[ad_1]

Butsaya/iStock by way of Getty Photographs

First, concerning the spot-on factor…

I didn’t after all issue within the Fitch downgrade which began the promoting on Thursday. My primary premise final week was that the market was steeply overbought. To my thoughts, Apple (AAPL) was going to be the catalyst and it was subsequently, Fitch obtained in a day early and blew off quite a lot of the froth so-to-speak then AAPL did the remainder. I obtained some ethical outrage that I dared to throw shade on the sacred identify of AAPL. AAPL is a superb firm, it’s greater than a client digital firm I used to be reminded of, it’s an entire ecosystem. Many argue that it’s greater than that, it’s a client necessity, a staple, and a client product. Sure, everyone knows these items, however the inventory was method overvalued, now it’s simply overvalued. May it fall decrease? Sure, if August and September act as marketed quite a lot of shares shall be decrease. Now it might sound apparent however two weeks in the past once we have been wanting forward the S&P 500 broke over 4600 and hardly anybody made any sort of remark or carried the information on a headline, everybody was bullish. It was then I knew that it was time to placed on the hedges and trim positions to generate money however timed to AAPL’s earnings report. When Monday of final week got here across the market was on an uptrend and I used lengthy requires fast trades to generate earnings. When Fitch introduced on Wednesday I made a decision to cowl and take earnings on my hedges. I believed that the following day the market would bounce again for the reason that final downgrade 10 years in the past didn’t have an effect on something. On Thursday, I used to be sitting with practically 25% money and thought that I would as effectively simply sit tight and maybe I may decide up some bargains on Friday. We will talk about what I picked up later. Ultimately, AAPL took the market down additional, and now we’re 3% from our current intraday excessive.

In addition to Apple and Fitch, the week gave us issues to be comfortable about.

Amazon (AMZN) did spectacularly outperforming in earnings and income. Even AWS seems to be like it’s turning round in progress. Andy Jassy appears to be pulling off the agenda of his personal “period of effectivity”, chopping employees and pointless logistical enlargement the place it was vital. But elevating productiveness by way of decreased supply occasions for e-commerce. Earnings outcomes elsewhere proved that we’re in a stock-pickers market with Etsy (ETSY) underperforming in e-commerce. Expedia (EXPE) was one other instance of underperformance the place Reserving Holdings (BKNG) outperformed in the identical sector. Uber (UBER) outperformed even the optimistic prognostications, and plenty of commentators have put ahead the notion that UBER’s greatest days are earlier than it. Not so with its smaller rival that’s presently buying and selling at lower than half of its 52WH, although 2nd quarter earnings are this Tuesday. DraftKings (DKNG) additionally outperformed and I imagine (and I’m probably not alone) that there are just a few leaders like Flutter’s Fan Duel, and maybe one or two extra that may find yourself with the lion’s share of the “App-Based mostly” betting leaving the remainder behind. DKNG is now self-funding enlargement from older States which have opened as much as DKNG years earlier. But because the CEO shared, the older states are nonetheless rising. DKNG stockholders and critics who as soon as have been shedding persistence with the timeframe for earnings now see free money move and a roadmap to profitability. All-in-all Q2 earnings is displaying that there was no large downturn in client spending. Some corporations did effectively and others didn’t, to this point about 80% of reported earnings beat expectations, which is a lot better than traditional. That stated, earnings are lagging from the 12 months earlier when customers had deeper pockets stuffed with pandemic cash. On the Friday earlier than final, July twenty seventh we realized that Q2 GDP grew at 2.4%, which is a greater efficiency than Q1’s 2%. The place am I going with this? Issues are fairly dang good. So why do I’ve a worrying lack of visibility into subsequent week?

Friday’s wild swings within the VIX and the 10-Y have thrown me off

If not for Friday’s wild swings, I’d probably expect a pleasant rebound from Fitch and AAPL’s weight on the indexes, and maybe be mildly hedged going into Thursday for the CPI. Likelihood is the pricier gasoline, and meals prices haven’t discovered their method into the federal government’s statistics as but. Not so for the PPI on Friday. PPI nearly by no means has an impact in the marketplace but when there’s even a freckle on the CPI, the PPI will rise in significance and strain the market. I assume if there have been two freckles on the CPI that would take the S&P 500 down exhausting once more. That wouldn’t perturb me in any respect, and I’d be prepared for it. Monday would then be if not recovering then at the very least on the flat aspect. That may give a few of my lengthy place sufficient alpha to be closed out and grow to be a part of my money hoard once more. Nevertheless, I’ve a lot issue with these two highly effective indicators and their predictive energy of the place the market goes. I haven’t seen a lot or really any commentary on the motion of the 10-Y to begin. If it slowly rose to 4.20% and held there I may clarify it away as the speed is rising as a result of it’s clear that no recession is coming anytime quickly. As a substitute on Wednesday, the 10-Y was at 4.04% thereabouts, then Thursday it blasted to 4.19. By Friday at 8 am it was nonetheless at 4.19, then peaking at 4.20 it proceeded to tumble. By 10.15 it was already 4.09% after which a bit extra slowly drops to 4.06 on the shut. I’ve usually remarked how rates of interest just lately have been too risky however to my reminiscence, this 24-hour efficiency is the winner. So does the crash imply that July’s 187K jobs crammed is an indication that the slowdown is coming and a recession quickly after? Does it imply that recession has been vanquished so there’s no want for this degree of rates of interest? Do I simply chalk it as much as “canine days of summer season” and low quantity brings volatility? Okay, however that is the US Treasury debt we’re speaking about, the biggest most liquid market on the planet. Some are saying that it was nerves that there’s going to be an enormous bond providing, however then the speed ought to have stayed at 4.20% not dropped like a rock.

