[ad_1]

Dilok Klaisataporn/iStock through Getty Pictures

Once I wrote “Wild Playing cards for September” over the weekend, 9 or 10 days in the past – I write these commentaries over the weekend, whereas most of you learn them on Tuesdays – I didn’t anticipate that one in all them would instantly start to maneuver world markets.

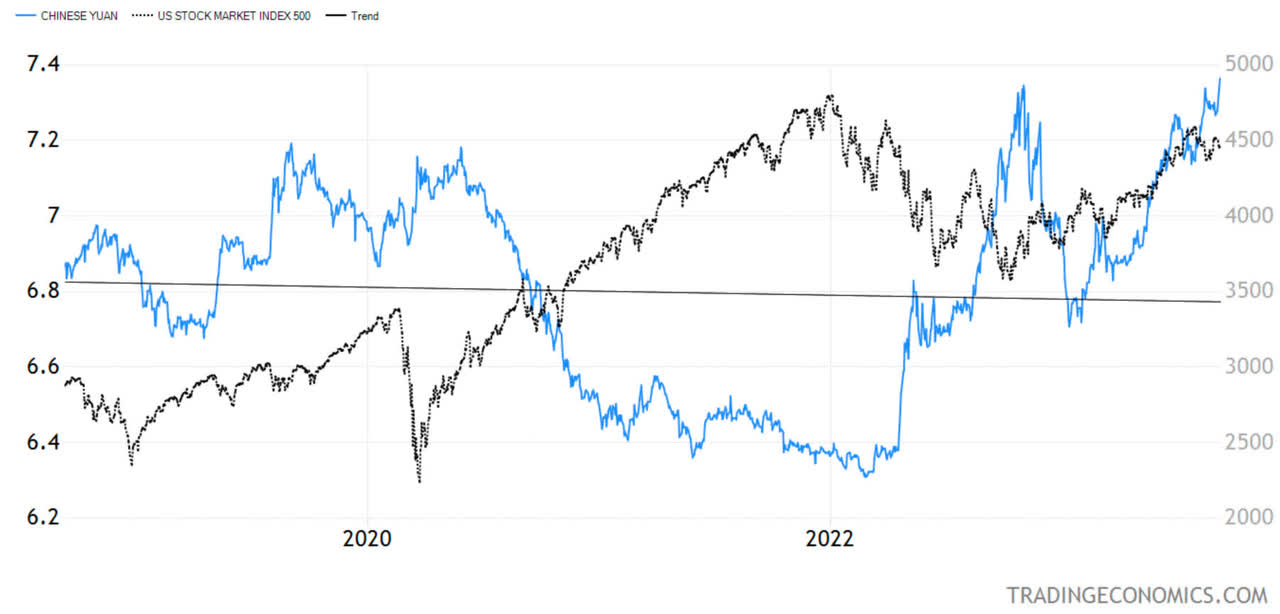

As of final Friday, the Chinese language yuan depreciated to a 15-year low towards the greenback, to shut final week at 7.3640 ($0.1358) on the USDCNY trade fee.

Because it was sliding all through the week, with U.S. Treasury yields on the agency facet, so did U.S. shares.

Graphs are for illustrative and dialogue functions solely. Please learn vital disclosures on the finish of this commentary.

As this chart exhibits, the U.S. inventory market usually has a detrimental correlation with the yuan, albeit not an ideal one. Nonetheless, the sharper the depreciation of the yuan, the extra stress there’s on U.S. shares costs. If the yuan retains sliding this week, I anticipate to see additional weak point in inventory markets, globally.

Former Chinese language Premier Li Keqiang used to say, “We’d by no means use the foreign money” in a bid to assist the Chinese language economic system. Nicely, he’s now not the premier, they usually are utilizing it, since it’s a managed foreign money and China does have $3.16 trillion in foreign exchange reserves to help the yuan, if it needed to.

Practically 30 years in the past, it was the huge 33% devaluation of the Chinese language yuan in January 1994 that in the end sowed the seeds of the Asian Monetary Disaster in 1997. In that respect, it got here at a really excessive price to the area and the world. May the identical form of occasion occur once more?

World markets nonetheless keep in mind 1997 properly, they usually received’t like seeing any sharp yuan devaluation, which is why the Individuals’s Financial institution of China (PBOC) is devaluing it slowly in the meanwhile.

On this case, the problem is the big Chinese language economic system, as there are issues in the actual property market, in addition to with the fee of purchasers of any fixed-income wealth administration merchandise tied to mortgages.

