[ad_1]

In our first weblog publish on the New York and New York Metropolis’s proposed amendments to their debt assortment legal guidelines, we explored the proposed amendments and the choice opt-out legal guidelines within the federal Honest Debt Assortment Practices Act (FDCPA) and the Washington, DC debt assortment modification that obtain the identical goals with out the unintended penalties. On this half two, we discover the advantages of digital communications for shoppers in all different states and jurisdictions—besides New York—in addition to these unintended penalties New Yorkers face from these potential amendments.

For the reason that New York Division of Monetary Companies (NYDFS) continues to be contemplating the feedback obtained to their proposed adjustments and the New York Metropolis Division of Client and Employee Safety remark interval is open till November 29, 2023, there may be nonetheless time for these Departments to revise their proposals to match the federal legislation or Washington DC’s legislation. Each the federal and DC legal guidelines allow debt collectors to speak digitally a few client’s account so long as the digital communications comprise clear and conspicuous opt-out language with strict penalties for failing to abide by the opt-out provisions. Washington, DC goes a step additional and restricts digital communications to at least one per week except a client opts in to extra digital communications in a seven day interval.

Each NYDFS and NY ought to permit their shoppers to have the identical expertise because the shoppers in the remainder of the nation.

Digital Communication Advantages Shoppers, Collectors, and Collectors

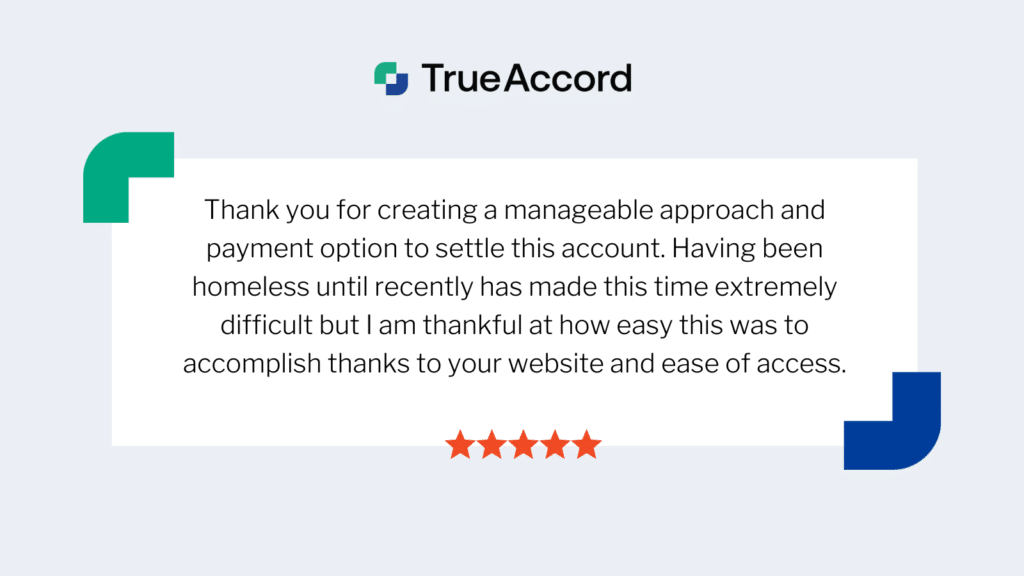

TrueAccord is aware of digital communication advantages shoppers, as evidenced by numerous shoppers who’ve offered suggestions (both instantly or on-line) all through our years in enterprise, like this client who wrote in July 2023:

Digital Communications are a Step Ahead in Client ProtectionDigital communications are simply managed by shoppers and tightly managed by service suppliers with inbuilt mechanisms to forestall harassment. These strategies already present superior client protections than cellphone calls and letters for a number of causes:

All digital communications are written, documented, and could be searched, routinely making a paper path of communication between the buyer and the collector.

Digital communications supply considerably higher safety from undesirable or harassing communication in comparison with cellphone calls and letters. Shoppers maintain the ability and may simply choose out of digital communication by clicking “unsubscribe,” marking emails as spam, replying STOP to a SMS, or blocking a quantity fully from their gadget.

