[ad_1]

Monetary and lending establishments use credit score scores to find out how probably somebody is to repay a mortgage. In accordance with FICO, the common credit score rating in the USA is round 716, however that quantity varies considerably by state. Credit score scores vary from 300 to 850, and every quantity corresponds to a distinct stage of credit score danger.

Monetary and lending establishments use credit score scores to find out how probably somebody is to repay a mortgage. In accordance with FICO, the common credit score rating in the USA is round 716, however that quantity varies considerably by state. Credit score scores vary from 300 to 850, and every quantity corresponds to a distinct stage of credit score danger.

A excessive credit score rating means you’re a low-risk borrower, which may result in decrease rates of interest on loans and different strains of credit score. Alternatively, low credit score scores may imply increased rates of interest and a higher likelihood of not being authorised for a mortgage.

Whereas most individuals know they’ve credit score scores, they might not perceive why these rating numbers matter or how they’re decided. Learn on as we discover how completely different credit score rating ranges map to monetary conditions and tips about how one can enhance your credit score rating.

What Credit score Rating Ranges Ought to Imply to You

Totally different credit score rating ranges correspond to various ranges of danger. Figuring out your credit score rating is extremely useful in terms of figuring out whether or not you’ll qualify for a mortgage or bank card.

Bank card firms and lenders use credit score scores to find out your mortgage qualification, credit score restrict, and relevant rate of interest. Lenders typically give extra interesting rates of interest to folks with excessive credit score scores as a result of there’s a decrease likelihood of the debt not being repaid by the borrower.

Since folks with low credit score scores are thought-about high-risk debtors, they might have bother getting authorised for varied monetary merchandise, together with private and bank cards. Because of this, they could possibly be charged increased rates of interest or denied credit score completely.

What Are the Credit score Rating Ranges?

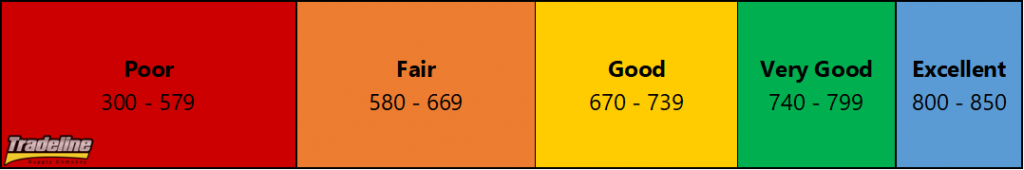

Credit score scoring firms like FICO use a number of credit score scoring fashions to find out your credit score rating. FICO scores dominate the market, and the preferred variations vary from 300-850, with every quantity indicating how probably you’re to be a accountable borrower. Under are the completely different credit score rating ranges and what they symbolize financially:

Generally used FICO credit score scores vary from 300 to 850.

Distinctive: 800-850

Customers with distinctive credit score scores have constantly glorious credit score utilization habits. They’ve low balances on their bank card accounts, preserve their credit score utilization ratios round 10% or decrease, and have an extended historical past (a long time) of on-time month-to-month funds. Debtors inside this vary are provided increased credit score limits and may qualify for decrease charges on private loans, bank cards, strains of credit score, and mortgages.

The very best potential credit score rating you may have on the FICO scoring system is 850. Whereas it’s potential to acquire an ideal 850 credit score rating, it’s not crucial to take action as a way to get the most effective credit score provides, neither is it a sensible aim. Getting an 850 credit score rating requires that each single credit score scoring issue should be excellent, which is solely not potential for many customers.

Customers with credit score rating ranges which are excellent or distinctive will get the most effective rates of interest on mortgages and different loans.

Very Good: 740-799

A rating between 740 and 799 is within the excellent credit score vary. These debtors typically have good monetary duty concerning credit score and cash administration. They’ve decrease credit score utilization ratios, a very good historical past of on-time funds, and few derogatory marks on their credit score reviews.

Most lenders are nonetheless comfy extending strains of credit score to those debtors, so folks inside this vary are prone to get authorised for loans and different merchandise with favorable rates of interest.

Good: 670-739

A FICO rating falling between 670 and 739 is taken into account a very good credit score rating. The nationwide common credit score rating stands on this vary. This rating signifies that you’ve typically been accountable with credit score previously and paid your payments on time. It’s possible you’ll qualify for common charges, however it could develop into tougher to be authorised for some sorts of credit score. You’ll probably have to buy round as a way to discover the most effective rates of interest.

Truthful: 580-669

People with credit score scores inside this vary are beneath the nationwide common and should have adverse marks on their credit score reviews. In case you have a FICO rating on this vary, you’ve probably missed funds or proven indicators of excessive credit score utilization and delinquencies. This implies chances are you’ll not qualify for some sorts of credit score, equivalent to loans or bank cards. Few lenders will probably prolong a credit score line to you however provide high-interest charges.

