[ad_1]

Folks typically level the finger at credit score inquiries as the reason for their low credit, however is that this blame justified? Is it actually true that inquiries can kill your credit score rating? Preserve studying to search out out the distinction between onerous inquiries and delicate inquiries and study the reality about how inquiries can have an effect on your credit score rating.

Credit score Inquiries Definition

A credit score inquiry, additionally generally known as a credit score test or a credit score pull, is a request by a enterprise to test your credit score report.

There are two various kinds of credit score inquiries: a tough inquiry (also referred to as a “onerous pull”) and a delicate inquiry (also referred to as a “delicate pull”).

The kind of inquiry will depend on the rationale for the credit score pull and the enterprise conducting it.

Credit score Countdown Video: What Are the Sorts of Credit score Inquiries & Why Do They Matter?

Watch this Credit score Countdown video with John Ulzheimer for a short introduction to the sorts of credit score inquiries, then maintain studying beneath for an in-depth evaluation of the subject of inquiries.

What Is a Exhausting Inquiry?

A tough inquiry is when a creditor who’s contemplating issuing you credit score pulls your credit score report from one of many credit score bureaus.

A tough inquiry happens when a enterprise that’s contemplating issuing you credit score will get your credit score report from one of many bureaus.

Exhausting inquiries sometimes happen if you find yourself making use of for loans, together with mortgages or auto loans, in addition to bank cards.

How Many Factors Does a Exhausting Inquiry Have an effect on a Credit score Rating?

Since a tough credit score inquiry in your credit score report means you might be actively searching for to get new credit score, that is seen as dangerous habits by lenders. In response to FICO, folks with six or extra inquiries on their credit score information are eight occasions extra prone to declare chapter than individuals who would not have any inquiries on their credit score stories.

For that reason, every inquiry could decrease your credit score rating by as much as 5 factors.

The particular variety of factors an inquiry prices you will depend on different elements in your particular person credit score profile, such because the size of time that has handed since your final inquiry. For those who would not have every other inquiries in your credit score report, a tough pull probably gained’t have an effect on your rating very a lot.

Relying on what else is in your credit score profile, it might not even decrease your rating in any respect.

As well as, it’s vital to understand that onerous credit score inquiries are handled in a different way relying on which credit score scoring mannequin is getting used, significantly on the subject of how they cope with charge purchasing.

Procuring Round for Credit score

For mortgages, auto loans, and pupil loans, inquiries of the identical kind are grouped collectively inside a sure time interval.

When shoppers wish to get sure sorts of loans, akin to mortgages, pupil loans, and automobile loans, they typically apply for loans from a number of lenders to allow them to examine rates of interest and get the most effective deal.

The credit score scoring fashions have integrated numerous methods to account for this because it wouldn’t make sense to punish shoppers for being savvy customers.

With older FICO scores, shoppers have a 14-day window through which they’ll apply for a number of loans of the identical kind (e.g. auto loans) and have all of the inquiries grouped collectively to rely as just one inquiry.

With newer FICO scores, the time window has been prolonged to 45 days. Nevertheless, inquiry grouping solely counts for pupil loans, auto loans, and mortgages. With bank cards, every inquiry is counted individually no matter while you utilized for the playing cards.

FICO additionally features a 30-day “buffer” for onerous inquiries, that means that when your rating is calculated, it doesn’t think about any inquiries that had been made inside the final 30 days.

VantageScore works a bit in a different way: it teams collectively any inquiries that happen inside a 14-day time interval for all account sorts, even bank cards.

When Do Exhausting Inquiries Fall Off a Credit score Report?

Exhausting inquiries are mechanically eliminated out of your credit score report two years after the date of the inquiry.

How Lengthy Do Exhausting Inquiries Have an effect on a Credit score Rating?

Whereas it takes two years for onerous credit score inquiries to fall off your credit score report, they solely impression your credit score rating for the primary 12 months.

What Is a Comfortable Inquiry (Additionally Generally known as a Comfortable Credit score Test)?

A landlord could do a delicate credit score test when evaluating your rental software.

A delicate inquiry, also referred to as a delicate pull or delicate credit score test, can occur for a wide range of completely different causes.

In contrast to onerous inquiries, that are performed by companies which are contemplating providing you new credit score for the primary time, delicate pulls are utilized by entities which are interested by your credit score report for different functions.

