[ad_1]

DollarBreak is reader-supported, while you join by way of hyperlinks on this publish, we could obtain compensation. Disclosure.

The content material is for informational functions solely. Conduct your personal analysis and search recommendation of a licensed monetary advisor. Phrases.

11 Locations to Get Free Checking Account

Chime

Chime is a Fintech firm that gives a variety of banking providers akin to saving accounts and secured bank cards.

It additionally gives a free checking account with the next options;

Doesn’t appeal to month-to-month charges

No minimal opening stability

No account upkeep payment

Entry to a big ATM community of over 40,000 machines

The account allows you to make deposits and obtain funds inside two days with no additional cost.

If you obtain a direct deposit of $500 and above, you may be part of the non-compulsory Spot Me service that gives an overdraft of as much as $20 in your debit card for purchases with out paying a payment.

Chime can even enhance your restrict as much as $200, relying in your account historical past.

Ally Financial institution

Ally Financial institution Abstract

$0 adivsory charges on funding portfolios0.5% annual share yield for savingsNo withdrawal charges at over 55,000 ATMs24/7 buyer assist additionally accessible

Ally Financial institution gives a free and interest-free checking account for its purchasers with out a gap stability; nevertheless, it’s essential to fund your account inside thirty days for it to stay lively.

After the preliminary funding, you’ll not pay any charges, and you’ll obtain your checks and entry as much as 43000 ATMs throughout the nation.

It’s also possible to get refunds of as much as $10 after incurring different ATM charges.

Different advantages of Ally Checking account

You may take pleasure in a 0.10% APR or Annual Proportion Yield in case your account has a minimal every day stability under $15000 and 0.25% APR in case your account has over $15000 minimal every day stability.

This account has no upkeep charges; nevertheless, you’ll be charged a $25 payment in case your account has a damaging stability.

You’ll not pay to obtain common checks in your mailbox inside 7 to 10 days; however, for fast service of two days, and also you’ll be charged $15 per test.

Capital One

Capital One gives a free checking account, nevertheless, it’s essential to deposit funds inside sixty days of opening the account for it to stay lively.

There’s no minimal stability required to open this account, and you’ll entry over 70000 ATMs throughout the nation with out paying any payment.

One main advantage of this account is the 0.1% APY and nil month-to-month upkeep prices alongside zero ACH switch charges.

One other key function of this account is the auto decline operate that ensures you don’t overdraw your account. Nonetheless, in case you overdraw, the Subsequent Day Grace function will cushion you towards paying the $35 overdraft cost.

This implies you could overdraw your account and in case you reimburse the funds earlier than the top of the day, you’ll not pay a $35 payment.

Different further options you’ll discover on this account embrace;

Free switch from financial savings accounts

Free checks

Actual-time notifications of your account exercise

Connection to Zelle on-line answer.

Hills Financial institution

Hills Financial institution gives a free checking account with no minimal stability, month-to-month charges, or preliminary deposit. You’ll get a free debit card, entry to on-line banking, and limitless free ATM transactions while you open this account.

It’s also possible to entry the account by way of your desktop and cellular app in your android or iOS units.

Bank5 Join

Bank5 Join checking account comes with no opening or month-to-month upkeep payment; nevertheless, you want a minimal deposit of at the least $10 to open an account.

After opening an account, you don’t want to take care of a minimal stability to be lively and it’s also possible to take pleasure in different providers, akin to invoice settlement with no additional payment.

The one charges you may pay with this account are;

ActivityFeeOverdraft payment$15Returned merchandise payment$15Cashed test returned payment$15Stop fee charges$15

As well as, the account has no every day deposit restrict; nevertheless, the funds could take longer to entry in case you deposit greater than $5000 in a single day.

Different options embrace ATM payment reimbursements and invoice pay providers.

Uncover Financial institution

When you’d like an account to obtain your deposits or fee, you may think about Uncover Financial institution’s free checking account, with no month-to-month or upkeep charges.

When you open your account, it’s essential to deposit funds inside 44 days for it to be lively.

Uncover Financial institution free checking account has a number of different handy options akin to;

Zero minimal stability requirement for one year,

free ATM withdrawals,

Zelle connection inside 90 days of opening the account

Zero ACH switch charges.

Free wire transfers

$30 for outgoing wire transfers

Free common checks and overdrafts.

Aliant Credit score Union

Alliant Credit score Union private checking account comes with a pack of helpful options, together with no account opening payment, no month-to-month upkeep payment, and free ATM withdrawals.

As well as, you’ll not pay overdraft charges; nevertheless, another prices like a cease fee payment of $25 could apply.

A $20 ATM rebate payment is a wonderful function in case you journey typically and use overseas ATMs.

