[ad_1]

Marco Bello

ARK Genomic Revolution ETF (BATS:ARKG) is an actively managed fund with a pointy concentrate on genomic innovation. It seeks to drive long-term capital development by means of strategic investments in a various vary of sectors: healthcare, data know-how, supplies, power, and shopper discretionary. Key funding applied sciences embody CRISPR, focused therapeutics, bioinformatics, molecular diagnostics, stem cells, and agricultural biology.

This report goals to meticulously look at the ARKG fund’s buying and selling actions. We highlight developments in particular person holdings, assessing their potential to considerably affect the ETF’s efficiency. A crucial facet of this evaluation is gaining insights into the fund administration workforce’s decision-making processes.

Investor Advisory: For knowledgeable funding choices, thorough session of the detailed ARKG fund data is really useful. Entry complete information and insights right here: https://ark-funds.com/

High Holdings

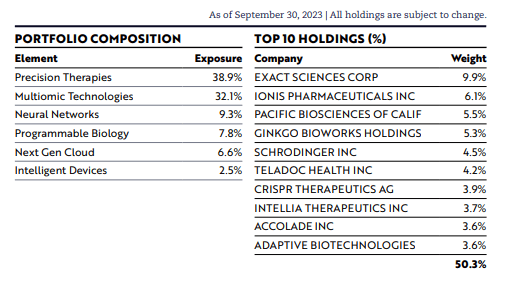

At September thirtieth of 2023, the ARKG fund is constituted by the next holdings:

ARK

The fund’s portfolio reveals a notable focus, with its high 10 holdings representing about half of its whole worth, a slight decline from 54% within the earlier quarter. This focus is evidenced by the soundness of its largest investments: Precise Sciences stays the main holding, whereas Ionis Prescribed drugs has risen to second place, adopted by PacBio and Ginkgo. Though there’s been some reshuffling inside the high 10, no new entries or exits had been noticed, indicating a interval of relative stability within the fund’s key investments.

Shopping for exercise

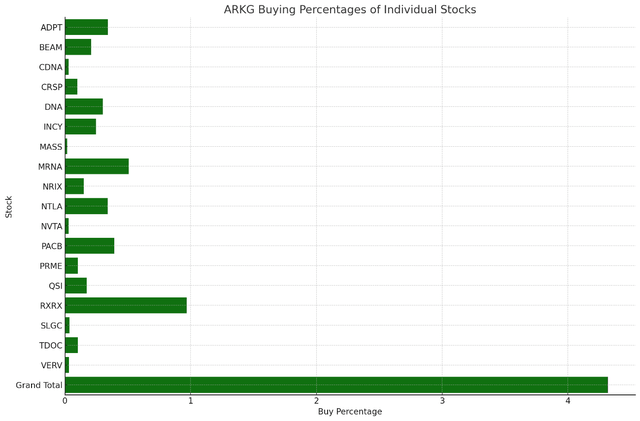

Now, let’s flip our consideration to the shopping for exercise. Within the final quarter, the fund’s managers purchased shares amounting to over 4% of the fund’s whole worth. This shopping for spree was notably targeted on 4 shares: Recursion (RXRX), Moderna (MRNA), Pacific Biosciences (PACB), Adaptive Biotechnologies (ADPT).

Creator’s computations primarily based on firm filings

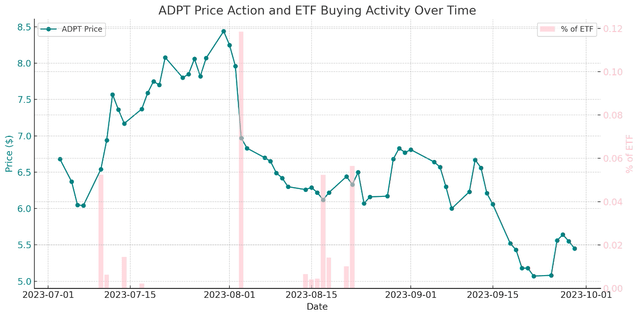

These 4 shares accounted for half of the fund’s shopping for exercise, providing insightful glimpses into the fund’s technique. Pacific Biosciences, holding 5.5% of the fund’s portfolio, is a distinguished funding, suggesting robust confidence in its development prospects. Adaptive Biotechnologies, with a 3.6% portfolio share, sits comfortably within the fund’s upper-middle tier, persevering with the pattern from the earlier quarter.

