[ad_1]

Estimated studying time: 10 minutes

Welcome to the July 2023 Finances Replace version for the CBB household.

At present, you’ll learn how we spent $9325.49 over funds in July.

I sit up for placing this submit collectively because it lets us see the place our cash was spent.

It additionally lets my readers know that we’re NOT excellent and should make modifications like everybody else.

We use the instruments (Free funds Binder), and I hope you could have downloaded your free copy.

Alright, let’s get into this.

Dialogue July 2023 Finances

These funds updates are huge for us since we strive onerous to save lots of.

Relating to renovations and the rise in bills, it’s good to know that we’re bettering our dwelling, however that comes at a value.

I hope you benefit from the July 2023 funds replace, and please share your feedback on the finish.

Percentages For July 2023 Finances

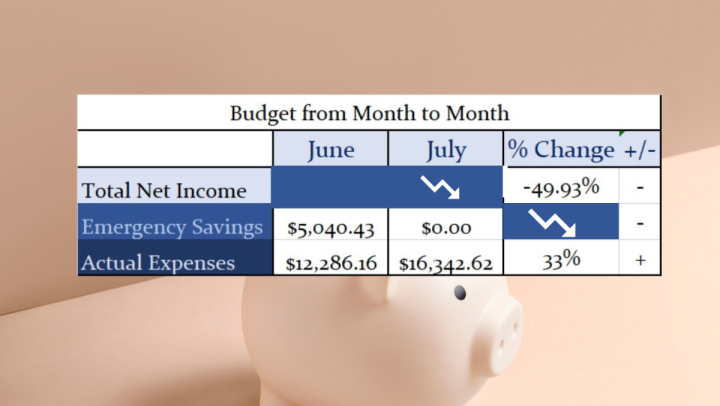

Finances Month To Month

The large drop in our web earnings seems to be terrible, but it surely’s as a result of, in June, I acquired my earnings tax return cash.

We had a 33% expense improve as a consequence of anticipated renovations and different class overages.

July 2023 Family Finances Percentages

Our financial savings of 28.51% consists of investments and financial savings based mostly on our web earnings.

The housing class is thru the roof at 103.14% as a consequence of anticipated renovations.

Equally necessary is saving cash for our projected bills due all year long.

All classes took 100% of our earnings, displaying we accounted for all of the income in July 2023.

Our Life Ratio class is greater than the projected 25% or much less at 38.77% and is one thing we are going to assessment if it turns into an issue.

Life accommodates all the things from groceries, leisure, miscellaneous, well being/magnificence, clothes, and many others.

Each housing and transportation keep beneath the month-to-month share factors.

We’ve zero debt, which helps fund different funds classes to maximise investments and financial savings.

Grocery Meals Financial savings Jar July Replace

Quickly, I will probably be writing an in depth weblog submit about why we are going to observe our grocery reductions.

Replace: Monitoring Our Grocery Reductions For One 12 months + Free Printable

I’ll tally it on the finish of the 12 months to see how a lot we saved shopping for lowered meals merchandise.

For July 2023, we saved $62.08 by buying meals that was lowered in value.

Additionally, we acquired free meals from the Flashfood app utilizing rewards factors that I don’t calculate into our grocery bills.

To this point, in 2023, buying discounted meals has saved us $721.15.

July 2023 Finances and Precise Finances

Beneath are two tables: Our July 2023 Finances and our Precise Finances.

Our July 2023 month-to-month funds represents two adults and an 8-year-old boy.

Finances Color Key: It’s a projected expense when highlighted in blue.

Since Might 2014, we’ve been mortgage-free, redirecting our cash into investments and residential enchancment tasks.

Spending lower than we earn and budgeting has been the best approach to repay our debt and get monetary savings.

Such a funds is a zero-based funds the place all the cash has a house.

Estimated July 2023 Finances

Precise July 2023 Finances

Our Canadian Banks

Breakdown Of Our July 2023 Finances

Beneath are a few of our variable bills from July, other than investments.

In July, we spent $9325.49 over our budgeted $6840.26, so let’s take a look at the place the additional money went.

July 2023 Finances Class Adjustments

We’ve two projected bills that have been added in July.

Ring Doorbell Video Plan $65/yearly.

Will increase to Prime Membership and Spotify.

Family Payments

Our typical family payments, together with fuel, hydro, water, and insurance coverage, all appear regular.

We comply with the time-of-use timeline to maintain our electrical energy and water invoice at an affordable expense.

Throughout the summer time, we maintain the home windows open all night time after which, through the night, flip the A/C on if wanted.

Typically I flip the A/C on mid-day because it’s too sizzling in the home.

Residence Upkeep/Renovations

In July, I paid the rest of the invoice for the epoxy flooring, which was almost $3000 and an enormous chunk of the particular quantity.

I’ve additionally begun remodeling the storage right into a pricey workshop, however will probably be value it.

