[ad_1]

Lower than 100 shares to go after this submit…I took a while to proceed as a result of I misplaced a full submit to the bloody WordPress editor. Because the random generator picked some fairly fascinating shares this time, I had written rather a lot. This verson is shorter, however 5 shares are price to “watch”. I’m nonetheless optimistic to complete earlier than yr finish. Get pleasure from !!!

166. Zaptec

Zaptec is a 175 mn EUR market cap 2020 IPO that’s surprisingly buying and selling above its IPO value. In response to Euronext, Zaptec is a “expertise firm inside Electrical automobile (EV) charging techniques in Europe. The corporate develops EV charging techniques for multi and single-family houses and workplace buildings.”

The corporate really has first rate gross sales, is rising rapidly, is sort of break even, and extra surprisingly doesn’t appear to have debt. In Q1, the corporate confirmed income development of +100% at a barely optimistic EBITDA margin. Orders even went up +200%.

The corporate appears to be a a producer of charging stations and energetic in Norway but additionally exporting ~2/3 of their manufacturing. As Norway is clearly an early adopter of EVs, Zaptec might need used this to develop a sure edge in comparison with opponents. General, regardless of being a latest IPO, this might be one to “watch”.

167. Lea Financial institution

Lea Financial institution is a 77 mn EUR market cap financial institution basd in Oslo that regardless of its small measurement, appears to be energetic throughout Europe as a “digital area of interest financial institution”. The inventory appears to be like low cost at 6x P/E however trying on the mortgage losses that are ~1/4 of Income, it appears to be like like that they cater to the “subprime” market. “Move”.

168. Treasure ASA

Treasure ASA is a 360 mn EUR firm that’s majority owned (78%) by Wilh. Wilhelmsen. The principle exercise of Treasure appears to be to “personal 4 125 000 (11.0%) shares in Hyundai Glovis Co., Ltd. (Hyundai Glovis), a world transportation and logistics supplier based mostly in Seoul, Korea.”

I don’t know the background of this, however Korean logistics firms are clearly exterior my CoC, due to this fact I “go”.

169. Ice Fish Farm

Ice Fish Farm is , because the identify signifies a 293 mn EUR market cap fish farm, farming Salmon in Iceland. Being IPOed in 2020, they’re nonetheless loss making. “Move”.

170. Hunter Group

Hunter is (accordig to Euronext) a 4 mn EUR market cap funding firm that used to gained oil tankers. As of yr finish, that they had no working belongings left. They appear to have dividended out all the things and have just a few tens of millions left in money and declare to focus now on CO2 in a roundabout way. “Move”.

171. Softox

Softox is a 7 mn EUR market cap firm that “will develop a portfolio of antimicrobial options to unravel world challenges associated to pores and skin infections, each antibiotic resistant and persistent infections.” The corporate has new administration since January 1st and is making losses, money would possibly run out this yr. “Move”.

172. Vow ASA

Vow ASA is a 150 mn EUR market cap firm which essential enterprise is treating waste water from Cruise ships. Through the Covid/ESG/Cleantech hype, they managed to place themselves as a type of Inexperienced round economic system inventory with some JVs and the share value took of like a rocket:

Since then nevertheless, issues calmed down quite a bit. Gross sales have elevated, however profitability has been reducing. My impression is that the administration is kind of promotional and each new order is well known like a Nobel value win, regardless of how small it’s. “Move”.

173. Rana Gruber

Rana Gruber is a 190 mn EU market cap Norwegian Iron ore miner that has been IPOed in 2021. Surprisingly for this classic, the share trades above the IPO value.

At first sight, it does look fascinating. At present market costs, the corporate is kind of worthwhile and low cost (6x trailing P/E). They appear to have internet money. In addition they declare that they’ll be capable of mine “CO2 impartial” Iron ore by 2025.

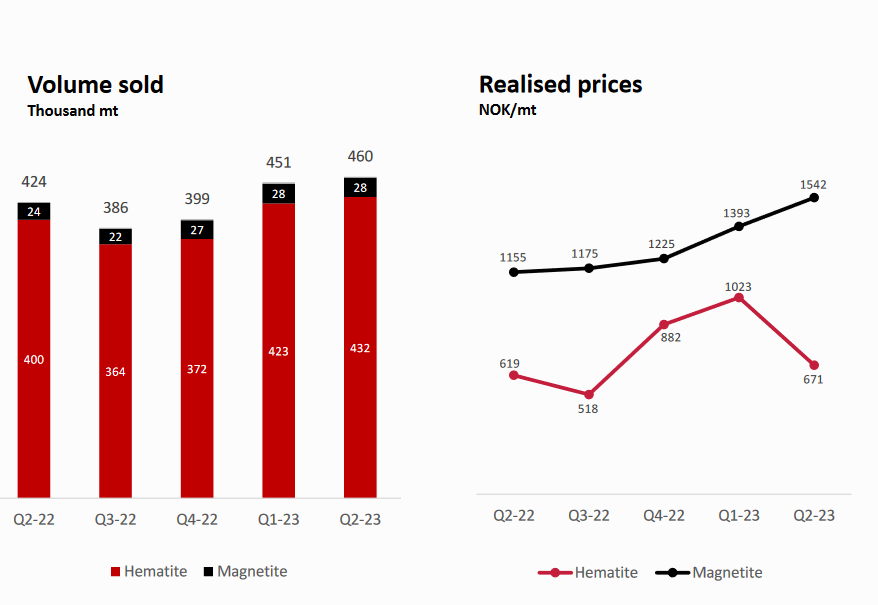

Nonetheless, market costs for his or her essential prodcut Hematide appear to be fairly risky as we are able to see on this chart from the 6M presentation:

