[ad_1]

FICO held a two-day Telco MasterMind in San Diego final week, with subjects starting from upcoming financial forecasts to rising trade traits, the affect of widespread super-fast 5G adoption and the way the Web-of-Issues (IoT) is now shaping up. Debate at this inaugural occasion centred on 4 crucial areas which might be set to form the trade for years to come back.

1. Financial Fears and Client Spending Issues Inform Telco Plans

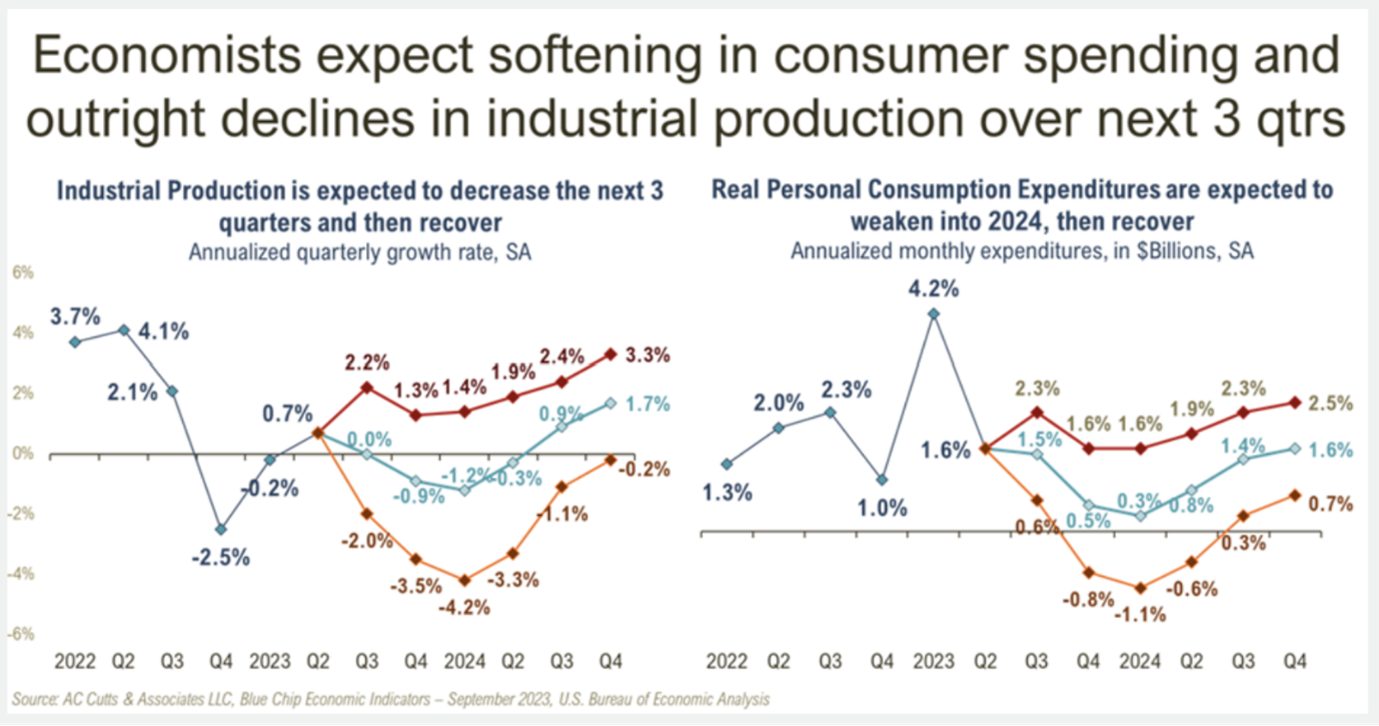

A consensus of financial views pointed to fears that industrial manufacturing and private discretionary spending might soften throughout the subsequent 12 months or so.

