[ad_1]

The New York Metropolis Division of Shopper and Employee Safety (NYC DCWP) simply launched an up to date proposed modification to its guidelines referring to debt assortment. This up to date modification adjustments considerably greater than the primary proposed modification launched by NYC DCWP final yr. Apparently, this replace comprises revisions which are much like the New York Division of Monetary Companies (NYDFS) proposed amendments to New York’s debt assortment legislation, 23 NYCRR 1, that NYDFS launched final yr. After receiving a lot of feedback to the proposal, together with a remark from TrueAccord, NYDFS paused the rulemaking and has not but launched any revised proposal. Each of those departments, NYDFS and NYC DCWP ought to change their proposed amendments to provide New Yorkers the identical digital communication advantages all non-New Yorkers obtain.

The NYC DCWP and NYDFS proposed amendments are designed partially to align with the federal Shopper Monetary Safety Bureaus’s Debt Assortment Rule, Regulation F, that took impact in November 2021. Despite the fact that customers usually favor to speak digitally, the NYDFS and NYC DCWP up to date proposals are extra strict than Regulation F, notably because it pertains to the proposed restrictions on digital communications. Whereas trying to supply extra protections for customers when debt collectors attain out utilizing digital channels, these NYDFS and NYC DCWP restrictions create unintended penalties that increase limitations for NY customers to correspond with assortment businesses of their channel of choice and hinder communication efforts. The impact will increase the variety of lawsuits introduced in opposition to NYC customers and in the end enhance the price of credit score for all customers throughout the US to offset New York losses.

As an organization that predominantly leverages digital communications for just about all elements of our buyer interactions, TrueAccord has distinctive expertise and knowledge from serving over 20 million customers, which showcases the advantages of digital communication in collections. Small edits to those proposed amendments can have the identical desired impression (defending customers from a barrage of digital debt assortment messages) with out limiting the flexibility of debt collectors to proactively attain out—actually, each the federal debt assortment rule, Regulation F, and Washington, DC’s latest debt assortment legislation amendments prohibit the frequency of outbound digital communications and embrace particular necessities for opt-outs on all communications with extreme penalties for failing to honor a client’s request.

On this two half weblog collection, we discover the provisions in these proposed amendments that concentrate on restrictions on digital communications, the unintended penalties to customers when legal guidelines require opt-in as an alternative of opt-out guidelines for debt collectors, and the way the proposals could possibly be modified to perform the identical consequence with out putting limitations on customers potential to speak of their channels of choice. This primary installment focuses on the provisions of the legislation, customers choice for digital communications, and the small adjustments that could possibly be applied earlier than these amendments are last. The second installment seeks to supply details about the advantages of digital communications for customers in all different states and jurisdictions—besides New York. In case you are impacted by the present NYC proposal, contemplate talking on the upcoming listening to (just about or in individual). Data on the best way to register is beneath.

Proposed New York State and New York Metropolis Amendments

Three proposed amendments, two completely different departments, two completely different jurisdictions, and potential unintended penalties that may hurt customers. Let’s begin by evaluating the completely different proposals by jurisdiction.

New York’s Method to Digital CommunicationsThe New York debt assortment legislation, 23 NYCRR 1, which took impact in 2019, already restricted the flexibility of a debt collector to achieve out proactively to customers through electronic mail with out first having direct specific consent from the patron. Because of this a debt collector should first name a client to acquire consent earlier than the collector may ship an electronic mail message in regards to the account. Whereas a debt collector can ship proactive emails in an effort to acquire consent, to adjust to the legislation these emails can’t reference the explanation why a client would wish to opt-in to speak by electronic mail with the corporate, (i.e. a few late account) and can’t even reference details about the account. So, they in the end sound like spam.

For instance, if a client acquired a message from an organization they have no idea, with none details about why the corporate is reaching out and asking for consent to electronic mail, why would a client opt-in?

The consequence, not surprisingly, is that New York customers who had already opted in to speak through electronic mail in regards to the account with the creditor would, after falling behind on funds and being referred to a debt collector, solely obtain cellphone calls and letters from debt collectors.

New York’s First Proposed AmendmentDecember 2022 NYDFS launched its first proposed modification to its debt assortment guidelines. Feedback have been due February 13, 2023. The primary New York proposed modification additionally by no means grew to become last. The modification included the next:

Revised definitions of communication, creditor and debt and a brand new definition of digital communication

Revised necessities for the validation discover, together with that the preliminary communication should be made in writing to keep away from having to ship one other written communication inside 5 days of the preliminary communication

Revised requirement that the validation discover can’t be made by digital communication however could also be made within the type requested by a client to part 601-b of the Common Enterprise Legislation

Revising the disclosure necessities for money owed which have handed the statute of limitations for the aim of submitting a lawsuit

Revisions to the substantiation necessities, together with a 7 yr retention interval and requirement to supply full chain of title