This might embody potential employers, landlords pulling your credit score as a part of a background test, utility suppliers, or insurance coverage suppliers, for instance.

Whenever you test your individual credit score report, that is additionally thought of a delicate inquiry.

Comfortable credit score checks may additionally be utilized by companies you have already got accounts with, akin to your bank card issuers, who routinely test your profile to ensure you are nonetheless a creditworthy client.

How Do Credit score Inquiries Have an effect on Your Credit score Rating?

Comfortable Inquiries

Comfortable inquiries don’t have an effect on your credit score rating. It’s because delicate pulls are sometimes not used if you find yourself actively searching for new credit score, so they don’t essentially point out dangerous monetary habits. Due to this fact, they don’t seem to be factored into your credit score scores, that are designed to estimate danger.

Since checking your individual credit score report is classed as a delicate credit score test, you do not want to fret that checking your individual credit score report will have an effect on your rating. It’s a widespread credit score delusion that checking your credit score will make your rating go down. You may really test your individual credit score report as many occasions as you want with out it affecting your rating.

The truth is, you possibly can even conduct a free delicate inquiry by yourself credit score report utilizing free academic web sites like creditkarma.com.

Exhausting Inquiries

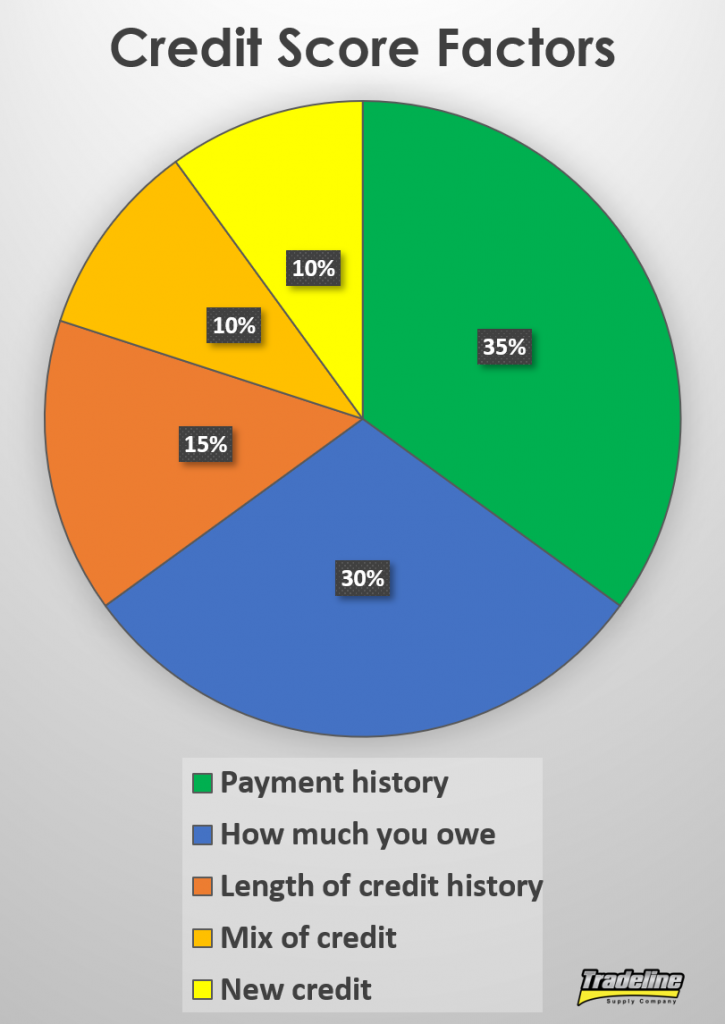

New credit score makes up 10% of a FICO rating.

Relating to onerous pulls, though folks are inclined to fixate on the impression of those onerous credit score inquiries, the reality is that they’re a comparatively minor participant in your credit score rating.

The “New Credit score” Class Contains Extra Than Simply Inquiries

Of the elements that go into your credit score rating, the class that features inquiries, “new credit score,” is the smallest one, making up about 10% of your rating.

Inside that small class of latest credit score, in keeping with FICO, there are a number of completely different information factors which are considered. These information factors embody:

The variety of new accounts

The proportion of latest accounts vs. seasoned accounts for every kind of account

The variety of latest credit score inquiries

The period of time that has handed since latest account opening(s) for every kind of account

The period of time that has handed since your latest credit score inquiries

As you possibly can see, there are a number of variables on this class that may have an effect on your credit score rating past simply the variety of inquiries in your credit score report.

