[ad_1]

baranozdemir

I feel NET Energy Inc. (NYSE:NPWR) is a $100 Billion firm valued at $3 billion, and that perception is gaining followers. It has been delivered to market by the Rice brothers, and they’re the winners the title refers to. (See beneath part: The Firm for extra element)

Within the newest e-newsletter from David Einhorns GreenLight Capital, NET Energy was described as a possible multi-bagger, with a danger better than they might usually take, however they’ve taken it. I feel Greenlight and I agree: Winners win and are at all times definitely worth the danger.

The world wants a low-cost, clear, and dependable base load power supply to switch its ageing coal and pure gas-fired electrical energy stations. NET Energy calls it the trifecta: clear, Low-cost, 24-hour. (Pipe presentation Slide 39)

NET Energy is a expertise that gives the trifecta and will be the just one at present accessible.

NET Energy had its inaugural earnings name earlier this month. Administration outlined their street map, methods, and monetary place.

Hyperlink to: Inaugural Earnings Name 2023 Within the article, I’ll confer with the earnings name as there is just one to date.

The Firm

NET Energy is a three way partnership between a few of the largest names within the Pure Gasoline and electrical energy provide trade and hopes to be the world’s largest provider of electrical energy era vegetation.

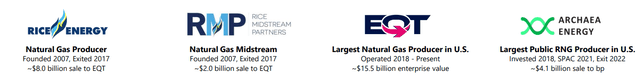

The JV consists of The Rice household, Occidental (OXY), Baker Hughes, 8 Rivers, and the unique NET Energy Firm. The Rice Household introduced the corporate to the markets through a SPAC deal. Final yr, the primary Rice SPAC Archae Power was offered to BP for $4.5 Billion. Like many different buyers, I noticed my shares go from $10 to $25 in lower than 18 months. I’m a serial investor within the Rice household, they usually have made a fabric distinction to my wealth by the 4 corporations they’ve run that I’ve invested in.

RICE household corporations (SEC Pipe presentation)

I’ve written about Archae Power 4 occasions; that is my third article on NET Energy. I’ll focus on new info that has emerged since my final report (Rice Acquisition Corp. II: A JV Aiming To Be The World’s Largest Clear Power Provider) for a extra in-depth evaluation of the character of this firm, its JV companions, and the expertise; please see the earlier article.

Multibagger potential

NPWR has some high-profile buyers; solely 7% of its inventory is held by most people, and this month, Greenlight Capital Inc joined the social gathering, saying in its Q2 fund letter

NPWR is within the early phases of its business deployment and if it does not work out, the draw back is greater than we’d normally abdomen. Nonetheless, the upside additionally seems to probably be a multi-bagger

Over the following 20 years, the US should exchange retiring baseload coal and gas-fired electrical energy stations equal to 1,300 NET Energy vegetation (Q2 Earnings name). The EPA recommends capturing or eliminating 95% of CO2 emissions from Gasoline and coal-powered stations. Presently, the expertise doesn’t exist to do that, and NET Energy seems to be the one answer with the trifecta low-cost, clear, 24-hour reliability.

The US authorities incentives from the IRA and 45Q make NET Energy decrease value than the Dominion carbon seize different and fewer than half the value of a brand new nuclear energy station. (Earnings Name CEO ready assertion)

The Technological Roadmap

NPWR goals to ship the power trifecta with its patent-protected electrical energy era system.

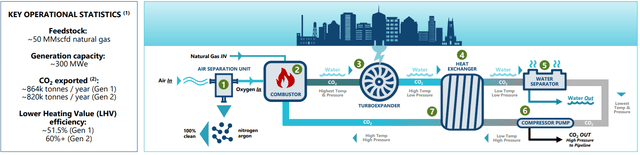

The NET Energy system (NPWR web site)

The method has zero emissions. It’s a fully closed loop. Pure Gasoline is combusted with Oxygen extracted from the air. In contrast to aggressive expertise, gasoline burning doesn’t drive the turbine. The Combustor produces CO2 in a dense state (NPWR calls it a Supercritical state) and water, which fits right into a patented turboexpander; it’s right here that electrical energy is produced. The supercritical CO2/Water is at very excessive stress and turns the turbo blades to generate electrical energy. The ultimate stage is the CO2 leaving the closed loop system, it leaves by pipe and goes straight to storage.