Poor: 300-580

This vary is the bottom credit score rating ranking on credit score reviews and is taken into account to be very low credit score. Individuals with a FICO rating on this vary are seen as high-risk debtors and could also be unable to get authorised for loans, strains of credit score, or mortgages. They’ve a number of circumstances of missed funds, excessive balances, and excessive credit score utilization ratios. Poor credit score scores may additionally end result from submitting chapter or having debt in collections.

“Credit score invisibles” are those that don’t have a credit score rating, which will be equally as problematic as having low credit score.

No Credit score Rating

It’s potential to not have a credit score rating in any respect, which is named being credit score invisible. Should you haven’t had a mortgage or bank card for a number of years, your credit score rating could not have the ability to be calculated as a result of there’s inadequate info in your credit score reviews.

Lenders should enable you entry to credit score based mostly in your different property, but it surely normally requires further verification of your property and revenue.

Find out how to Construct Credit score & Earn a Higher Credit score Rating

Constructing and bettering your credit score rating generally is a difficult however rewarding expertise. Your credit score rating will enhance your entry to financing merchandise with decrease rates of interest and charges on all the pieces from loans to mortgages. Under are some suggestions that may assist enhance your rating:

Make All of Your Month-to-month Funds on Time

Probably the most important elements that go into calculating your credit score rating is your fee historical past. A historical past of on-time funds will assist enhance your credit score rating. Should you miss funds, this may be reported to credit score reporting companies and harm your credit score rating.

Pay Extra Than the Minimal Cost

By solely making the minimal fee every month, you accumulate increasingly more debt. Not paying your steadiness in full additionally will increase your utilization ratio, which impacts your rating negatively the upper your utilization turns into. Deal with paying off as a lot of the steadiness as potential every month, if not the entire steadiness.

Hold Credit score Card Balances Low

Once more, carrying giant balances negatively impacts your credit score rating, so it is very important constantly preserve your balances low for those who can. In case you have giant excellent bank card balances in your accounts in comparison with your accessible credit score, lenders are additionally extra reluctant to provide you a brand new line of credit score as a result of they might view you as financially over-extended.

Preserving your bank cards open whereas sustaining low balances helps your credit score utilization and, by extension, your credit score rating.

Hold Your Credit score Playing cards Open

Closing a bank card account can damage your credit score rating since you now not get the good thing about its credit score restrict. Preserving your bank cards open even if you’re not utilizing them a lot permits the playing cards to assist out your credit score utilization metrics, boosting your credit score scores.

Solely Apply for Credit score When You Want It

Every time you apply for a brand new mortgage or bank card, lenders verify your credit score report, which ends up in a tough inquiry being added to your credit score report. Having too many exhausting inquiries inside the previous 12 months can affect your rating negatively. If lenders see plenty of inquiries in your credit score historical past, they might be involved that you’re taking up an excessive amount of new debt and won’t have the ability to make your whole funds on time.

Why You Ought to By no means Belief a CPN to Enhance a Credit score Rating Vary

Should you’re seeking to enhance or reset your credit score rating and are available throughout an organization that gives Credit score Privateness Numbers (CPN), it’s greatest to remain away. A CPN is a nine-digit pretend or stolen Social Safety quantity that credit score restore firms promote to individuals who wish to restore their credit score scores.

These firms instruct you to make use of the CPN rather than your Social Safety Quantity when making use of for credit score. CPNs are generated randomly or stolen Social Safety numbers, largely from kids, inmates, and senior residents. Utilizing a CPN is against the law, and when caught, you may face a hefty nice and even jail time.

Utilizing a CPN as an alternative of a stolen Social Safety quantity, chances are you’ll be committing an id theft crime. Relying in your state and the statute of limitations, you might be jailed for a most of 15 years and face 1000’s in fines. Utilizing a CPN to reset or enhance your credit score rating will not be well worth the danger.

7 Quick Credit score-building Methods to Affect Your Credit score Rating Vary

Credit score scores have develop into a necessary a part of at present’s society. It’s now not simply used for mortgage functions. Employers and landlords may additionally ask to evaluate your credit score rating or credit score historical past. In some circumstances, chances are you’ll not get entry to housing, utilities, or insurance coverage if in case you have a low credit score rating.

In case your credit score rating isn’t your perfect quantity, or is beneath the common credit score rating, there are a number of issues you are able to do to assist enhance it. Listed below are seven quick methods to assist enhance your credit score rating vary:

1. Develop Your Credit score File

Making a optimistic credit score file is step one in constructing credit score. This may be performed by opening a credit score line that’s reported to the foremost credit score bureaus. Should you make on-time month-to-month funds and preserve your revolving utilization ratio beneath 30%, this demonstration of fine credit score habits will enhance your credit score rating and, in flip, enhance your credit score rating vary. Greater credit score scores will open doorways to raised financing choices and decrease charges.

2. Verify Your Credit score Reviews

When constructing your credit score rating vary, it’s crucial to verify your credit score reviews to know the place you stand.