I’m not positive if these indicators are actual proof of an onset of a Chinese language laborious touchdown, because the Chinese language authorities has managed to delay a recession for 30 years with its intelligent grip on the economic system and the monetary system with its notorious lending quotas, which don’t exist anyplace else on the earth.

No matter it’s, it’s a scenario value our consideration, as a weaker yuan could imply weaker U.S. inventory costs, notably if devaluation occurs quick.

The EU Pure Fuel Saga is Not Over

I spoke at size with a former power minister of a small EU nation embroiled in Europe’s pure gasoline pipeline points. Because the man is actively concerned in politics, I received’t point out his title, however I can share what he mentioned, which he believes is widespread data within the EU.

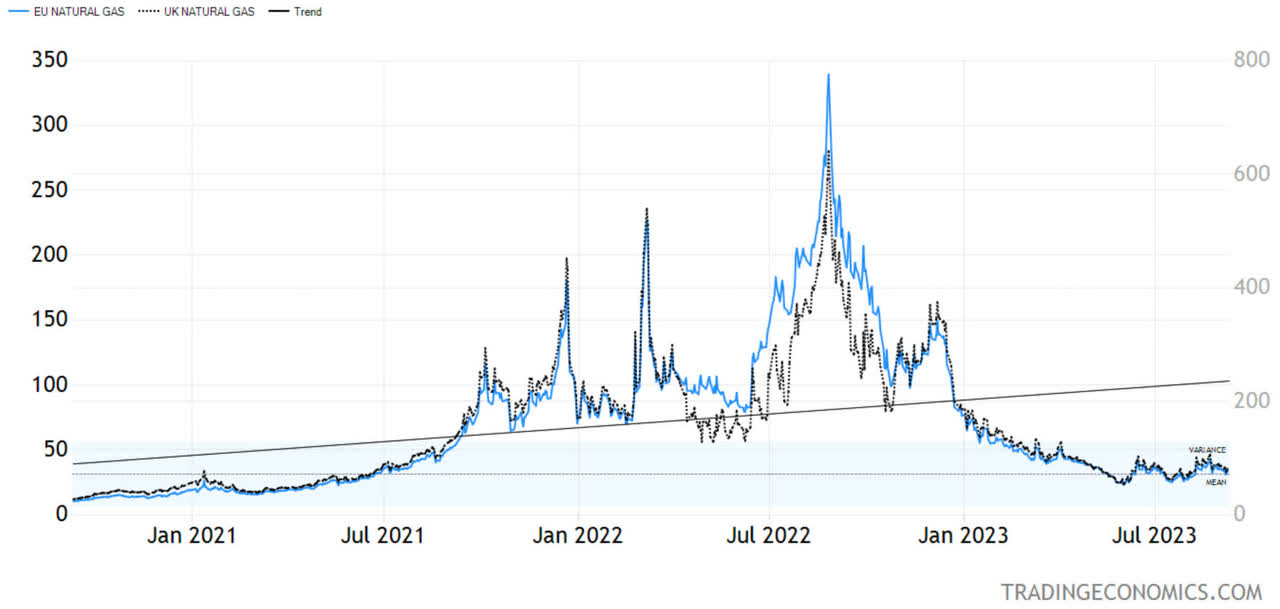

First, he doesn’t suppose the EU pure gasoline downside is fastened. The first purpose the EU survived final winter comparatively unscathed is as a result of final winter was gentle. If the approaching winter is extreme, we’re more likely to see pure gasoline and electrical energy value spike.

Graphs are for illustrative and dialogue functions solely. Please learn vital disclosures on the finish of this commentary.

LNG gasoline is costlier and regardless that there’s fairly a bit of latest capability, there’s not sufficient to substitute pipeline gasoline. Since three of the 4 predominant pipelines going to Germany have been blown up, and only one continues to be operational, however not at the moment transporting gasoline, the value of EU pure gasoline shall be risky.

This brings up the problem of EU inflation. The worth spikes within the fall have been really horrific. Shortages of provide and extreme climate are two examples of the kind of inflation which have little to do with financial coverage, which poses fairly the dilemma for the European Central Financial institution.

All content material above represents the opinion of Ivan Martchev of Navellier & Associates, Inc.

Disclosure: *Navellier could maintain securities in a number of funding methods provided to its purchasers.

Disclaimer: Please click on right here for vital disclosures positioned within the “About” part of the Navellier & Associates profile that accompany this text.

Authentic Publish

Editor’s Be aware: The abstract bullets for this text have been chosen by Searching for Alpha editors.

Editor’s Be aware: This text covers a number of microcap shares. Please pay attention to the dangers related to these shares.

[ad_2]

Source link