Service suppliers carefully monitor inbound communications and people senders who look like mass advertising are sometimes blocked from supply altogether within the spam filters for each electronic mail and SMS. Sadly for licensed companies, like legislation abiding debt collectors who’ve a legit cause for these digital communications, their digital communications might by no means attain a client’s cellphone or inbox with no very refined supply technique that takes under consideration frequency.

Moreover, electronic mail is designed to journey with a client ceaselessly, whereas addresses and oftentimes cellphone numbers can change. E mail addresses will not be ever reassigned by service suppliers. If shoppers incessantly change addresses, like army households, electronic mail could also be the most effective channel to make use of to speak because it lowers the danger of missed communication when shoppers overlook to replace their account info with their new bodily deal with.

Shoppers Want Digital Debt CollectionBy and huge, shoppers favor to speak with their assortment businesses digitally—they already predominantly talk with their banks, collectors, and lenders digitally, so digital assortment is a clean transition when an account strikes to assortment. As this client reported simply this previous August 2023:

Nearly all TrueAccord communications with shoppers (96%) occur electronically with no agent interplay. That is potential as a result of our digital communications comprise hyperlinks to on-line pages the place shoppers can take motion on their accounts. The truth is, greater than 21% of shoppers resolve their accounts outdoors of typical enterprise hours—earlier than 8AM and after 9PM—when name facilities are closed and it’s presumed inconvenient to contact shoppers below the FDCPA.

Shoppers Ought to Not Should Choose-In to Digital Communications TwiceConsumers already choose in and talk by means of primarily digital channels with their collectors. Requiring shoppers who’ve already opted in to must once more choose in to digital communications as a way to talk about the identical account with a set company provides burden to shoppers. When a client offers their digital contact info (electronic mail deal with or cellular phone quantity) to the creditor, there must be little doubt that the buyer wishes to speak electronically. If the buyer doesn’t, they’ll unsubscribe or choose out from persevering with to obtain messages by means of these channels.

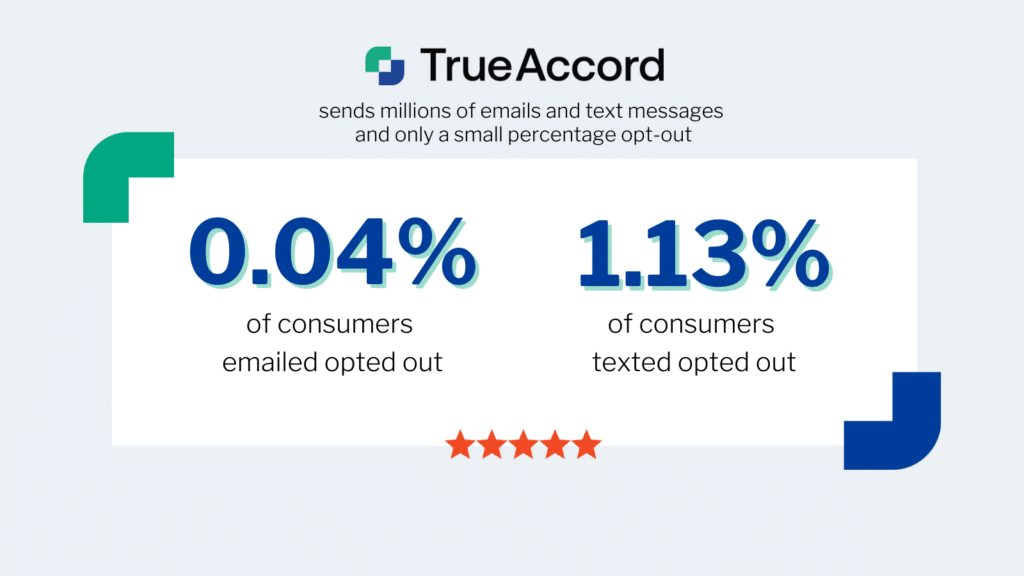

Shoppers are conversant in opt-out strategies equivalent to the usual unsubscribe hyperlink in emails and the phrase “Reply STOP to opt-out” in textual content messages, as they do from all different undesirable communications in different industries. Not solely can shoppers opt-out from digital communications by merely replying cease to a textual content or clicking twice to unsubscribe, at TrueAccord shoppers may also reply to any digital communication, cellphone into the workplace or ship us a letter. Even with the a number of choices and ease of choose out, few shoppers unsubscribe. Of the tens of millions of electronic mail communications TrueAccord sends, solely 0.04% of shoppers unsubscribe, most utilizing the unsubscribe hyperlink offered within the electronic mail. And out of the tens of millions of textual content messages we ship, all textual content messages comprise the phrase “Reply STOP to opt-out,” and on common just one.13% of shoppers reply cease.