Revisions to the requirement for a debt collector to acquire consent from a client earlier than emailing, together with, extending the consent requirement to textual content messages, requiring the consent to be given in writing and retained for 7 years, requiring digital communications to incorporate clear and conspicuous opt-outs, requiring collectors to honor such opt-outs, and explaining opt-outs are efficient upon receipt

New provisions protecting the connection with different legal guidelines, clarifying, for instance, that native legal guidelines aren’t inconsistent with this legislation in the event that they afford larger protections

New part on severability making clear that if any court docket guidelines one part of the legislation to be invalid, it doesn’t invalidate the opposite sections of the legislation

The proposed adjustments to Part 1.6(b) search to increase the prohibition on a debt collector to achieve out proactively to customers through electronic mail with out first having direct specific consent from the patron to textual content messages. This limits the one digital channel at the moment out there for proactive outbound debt assortment communications with customers in New York.

New York Metropolis’s Method to Digital CommunicationsNew York Metropolis’s debt assortment legal guidelines didn’t comprise any restrictions on digital communications. However, after the New York legislation limiting proactive emails took impact in 2019, New York Metropolis customers who had already opted in to speak through electronic mail in regards to the account with the creditor would, after falling behind on funds and being referred to a debt collector, solely obtain cellphone calls and letters from debt collectors.

New York Metropolis’s First Proposed AmendmentNovember 2022 NYC DCWP launched its first proposed modification to its debt assortment guidelines, feedback have been due December 5, 2022. These first NYC proposed amendments contained adjustments to align their legal guidelines with these of New York, nonetheless, the proposals by no means grew to become last. The amendments included the next:

Revised the out of statute disclosure businesses should present on communications with customers whose accounts have handed the statute of limitations for the submitting of a lawsuit to get well the debt

Revised necessities for debt collectors to take care of data of tried communications, complaints, disputes, stop and desist requests, calls, together with what calls are recorded and never recorded, credit score reporting, unverified debt notices, and communication preferences (if recognized) in addition to unsubscribes or opt-outs from explicit channels

New definitions for tried communication, digital report, digital communication, clear and conspicuous, language entry companies and restricted content material message

New prohibition on digital communications except the debt collector despatched the preliminary communication with the validation discover by mail and the patron opted in to digital communications with the debt collector instantly and clear and conspicuous opt-outs with out penalty or cost on all digital communications

Revised unconscionable and misleading practices to incorporate: including tried communications wherever communications appeared, corresponding to including tried communications to the extreme frequency prohibition

New prohibition on social media platform communications except the debt collector obtains consent and communicates privately with the patron

New guidelines on necessities previous to furnishing info to credit score reporting businesses

Revised validation discover disclosures and obligations for translating, if notices are supplied in several languages

New York Metropolis’s Revised AmendmentNovember 2023 NYC DCWP launched an up to date NYC proposed modification. Feedback could be submitted by means of November 29, 2023. A listening to might be held that very same day at 11AM. The up to date model comprises all the adjustments recommended within the first proposal in addition to:

Extra revisions to what info is required to be maintained in debt assortment logs that may require main adjustments to all assortment software program programs

Extra new definitions for coated medical entity, monetary help coverage, itemization reference date, unique creditor and originating creditor

Clarifies that any communications required by the foundations of civil process in a debt assortment lawsuit don’t depend towards frequency restrictions

New disclosures for medical money owed in addition to particular therapy of medical accounts, corresponding to validation procedures and verification of coated medical entity obligations previous to collections

These amendments align the New York Metropolis legislation to that of New York. If these amendments turn into last, New York might be an opt-in jurisdiction as an alternative of an opt-out jurisdiction, that means debt collectors should talk by phone or letter to acquire consent to textual content or electronic mail, even when a client already opted into digital communications about their account. This places New Yorkers at a drawback from customers in all different states who’re capable of talk electronically below the provisions of the federal Honest Debt Assortment Practices Act (FDCPA) and Regulation F.

Decide-Out Jurisdictions Supply Customers the Identical Protections

The remainder of the US have approached debt assortment makes an attempt through digital communications very in another way from New York. For all customers outdoors of New York, debt collectors might ship proactive debt assortment communications through electronic mail or textual content messages. The legal guidelines require all digital communications comprise clear and conspicuous opt-out strategies (unsubscribe flows in emails and “reply STOP to opt-out” in textual content messages) with strict penalties for debt collectors who don’t honor a client’s request to opt-out of digital communication channels. Digital communications additionally fall below the frequency limitations of the FDCPA and Regulation F.

