[ad_1]

Wolterk

The oil market is among the many few that gives a normal hedge in opposition to essentially the most vital dangers impacting shares and bonds. In 2021, the sharp rise in oil and fuel costs was a serious contributing issue to inflation, hampering the profitability of some shares and contributing considerably to the rise in rates of interest. This alteration could be seen clearly within the correlations of shares, bonds, and oil-producing shares. Previously, the S&P 500 was extremely correlated to the oil-producer fairness ETF (XOP) at a 0.8X correlation in 2021 (36-month rolling), however is all the way down to 0.5X at present. On the identical time, the correlation between the S&P 500 (SPY) and long-term bonds (TLT) has risen from -0.5X to +0.5X, whereas XOP and TLT have turn out to be uncorrelated.

For my part, though this level could seem technical, it is without doubt one of the most vital developments impacting monetary markets at present. Shares and bonds, nearly all the time negatively correlated, now transfer collectively because of their shared destructive publicity to inflation. Conversely, oil shares diverge from most different equities as a result of they’re among the many few that profit most straight from inflation. In fact, that can solely stay the case so long as oil market tightness stays a serious inflationary issue.

Key oil producers like Marathon Oil (NYSE:MRO) are a wonderful hedge funding in opposition to this threat issue. Marathon’s place as a major US-based oil producer offers it a key benefit within the geopolitically turbulent oil market. Additional, the corporate trades at a really low valuation and now returns large capital to shareholders. Relying on modifications to grease costs, Marathon Oil could have vital upside potential over the approaching quarters.

Marathon Stands to Profit From Oil Volatility

On Wednesday, Marathon printed its Q3 earnings report, beating barely on each EPS and gross sales. Most importantly, it generated $718M in free money movement, up 35% sequentially. Like many shale-oriented US producers, Marathon is within the midst of a transition from development to maturity. Over many of the previous fifteen years, it has aggressively expanded its place in shale oil, investing large capital, leading to a major glut in world oil manufacturing. Leading to low oil costs harmed income and elevated Marathon’s debt dangers.

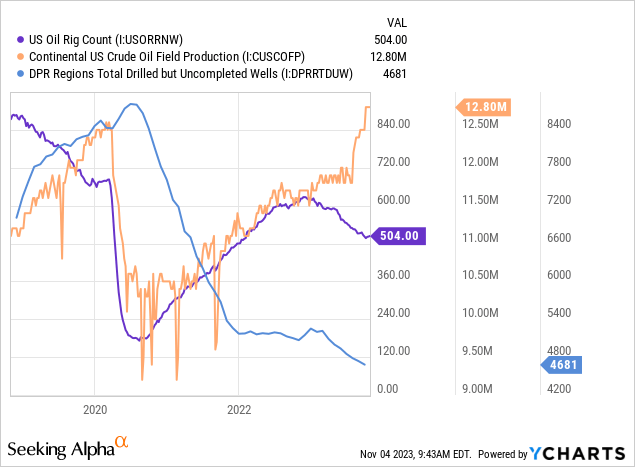

Nevertheless, since 2020, US oil shale manufacturing has slowed. For many of this 12 months, there was elevated debate relating to “peak shale,” with many executives seeing shale oil manufacturing topping out quickly or within the coming 12 months or two. Though US oil manufacturing is now again at pre-COVID ranges, a falling rig depend signifies that output mustn’t rise a lot additional as drillers give attention to high quality over amount. See under:

Substantial drilling reductions in 2020 led to an vitality market disaster of low provides and better gasoline costs. Because of this, producers resembling Marathon aggressively elevated drilling and utilized many “drilled however uncompleted” wells, that are a less expensive however restricted technique to enhance manufacturing. The numerous decline in oil costs over the previous 12 months has brought about most producers to scale back their drilling charges, often leading to decrease oil manufacturing. That stated, complete US manufacturing has continued to rise over latest months regardless of intense drilling because of renewed use of “drilled however uncompleted” wells. This pattern can proceed for a while, however not for greater than one other 12 months on the present tempo of “DUC” declines, which may even restrict manufacturing development additional out.