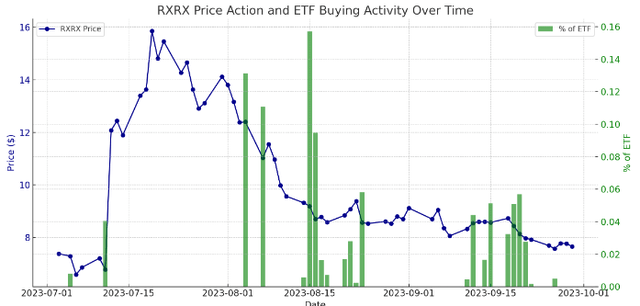

Recursion Prescribed drugs, although not but within the high 10, emerged as a key participant. It is a comparatively smaller place in comparison with PACB and ADPT however has witnessed essentially the most important funding from the fund within the third quarter. This improve in funding, particularly following a inventory value slide, underscores the fund’s robust conviction in Recursion’s potential. For a deeper evaluation of Recursion’s place and prospects, additional detailed data is accessible right here.

Creator’s computations primarily based on firm filings

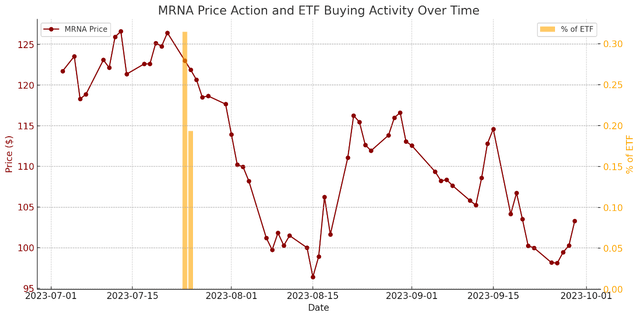

Moderna, whereas a smaller holding compared to the opposite three shares mentioned, presents a singular case. This quarter, the fund’s appreciable investments in Moderna marked it because the second-largest acquisition, a transfer that seems extra about strategic positioning relatively than excessive conviction.

Creator’s computations primarily based on firm filings

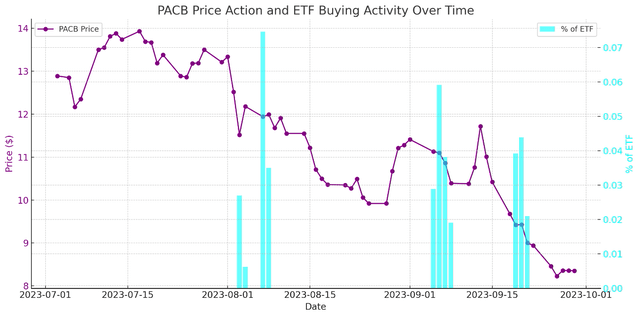

In distinction, Pacific Biosciences stands out as one of many fund’s most assured picks. The current launch of its Revio sequencing platform, with promising preliminary outcomes, has solely strengthened this place. My detailed evaluation on PacBio, out there elsewhere, delves deeper into this. The fund’s technique of accelerating its stake in Pacific Biosciences as costs dropped aligns with ARKG’s typical method.

Creator’s computations primarily based on firm filings

Adaptive, the fourth largest acquisition this quarter, additionally adopted the sample of shopping for on dips, elevating it to a high 10 holding within the fund.

Creator’s computations primarily based on firm filings

General, the purchases of Recursion and Pacific Biosciences are notably noteworthy. These shares have been long-term additions to the fund, and their current developments have solely heightened their significance within the portfolio. buyers ought to hold monitoring them.