CO2 storage

The important level that makes this complete factor work is that 100% of the CO2 is eliminated in a extremely cost-effective method. Nothing is launched into the ambiance. Within the earnings name, the CEO repeated a declare that they consider the CO2 elimination to be the most cost effective and solely 100% system. As soon as eliminated, it has to go someplace, and within the NPWR case, it goes by pipe to storage wells. These wells are available in two variants, and the distinction between these two is an enormous situation.

(hyperlink to: info on class II and VI wells)

Class II wells: The Fast Repair

The environmental foyer detests class II wells; they name them greenwashing and consider them to be a means oil corporations faux they’re being inexperienced when, genuinely, it’s merely growing their income and the quantity of oil/Gasoline they produce.

I feel the environmental foyer and the present US administration agree. Storing CO2 in school II wells attracts a considerably decrease authorities incentive than storing in school VI wells.

A category II effectively is used to boost oil or gasoline manufacturing. Numerous liquids, together with CO2, could be pumped right into a effectively to brush hydrocarbons in a reservoir towards a producing effectively. The CO2 successfully pushes the oil from underground to the floor and replaces it; these wells are used for storing the US strategic oil reserve and different liquids for later use.

Class II wells don’t want any permits, making them a fast and simple answer. Therefore, the positioning choice for SN1 is an oil-producing space, so class II wells can be found instantly.

Class VI wells

These are a lot deeper, finest considered, and described as a CO2 tomb. Class VI wells are single-purpose; they’re drilled solely to take CO2 effectively beneath the earth’s floor, the place it’s entombed ceaselessly.

Extra beneficiant subsidies can be found for these wells; the CEO has stated he thinks future CAPEX of an NPWR set up could be funded completely from Class VI CO2 incentives. (earnings name Q&A)

Class VI wells want permits as a result of you need to drill the effectively; within the case of Class II wells, they’ve already been dug. North Dakota and Wyoming have primacy over granting class VI permits, however the EPA has primacy for different states. Making use of for these permits might take months on the state stage and presumably years on the EPA stage. The CEO implied within the Q&A session that in the event that they needed to go for sophistication VI wells to enter service earlier than 2028, he can be very involved; nonetheless, class II wells are available on this timeframe.

The US has a few of the largest CO2 storage potential on the earth, sufficient for 300,000 NET Energy websites (earnings name). The IRA 45Q supplies $85-$160 per ton of CO2 sequestered and completely saved in a category VI effectively.

NET Energy Commercialization

The earnings name laid out the commercialization plan (CEO ready remarks)

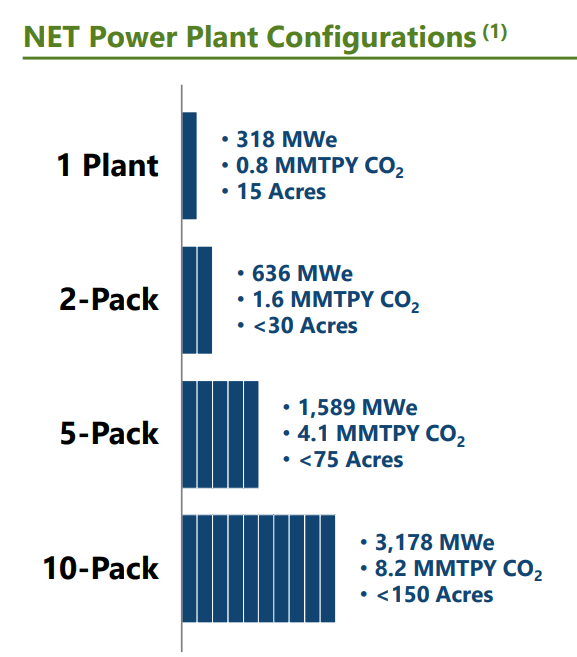

Constructing the primary utility-scale website, “serial number one” (SN1), a 300MW plant. Design and take a look at the mission-critical utility-scale expertise. Construct the pipeline of future websites. Plan the right way to manufacture the expertise at scale.

I’ve been writing in regards to the Rice brothers for a while and have discovered them meticulous planners; nothing is left to likelihood. They comply with a concrete plan and by no means deviate from the important thing targets. If you’re new to their operations, you may wish to learn Archae Power Grade A for execution. They plan, plan some extra, after which under-promise and over-deliver repeatedly.

