credit score.

Instances like this appear to point that total utilization might not play as large of a task as conventional knowledge has led us to imagine and that the person utilization ratios may very well be extra essential to 1’s credit score.

This is without doubt one of the the explanation why we sometimes recommend that customers give attention to the age of their accounts fairly than their credit score limits. Though individuals are likely to give attention to getting excessive credit score limits, the age and fee historical past of their accounts is truly extra highly effective most often, particularly contemplating that decreasing one’s total utilization ratio might not assist very a lot.

Video: Which Is Extra Essential: Particular person or Total Utilization?

Tradelines and Credit score Utilization

Though age ought to normally be the highest precedence, it’s nonetheless essential to contemplate the credit score utilization issue of any revolving tradelines in your credit score file.

Our tradelines are assured to have utilization ratios which might be at or under 15%, which suggests not less than 85% of that tradeline’s credit score restrict is on the market credit score. In reality, most of our tradelines sometimes preserve utilization ratios which might be a lot decrease than 15%.

Earlier than shopping for tradelines, see the place you stand presently by utilizing our tradeline calculator, which mechanically calculates your credit score utilization ratios for you. You too can use the calculator to see how your total utilization ratio may very well be affected by altering a number of the variables.

What Is the Splendid Utilization Ratio?

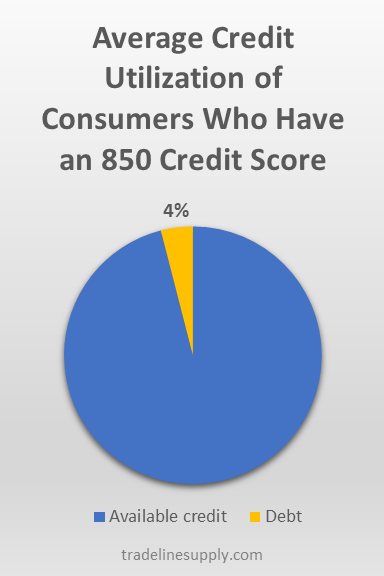

The common credit score utilization ratio of customers who’ve an 850 FICO rating is about 4%.

As a basic rule of thumb, merely goal to maintain your utilization as little as attainable. Nevertheless, you is likely to be shocked to be taught that having a zero stability on all revolving accounts is definitely not the most effective state of affairs in your rating.

In accordance with creditcards.com, “…the perfect state of affairs tends to be having all however one card present a zero stability (zero p.c utilization) and having one card with utilization within the 1-3 p.c vary.”

Why? Because it seems, customers with a 0% utilization ratio even have a barely greater danger of defaulting than these with low (however greater than 0) utilization. A 0% utilization signifies {that a} shopper might not use credit score commonly, which results in the patron having the next danger of default sooner or later.

Nevertheless, your utilization doesn’t essentially should fall according to the above state of affairs with a purpose to have an ideal credit score rating. In “Easy methods to Get an 850 Credit score Rating,” we discovered that customers with FICO credit score scores of 850 have a mean utilization charge of 4.1%.

For these of us who use credit score commonly, nevertheless, sustaining a minuscule stability might not at all times be sensible. So what’s a practical threshold to shoot for?

When you might hear the determine 30% cited ceaselessly, educated credit score consultants say this can be a delusion and that you need to goal for 20%-25% as an alternative.

Tricks to Keep away from Extreme Revolving Debt Utilization

Unfold out your fees between completely different playing cards

Since we now have seen that it’s essential to maintain particular person utilization ratios low, one technique to perform that is to make your purchases on just a few completely different bank cards as an alternative of charging all the pieces to 1 card. Spreading out your fees helps to forestall an excessively excessive stability from accumulating on anybody particular person card.

Nevertheless, additionally understand that credit score scores might penalize you for having too many accounts with balances. Ideally, attempt to preserve low particular person utilization charges without having a stability on each single account.

Repay your balances extra ceaselessly

If you happen to do spend rather a lot on one card, it helps to repay your stability greater than as soon as a month. In case your card experiences to the credit score bureaus earlier than you’ve got paid off your stability, it’s going to present the next utilization than if you happen to had paid some or all the stability down already.

If you happen to spend rather a lot on certainly one of your playing cards, contemplate spreading out your fees between completely different playing cards or paying down the stability extra usually.

You’ll be able to both time your fee to put up simply earlier than the reporting date of your card or you can also make funds a number of occasions monthly. Some individuals even desire to repay every cost instantly so their card by no means exhibits a big stability.

Arrange stability alerts to watch your spending

To stop senseless spending from getting uncontrolled, attempt establishing stability alerts in your bank card. Your financial institution will mechanically notify you when the stability exceeds an quantity of your selecting, so you may again off of spending on that card or pay down your stability.

Don’t shut previous accounts

Even if you happen to don’t use a few of your previous bank cards anymore, it’s usually a good suggestion to maintain the accounts open to allow them to proceed to play a optimistic function in your total utilization ratio and the variety of accounts that have low utilization vs. excessive utilization.

Ask for credit score restrict will increase

Attempt calling up your bank card issuer and asking for the next credit score restrict. If you happen to get accepted, as most individuals who ask do, this could enhance your credit score utilization.

One other option to lower your utilization ratios is to name your bank card issuers and ask them to extend your credit score restrict. By growing your quantity of obtainable credit score, you lower your utilization ratio, each on particular person playing cards and total.

Remember that your financial institution might do a tough pull in your credit score to resolve whether or not or to not grant your request, which may ding your rating just a few factors briefly. Nevertheless, the small adverse impression of the credit score inquiry may very well be offset by the advantage of the credit score line improve.

Additionally, this won’t be an excellent technique if you happen to suppose you may be tempted to spend the brand new credit score obtainable to you, which may depart you even worse off than you began.

If you wish to be taught extra about how one can efficiently ask for credit score line will increase, try our article, “Easy methods to Enhance Your Credit score Restrict.”

Like asking for the next credit score restrict, opening a brand new bank card also can decrease your credit score utilization, offered you permit many of the credit score obtainable.

Once more, it will add an inquiry to your credit score report, in addition to lower your common age of accounts, so this might have a adverse impression in your rating briefly, which can be outweighed by the lower in your credit score utilization.

Switch your bank card balances to different playing cards

A stability switch is if you use obtainable credit score from one bank card account to repay the stability on one other bank card, thus “transferring” your debt stability from one card to a different.

There are two methods to do that: you may switch a stability to a different bank card you have already got, so long as it has sufficient obtainable credit score, or you may switch a stability by making use of for a brand new bank card and letting the cardboard issuer know in your software which accounts you wish to switch balances from and the way a lot you wish to switch.

The latter choice is finest in your credit score utilization since opening a brand new bank card means you might be including obtainable credit score to your credit score profile. As well as, it offers you the chance to use for particular stability switch bank cards, which normally include low promotional rates of interest on the balances you switch.

Nevertheless, utilizing an present account to do a stability switch can nonetheless be useful if completed correctly, as a result of it could assist your particular person utilization ratios. Simply make certain the account you might be transferring the stability to has the next credit score restrict than the account that’s presently carrying the stability with a purpose to hold the person utilization ratios as little as attainable on every account.

Pay down small balances to zero

Having too many accounts with balances can deliver down your rating since credit score scores contemplate the variety of accounts in your credit score file which might be carrying a stability. When you’ve got any accounts with low balances, paying these right down to zero will lower the person utilization ratios on these accounts, cut back your total utilization ratio, and cut back the variety of accounts with balances, thus bettering your credit score profile in a number of methods.

[ad_2]

Source link