As mandated by the Truthful Credit score Reporting Act (FCRA), you will get your credit score report without spending a dime yearly from every of the three credit score bureaus. Moreover, through the COVID pandemic, the credit score bureaus have volunteered to offer free credit score reviews to everybody on a weekly foundation. This

Evaluation every credit score report for inaccurate info and dispute errors as crucial.

3. Dispute Credit score Report Errors

Your credit score rating will be considerably lowered in case your credit score report comprises faulty adverse gadgets. Nevertheless, the credit score bureaus will be contacted if any errors are discovered. Your dispute letter should be investigated and responded to by the credit score bureau inside 30 days. Should you discover the knowledge to be inaccurate, you may request that it’s eliminated or corrected in your credit score report.

4. Pay Your Payments on Time

Cost historical past is essentially the most crucial think about your credit score rating, accounting for 35% of your rating. No credit-building technique might be efficient if you don’t constantly pay your payments on time. Late funds can stay in your credit score report for as much as seven years.

Should you do that efficiently, having an extended historical past of on-time invoice funds will make it easier to obtain glorious credit score scores. To keep away from unintended lacking or late funds, you may arrange reminder notifications and automated invoice funds along with your lenders.

5. Enhance Your Credit score Restrict

Paying off bank cards and different revolving accounts could assist enhance your credit score rating vary, however having a excessive quantity of accessible credit score will add factors to your rating. Contemplate growing the restrict in your strains of credit score to lower your utilization ratio. A great time to do that is after build up a historical past of accountable credit score utilization or when you have got began a better-paying job.

In accordance with the Client Monetary Safety Bureau, your fee historical past, credit score combine, debt owed, and size of your credit score historical past are some essential credit score elements a bank card issuer will have a look at when figuring out your credit score limits.

6. Catch Up on Delinquencies and Previous Due Accounts

In case you have missed funds previously, attempt to resolve them as quickly as potential. Bringing your delinquent accounts present will assist enhance your credit score rating, and paying off collections could assist your rating relying on which credit score scoring mannequin is used.

Since most adverse info like late funds stays in your credit score report for seven years, it’s essential to start out repairing your credit score historical past as quickly as potential.

In case you have bother with bank card debt, contemplate speaking to a credit score counselor to create a debt administration plan. They are able to negotiate decrease month-to-month funds and curiosity along with your collectors and make it easier to repay outdated assortment accounts sooner. Some could even work to get these adverse marks eliminated out of your report.

7. Get a Secured Credit score Card

In case you are simply beginning out or have had credit score issues previously, making use of for a secured card can assist you enhance your credit score rating. If you apply for a secured card, you make a safety deposit that the issuer will use as collateral if you’re unable to pay.

Month-to-month funds on a secured bank card will assist construct your credit score rating. You must search for secured playing cards that report back to all three main credit score bureaus as a way to reap the benefits of the credit-building advantages of bank cards.

The Greenback Variations in Credit score Rating Ranges

The distinction between good credit score and low credit score can add as much as 1000’s of {dollars} of curiosity over your lifetime.

The upper your credit score rating vary, the much less danger you pose to lenders and the extra probably you’re to be authorised for a mortgage with a decrease rate of interest.

For that reason, having a very good credit score rating can prevent 1000’s of {dollars} in curiosity prices.

Nevertheless, these with low credit score scores could have bother getting authorised for a mortgage, and those that do could also be required to pay a better rate of interest to offset the elevated danger of lending. Subsequently, having a low credit score rating means you pay extra for financing big-ticket gadgets like a automobile or a house.

Video: Is It Well worth the Work to Have a Good Credit score Rating?

Credit score professional John Ulzheimer discusses the worth of getting a very good credit score rating. Test it out beneath!

Subscribe to our channel on YouTube to see extra credit score movies!

Why You Ought to Share What You Realized A couple of Credit score Rating’s Vary

Sharing your data about credit score rating ranges will assist folks perceive the significance of sustaining a very good credit score rating. To get financing for big-ticket gadgets or a dream dwelling, your credit score rating should mirror your monetary duty. In the long term, customers will lower your expenses and have simpler entry to credit score once they have a historical past of fine credit score habits.

For lenders to really feel assured that you’re financially accountable, it’s best to preserve a very good credit score mixture of accounts together with a checking account, financial savings account, and an funding portfolio.

Comply with the credit score suggestions above, equivalent to sustaining a low credit score utilization price, making on-time funds, and never opening too many accounts at one time so as to preserve a very good credit score rating.

Conclusions on Credit score Rating Ranges

It’s essential to grasp credit score rating ranges and notice that they’re a mirrored image of your creditworthiness.

Optimistic credit score habits can open doorways to monetary alternatives that you wouldn’t have the ability to entry in any other case, so begin build up your credit score historical past and credit score scores now. Lastly, be certain to maintain up your good credit score habits constantly to set your self up for monetary success sooner or later.

[ad_2]

Source link