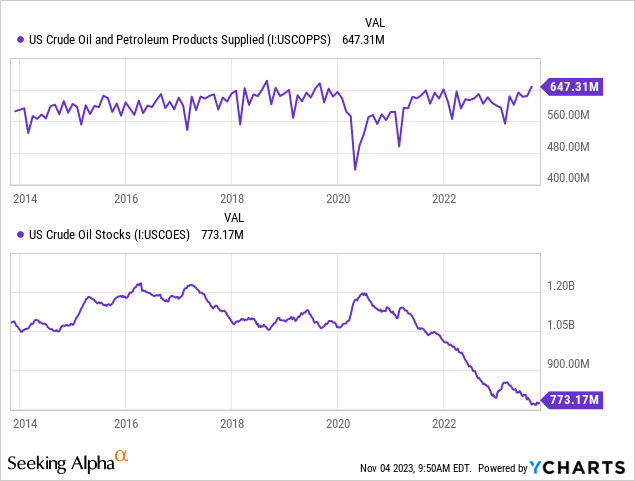

General, it isn’t completely correct to say that oil manufacturing has peaked, however drilling nearly actually has. At this time, positive aspects in oil manufacturing are because of the cost-effective completion of beforehand drilled wells. One 12 months from now, this can end in decrease manufacturing with out a rise in drilling. Nevertheless, it prices round $50-$70 to supply a barrel of oil in a brand new properly, so drilling isn’t too worthwhile with oil round $80. Naturally, increased manufacturing ought to end in decrease oil costs. That stated, the market can be supported by record-high demand, as seen within the newest “merchandise provided” determine. Moreover, complete US oil inventories are traditionally extraordinarily low at present, which means an exterior market shock would have a extra bullish impression than regular. See under:

For many of this 12 months, oil has been weighed down by the prospects of decrease oil demand because of slowing financial development. On the one hand, there’s a appreciable slowdown in family/shopper credit score and spending stability ranges, in addition to small enterprise stability. Conversely, GDP development is strong at present because of elevated US authorities spending and excessive fastened investments. Thus, versus the 2020-2022 “low demand, low provide” market, we’re now seeing a “excessive demand, excessive provide” market, which may have ambiguous impacts on oil costs.

As issues stand, there may be not essentially a transparent bullish or bearish bias on the oil market. As I’ve said in earlier oil markets, deterioration in “drilled however uncompleted” oil properly inventories, in addition to oil inventories, are vital long-term bullish elements; nonetheless, these elements have to be catalyzed by a speedy provide and demand imbalance. Russia and OPEC could pursue extra oil cuts, as mentioned, however there may be additionally some proof suggesting that Russia is distancing itself from OPEC.

To me, the most probably bullish catalyst for oil could be an enforcement of the US embargo on Iranian oil exports. Though the US has lengthy since enacted sanctions to attempt to cease Iranian oil exports, there was no efficient enforcement, inflicting Iran’s oil exports to rise by round 7X lately. Actually, Iran has been one of many fastest-growing main world economies over the previous 12 months. Unsurprisingly, the sharp enhance in Center Japanese instability over the previous month and Iran’s assist for Hamas has led to each a rise in requires enforcement of the Iran embargo and Iran calling for a counteracting OPEC+ embargo. Nevertheless, OPEC+ doesn’t presently assist that. Nonetheless, enforcement of Iranian oil exports seems considerably probably, probably blocking a major supply of worldwide oil and probably leading to a broader enhance in tensions amongst oil exporters. Nevertheless, as a result of China imports nearly all of Iran’s output, the US faces difficulties blocking Iran.

Modifications in oil costs primarily drive Marathon Oil’s efficiency. For my part, it’s unlikely we are going to see a pointy decline in oil costs as a result of that’s already leading to drilling cuts. Nevertheless, though it isn’t essentially a “excessive likelihood” state of affairs, I consider we might even see a “domino impact” of oil-impacting occasions within the Center East, primarily if the US seems to cease Iran’s major supply of earnings. For essentially the most half, oil has misplaced its “conflict premium.” To me, some premium is affordable, contemplating a blockade of key oil export delivery lanes might simply end in an enormous (~$50-$100) oil worth enhance as a result of the market is so supply-sensitive and world oil inventories are so low. Once more, even when this isn’t a “excessive likelihood” final result, traders ought to hedge in opposition to it as a result of it will likely be bearish for nearly all shares and bonds in addition to oil producers like Marathon.

Marathon Oil vs. Different Oil Producers

The macroeconomic state of affairs is comparatively bullish for all US oil producers as a result of declines in Iranian oil exports would naturally enhance income for US exporters towards Asia. To me, in a “no change” state of affairs, we are able to anticipate Marathon to proceed to earn the EPS and free money movement that it did in Q3. Based on the corporate’s metrics, its FCF breakeven oil worth ought to be round $45 per barrel in 2024, the bottom among the many bigger oil producers. Nevertheless, its pure fuel and liquid segments usually are not worthwhile because of low costs in these markets, so it solely earned round $12 in FCF per barrel of oil equal final quarter, which remains to be higher than most of its friends ($10 common).

