[ad_1]

These within the learn about credit score will do not forget that credit score utilization is likely one of the largest components that affect your credit score rating.

These within the learn about credit score will do not forget that credit score utilization is likely one of the largest components that affect your credit score rating.

To be particular, credit score utilization makes up about 30% of your FICO rating and about 20% of your VantageScore, with accessible credit score comprising an extra 3% of your VantageScore.

Understanding this, we are able to conclude that the extra accessible credit score it’s a must to your title, all different components being equal, the higher your credit score rating will probably be.

Why? As a result of the extra accessible credit score you might have, the decrease your credit score utilization will probably be, which is good to your scores.

Nevertheless, this naturally results in the query, “Can you might have an excessive amount of credit score?”

It is sensible to surprise if there’s a restrict to which it’s useful to have accessible credit score. Is it potential that lenders may frown upon having an excessive amount of accessible credit score? Do they fear that when you have been to make use of all of that accessible credit score, you could possibly find yourself deep in debt and unable to pay again your loans?

As well as, there are a few different views to contemplate relating to the query of how a lot credit score is an excessive amount of. For instance, you may also surprise how a lot debt is an excessive amount of with respect to your accessible credit score (i.e. in case your credit score utilization price is simply too excessive) and if having too many bank cards can harm your credit score rating.

So, let’s attempt to reply the query of whether or not having an excessive amount of credit score may harm your rating by addressing three completely different angles of the problem: having an excessive amount of accessible credit score, having an excessive amount of debt, and having too many credit score accounts. We’ll additionally take a look at the quantity of credit score the common client has so you possibly can see the place you stand in relation to the nationwide common.

How A lot Credit score Does the Common Individual Have?

To offer some context earlier than defining what might represent “an excessive amount of credit score,” first, let’s learn the way a lot credit score the common client tends to have.

What Is the Common Quantity of Out there Credit score?

In accordance with a latest report by Experian on U.S. client bank card debt, within the second quarter of 2019, the common credit score restrict of customers who’ve bank cards was $22,751.

The identical report discovered that the common American has round 4 bank cards, so this $22,751 credit score restrict is probably going unfold throughout 4 playing cards for the common client.

Credit score limits present traits based mostly on age and placement. Child boomers, or those that are at present between the ages of 55 to 73, have the best common complete credit score restrict in comparison with different generations, at $39,919. In distinction, millennials have a mean complete credit score restrict of $20,647, whereas Era Z (the youngest era) has a mean complete credit score restrict of $8,062.

Experian discovered that the common complete credit score restrict is $22,751 and the common quantity of bank card debt per client is $6,194.

The states with the best quantity of accessible credit score embody New Jersey ($37,845), Connecticut ($36,272), and Massachusetts ($34,685). The bottom common complete credit score limits per client are present in Mississippi ($21,676), Arkansas ($24,570), and West Virginia ($24,684).

What Is the Common Credit score Restrict of a Credit score Card?

The above determine for common complete credit score restrict refers back to the complete credit score restrict for all bank cards owned by a client added collectively, not the common credit score restrict of every particular person bank card. So if the common client has 4 bank cards, the common credit score restrict per card would come out to $5,687.75 ($22,751 / 4 = $5,687.75).

How A lot Credit score Card Debt Does the Common American Have?

In accordance with Experian, within the second quarter of 2019, the common quantity of bank card debt per client was $6,194.

Identical to accessible credit score, the quantity of client bank card debt varies throughout areas. Alaska has the best common bank card debt per client at $8,026, adopted by New Jersey at $7,084 and Connecticut at $7,082. Iowa, Wisconsin, and Mississippi had the bottom common quantity of bank card debt at $4,744, $4,908, and $5,134, respectively.

Can You Have Too A lot Out there Credit score?

There isn’t any easy reply to this query, as credit score is advanced and everybody’s state of affairs is completely different. Nevertheless, we are able to focus on how accessible credit score impacts your credit score rating and how one can begin to determine what quantity of accessible credit score could be an excessive amount of for you.

Can Too A lot Credit score Damage Your Rating?

With respect to accessible credit score, having quite a lot of credit score won’t harm your credit score rating. As we described above, having a excessive credit score restrict is nice to your credit score utilization ratio, which implies it may be very useful to your rating.

Nevertheless, this doesn’t imply that having an abundance of accessible credit score doesn’t have any downsides. For some folks, it could be potential to have an excessive amount of accessible credit score for different causes that shouldn’t have to do with their credit score rating.

For instance, in case you are planning to use for a mortgage sooner or later, similar to a mortgage or enterprise credit score, it’s probably that the lender will take a look at the quantity of accessible credit score that you’ve got when contemplating your software as a result of it’s potential that you could possibly use that accessible credit score sooner or later.

