[ad_1]

netrun78

Funding Thesis

Carter’s Inc.’s (NYSE:CRI) low ahead a number of had me intrigued, so I made a decision to look into its financials to see whether it is warranted. What I discovered was a blended again of metrics and lackluster progress with deteriorating margins, which tells me that the low a number of, for now, is justified, and I assign a maintain ranking till these enhance.

Briefly on the corporate

Carter’s is a retailer of childrenswear within the US and Internationally by means of manufacturers like OshKosh, Skip Hop, and Youngster of Mine. The corporate has wholesale areas and e-commerce on-line shops.

Financials

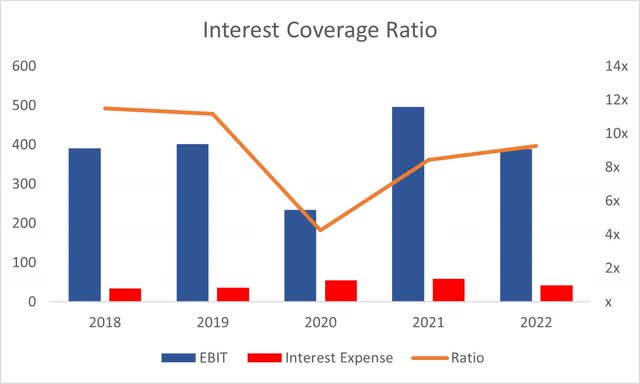

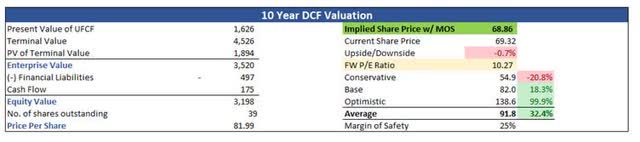

As of Q2 ’23, the corporate had round $175m in money and equivalents in opposition to ~$497m in long-term debt. It is value stating that the debt burden has lowered since FY22 by round $120m, which is a constructive signal. So, how unhealthy is that this debt for the corporate? I am all for firms taking over debt for varied strategic causes so long as it’s manageable. The historic curiosity protection ratio has been greater than acceptable, going as excessive as 11 and as little as 4. Which means that EBIT was capable of cowl annual curiosity expense 4 to 11 instances over. For reference, many analysts imagine 2x is a wholesome ratio, whereas I search for no less than 5x for extra security as I prefer to be extra on the conservative finish. I really feel 2x is somewhat too tight.

As of Q2 ’23, the corporate was at round 5x protection, which is simply at that minimal of mine, nonetheless, since I do not take quarterly experiences too significantly as I wish to see the larger image, the corporate nonetheless has 2 quarters of efficiency to enhance on the ratio, and I believe it should. Nonetheless, it’s secure to say the corporate is at no danger of insolvency.

Protection Ratio (Creator)

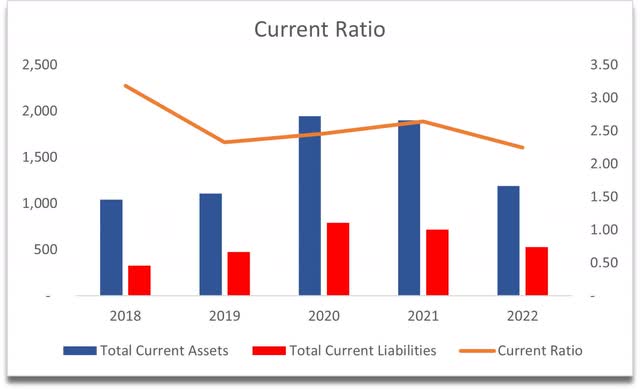

The corporate’s working capital ratio is round the place I need it to be on the subject of effectivity. Perhaps barely on the inefficient finish. What I name an environment friendly present ratio is wherever within the vary of 1.5-2.0. This vary tells me that the corporate has sufficient liquidity to repay short-term obligations and nonetheless has liquidity left over for strategic progress initiatives, and it additionally tells me that the corporate is not hoarding money or is holding an excessive amount of stock. The corporate’s present ratio as of Q2 improved to 2.0 from 2.25, and I say improved as a result of, for my part, it grew to become extra environment friendly because of the firm’s skill to decrease its stock ranges and use its money. Secure to say, that the corporate has no liquidity points.