Whereas there’s confidence that shopper spending — the US economic system’s important driver — received’t deteriorate an excessive amount of, there are clear indications of a continued squeeze on family earnings underlined by rising bank card balances and delinquencies. The affect is in flip anticipated to circulation via to diminished shopper spending, though there are robust hopes a big recession may be averted. Some individuals expressed considerations that the US labor market can also soften.

Regardless of telco payments being a family necessity for a lot of clients, the knock-on affect of diminished spending is prone to hit all the things from bundled subscription renewals to delays on shopping for choices round new handsets.

2. Buyer Retention Initiatives Feed an Urge for food for Telco Apps

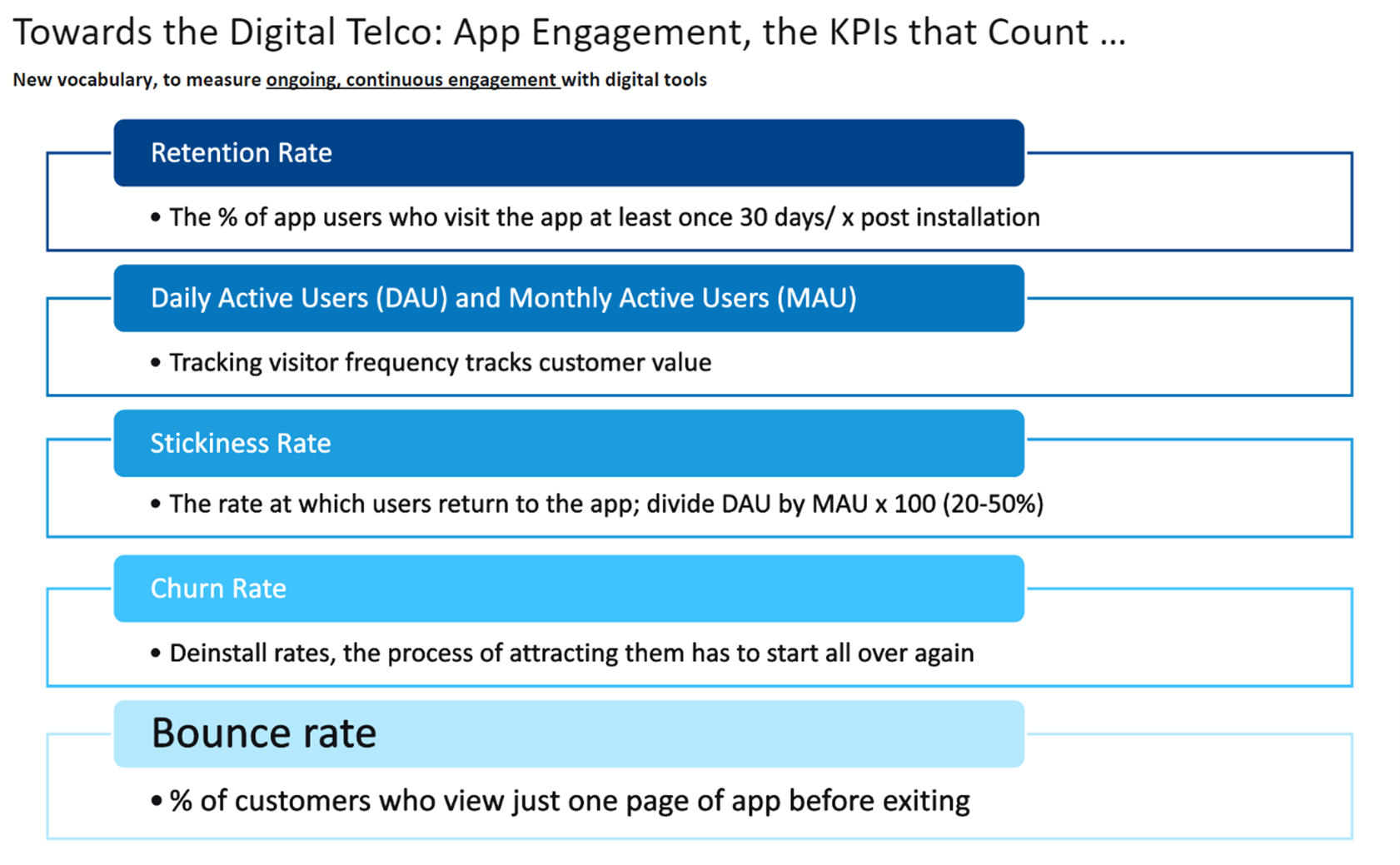

It’s extensively accepted that many US carriers are behind their worldwide counterparts in relation to instantly incorporating digital engagement evaluation into metrics wanted to determine telcos’ “finest clients”.

Now, many main telco manufacturers are launching digital apps to assist drive higher engagement technique with customers — and observe all subsequent touchpoints and transactions. Inside telcos’ back-offices there’s now a transparent urge for food to include detailed evaluation and extra granular measures to evaluate all the things from digital engagement, retention, loyalty, stickiness and churn to so-called “bounce” – exercise typified by acutely price-sensitive clients leaving straight after a single internet web page.

On the similar time, larger app adoption can be anticipated to assist present a springboard for telcos’ creation of digital marketplaces, with loyal clients frequently supplied aggressive tariff offers, upgrades on shopper tech — tablets and good watches to enrich their telephones — in addition to associated monetary companies.

In Europe, it was famous that suppliers had been now providing all the things through their apps for Disney+ and associated streaming companies, to Amazon Prime, McAfee safety bundles, journal subscriptions, to chose companions’ white-label monetary companies.

Each provide tabled has the potential to win or retain extra clients whereas additionally safeguarding market share.

3. AI and Different Improvements Current New Alternatives

A whole lot of effort is already being invested in enterprise-wide finest practices round AI adoption, collections and two-way digital communications, fraud and system financing. Within the discussions amongst telco leaders at our occasion, these had been the details round innovation:

The accountable use of AI and machine studying is now deemed obligatory to assist suppliers higher perceive buyer conduct and guarantee extra predictive outcomes to up-sell, cross-sell and advertising and marketing exercise.Continuous use of A/B testing can be very important to assist refine omni-channel messages and drive two-way digital dialogue with clients in relation to tackling threat, late funds, and larger product penetration. Cox Communications is a flagship pioneer in its use of omni-channel communications to effectively drive collections and income. It has already seen mobile-first engagements — electronic mail, textual content, and IVR — ship a US$2 million discount in prices, a 40% enhance in buyer self-service funds, and a 50% discount in name centre transactions.Fraud is an enormous problem in telcos’ digital channels. However it’s a really delicate space, given the comparatively low tolerance clients have for high-friction approval and onboarding processes. Among the many key initiatives highlighted had been utilizing hyperlink evaluation to detect organised crime and fraud rings, larger co-operation and sharing of so-called “sizzling lists” to flag identified fraudsters and definitive routes to “no move” authentication — when suspicious candidates and potential scammers are instructed to indicate up at their nearest supplier’s outlet in individual in the event that they want to proceed with the transaction.Given the relentless rise within the prices of cellular handsets, it’s clear reinventing system financing is a precedence for a lot of for telcos. In an ultra-competitive market, suppliers’ means to harness the facility of mathematical optimization and simulation will now be a key differentiator. It is going to probably be utilized to pricing, different deal buildings and aggressive buyer provides — most notably once they’re underpinned by acceptable curiosity charges utilized to future gross sales of costlier smartphones.

4. Enhancing Margins Comes from Monetizing Telco Knowledge and IoT Companies

Telco leaders on the summit mentioned the mass of quickly looming alternatives supplied by the increasing IoT, together with the anticipated Zettabytes of knowledge it creates, will ship a number of recent earnings streams.

The problem for carriers is enhancing their monetization of the data and insights on provide.