Though I’ve little to no clue about iron ore mining, I someway discover this fascinating, due to this fact “watch”.

174. Philly Shipyard

Because the identify signifies, this Norwegian listed firm is definitely a shipyard in Philadelphia, US. On the time of writing, the inventory simply had jumped +30% after a rumor surfaced {that a} Korean shipbuilder is likely to be all in favour of taking on the corporate. With a market cap of round 45 mn, this can be a small fish and the corporate is majority owned by the Aker Group, which in flip is owned by one of many richest Norwegian guys, self made billionaire Kjell Inge Roekke who is meant to be a great capital allocator.

The corporate has been loss making for a while and nonetheless is, regardless of rising gross sales. “Move”.

175. Protector Forsikring

Protector is a 1,3 bn EUR market cap insurance coverage firm that has been one thing like a “challenger” Insurance coverage firm within the Nordics. They’ve been very profitable with promoting insurance coverage solely by way of the dealer channel and have just lately expanded into the UK the place they’re rising like loopy. I had written within the weblog about them in March final yr and never invested. Since then the inventory has gone up one other 50%:

To be sincere, I’ve completely no thought, how particularly within the US they handle to develop so quick and as a brand new entrant, have loss ratios far beneath the competitors. This goes in opposition to all the things I’ve realized in insurance coverage, particularly for those who solely promote via brokers. Protector is kind of quick with their outcomes, Q3 numbers will probably be launched on October twentieth. I’ll proceed to “watch” however at the very least the UK outcomes look too good to be sustainable to me. However I might after all be mistaken once more.

176. Nork Hydro

Norsk Hydro is a 11 bn EUR market cap Aluminium and Energy producer that loved an excellent 2022 as vitality costs rose and costs for Aluminium went up considerably. In 2023, the costs appear to be declining, however Norsk Hydro continues to be fairly worthwhile and buying and selling at a p/E of 12x and an EV/EBIT of 9x which is round long run averages. Nonetheless, profitability continues to be far above historic averages, which could implay some “imply reversion” draw back potential.

The Norwegian Authorities owns 34% of the corporate. The corporate additionally appears to develop its Energy segement additional, including wind and photo voltaic renewables on prime of its conventional Hydro energy era.

The corporate mentions of their IR presentation, that the present plan to tax carbon emissions on imports on the borders of Europe someway excludes scrap aluminium, which might be an amazing drawback for European producers.

General, this type of enterprise is just too risky for me, so I’ll “go”.

177. Goodtech

Goodtech is a 28 mn EUR market firm that claims to be “one of many Nordic area’s main system integrators with greater than 300 expert engineers and specialists” . Regardless of the great identify, the corporate confirmed losses for 7 out of the final 10 years. “Move”.

178. Aquila Holdings

Aquila Holdings is a 20 mn EUR market cap firm that modified its identify just lately from “Carbon Transition” and appears do do one thing with Seismic Information and Investments. “Move”.

179. TGS

TGS (former TGS-Nopec) is a inventory I owned prior to now. The 1, 7 bn EUR market cap firm is buying seismic knowledge which it then sells to grease firms. Up to now, their aggressive benefit was that they didn’t personal ships themselves however rented them after they have been low cost.

Over the previous years, the consolidated the markets and took over Spektrum and extra revently, PGS, which nevertheless owns its personal ships. Aside from a spike in 2019, long run shareholder worth era was very restricted over the previous 10 years as we are able to see within the chart:

In 2020 and 2021, they confirmed losses, 2022 was excellent. For no matter purpose, 2023 appears to be like fairly dangerous once more with working revenue down -20% for the primary 6M. The PGS deal will shut in early 2024. I’ll undoubtedly revisit them after the PGS deal, so “Watch”.

180. Pareto Financial institution

Pareto Financial institution is a 370 mn market cap Financial institution that’s a part of the broader Pareto Group, however not it’s Topco. As many Nordic banks, the inventory appears to be like low cost at round 7x P/E and 1x guide worth. ROE has been continually within the 13%-15% vary which is superb. EPS has doubeld from 2016 to 2022.

The inventory chart is unspectacular however regular:

General, this appears to be like to me like possibly essentially the most intersting Norwegian Financial institution I’ve seen up to now, due to this fact I’ll “watch”.

[ad_2]

Source link