[ad_1]

Over 5000 years of recorded historical past, gold has confirmed itself to be actual cash. Gold’s worth is in its use as cash. That worth is unquestioned.

No matter arguments are put forth towards gold’s use as cash are makes an attempt by authorities to free itself from the restrictions that gold imposes. Gold, when used correctly, limits the power of presidency to inflate and debase its cash.

Gold is authentic cash and is the unique measure of worth for all the pieces else. It was by no means a query as to what gold is value. The equation of value and worth was calculated utilizing fractional models (ounces, grams, grains) of gold. Client items and companies had been priced in gold.

PRICE OF GOLD IS IRRELEVANT

The value of gold is irrelevant so far as gold is anxious. Since gold is actual (and authentic) cash, makes an attempt to place a value on it are misguided. The worth of gold is in its use as cash and placing a value on it doesn’t inform us something about gold.

The gold value tells us solely what has occurred to the medium used to measure the worth of gold. In different phrases, the gold value in U.S. {dollars} tells us solely what has occurred, or is occurring, to the greenback.

A better gold value over time is a mirrored image of the lack of buying energy within the U.S. greenback. A better gold value doesn’t in any approach imply that gold is gaining in worth.

The identical relationship exists between gold and another forex or medium used to cost gold. Makes an attempt to cost gold in something apart from {dollars} received’t change something with respect to the worth of gold.

If the U.S. greenback had been changed because the world’s reserve forex, all that may matter with respect to the value of gold in {dollars} is whether or not the greenback loses further buying energy and the way a lot.

If gold had been to be priced in euros or yen, the one factor a rising gold value will inform us is that the euro or yen has misplaced further buying energy.

STOP ANALYZING GOLD

Makes an attempt to investigate gold are pointless. Gold’s worth has already been established. That worth – its use as cash – is fixed and unchanging.

Gold in its function as cash is a long-term retailer of worth. What I can purchase with an oz. of gold immediately is not any roughly than what could possibly be purchased ten years , or 100 years in the past. An oz. of gold immediately is not any extra priceless than it was in Roman occasions, both.

Inferring something about gold or its worth based mostly on modifications in its value is fraught with confliction and contradiction. Assuming correlation – or inverse correlation – of something apart from the buying energy of the U.S. greenback is misguided.

The value of gold is ALL concerning the U.S. greenback. (see What’s Subsequent For Gold Is All the time About The U.S. Greenback)

NO NEW HIGHS

By no means has extra been stated about nothing than the most recent references to “new highs in gold”.

When the value of gold peaked in August 2020 at $2058 oz. it was indicative of a ninety-nine p.c lack of buying energy within the U.S. greenback. The $2058 value was a one-hundred fold improve from its its authentic mounted value of $20.67 oz. and confirmed the consequences of greater than a century of inflation.

The one-hundred fold improve in gold’s value didn’t in any approach, form, or kind inform us that the worth of gold had elevated. It was merely a mirrored image of the lack of buying energy within the U.S. greenback.

When the gold value moved above $2000 oz. earlier this 12 months, it peaked at $2053 oz. – almost equivalent to the $2058 value in 2020.

Some say that the value acquired as excessive as $2080. Even when it did, it was not a brand new excessive for the gold value in actual phrases.

The results of inflation since gold’s value peak in 2020 imply that for the gold value to make a brand new excessive in actual phrases, it must exceed $2300 oz. in immediately’s cheaper {dollars}. As it’s, the “new excessive” in gold’s value was brief by $300 oz., or fifteen p.c.

That’s solely in reference to the excessive in 2020, although. When evaluating the gold value in immediately’s {dollars} to the height in 1980, gold’s value must be $2650 oz. simply to match the 1980 peak.

UNDERSTANDING PRICE vs VALUE

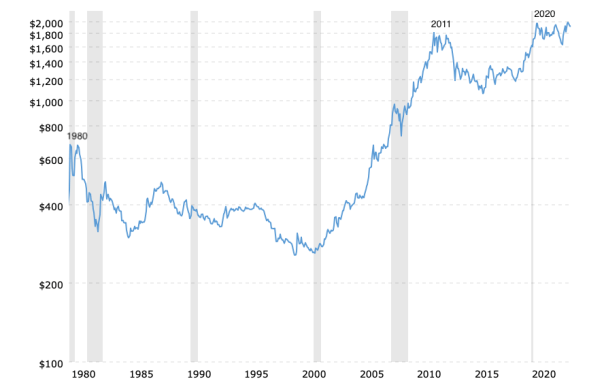

The chart instantly under is a historical past of gold costs since 1980…

Gold Value Historical past 1980-2023

As seen on the chart above, the value of gold tripled ($680 to $1895) between 1980 and 2011. However, none of that improve represented actual income or a rise in worth.

The complete improve over these three many years was attributable to the consequences of inflation that occurred after 1980.

Likewise, the rise in value between 2011 and 2020 accounted just for the consequences of inflation after 2011 and as much as 2020.

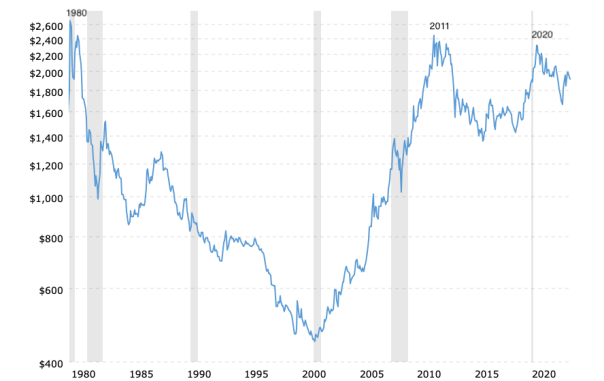

This stuff and extra might be seen on the chart under which stands in stark distinction to the earlier chart…

Gold Value Historical past (inflation-adjusted) 1980-2023

Taking a look at each charts once more, the next issues are obvious:

Gold’s collection of value peaks (inflation-adjusted) since 1980 are successively decrease than every earlier peak; 2011 was decrease than 1980, 2020 was decrease than 2011, 2023 was decrease than 2020. (Chart No. 2)*

Gold at $2000 oz. immediately is cheaper than at $680 oz. in 1980 (Chart No. 2).

Gold’s worth hasn’t elevated (Chart No. 2); solely its value (Chart No. 1).

Gold regularly strikes greater in value solely (Chart No. 1); not in worth (Chart No. 2).

Main turning factors within the gold value (1980, 2001, 2011, 2016, 2020) are correlated with modifications in greenback energy/weak spot.

*One issue which is likely to be retaining gold from matching its earlier value peaks is that the general results of Federal Reserve inflation are persevering with to have much less and fewer influence. (see Every thing Peaked in 1980 – The Waning Results Of Inflation)*

SUMMARY AND CONCLUSION

Gold is actual cash and the unique measure of worth for all the pieces else. The U.S. greenback and all fiat currencies are substitutes for actual cash/gold. All governments inflate and destroy their very own currencies.

The value of gold in U.S. {dollars} or the rest tells us nothing about gold. A better gold value in {dollars} tells us in hindsight how a lot buying energy the greenback has misplaced – nothing extra, nothing else.

Regardless of how excessive the value of gold goes in U.S. {dollars}, the worth of an oz. of gold stays the identical. Gold is actually priceless.

[ad_2]

Source link