It’s a requirement of the FDCPA to incorporate a transparent and conspicuous technique to choose out of digital communication. Moreover, failure to honor a request to cease speaking in a selected channel is a violation of the legislation topic to fines that embrace legal professional’s charges. As well as, shoppers anticipate a simple strategy to choose out, if that possibility is just not out there in digital communications (not solely is it a violation of the legislation) however shoppers can simply as simply report the communication as spam which is able to consequence within the incapability of the debt collector to ship digital messages. All of those protections, together with the clear client desire for digital (partially demonstrated by their low choose out fee), negates the necessity to change the expertise to at least one the place the buyer has to take steps to cellphone in to consent earlier than any digital communications could be despatched notifying the buyer of their account in collections as would be the case if the NY and NYC amendments take impact.

Unintended Harms to Shoppers if Digital Communications are Restricted

Limiting Digital Communication Use Hurts All ConsumersRequiring particular consent for electronic mail, textual content messaging, or different digital channels, when no such consent is required for calls and letters, hurts shoppers by growing undesirable calls and litigation threat. The proposed adjustments would require debt collectors to seize consent from shoppers instantly, even when shoppers already opted in to textual content and emails about their account with their collectors. Because of this a debt collector can not textual content or electronic mail to tell the buyer about their account being in assortment, present them with a discover of their rights, and element potential subsequent steps (the quickest, least bothersome strategies of communication).

As a substitute, debt collectors should mail shoppers letters and shoppers should affirmatively reply to these letters by calling into the workplace (one thing that should be accomplished throughout working hours versus digital communications that may be explored at any handy time for shoppers). This stifles the circulate of data that helps shoppers make knowledgeable selections about their funds and concurrently helps collectors make knowledgeable decisions about restoration choices and future lending methods. In any case, we all know busy shoppers usually don’t reply to outbound letters.

If shoppers don’t reply, then debt collectors place outbound calls—which we additionally know is not shoppers’ most most popular technique of communication—till they get the buyer on the cellphone to debate their account and seize the direct consent that shall be required if the NYC proposal takes impact.

When a debt collector can not attain a client to speak about their debt the creditor is pressured to make tough selections about easy methods to recuperate, absent an understanding of why a client is just not reaching out. This features a determination about whether or not or to not file a lawsuit to recuperate the debt (which, if profitable, leads to garnishment of a client’s paycheck or a lien in opposition to a client’s property).

In some situations the place a client won’t personal property or be employed, a creditor might not file a lawsuit however merely settle for the loss. This determination can have adverse impacts on all shoppers: sooner or later it is going to be harder or inconceivable to obtain entry to credit score, not just for the person client who was unable to repay the debt however for others shoppers which have poor credit score historical past or no credit score historical past, as lenders turn into much less more likely to take dangers when there’s a decrease probability of restoration. Moreover, and relying on the extent of their loss, lenders might select to lift rates of interest and APRs impacting all shoppers to in the end cowl these losses.

Non-Digital Communications Can Be Disruptive to ConsumersConsumers use the web, cellular units, and their emails for communication, procuring, and monetary transactions. When a buyer defaults on their account, it’s a disruption to their lives to all of a sudden obtain cellphone calls and letters concerning an account for which they beforehand solely communicated through digital channels. A lot of TrueAccord’s creditor-clients, involved about their client expertise and their model picture, favor a seamless transition to debt assortment communications and prohibit TrueAccord from making any outbound calls or sending letters on their accounts as a result of their clients have solely ever interacted digitally.

This method has confirmed to learn the shoppers that need assistance essentially the most, as one buyer defined to us in February, 2023:

[ad_2]

Source link