Present Ratio (Creator)

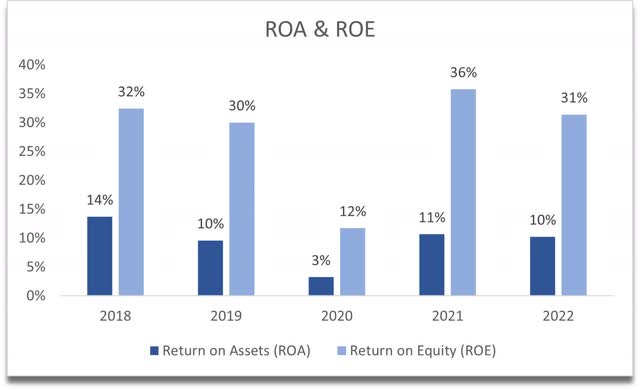

When it comes to effectivity and profitability, CRI’s ROA and ROE have been very sturdy traditionally. These have recovered fairly effectively from the pandemic lows and have averaged across the historic numbers. These are additionally effectively above my minimal of 5% for ROA and 10% for ROE. This tells us that the administration may be very adept at using the corporate’s property and shareholder capital effectively, thus creating worth within the course of.

ROA and ROE (Creator)

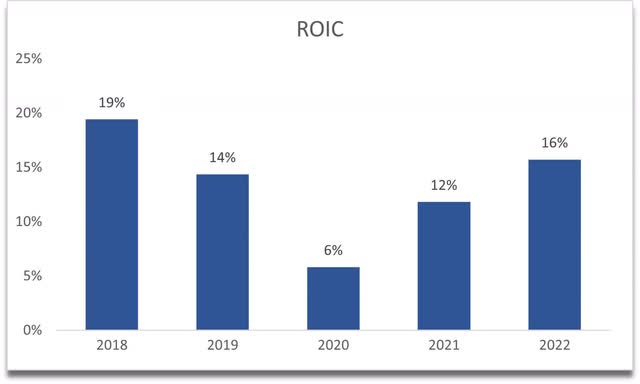

We will see an identical story unfolding within the firm’s return on invested capital, or ROIC. It’s effectively above the pandemic lows and above the minimal of 10% that I’m trying to get from an funding. This tells us that the corporate has a aggressive benefit and a good moat, which I might be prepared to pay a slight premium for.

ROIC (Creator)

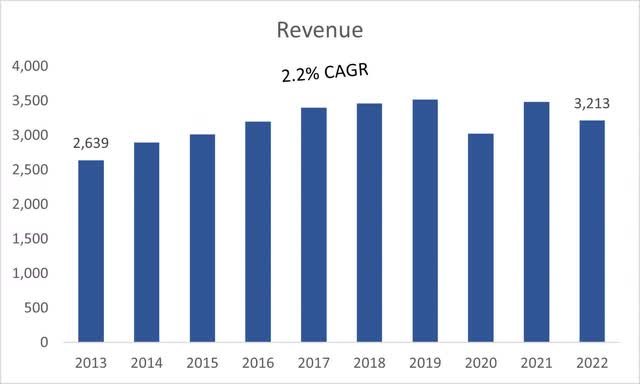

What I’m fairly disillusioned in and doubtless motive the corporate’s buying and selling at such low multiples, is the corporate’s lackluster income progress. Over the past decade, the corporate managed to maintain up with the US long-term inflation aim of round 2%, which is sort of underwhelming. I’ve no motive to suspect the corporate’s going to develop at a faster tempo than its historic.