Crucially, siloed considering, siloed working, legacy expertise and regulatory challenges throughout an enterprise pose the best obstacles to efficiently rising margins at pace and scale. Improved digital engagement, new enterprise fashions and the rising earnings streams that journey on high of IoT companies, together with new trade partnerships, are already serving to modern telcos higher monetize their very own knowledge and infrastructure.

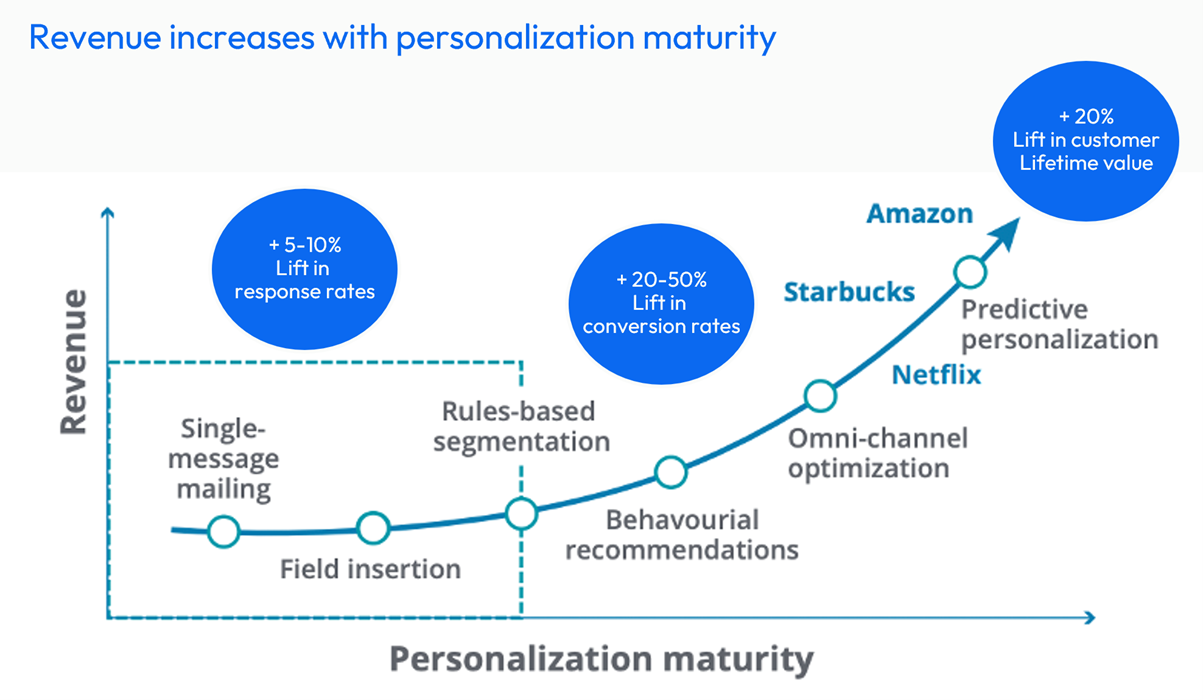

However it’s the correct concentrating on of the “section of 1” throughout the client lifecycle that’s very important. Telcos merely don’t all the time know who they’re coping with or have a transparent image of their clients at a family stage. As an illustration, Dad might have purchased a bundled household deal so he can watch reside sport on the go. Mother might favor films and re-runs of Downton Abbey, whereas the household’s two youngsters favour music streaming and making TikTok clips.

Success in monetizing this kind of family alternative hinges on utilizing a suitably designed expertise platform to ship granular insights and knowledgeable methods for purchasers, processes, and pricing provides. It’s an space FICO has championed for 1000’s of purchasers throughout the globe.

How FICO Is Serving to Telcos

To be taught extra about how we’re serving to telcos throughout the globe, click on on the hyperlinks beneath.

[ad_2]

Source link