They will even know your earnings, and so they might weigh your complete accessible credit score towards your earnings. This might help the lender perceive whether or not you’d be capable to repay your entire debt when you have been ever to make the most of your entire quantity of the credit score that’s at your disposal.

For those who’re planning to use for a mortgage and also you’re involved you may need an excessive amount of accessible credit score, speak to your mortgage officer.

In case your quantity of accessible credit score is excessive in comparison with your earnings, the lender might not really feel assured that you could possibly pay them again if you find yourself maxing out your entire different accounts.

How A lot Out there Credit score Is Too A lot?

Since we all know that having quite a lot of accessible credit score doesn’t negatively have an effect on your credit score rating, then how can you know the way a lot accessible credit score is an excessive amount of?

The quick reply is that “an excessive amount of” accessible credit score is nevertheless a lot you won’t be able to handle efficiently.

In case you are the form of one who pays off your bank cards in full every month, then you possibly can most likely deal with excessive credit score limits with out a downside.

However, when you are inclined to overspend and also you assume that having a excessive quantity of credit score accessible to you would possibly lead you to get deep into debt, then it could be finest to take care of a decrease credit score restrict with a view to take away the temptation.

As well as, in case you are involved about an excessive amount of accessible credit score doubtlessly affecting your possibilities of getting authorized for a mortgage, it’s best to debate your considerations together with your mortgage officer. They need to be capable to offer you an thought of what it is advisable do to spice up your possibilities of getting authorized.

How A lot Out there Credit score Do You Want?

In answering the query of how a lot accessible credit score you might want, you possibly can calculate this quantity based mostly on how a lot you usually spend in your bank cards every month and what you’d like your most credit score utilization share to be.

As a hypothetical instance, let’s say that you just spend a mean of about $1,000 in your bank cards every month, and also you need to maintain your total credit score utilization ratio beneath 10%.

Once we can take the formulation for credit score utilization (utilization = debt / accessible credit score) and rearrange it to find out accessible credit score, we get: accessible credit score = debt / utilization.

Now, we are able to plug in your excellent numbers to provide you with the quantity of accessible credit score that you just want. On this instance, we’ll plug in 10% (or 0.10 in decimal kind) for utilization and $1,000 for debt: accessible credit score = $1,000 / 0.10 = $10,000.

Due to this fact, based mostly in your spending on this instance, you would wish no less than $10,000 in accessible credit score with a view to maintain your credit score utilization beneath 10%.

Now you possibly can go forward and do that calculation utilizing actual numbers from your personal life!

Alternatively, if you understand you need your credit score utilization to remain round 20%, you should use this straightforward formulation: simply take the quantity you spend every month and multiply by 5 to get the quantity of accessible credit score you must have.

For instance, when you spend $1,000 monthly, multiplying by 5 provides you $5,000, which tells you that you must have no less than $5,000 of accessible credit score with a view to obtain your purpose of sustaining 20% or decrease credit score utilization.

Can You Have Too Many Credit score Playing cards or Installment Loans?

The credit score combine issue of your credit score rating rewards having a various mixture of a number of several types of credit score accounts. In truth, as we all know from Learn how to Get an 850 Credit score Rating, customers with excessive FICO scores have a mean of seven bank card accounts, which incorporates each open and closed accounts.

So long as your credit score utilization is in a great vary, then having quite a lot of bank cards probably received’t harm your credit score rating.

Nevertheless, there’s a restrict to what number of accounts you must have in your credit score profile.

Does Having Too Many Credit score Playing cards Damage Your Rating?

It’s true that having too many bank cards can start to harm your credit score rating, in line with an article by credit score professional John Ulzheimer. Fortuitously, nevertheless, this is a matter that most individuals most likely won’t have to fret about.

Except you’re “bank card churning” to benefit from bank card signup bonuses, you probably aren’t opening new bank cards left and proper. A 2019 report by Experian discovered that the common American has round 4 bank cards, and as we talked about, FICO excessive scorers are inclined to have about seven bank cards of their credit score file.

You Can Have a Lot of Credit score Playing cards and Nonetheless Have Good Credit score

Whereas it’s finest to not go wild opening a ton of accounts, it’s nonetheless potential to have good credit score even when you’ve got a pockets filled with bank cards.

Bear in mind, credit score combine solely makes up about 10% of your credit score rating, and your complete variety of accounts is just one a part of the credit score combine class, which implies it has a weight of even lower than 10%. Due to this fact, even when you do have too many bank cards, that issue alone can not offer you weak credit.

In truth, the Guinness World File holder for having probably the most bank cards has nearly 1,500 of them! He claims to have “almost good” credit score, which he maintains by solely utilizing one card and paying it off each month.