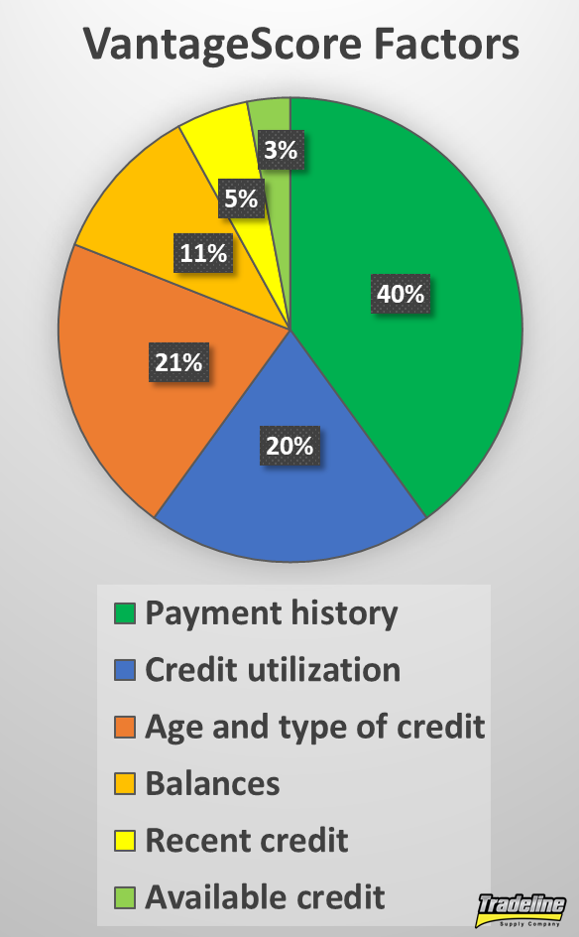

How Does VantageScore Take into account Credit score Inquiries?

With VantageScore, the “latest credit score” class solely accounts for about 5% of your credit score rating, which is an excellent smaller proportion than FICO’s 10%. Assuming there are a number of variables inside this class in addition to the variety of latest inquiries, we are able to conclude that inquiries probably make up a really small share of your VantageScore.

VantageScore has confirmed this to be true on their web site, which reads:

“Within the VantageScore credit score scoring system, credit score inquiries are thought of to be much less influential than different credit score behaviors, akin to fee historical past. And even though inquiries can stay in your credit score report so long as two years, a credit score rating that’s lowered by a tough inquiry usually will improve again to its pre-inquiry stage in only a few months – offered no new unfavourable info is added to your credit score information.”

The Impression on Your Credit score Rating Impression Relies on the Timing and Variety of Inquiries

Latest credit score makes up 5% of a VantageScore.

Since inquiries are only one variable inside one small piece of the credit score rating pie, they don’t weigh closely on one’s credit score rating. Due to this fact, as we talked about above, every onerous inquiry ought to solely value you a most of 5 factors, and if they’re carried out inside a brief time period they typically are solely counted as one inquiry.

Inquiries sometimes solely trigger issues to your credit score if you happen to present a sample of latest onerous inquiries repeatedly over an extended span of time, which makes you appear extra dangerous to potential lenders.

This is smart as a result of you probably have your credit score pulled a number of occasions over an prolonged time period, this might point out that you’re making use of for credit score and being denied or opening numerous new accounts and going into debt.

As talked about above, this isn’t the case so long as the inquiries are carried out in a brief time period. That’s assumed to be the rate-shopping interval.

Inquiries Matter Most in Borderline Instances

Within the case of somebody having steady onerous pulls over an prolonged time period, a number of factors misplaced per inquiry can add up if there are numerous them. In case you have 10 inquiries in your credit score report over an prolonged time period and the typical lower in rating per inquiry is 3 factors, that’s a complete lack of 30 factors! In case you are close to the decrease fringe of the “good credit score” vary, this 30-point dip might take you right into a decrease credit score rating stage.

This may be an instance of a extra excessive scenario, but when this particular person had been within the “low credit” class after the hit from these inquiries, the inquiries could have helped to tip the size on the credit score rating class, however they don’t seem to be the unique explanation for being on the cusp of low credit to start with.