Promoting Exercise

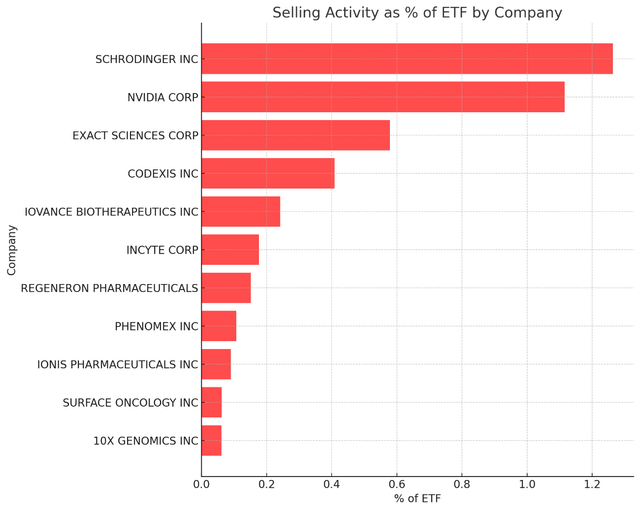

Over the past quarter, the fund engaged in important promoting exercise, notably lowering holdings of Schrodinger (SDGR), Nvidia (NVDA), Precise Sciences (EXAS) and Codexis (CDXS).

Creator’s computations primarily based on firm filings

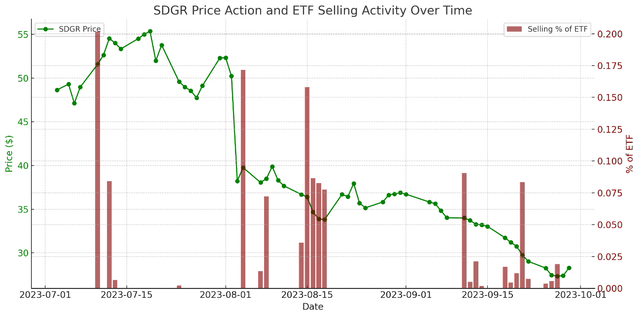

Schrodinger, regardless of being the biggest sell-off, stays inside the fund’s high ten holdings. This means that the sale was pushed extra by the inventory’s appreciation relatively than a diminished perception within the firm’s prospects. The fund typically adopts this technique, as indicated by the accompanying chart. Nonetheless, the dimensions of promoting implies a average conviction in Schrodinger, particularly when in comparison with the ARK’s tendency to take care of excessive conviction shares at round 10% of the portfolio.

Creator’s computations primarily based on firm filings

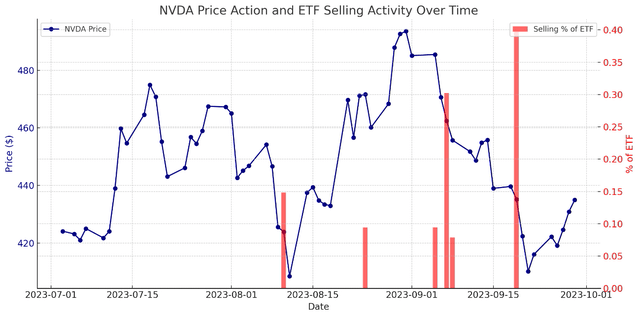

Nvidia’s sale was the second-largest. Cathie Wooden’s earlier remarks about Nvidia not being the fund’s most well-liked alternative for AI chips, notably given its present valuation, gives context for the substantial sell-off throughout this quarter’s bullish market. This aligns with the fund’s strategic method to portfolio administration, adapting to market valuations and efficiency developments.

Creator’s computations primarily based on firm filings

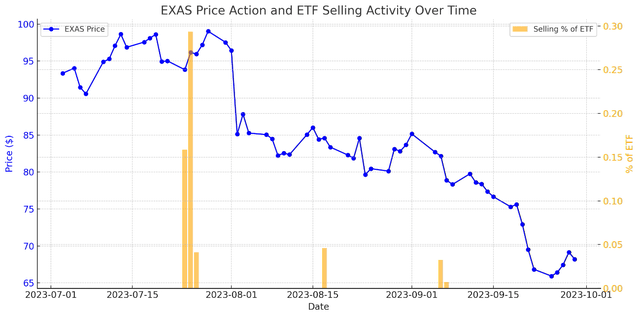

Precise Sciences mirrored Schrodinger’s promoting sample, but the fund maintained its remaining stake near 10%. This technique suggests a robust conviction in Precise Sciences, an inference supported by my detailed evaluation of the inventory out there elsewhere.