The Risks of Having Too Many Credit score Playing cards

For those who’re not accustomed to juggling handfuls of bank cards, although, having an extra of playing cards would possibly put you in peril of changing into overwhelmed and by accident lacking a cost.

For those who apply for lots of bank cards inside a short while span, you could possibly find yourself with too many arduous inquiries in your credit score report, which may harm your credit score rating.

Though you possibly can mitigate this potential downside by establishing computerized invoice pay on all of your accounts, as we described in our “Credit score Hacks” article, in some circumstances, it could be a greater thought to maintain issues easy so you possibly can keep away from ending up with a derogatory merchandise in your credit score report.

One other pink flag that you could have opened too many bank cards is that if the inquiries out of your latest bank card purposes are having a big unfavourable affect in your credit score rating.

Each time you apply for a bank card, the lender will almost certainly do a tough pull in your credit score, and every arduous inquiry has the potential to cut back your rating by just a few factors. Whereas credit score inquiries often aren’t an enormous deal within the grand scheme of issues, when you apply for credit score too many occasions inside a short while span, the affect of these inquiries in your credit score might grow to be extra extreme.

Ought to You Shut A few of Your Credit score Card Accounts?

If all this data has you feeling such as you may need too many bank card accounts, it’s vital to notice that closing a few of your playing cards won’t truly allow you to lower your variety of accounts. When credit score scoring fashions take a look at your variety of accounts, they rely each open and closed accounts.

As well as, closing bank card accounts will harm your credit score utilization by eradicating the accessible credit score related to these accounts. Due to this fact, it’s higher to your credit score rating to maintain accounts open and in good standing by making a purchase order occasionally and at all times paying off the balances on time.

So when you’ve got too many bank cards, the perfect plan of action is to cease opening new accounts whereas on the similar time preserving your present accounts open and easily letting them age. The extra age your accounts accumulate, the extra they will profit your credit score. You may learn extra concerning the significance of credit score age in “Why Age Is the Most Worthwhile Issue of a Tradeline.”

If you wish to learn extra on the subject of what number of bank cards one ought to have, make sure you try John Ulzheimer’s visitor article, “What’s the ‘Proper’ Variety of Credit score Playing cards?”

Right here is an fascinating video from Ask Sebby that helps sum up the reply to the query, “what number of bank cards is simply too many?”

Can Having Too Many Installment Loans Damage Your Credit score Rating?

To date, we’ve centered on bank card accounts in answering this query. The explanation for that is that revolving accounts, together with bank cards, are weighted extra closely in credit score scoring algorithms than installment accounts. Having installment debt will not be considered as negatively as having revolving debt.

You may study extra about how revolving accounts and installment accounts can every have an effect on your credit score in our article, “Are Revolving Accounts Extra Highly effective Than Installment Accounts?”

Between scholar loans, auto loans, mortgages, and private loans, It’s pretty frequent for customers to have a number of several types of installment accounts on their credit score reviews, which isn’t essentially a foul factor.

Nevertheless, it will make sense that having too many installment accounts in your credit score report may have a unfavourable impact in your credit score rating, particularly if the loans nonetheless have excessive balances that you’re at present paying off.

In relation to installment accounts, comply with the identical normal precept that applies to bank cards: you shouldn’t apply for an extreme quantity of installment loans, however alternatively, when you’re a reasonably typical client, you most likely don’t want to fret an excessive amount of about what number of installment accounts you might have in your credit score report.

How A lot Credit score Card Debt Is Too A lot?

The place we run into actual hassle is with having an excessive amount of debt and too excessive of a credit score utilization ratio. Though having quite a lot of accessible credit score and quite a lot of credit score accounts shouldn’t be disastrous to your credit score rating per se, that’s depending on you not maxing out these credit score limits.

If you find yourself utilizing all that accessible credit score in your completely different credit score accounts, that’s when your credit score rating will actually undergo.

In relation to how a lot debt is an excessive amount of, there isn’t a simple reply that may be utilized to all customers. It depends upon your particular person credit score file and the way properly you possibly can handle your credit score.

The quantity of debt that’s an excessive amount of is any quantity that’s greater than you possibly can efficiently repay. You don’t need to be in a lot debt that you would be able to’t sustain together with your funds, as cost historical past is the primary most vital consider your credit score rating.

Though there isn’t a one-size-fits-all reply, you possibly can consider an excessive amount of debt as any quantity that you just can not afford to repay.

How A lot Credit score Utilization Is Too A lot?

However, since credit score utilization is expressed as a share as an alternative of a greenback quantity, it’s simpler to generalize how a lot credit score utilization is an excessive amount of throughout customers.