Video: Do All Inquiries on Your Credit score Studies Decrease Your Scores?

Can You Nonetheless Get a Mortgage if You Have Inquiries on Your Credit score Report?

Some folks consider that you just can not get a mortgage you probably have latest inquiries in your credit score report. Nevertheless, inquiries themselves are sometimes not an automated disqualifier, though you’ll have to offer a number of sentences to elucidate every inquiry.

In case you have sufficient inquiries in your credit score report to decrease your credit score rating, although, this might have an effect on the phrases of your mortgage. Even a small distinction within the rate of interest of a house mortgage can value you tens of 1000’s of {dollars} over the lifetime of the mortgage.

If you wish to get the most effective charge doable, it’s most secure to attempt to keep away from getting any new inquiries or opening new credit score accounts across the time that you’re planning to use for a mortgage.

Can You Take away Inquiries From Your Credit score Report?

Folks with numerous inquiries on their credit score stories typically need to know the right way to take away inquiries from a credit score report quick. Nevertheless, as with all credit score restore course of, there isn’t any silver bullet that can immediately increase your credit score rating. It takes time, work, and persistence if you wish to see your credit score rating go up.

It’s additionally vital to notice that there isn’t any official method to take away well timed and correct inquiries out of your credit score report. For those who actually did get a tough inquiry, it could be fraudulent to lie and declare that the inquiry shouldn’t be right and needs to be eliminated.

In response to the Federal Commerce Fee, “Nobody can legally take away correct and well timed unfavourable info from a credit score report.”

The identical guidelines apply if you find yourself working with a credit score restore firm. The FTC says, “The primary rule of credit score restore is that no credit score restore firm can take away correct and well timed unfavourable info from somebody’s credit score report.”

In case you have inaccurate inquiries proven in your credit score report because of id theft or a reporting error, nonetheless, you possibly can and may look into the right way to delete onerous inquiries so you may get the credit score inquiries eliminated.

How one can Take away Inquiries From a Credit score Report

Exhausting inquiry elimination could seem intimidating, however eradicating credit score inquiries out of your credit score report is definitely doable and shouldn’t be a difficulty if they’re inaccurate or fraudulent.

In case you are interested by the right way to delete credit score inquiries, one of the best ways to go about it’s to put in writing a credit score inquiry elimination letter. Write a letter to the credit score bureau(s) that explains the errors and supply no matter proof you’ll have that you just didn’t authorize the onerous pull in your credit score report. The FTC offers a pattern credit score inquiry letter that you should utilize as a template.

It’s additionally useful to connect a duplicate of your credit score report that you’ve annotated to point which inquiries are inaccurate.

As soon as the credit score bureau receives your credit score inquiries letter, they’ve 30 days to analyze the dispute and reply. If the creditor can not show that you just licensed the onerous pulls in your account, the bureau will delete the inquiries out of your credit score report, and the credit score inquiry elimination course of can be full.

You’ll find out extra about the right way to delete inquiries out of your credit score report in “How one can Repair the Most Frequent Credit score Report Errors.”

Conclusion on Credit score Inquiries

We frequently hear folks blaming their low credit on the truth that they’ve too many inquiries on their credit score report. Nevertheless, it’s a delusion that inquiries alone may cause low credit.

In actuality, the reason for low credit is often a mixture of missed funds, defaults on loans, and/or excessive credit score utilization. These elements are all rather more vital than having too many inquiries.

We’re conscious that on many credit score monitoring platforms, the system could point out that the particular person has too many inquiries. Maybe that is one explanation for the parable that inquiries are the reason for low credit.

Nevertheless, as we illustrated on this article, inquiries are just one information level amongst a number of different information factors inside the class generally known as “new credit score,” which accounts for round 5%-10% of somebody’s general credit score rating.

This doesn’t imply that inquiries alone rely for 10% of your credit score rating. It implies that inquiries are certainly one of a number of information factors that, mixed, account for round 10% of a credit score rating. Due to this fact, it’s honest to imagine that the variety of inquiries you may have, actually, accounts for lower than 10% of a credit score rating.

It could be doable for inquiries to have a big impact on one’s credit score rating in excessive instances, akin to somebody having a number of onerous inquiries pulled repeatedly over the course of a 12 months. Nevertheless, in additional typical eventualities, inquiries almost certainly should not the reason for somebody having low credit.

[ad_2]

Source link