Creator’s computations primarily based on firm filings

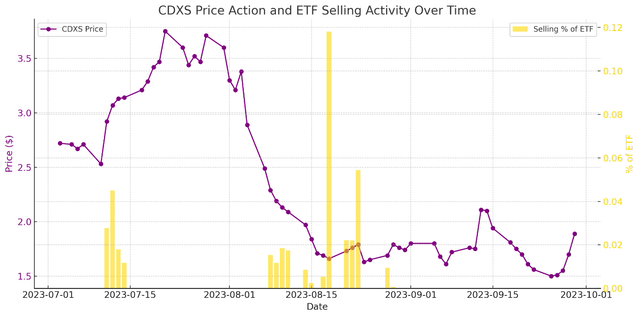

Codexis, nevertheless, stands out as an exception. Not like the others, it was bought throughout a interval of weak point, probably indicating a lower in confidence within the firm. As of this writing, Codexis is now not a part of the fund’s portfolio, additional emphasizing this shift in sentiment. This divergence in method highlights the fund’s dynamic funding technique.

Creator’s computations primarily based on firm filings

Predominant conclusions for ARKG

After reviewing the fund’s second-quarter exercise, eight firms emerge as key gamers: Adaptive, Recursion, Moderna, PacBio, Nvidia, Precise Sciences, Codexis, and Schrodinger. PacBio and Recursion are highlighted as robust conviction buys, made throughout value weaknesses, indicating a agency perception of their potential. Schrodinger’s sale seems tactical, capitalizing on power to reallocate assets, whereas the sale of Precise Sciences appears extra like a minor adjustment relatively than a strategic shift.

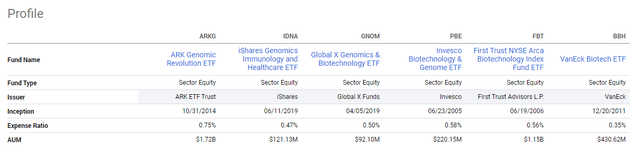

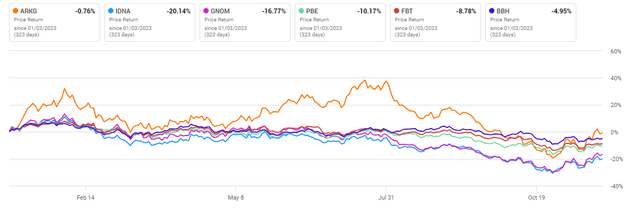

Nonetheless, it is essential to think about the fund’s context inside the market. ARKG stands out for its comparatively excessive administration charges in comparison with its friends.

In search of Alpha

Regardless of this, it is a billion-dollar fund that has not solely skilled durations of notable outperformance however can be at the moment main its sector year-to-date.

In search of Alpha

In my opinion, the fund’s future efficiency is prone to be closely influenced by its high 10 holdings. Its technique of promoting well-performing shares and shopping for throughout value dips attracts consideration to the businesses it invests in with the proceeds from these gross sales. The in depth checklist of third-quarter purchases warrants nearer scrutiny, particularly Recursion, a constant purchase, and PacBio, a sequencing tools supplier that has seen success in new product launches. The gross sales checklist additionally presents insights, notably the choice to take care of a major stake in Precise Sciences and the decreased funding in Schrodinger, indicating various levels of conviction in these shares.

Lastly, analyzing the dangers related to this ETF reveals some essential concerns. A good portion of the fund’s holdings are in early-stage firms, a lot of that are but to generate income. This case is corresponding to the uncertainty of gardening, the place some seeds will thrive, whereas others may not develop in any respect.

These early-stage firms are sometimes characterised by excessive money burn charges, necessitating additional capital infusion, probably by means of share issuance. This introduces two key dangers: dilution and liquidity. Dilution occurs when new shares are issued, probably diminishing the worth of present shares. However, liquidity danger turns into a priority if the businesses wrestle to safe the required funds, which might jeopardize their means to satisfy short-term monetary obligations.

For buyers contemplating this fund, it’s important to grasp and weigh these dangers. The potential for important development in early-stage firms is counterbalanced by the inherent uncertainties and monetary challenges they might face.

[ad_2]

Source link