I bought shelving for the storage from Amazon, two ceiling followers, plywood, lighting, insulation, ailings, retractable electrical cords, kind X drywall, and all of the equipment wanted for electrical, mudding, portray, and many others.

As an alternative of renting a drywall elevate, I made a decision to purchase one I’ll get good use from and promote as soon as I’m completed.

I figured it will retain its worth, and I didn’t need to rush it again to Residence Depot on their time.

We additionally paid $220 for a rubbish bin so I might toss out the previous insulation crammed with mice poo and drywall.

For weblog subscribers, I’ll have the entire images and hyperlinks to the merchandise I used so you may see what it seems to be like in my upcoming publication.

I additionally plan on writing a weblog submit concerning the transformation and prices.

It can point out prices properly for anybody who needs to do a double-garage transformation.

We may have our new driveway, home windows, sunroom, and storage door put in in August.

Will probably be a busy few weeks, however we sit up for the result and to sharing it on the weblog.

Pet Bills

Our $50 month-to-month funds is inadequate for pet bills, so we’re altering that for August.

We have to tie in different yearly charges, however we’ll know the prices this month after a visit to the vet.

Total in July, we purchased two extra toys on Prime Day for the cats, natural cat nip and dry meals, which is dear because it helps scale back allergens.

Our cats cut up three cans of fancy feast every day, and now we have three bowls of dry meals and water set across the dwelling.

We’re stocked up on moist cat meals and attempt to purchase it on Amazon after they have a sale, or we purchase 5 to save lots of 5% off the worth.

I’ve value checked the identical cat meals on the grocery retailer, and Amazon is the most affordable.

Snacks are the downfall, maybe for us, as we purchase Greenies and some different natural manufacturers month-to-month.

We try to feed our cats the perfect we are able to to maintain them wholesome.

Perhaps we’re feeding them an excessive amount of, however we will even discuss to the vet about this.

Child Bills

Bills for our son in June largely went towards shopping for clothes and back-to-school stuff.

We did purchase him new soccer sneakers and socks as he wanted them as a result of he gained’t cease rising.

Since he labored so onerous to journey his bike, I allowed ‘me’ to buy a $20 online game from Consumers Drug Mart. (that’s the way it goes, proper?) haha!

I additionally bought a case of jumbo freezies for the summer time so he might share them together with his buddies.

FlashFood App

We didn’t spend cash utilizing the FlashFood App in July however have saved $286 in 2023.

Well being and Magnificence

In July, our well being and sweetness class was over funds as Mrs. CBB ordered a brand new shampoo and conditioner.

She has an allergy to limonene, and it’s in tonnes of merchandise, notably hair.

It causes her follicles to annoy, and if she scratches, it causes a bunch of issues.

Within the mail, she additionally bought a subscription for concealer make-up each three months.

Different objects have been typical, shampoo, conditioner, deodorant, cleaning soap, and many others.

PC Optimum Factors

During the last 45 days between our PC World Elite MasterCard, Zehrs, and No Frills, we’ve earned 74,940 PC Optimum factors or $75.

That’s not too dangerous, contemplating we wouldn’t have come near incomes that in curiosity within the financial institution.

TD Visa Money Again Quantity

Our TD Visa has a cashback stability of $313.70, which we are going to proceed rising till we need to use it in the direction of our bank card invoice or redeem it.

What bank card do you utilize that gives you the perfect quantity of cashback?

Remark beneath.

Grocery Finances July 2023 Finances

We went over funds in July for groceries by $196.33, which is important to us.

Worth will increase are taking their toll on the funds regardless that we solely purchase objects on sale.

There have been many new objects we bought this month from Amazon that weren’t budgeted.

These objects included spices, quinoa, buckwheat, chickpea flour, Alpen cereal, Cheerios, coconut, and pomegranate molasses.

I’ve been engaged on testing new recipes for the weblog, together with extra Mediterranean flavours.

Beginning subsequent 12 months, I’ll create a weblog grocery funds to trace my spending.

Through the years, I’ve simply budgeted the bills in however with elevated pricing, it’s troublesome.

July 2023 CBB Internet Value Replace

Month-to-month I’ll share the distinction and p.c change in our funding portfolio.

In July 2023, we noticed a 0.47% improve in web value as a consequence of elevated investments.

That quantity equated to a $7,305.17 improve in our general wealth.

The subsequent course could also be transferring cash to higher-interest funding accounts with Manulife.

Till Subsequent Time!

That’s all for our July 2023 Month-to-month Finances, though I could change issues as I’m going alongside.

If there’s one thing you’d prefer to see in our month-to-month replace, hit reply to this e-mail and let me know.

Thanks for stopping by, and please subscribe if you’re new to CBB.

Mr. CBB

Subscribe To Canadian Finances Binder

[ad_2]

Source link