Sadly, nevertheless, there’s nonetheless no magic quantity that determines the edge between a great quantity of credit score utilization and an excessive amount of credit score utilization. In spite of everything, the credit score scoring algorithms are proprietary and the scoring firms don’t share the specifics of these algorithms.

What we are able to say for positive about credit score utilization is that the decrease it’s, the higher your scores. The exception is 0% utilization, which is definitely worse than having 1% utilization as a result of it signifies that you don’t use credit score and subsequently might not be capable to handle it properly.

Which means that the best state of affairs to your credit score utilization is being at a share that’s within the single digits however larger than zero. When you begin to get past that vary, your utilization can start to have a unfavourable affect in your credit score.

The Supreme Utilization Ratio Relies on Your Credit score Targets and Spending

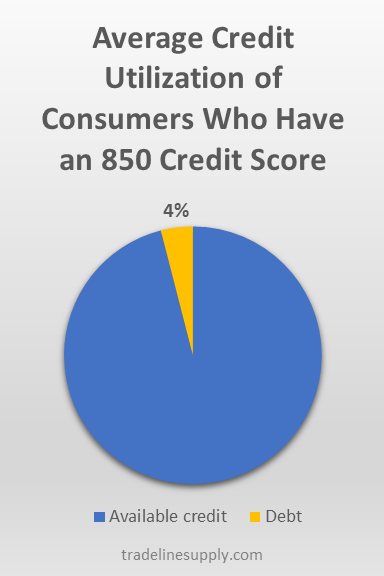

To get the best credit score rating potential, you’ll need to shoot for round 4% utilization.

Credit score utilization is a steady scale between zero and 100 somewhat than a binary “good” or “unhealthy” end result (versus, say, derogatory objects, the place you both have one in your credit score report otherwise you don’t). For that reason, as an alternative of making an attempt to attract a line within the sand to mark how a lot credit score utilization is an excessive amount of, it’s a must to take into consideration what your targets are and why your credit score utilization is vital to you.

In case you are not planning to use for credit score anytime quickly, then your credit score utilization and credit score rating might not matter very a lot. In that case, you might not care in case your credit score utilization goes all the way in which as much as 100%, so long as you make your entire funds on time.

However, in case you are seeking to keep excellent credit score, you will want to be extra cautious.

In our article on total credit score utilization and particular person utilization ratios, we talked concerning the fantasy of the 30% credit score utilization ratio. Though you could have heard that preserving your credit score utilization beneath 30% is the way in which to go, your credit score can nonetheless undergo in case your utilization is as excessive as 30%, so it will be higher to attempt for 20% and even decrease if potential.

Due to this fact, if you wish to have excellent credit score, you would possibly contemplate something above 20% to be too excessive. In different phrases, the quantity of credit score you continue to have accessible must be no less than 5 occasions larger than the quantity of revolving debt that you’ve got.

If you wish to get the perfect credit score rating potential, you will want to go even decrease than 20% utilization. Latest information collected on excessive FICO scorers present that customers with good 850 FICO scores have a mean utilization price of 4.1%.

To summarize, the utilization price that’s “an excessive amount of” depends upon your private state of affairs and what you are attempting to realize, though 20% is usually thought of to be a protected credit score utilization ratio for many functions.

Credit score Countdown Video: Is Having Too A lot Credit score Unhealthy for Your Credit score Rating?

Within the video beneath, John Ulzheimer explains whether or not having “an excessive amount of” credit score can have an effect on your credit score scores. Plus, he reveals tips on how to discover out precisely how a lot credit score it is advisable have optimum credit score scores.

Conclusions: How A lot Credit score Is Too A lot?

As you understand from studying all of our credit-related articles, credit score is a fancy matter, and the query of how a lot credit score could also be an excessive amount of isn’t any exception.

In relation to accessible credit score and your credit score rating, technically, there isn’t a such factor as an excessive amount of. Nevertheless, when making use of for a mortgage, extreme accessible credit score might be a downside, so examine together with your lender. As well as, you should be diligent about managing your spending, as a result of as soon as accessible credit score turns into debt, that debt has the alternative impact in your credit score.

Equally, having many credit score accounts in itself will not be essentially a pink flag, so long as they’re all managed correctly, i.e. you make your entire funds on time. Usually, closing credit score accounts received’t allow you to, so even when you’ve got quite a lot of bank cards, it could nonetheless be a good suggestion to maintain them open.

With credit score utilization, we’ve a extra concrete thought of how a lot utilization is an excessive amount of. Many credit score consultants suggest staying beneath 20% with a view to have good credit score, whereas it would be best to shoot for beneath 5% to get the right 850 credit score rating.

In the end, how a lot credit score is an excessive amount of is a query that it’s a must to reply for your self based mostly in your private targets and what works finest for you. We hope that the knowledge on this article helps to information you in your journey!

[ad_2]

Source link