[ad_1]

Let’s say that you’re holding shares in a blue-chip firm. The inventory has executed properly in the previous couple of years. However, you want a approach to generate extra revenue. You can at all times promote your shares, however you suppose the inventory will proceed to extend in worth. So that you wish to maintain onto the shares. So, how do you earn a living from the inventory with out promoting your shares?

Right here is methods to unlock the hidden potential.

Dividends: The Energy of Compounded Reinvestment

If the inventory you might be holding pays dividends, you possibly can merely do nothing. Simply sit again and reinvest the funds. This tried-and-true methodology lets you reinvest your earnings again into the very shares that generated it. You get the good thing about your portfolio rising exponentially. This works properly.

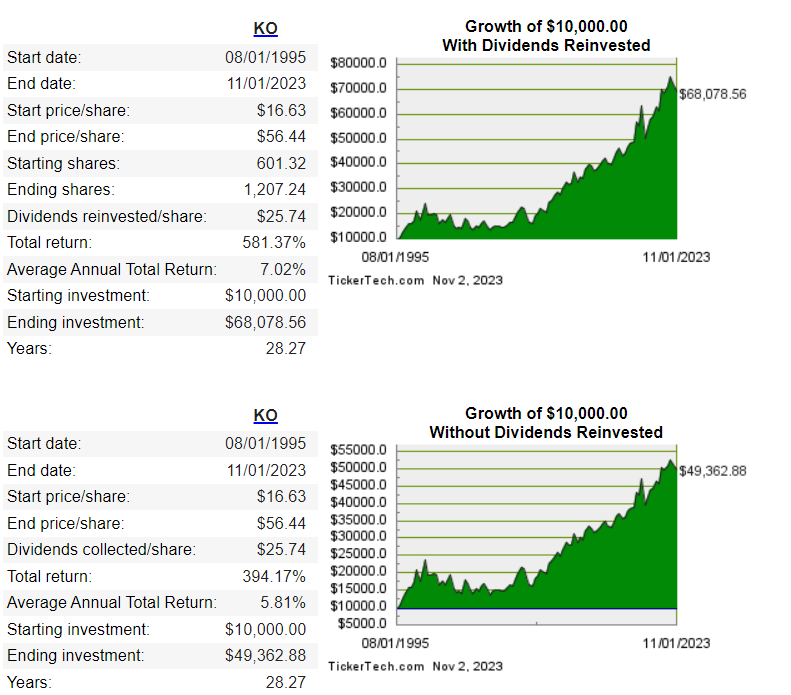

Listed below are a few comparative charts. They present the expansion of the Coca-Cola firm during the last 28 years. The lengthy and wanting it’s that when you merely let the inventory sit and compound and also you reinvested all of your dividends, you’d have roughly doubled the variety of shares you personal and elevated the worth from 49 thousand to 68 thousand.

Picture courtesy of Dripreturnscalculator.com

So, one approach to earn a living from shares with out promoting them is simply to carry the shares and acquire the dividends, or allow them to reinvest.

Promote Your Share’s Voting Rights: Shareholder Vote Alternate

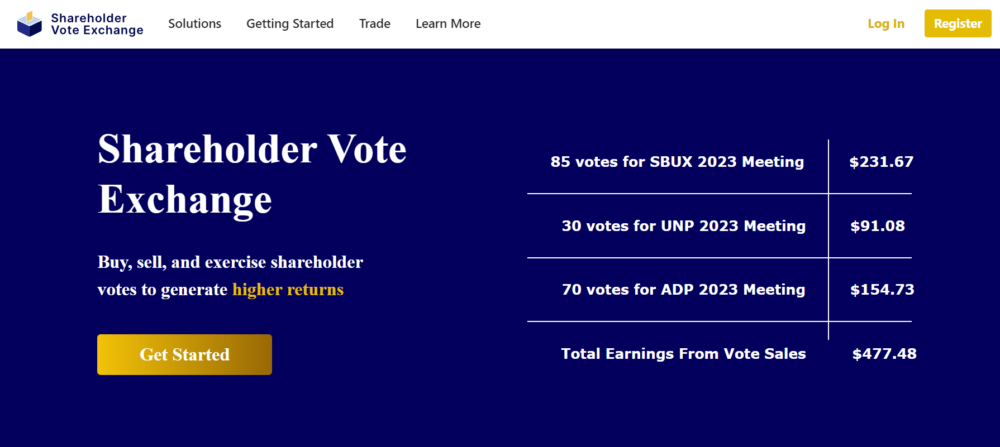

An alternative choice is promoting your votes.