Income Progress (Creator)

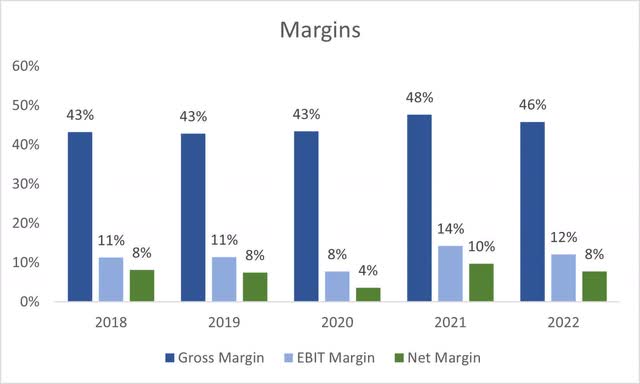

When it comes to margins, these have been regular over time, with slight deterioration in FY22, and sadly, six months ended July 1st ’23, the margins haven’t improved and likewise received somewhat worse, nonetheless, as I stated earlier, I’ll take the quarterly experiences with a grain of salt as a result of they do are likely to fluctuate extra q/q.

Margins (Creator)

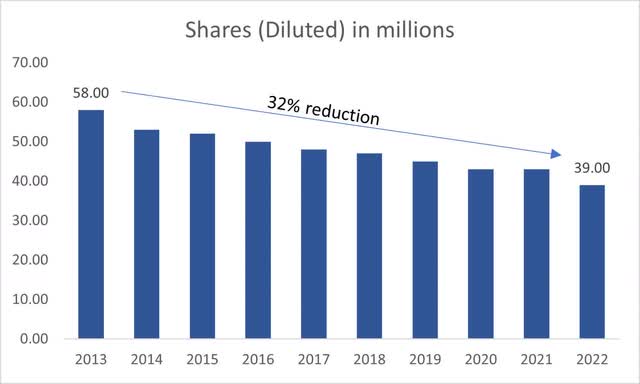

The corporate has been decreasing its shares excellent fairly significantly over the past whereas, which goes to enhance its EPS and create worth for shareholders. I am all up for firms shopping for again their shares, nonetheless, provided that there are not any higher methods of making worth for shareholders and if the shares are thought-about low-cost. If not, then I really feel prefer it’s not the perfect use of the corporate’s cash.

Shares excellent (Creator)

General, the corporate appears to be working fairly easily, however quite unexciting by way of income prospects and what looks as if persevering with margin deterioration. The corporate does have a good aggressive edge and a moat, which is a plus, and the administration appears to have the ability to use the corporate’s property effectively. So, let’s examine what I might be prepared to pay for an absence of progress in revenues.

Valuation

As I stated, there’s no motive for me to imagine the corporate would be capable of obtain the next income progress than its historic common. For my base case, I went with round 2.2% CAGR for the subsequent decade, which is its historic common. For the optimistic case, I went with a 4% CAGR, whereas for the conservative case, the corporate will see 0 progress to present me a spread of potential outcomes.

When it comes to margins, for the bottom case, I made a decision to maintain them as they had been on the finish of FY22, primarily as a result of these want to deteriorate additional, which does not give me confidence that the corporate goes to turn out to be far more environment friendly and worthwhile over time. For the optimistic case, I went with round 400bps enhancements from the bottom case over the subsequent decade, whereas for the conservative case, I went with round 200bps worse than the bottom case over the identical interval.

On prime of those estimates, I made a decision so as to add a 25% margin of security, primarily as a result of the corporate’s lack of progress and margin deterioration is protecting the corporate comparatively low valued, and for me to tackle such the corporate’s lack of progress, I require some further security. With that stated, CRI’s intrinsic worth is round $69 a share, which tells me that the corporate is buying and selling at its truthful worth at the moment.

Intrinsic Worth (Creator)

Closing Feedback

I’m assigning a maintain ranking for now, resulting from a few unknowns. Firstly, it is the corporate’s lackluster income progress which may be enjoying an enormous function within the firm’s comparatively low a number of as a result of traders are in search of an thrilling firm that has progress potential and Carter’s appears to have stalled. The second motive I give it a maintain ranking is the uncertainty within the firm’s profitability and effectivity. The margins to date appear to be persevering with their deterioration. If this pattern continues, I can see the share worth dropping additional till the corporate turns it round and introduces some respectable cost-cutting initiatives to realize again the effectivity it as soon as had.

I’ll have a look at the corporate’s subsequent 2 quarters for a greater image of margins and revisit if I see that the margin state of affairs is bettering or no less than exhibiting some indicators of enchancment.

[ad_2]

Source link