Constructing SN1

The primary utility-scale 300MW plant can be constructed on the Occidental (OXY owns 50.5% of NET Energy) website close to Midland Odessa, Texas. It will likely be the primary and solely website that NPWR and its companions constructed and personal. Its success can be essential to the way forward for the enterprise. SN1 is now being referred to as Venture Permian; its efficiency will resolve the destiny of NPWR.

The chosen website has the three crucial wants for a profitable NET Energy set up: accessible Pure Gasoline, electrical energy demand, and accessible CO2 storage.

Zachry group has been chosen to construct and develop the positioning and is progressing by the FEED (Entrance-end engineering and design) stage. Zachary will finalize Venture Permian and the premise of the long run design and planning for NET Energy websites. Zachry was appointed not too long ago as the primary licensed FEED and EPC provider (Engineering, Procurement and Development)

The appliance to hyperlink SN1 to the electrical energy grid was submitted final quarter; suggestions is anticipated from the state within the subsequent month or two. They’re nonetheless three years forward of after they want to join, so this ought to be high-quality. An utility for grant help submitted to the US Division of Power might convey as much as $270 million.

Permian is a first-generation (GU1) website anticipated to ship an effectivity of 51%. It is going to take 3,800 tons of Oxygen every day and blend it with 45 million cubic toes of Pure Gasoline. Oxygen is from the air, and different components of air, together with Nitrogen and Argon, are launched again into the ambiance earlier than combustion. Because of this, the system has no NOX, SOX, or particulate matter air pollution shaped or launched.

The SN1 design takes up 3 times as a lot house because the La Porte demonstration website however will produce greater than ten occasions as a lot electrical energy due primarily to the power density of the supercritical CO2 fluid.

The Permian website is because of be on-line in 2026. It will likely be a crucial second for this firm.

Prices and Money

NPWR and its companions will construct the Permian Venture and must finance it. SN1 might value $900 million to construct; if NPWR goes to fund all of it themselves, they don’t have sufficient money. (Q and A session) The CEO spoke of constructing a consortium to seek out the CAPEX wanted and that NET Energy would make a considerable anchor funding.

They’re negotiating long-term provide agreements for pure Gasoline and long-term off-take contracts for the power water and CO2 created. These negotiations won’t conclude till 2024, and the ultimate funding resolution for the positioning can be taken at that time.

The funding resolution can be essential for shareholders as it’s going to probably be the one supply of future dilution.

The SN1 would be the most costly website they’ve ever constructed however it’s important for the long run advertising and technical improvement of the expertise.

Design and testing

Earlier than the SPAC merger, the corporate constructed its La Porte, Texas, demonstration website. That website has run a number of checks and related to the first electrical energy grid in 2022. Since my final article, it has been retrofitted to permit Baker Hughes (proprietor of 11% of NET Energy shares) to check utility-scale variations of the important thing expertise.

Baker Hughes has the unique license to construct the Combustor, Turboexpander, compressor, and different turbomachinery. These are the crucial technological gadgets within the course of, and the Cope with Baker Hughes includes joint commercialization, manufacturing, and advertising—a JV fairly than a provide chain.

As NPWR strikes in direction of constructing SN1, Baker Hughes will develop and take a look at the crucial utility scale components together with the unique inventor of the tech 8 Rivers. We are going to hopefully get common updates on how that is going.

Constructing the Pipeline of Initiatives

Archae Power grew in a short time as a result of cautious design of the advertising plan; they went to potential prospects with a whole answer, not the provide of trying into issues.

Within the NPWR earnings name, the CEO talked about that they had spent the final seven months synthesizing the expertise and long-term imaginative and prescient of the chance. He talked of three pillars. They have been bettering the tech, constructing the venture backlog, and shifting to a producing mode.

NPWR is pre-screening potential prospects and doing all of the preliminary work earlier than approaching them. They’re on the lookout for prospects with the potential to purchase 20- 30 items; a statewide operator is the kind of buyer they’re focusing on.

To achieve success, an NPWR facility wants the supply of Pure Gasoline and a strategy to get the CO2 to storage plus electrical energy demand. The spark unfold (the unfold between gasoline and electrical energy costs) governs the positioning’s profitability.

When NPWR approaches a utility-scale electrical energy supplier, they go armed with a whole answer. The spark unfold, the place the Pure Gasoline comes from, the CO2 storage choices, and the place the related pipelines must go. It considerably reduces the planning part of the decision-making course of.