Should you’ve held inventory for some time, you’ll know that possession offers you the suitable to vote on company issues of relevance. Nicely, do you know it’s attainable to purchase and promote your votes?

The shopping for and promoting of shareowner votes was made authorized by the landmark 2001 Delaware case (Hewlett v. HP). In Hewlett vs. HP the presiding decide dominated that, in precept, vote shopping for is authorized. Nevertheless, the follow has not been widespread attributable to technological limitations in creating an environment friendly marketplace for shopping for and promoting votes.

That is altering. Firms like Shareholder Vote Alternate make this attainable. This can be a win-win scenario, the place you enable others to buy your votes on a one-time foundation by way of a bidding system and also you get extra cash in your pocket. Sure, you continue to hold management of your shares. In some circumstances, votes could be fairly profitable – ranging between .13 cents and $1.23 relying. Within the occasion that you’ve got a whole lot or hundreds of shares, promoting votes may very well be a great way to earn a living from shares with out promoting them.

You may join The Shareholder Vote Alternate right here. Or click on on the button under:

Promote Your Inventory's Voting Rights Right here

Lending Your Shares by way of Brokerage Lending Packages: Passive Revenue on Steroids

One other good technique that that lets your shares be just right for you even whenever you’re not actively buying and selling is lending your shares.

Many of the main brokerage corporations, like Schwab or Constancy, have applications that mean you can lend your shares. The businesses want the shares to satisfy the demand for brief promoting.

These applications often have particular names. In Schwab’s case, it’s referred to as the “Absolutely paid Program”. In Constancy’s case, it’s referred to as ‘Full paid lending”.

Listed below are some fast factors about these lending applications:

There may be often an software course of. It’s important to speak with an actual individual.

Most brokerages have web price necessities. They wish to ensure you need to manage to pay for to know what you’re doing.

You usually retain financial management of your shares. You may at all times cancel this system when you’re not joyful.

The brokerage home will usually pay you curiosity on the loaned shares. Curiosity will range primarily based on the safety in query. Normally, the curiosity accrues every day and is paid month-to-month.

Normally, you’ll nonetheless get your dividend funds or money in lieu of the dividend

It’s like having a tireless monetary assistant that generates income around the clock. So, with this feature, sit again, chill out, and let your shares do the heavy lifting!

Promoting Choices: Strategic Maneuvers for Most Beneficial properties

Third on the checklist of how to earn a living out of your shares with out promoting them is buying and selling choices. This superior method lets you revenue from market actions with out relinquishing possession.

When individuals speak about choices, they’re referring to monetary devices which are primarily based on the worth of the underlying inventory. They’re principally contracts that supply consumers the chance to purchase or promote the underlying asset at a selected worth. Not like futures contracts, consumers of choices contracts don’t have to purchase or promote the asset in the event that they determine towards it.

Every choices contract could have a selected expiration date – the contract holder should train their choice by this date. The particular worth is commonly referred to as the “strike worth”.

Like shares and bonds, choices are often purchased or offered via brokerage corporations.

With the suitable technique, choices allow you to seize alternatives and increase your earnings potential.

Last Thought – What If You Don’t Maximize the Worth of Your Shares?

As a last thought – think about doing a thought train. Ask your self this: what occurs when you don’t maximize the worth of the shares you personal? What would occur when you didn’t reinvest your dividends, promote or your votes, or lend your inventory? What could be the 1-year end result? The five-year end result? The ten-year end result?

The reply to those questions ought to assist you see if any of those choices make sense for you.

As at all times – don’t neglect, that no person will care as a lot about your cash as you do.

Disclaimer: Keep in mind, investing entails dangers, and it’s essential to do your individual analysis or seek the advice of a monetary advisor earlier than making any choices. The methods talked about above is probably not appropriate for all traders and may end up in vital monetary losses. All the time proceed with warning and think about your particular person circumstances.

[ad_2]

Source link