[ad_1]

Final Automotive Cost

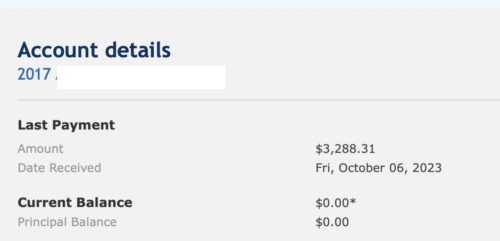

Guess what, pals! I did a factor! In a single fell swoop, I paid off my 2017 automotive mortgage. My stability is now $0!

That is my massive win to report, as this was my solely “shopper debt.” My solely remaining money owed are my scholar loans and our mortgage.

Scholar Mortgage Drama

I’ve talked about earlier than that I’m placing my scholar loans on the again burner. Whereas I’ll be making month-to-month funds towards my loans as required, I’m not planning to place something “additional” towards them proper now. As an alternative, I’m formally enrolled in PSLF and plan to experience that out till my remaining loans are forgiven. That stated, the federal government and mortgage service suppliers have made the method “clear as mud.” The final time I discussed my scholar loans again in February, I reported that the net platform indicated I had 44 qualifying funds to go.

By some means, at present, I logged in and noticed that 2 of my loans point out solely 15 funds remaining….whereas 2 of my loans present 0 eligible funds (thus, 120 funds to go). Like….what? Completely nothing has modified within the interim between February and now, so I don’t know why the net platform is telling me such disparate info. It can’t be correct. I referred to as my service supplier, Mohela, to attempt to discuss to a customer support rep and gave up after a full hour on maintain as a result of I had a gathering I needed to bounce into.

I just about detest these loans and allllll the curiosity I’ve already paid. And the servicers don’t make it simple to get info. Lengthy wait instances, rampant misinformation, and many others. Ick. Sadly, that is one thing I’ll must sort out one other day. Transferring on…..

New Monetary Objectives

Once we had our espresso date, I discussed being uncertain proceed after my automotive is paid in full. It is a “running a blog away debt” weblog. However I’m now feeling my priorities shift extra towards saving and investing. My husband and I do pay additional on our mortgage, however not with the steadfast dedication with which I paid off my automotive.

As an alternative, I’m eager about shifting to extra financial savings/funding choices. My open enrollment interval opens very quickly. I’d like to extend my financial savings/investments in a number of classes. Listed below are my ideas:

CURRENT in 2023NEW for 2024

HSA: $5500/yearHSA: $7750/yr

FSA: $700/yearFSA: $1000/yr

403B: $125/check403B: $175/examine

529: $50/youngster/month529: $60/youngster/month

If I’m doing my math proper, the full quantity of investments yearly from this desk would quantity to $14,740 (FYI: I’m paid biweekly. I’ve 2 children, and every has their very own 529).

That additionally doesn’t embody my regular retirement investments. By default, I make investments 7% of my wage towards retirement, which is matched by my employer dollar-for-dollar for the total 7%. In different phrases, I’ve 14% of my wage mechanically invested into retirement (my husband has the same scenario along with his wage, too). Then I’m proposing an extra $15,000/yr in investments and financial savings unfold amongst HSA, FSA, 529, and 403B.

This alteration is approx. $4,000/yr increased than my contributions for 2023. A distinction of $153/paycheck. However is that sufficient? Or ought to I be aiming to extend this much more?

Pulled in one million instructions

I’ve numerous different shorter-term financial savings presently saved in CapitalOne360 financial savings accounts. By nature, I’m a “splitter” versus a “lumper” in terms of financial savings. This is the reason I’ve completely different financial savings accounts for thus many alternative issues. Presently, I’ve financial savings accounts for:

scholar mortgage financial savings. My unique plan was to avoid wasting a little bit every month till I had sufficient to repay one of many 4 scholar loans in full. However I simply dipped into these financial savings to assist cowl the overage from my automotive cost. Additionally, I’m unsure if I even wish to pay “additional” for my scholar loans….

automotive repairs or new automotive

emergency fund

journey/Christmas/enjoyable. I save a little bit every month so I can at all times pay money for something “massive” or “additional” we would do as a household. That is principally used for journey however may very well be used to assist fund Christmas items and experiences, or something that may be over and above to the place it will blow the month-to-month finances… I’ve financial savings only for that!

annual charges. Examples: life insurance coverage, automotive insurance coverage (paid bi-annually), HOA (paid quarterly), and many others.

In spite of everything my current residence repairs, people have additionally recommended budgeting and saving particularly for residence repairs, in order that may be an account so as to add (or perhaps change my scholar mortgage financial savings to “residence restore” financial savings…..)

One other thought I’m contemplating is to open a cash market account – one thing that’s not essentially long-term financial savings, however one thing that may yield a better rate of interest than my present financial savings. Whereas this may be impractical for the annual charges I frequently use and restock, it’d work nice for issues just like the Emergency Fund and New Automotive financial savings. Sure, I do know I actually simply paid off my automobile. And I plan to maintain it for fairly some time. However I’d LOVE to have the ability to purchase my subsequent automotive in 5-ish years with money totally debt-free! That appears higher saved in a cash market vs a financial savings account.

This stated, I actually don’t know the place to begin! I’ve by no means had a cash market account earlier than. Solely retirement accounts, the funding automobiles listed above (e.g., HSA, FSA, and many others.), and regular outdated financial savings accounts. I’d need one with low-to-no charges, however an honest fee of return. Any suggestions? I’ve longer-term (retirement) investments with Constancy and Vanguard already. Ought to I see about opening up a Cash Market account?

What are your ideas? What ought to be my subsequent massive aim or focus for financial savings and short- and long-term investments?

P.s. Editors observe: In case you are studying this and having some bother paying off debt, take into account trying out The Cash Precept’s article on a ten level framework for getting out of debt, its price a learn.

The put up Automotive Paid Off and New Monetary Objectives appeared first on Running a blog Away Debt.

[ad_2]

Source link