Alliant Credit score Union checking account prices

Account FeatureChargeReturn deposit payment$15Paper assertion prices$1Manual paid checks and ACH merchandise cost$5Collections payment$29Verbal cease funds$25Non-sufficient funds objects$25Inactivity and dormant activation payment$10Account closure$10ATM rebate fee20

Varo Financial institution Free Checking Account

A Varo Financial institution checking account is a digital product you could solely entry on-line to obtain funds akin to wage remittances.

If you open this account, you’ll not pay a minimal deposit or a month-to-month upkeep payment.

There’s no minimal stability to function this account, and there’s no curiosity as nicely. The account doesn’t cost overdraft charges because it declines unfavorable transactions that may event an overdraft.

There are just a few drawbacks of working this account, as an illustration;

It doesn’t assist Zelle on-line banking

There are limitations on ACH transfers to lower than $5000 per transaction and $10000 per thirty days.

Checks and wire transfers aren’t accessible on this account.

You may withdraw your cash at over 55,000 ATMs with out paying any payment. Nonetheless, you could be charged $2.50 while you draw money from an out-of-network ATM.

FNBO Direct

You may open an FNBO Direct on-line checking account with out paying prices or a minimal deposit. As well as, there’s no minimal stability requirement, and also you’ll not pay an account upkeep payment to maintain this account lively.

You’ll not pay any ATM charges; nevertheless, there’s a every day cap of ATM transactions worth of $1000.

With this account, you” take pleasure in an APY of 0.15%, and there aren’t any ACH switch prices or incoming wire transfers, however you’ll pay $15 for outbound wire transfers.

Though the Zelle function is just not accessible, you will get person-to-person funds underneath PopMoney, a simple and safe on-line fee answer.

There’s an overdraft payment of $33 and you’ll solely have 4 overdrafts per day. Lastly, one disadvantage is that there aren’t any checks accessible underneath this account.

Schwab Financial institution

Schwab Financial institution’s free checking account gives free withdrawals and is right in case you don’t make deposits typically. The account gives limitless payment rebates at over 40,000 ATMs globally.

There aren’t any month-to-month charges or minimal stability necessities to function this account, and also you’ll take pleasure in free overdraft transfers from linked accounts.

You’ll not pay any month-to-month service payment on this account no matter your account stability, and you’ll take pleasure in a Schwab One brokerage account with out having a minimal stability. Additionally, on-line transfers between these two accounts are free.

Among the major account options you’ll discover on this account embrace;

Entry to account data

Cell deposits allowed

Invoice funds

Free incoming fund transfers

No overdraft switch charges

Free cease funds

It’s also possible to activate transaction alerts to get real-time notifications in your account exercise.

On the draw back, you’ll pay $25 per outgoing wire switch and $10 per cashier cheque.

G2bank

G2bank gives a free checking account with no month-to-month charges, hidden charges, and minimal stability.

There aren’t any overdraft charges on this account and also you’ll not pay a single cent to withdraw your funds from over 42000 ATMs; nevertheless, overseas ATMs will cost you 3% charges.

With the cellular app, you may handle your funds simply, together with paying your utility payments and cash transfers.

Establishing an account is quick on the web site or by downloading the G2bank to your cellular gadget. Listed below are the necessities:

You’ll want your identification paperwork akin to Authorities ID and SSN

Proof of tackle

After approval, you’ll obtain your Grasp debit card inside seven days, and you’ll deposit cash to activate and use it.

Free Checking Account FAQ

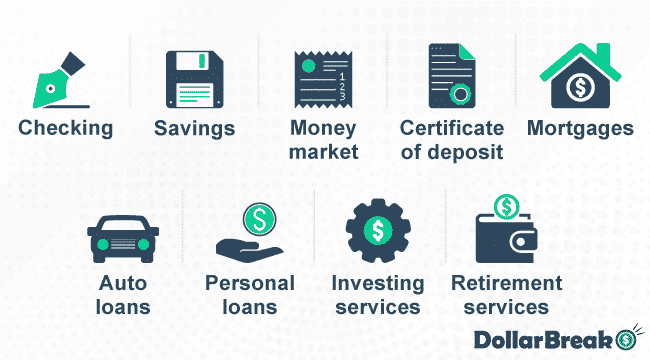

What’s a checking account?

A checking account is an account operated by monetary establishments. It permits customers to obtain deposits, funds, or salaries and make withdrawals. Due to this fact, you may entry your cash simply for every day use utilizing a checking account.

What are the necessities to open a checking account?

Very often, each financial institution has its personal guidelines and necessities to open and function an account. Nonetheless, some normal guidelines reduce throughout the trade, like having legitimate identification paperwork akin to SSN, driver’s licenses, authorities ID, and passport. Additionally, it’s essential to present your bodily tackle and a utility invoice.

[ad_2]

Source link