Manufacturing at quantity.

Straight out of the Rice playbook, At Archae Power, they designed and manufactured a modular sled that might exchange the one-off designs the trade used to seize Methane from waste disposal websites. They produced the sled within the manufacturing unit and delivered it straight to the positioning. It decreased prices a lot that beforehand uneconomic services for Gasoline assortment grew to become viable.

NPWR plans to fabricate the identical means, with no extra one-off designs for every website. Customary-size elements are made in a manufacturing unit and match collectively modularly. Manufacturing will happen in a manufacturing unit setting with far much less carried out on-site. Baker Hughes and Zachary are the primary corporations concerned however anticipate extra.

Slide 33 of the analyst day presentation mentioned the advantages of this modular development. Quoting decreased prices, sooner supply occasions, extra accessible permits, and regulatory controls.

NPWR Modular system (NPWR web site)

The Pipeline

Serial Quantity 2 (SN2) has not been introduced. Within the earnings name Q&A, they stated they have been engaged on early-stage planning however didn’t wish to share it. It’s more likely to be a part of the strategic plan; they stated they’ve a number of initiatives that wish to be a part of the plan, however the first dozen websites would be the ones most essential to the corporate, and they’ll select fastidiously the place to develop initially. They implied the second plant can be a part of a state-wide venture, a grasp plan, and a mannequin for different massive operators.

We establish the place we wish to put the primary plant and we actually have all of it mapped out with the place the following 20 vegetation or 30 vegetation are going to go from there.

And so, if I needed to wave my magic wand and pick the perfect situation, serial quantity two goes to be a plant the place now we have a pathway to delivering 20 vegetation to 30 vegetation in that given space the place the consortium of strategic stakeholders is.

(CEO Earnings name)

Funds

April twenty fourth OXY dedicated a further $250 million to the NPWR pipe whereas the Rice household dedicated a further $25 million. That amounted to a complete of $510 million.

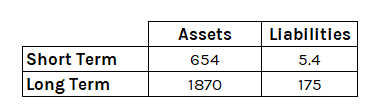

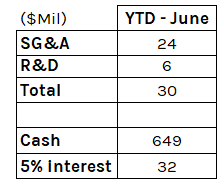

NPWR has a flawless stability sheet with no debt, and the money raised within the SPAC remains to be on the stability sheet. (figures beneath in US$ tens of millions)

NPWR Stability Sheet abstract (Writer Database)

It’s tough to get exact value and working figures from this primary set of accounts; the SPAC merger and related prices have an effect on virtually each line of the accounts. Nonetheless, the next is insightful.

Money out and in (Writer Mannequin)

The figures are all fairly rounded, however in the meanwhile, the money burn is matched by the curiosity on the money pile. It is going to solely be within the quick time period however speaks to the present energy of the stability sheet.

Conclusion

The Rice household are confirmed winners within the Pure Gasoline trade. NET Energy is their fourth enterprise on this trade, they usually have introduced collectively some large names to make it occur. Their plans have attracted the eye of high-profile buyers, and the shares are accumulating in worth.

The market they’re addressing is big. I stated in my final article that they’ve put collectively a Three way partnership aiming to be the world’s largest power firm. The newest earnings name gave details about how they may get there and what a few of the timelines and constraints is perhaps.

NPWR has the trifecta,

Low Price

100% Clear zero Emission

24 Hour Dependable base load electrical energy manufacturing.

Lastly, the valuation and the draw back dangers are clear; it might go to zero if the utility-scale tech doesn’t ship.

NPWR will use a licensing mannequin for its websites; slide 25 of the PIPE presentation outlines the charges they anticipate to cost. $10 million per yr for the primary three years, then $5 million per yr for the set up’s life.

They anticipate to promote greater than 1,000 websites to the US utility suppliers, representing $30,000,000,000 of their first three years and $5,000,000,000 per yr after that (that is $30 billion and $5 billion per yr). That is just one small a part of the potential market; they’ve a world alternative with electrical energy suppliers, and that’s earlier than they flip to the smaller knowledge heart/company market. Not till we get the information from the SN1 website can we start to measure the scale of the chance, however it’s huge.

I’ve written about NPWR twice already and have a place from final yr taken at $10.01 and one from earlier this yr at $12.54, and I’ve transferred my shares to my never-sell long-term household fund.

[ad_2]

Source link