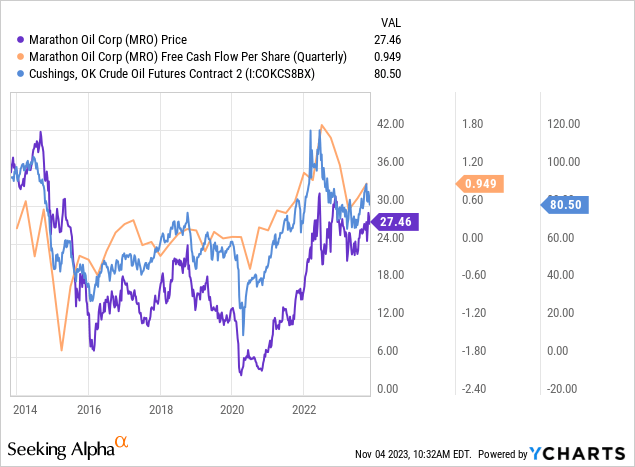

Round 82% of the corporate’s income comes from oil, with the remaining blended between pure fuel and liquids. To a fantastic extent, MRO’s worth and its free money movement per share are a direct perform of crude oil costs. See under:

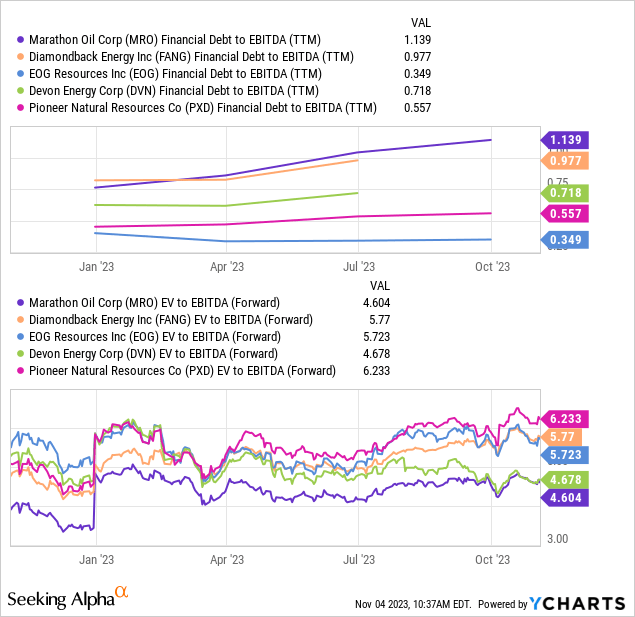

If we assume the oil market stays comparatively stagnant across the $75-$85 vary it has held over the previous 12 months, then Marathon ought to proceed to earn round $0.95 in FCF per share per quarter. Thus, it has a price-to-FCF of about 7.2X. Marathon additionally has the bottom ahead “EV/EBITDA” of its peer group but in addition has the best debt-to-EBITDA. See under:

Notably, “EV-to-EBITDA” accounts for leverage ranges, so though MRO is essentially the most leveraged amongst its friends, that alone doesn’t justify its valuation low cost. Additional, though its high-leverage place was a difficulty years in the past when it was dropping cash, it’s a profit at present as a result of it will probably now repay that debt fairly shortly, and its money flows are restored. Many traders would like if MRO’s dividend had been increased, but it surely nonetheless returns an immense quantity of capital to traders by means of share buybacks. See under:

Final quarter, MRO returned $608M to stakeholders by means of dividends, share buybacks, and modifications in debt (basically zero). For my part, dividend yields usually are not notably vital for long-term funding efficiency as a result of some firms pay dividends whereas elevating debt or promoting fairness, giving no precise profit to traders. Conversely, in Marathon’s case, its valuation is so low that it’s most cheap to make use of excessive FCF to purchase its inventory due to its discounted worth.

From my view, an organization’s true “yield” is its FCF-to-EV, or the amount of money generated after CapEx in comparison with its mixed fairness and debt worth, which is about 10% for MRO at present. In fact, if oil rises to $150 in a black swan occasion, its FCF (pre-tax) from oil ought to enhance by roughly 230% primarily based on its breakeven. I conservatively estimate that will enhance its quarterly FCF to round $1.5B per quarter after taxes, giving it a 25%+ FCF-to-EV. In fact, oil reached about $150 fifteen years in the past, so I’d personally not be shocked to see even increased oil costs in a world battle state of affairs, notably given abysmally low emergency stock ranges.

The Backside Line

General, I consider MRO is an efficient funding at present, given no change in geopolitical and macroeconomic circumstances. Its effectivity is stellar, and it’s cheaper than its peer group. Like most, it’s focusing away from development towards the return of capital to stakeholders. It trades at a a lot decrease valuation than most equities however is probably going extra steady given the state of affairs within the oil market. Thus, regardless of elevated geopolitical turbulence, I’m barely bullish on MRO. In fact, ought to the US look to dam Iran’s oil provide, or Iran look to dam Saudi oil exports to Israel (or the US), or, least probably, Saudi Arabia shift in opposition to the US and Israel (because it did within the Seventies), then oil might rise meteorically increased.

In that state of affairs, all American oil producers (north and south) would profit tremendously by being exporters who can produce away from turbulent markets. Marathon is my favourite massive US oil producer on this state of affairs. That stated, smaller US producers and South American firms in all probability have extra upside potential, albeit with extra quick dangers. For my part, though I don’t consider the likelihood of extra vital escalation occurring is just too excessive, the related threat for all different shares is nice sufficient that MRO (or others) could be a good way to hedge in opposition to it.

[ad_2]

Source link