Just one different jurisdiction to this point has created extra restrictions associated to digital communications that exceed the protections within the FDCPA and Regulation F. Washington, DC amended their debt assortment legislation Defending Customers from Unjust Debt Assortment Practices Modification Act of 2022, and the adjustments that took impact in January 2023. DC stays an opt-out jurisdiction with particular necessities for opt-outs on all electronic mail and textual content communications with extreme penalties for failing to honor a client’s request, but in addition added a particular frequency limitation on digital communications. Debt collectors are solely permitted to ship a client one digital communication per week—one electronic mail or one textual content message (one time in a seven day interval). A debt collector might solely talk digitally multiple time per week after a client opts-in to extra digital communications.

In consequence in these opt-out jurisdictions, customers can nonetheless obtain the digital communications they like with out having to have cellphone calls trying to get them to opt-in to digital communications, just like the customers in New York. Moreover, with these opt-out jurisdictions customers find out about their account quicker, can discover choices on their very own time, and obtain the extra advantages that include early communication about their money owed—corresponding to establishing a fee plan, having a credit score reporting tradeline up to date or deleted, offering proof of fraud or id theft, and disputing all or parts of the steadiness. New York customers who don’t reply their telephones are much less prone to obtain these advantages that include realizing there’s a debt in assortment and the choices to resolve.

In the end, New York nonetheless has time to amend their proposals to make sure their customers obtain the identical therapy as all different customers within the US.

Customers Desire Digital Communication

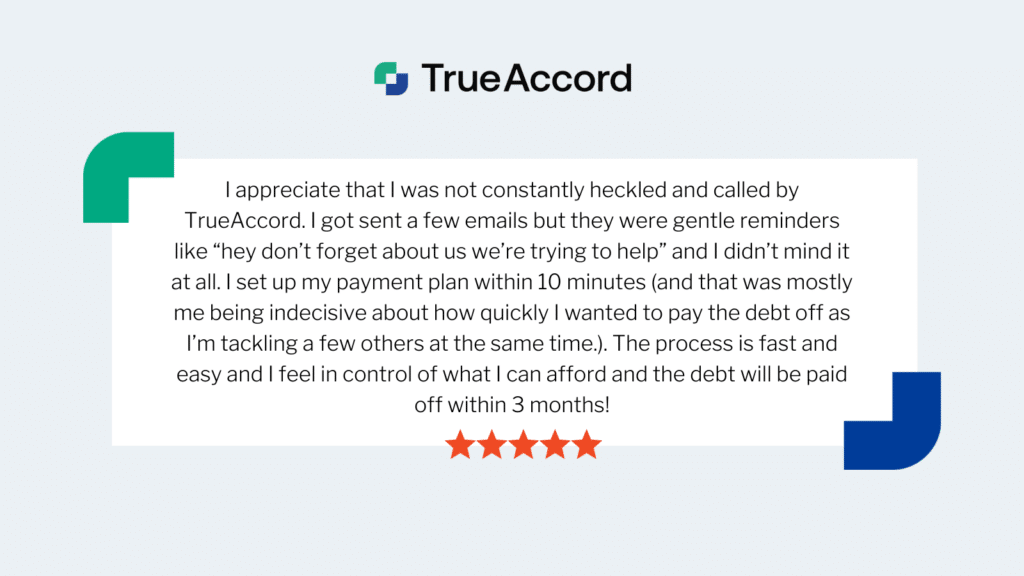

By and huge, customers favor to speak with their assortment businesses digitally—they already predominantly talk with their banks, collectors, and lenders digitally, so digital assortment is a easy transition. For instance, virtually all TrueAccord communications with customers (93%) occur digitally with no agent interplay as a result of the digital communications comprise hyperlinks to on-line pages the place customers can take motion on their accounts. In actual fact, greater than 21% of customers resolve their accounts outdoors of typical enterprise hours—earlier than 8AM and after 9PM—when it’s presumed inconvenient to contact customers below the FDCPA. In actual fact, customers usually put up publicly about their optimistic expertise with digital collections:

We imagine limiting digital strategies to achieve and serve customers will drawback susceptible populations of customers who primarily conduct most of their affairs digitally. In response to the Pew Analysis Heart, “reliance on smartphones for on-line entry is particularly frequent amongst youthful adults, lower-income People and people with a highschool training or much less.” As the patron described above, TrueAccord’s method of sending digital communications helps customers simply navigate to our web site and carry out actions at their comfort on-line.

We’ll proceed to discover the impression of those proposed amendments within the second weblog put up of this collection, together with how:

Limiting digital communication use hurts all customers

A number of opt-in necessities burden customers

Non-digital communications could be disruptive to customers

E mail and textual content messages are a step ahead in client safety

Register to Converse on the Upcoming Listening to

Signal as much as communicate for as much as three minutes on the listening to by emailing [email protected]. You would not have to be current on the listening to to talk if you happen to be a part of the video convention utilizing this hyperlink, https://tinyurl.com/z3svub58, assembly ID: 255 089 803 499 and passcode: 8HGNSw.

[ad_2]

Source link