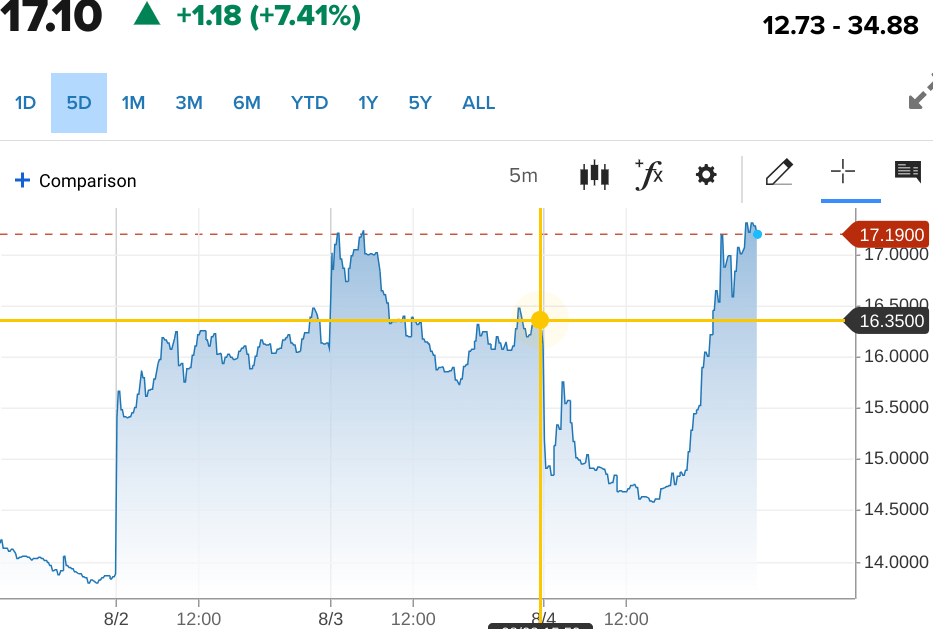

Now pile on the shenanigans of the VIX, how does that make sense? Listed below are the 5-day VIX futures.

CNBC

We’ve got early Thursday open at 17.19 then it closes at 16.35 which is cheap given the depth of the promoting. I feel Thursday was the worst promoting since March. Then the unusual factor occurs, Friday Morning with the information of AAPL already out the VIX drops like a rock to 14.58. Okay, effectively possibly AAPL is just not indicative of the complete market and this degree is within the vary of the place the VIX was buying and selling earlier than, although on the highest vary earlier within the week. So clarify the parabolic leap into area now we have after that. Does it imply that we dump subsequent week? Or that since that is the “Badlands” of the buying and selling 12 months the VIX shall be completely elevated. Or as soon as once more we will trot out the notion that this was all because of the summer season weekend. Possibly, everybody, suddenly determined that it could be clever to hedge going into subsequent week, simply to be on the protected aspect. Low quantity brings excessive volatility, and 17 VIX these hedges are going to be costlier. Therefore the puzzling lack of visibility, and the concern that subsequent week goes to carry surprises and never the nice variety. So what are we doing?

Proper now as I’ve stated, I’m sitting with a pleasant slug of money.

Relying on the futures and the way excessive the VIX is I’ll probably begin to hedge, if only a tiny bit. I’ll look to shut out as a lot of my lengthy Name Choice from Monday to Wednesday so long as the local weather is placid. If the futures are down 300 on the NDX Monday at 9:30 am, I would powerful it out. That’s if there’s promoting with no trigger. I’ve 20% money and that provides me flexibility. I’m working underneath the notion that regardless that this can be a unhealthy time of 12 months the economic system is rising with out inflation and that has obtained to place a ground underneath the indexes. In fact that makes the CPI and PPI all of the extra necessary. So let’s assume that the market is benign and the VIX slides again underneath 14. I’ll begin my hedges. Just about in nearly all circumstances, I’ll put some funds in direction of what I and plenty of others name “insurance coverage”. Insurance coverage means you’re paying that cash out within the hope that you just don’t want it. Then I’ll assume I can shut out my lengthy Name choices with some earnings. So what did I get lengthy this week that I’m going to wish to take earnings in? Should you guessed DKNG you’d be appropriate, with that on the board you’ll probably assume that I obtained lengthy UBER, and also you’d be appropriate once more. I’m additionally lengthy Datadog (DDOG) Name choices once more. I like {that a} large rival of theirs, New Relic (NEWR) is being acquired giving DDOG a better shortage worth, and in addition it’s a key part of growing AI purposes. I rolled down Confluent (CFLT) Name choices when it unexpectedly fell to 31, the following day it went again to 34 and I closed it out to financial institution some earnings. I obtained again into Oracle (ORCL) Name choices on Wednesday through the Fitch-induced portion of the sell-off considering that it ought to rebound this week. I’ve just a little Palantir (PLTR) in Name choices going into earnings this week. I managed to snag a small quantity of Yellow (YELL) Put choices with the notion that it’s prone to announce chapter this week.

Effectively, that’s it. Of all of the names I’ve talked about on the lengthy Name choices aspect, I’ve been including shares as effectively. I want to purchase some extra fairness because the market sells off to carry onto each for the medium and long run foundation. I imagine we are going to finish the 12 months at +4800 on the S&P 500, and I feel that in this time, the place we would produce other selloffs, it’s not a nasty time to nibble just a few shares each day.

Good luck everybody, I hope my jitters are misplaced.

[ad_2]

Source link