[ad_1]

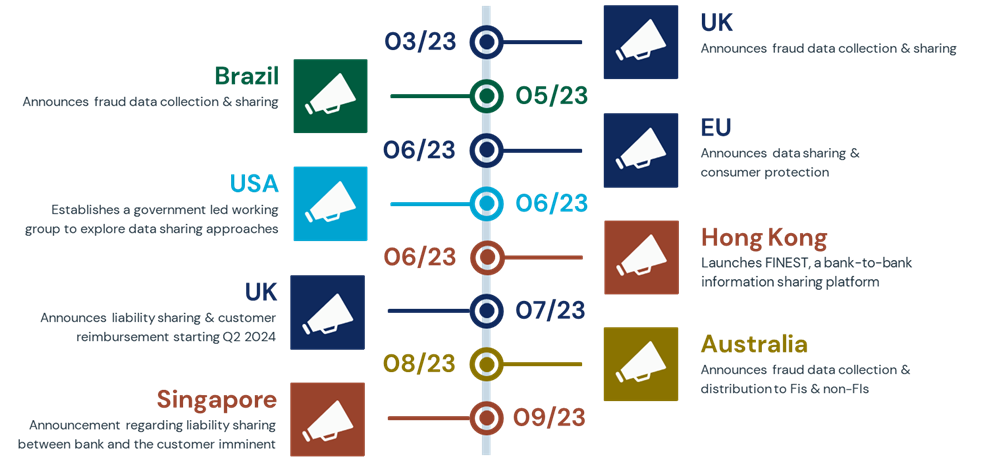

The UK Cost Techniques Regulator (PSR) grabbed lots of consideration after they introduced the 50/50 legal responsibility proposal and revealed their APP Fraud Efficiency Report. Whereas the UK has had the largest share of the media focus, this phenomenon just isn’t restricted to simply the UK and we’re seeing a number of international locations throughout all areas taking regulatory steps to fight the scams which are enabled by real-time funds.

Because the timeline above exhibits, there are a number of international locations taking shifting in direction of sharing information to stop scams. They haven’t but gone so far as the UK did with their 50/50 Legal responsibility Announcement, mandated buyer reimbursement and publication of the APP Fraud Efficiency Report. Nonetheless, we predict it is just a matter of time earlier than different international locations introduce comparable rules. We will already see this with the Financial Authority of Singapore’s proposed framework for legal responsibility sharing between the banks and the client.

In our discussions with monetary establishments world wide, the subject of further regulation may be very a lot on the forefront of their minds. The pinnacle of fraud at a tier-1 financial institution informed us, ‘We do not know precisely what the following steps shall be, however we all know one thing is coming.’ I strongly concur with this evaluation. We are going to see further regulatory steps being taken, and we are going to see them persevering with to unfold to different international locations.

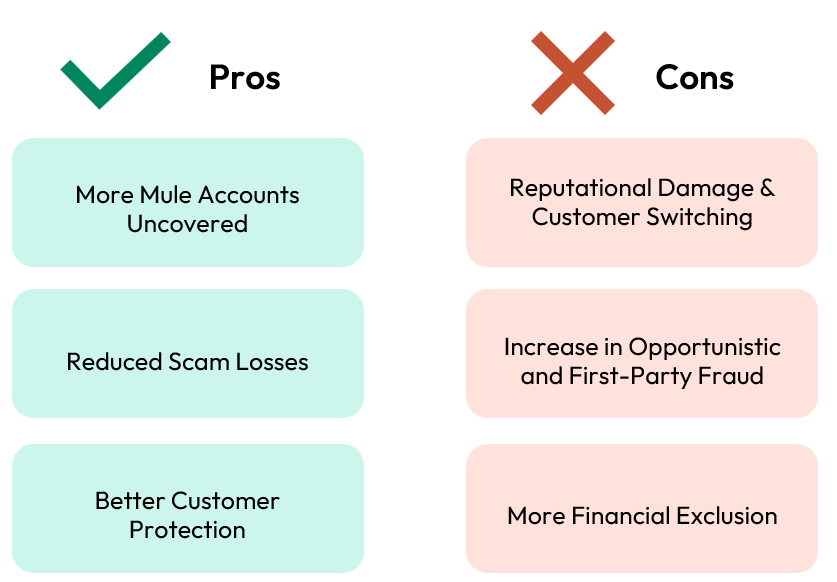

So, what are among the potential penalties of this upswing in rip-off regulation for fraud professionals? I imagine that quickly, as soon as all these regulatory modifications are in place, the next execs & cons will emerge:

With the rise in information shared, monetary establishments (FIs) could make extra correct choices to stop fraudulent functions from opening a mule account. Moreover, there shall be elevated skill to find out after on-boarding whether or not prospects are part of a mule community. Nonetheless, with the related reporting (such because the UK’s APP Fraud Efficiency Report) come potential dangers that efficiency when it comes to scams refunds and software controls shall be utterly laid naked, probably inflicting reputational injury to these organizations that aren’t topping sure charts or are topping the unsuitable charts. Prospects will achieve better consciousness of how effectively their monetary establishment protects them and the way doubtless they’re to be reimbursed, presumably inflicting them to modify account suppliers.

The opposite advantage of sharing of knowledge between monetary establishments, in real-time, in addition to cross-industry collaboration down the road, is that it paves the best way for important discount in rip-off losses. The power to herald sure occasion flags main as much as the fraudulent transaction will complement your decisioning with further information sources. Nonetheless, the enforced reimbursement of shoppers opens the door for opportunistic or first-party fraud, as accountholders falsely declare that they had been a sufferer of rip-off, when actually they’re gaming the system.

As the main focus of the regulation is the safety of rip-off victims, extra prospects shall be safeguarded, as FIs might want to show that the client actively participated within the fraud for them to not be reimbursed. On the identical time, if the extra information shared is used incorrectly (assuming the centralized information is of excellent high quality with right fraud definitions), it may imply that harmless people could also be prevented from entry to monetary companies as a result of poor matching processes. This downside shall be amplified if the collected information is of poor high quality.

The place Is Regulation Headed?

I feel we’re beginning to get a reasonably good image of what the completely different regulators are presently considering. So, the place is all this give attention to regulation probably headed? I imagine that the following massive wave is cross-industry collaboration, and we’re already getting a glimpse into this with the Australian Authorities/Anti-Rip-off Centre’s current announcement, which even begins stipulating information distribution for such collaboration for:

Banks to freeze an account.Telecommunication corporations to dam a name.Digital platforms to take down an internet site or an account.

In my view that is really the place the regulation ought to be heading. The issue of scams is one that can’t solely be tackled by the banks. Telecommunication corporations, ISPs and social media corporations all have to play a job in sharing information and tackling scams.

4 Tips about Learn how to Put together for World Rip-off Regulatory Change

So, what must you think about to assist put together your self for this wave of rules?

1. Versatile Information Ingestion

Consider how versatile your fraud answer is when it comes to the consumption of various information sources. The present units of worldwide regulation allow FIs to share fraud-related data between themselves. With the following wave of regulation, we’ll see a further have to ingest information from non-FI sources similar to telcos, ISPs, and social media corporations. I count on that the variety of further information sources will develop over time. Using this extra information requires having an answer that may quickly construct new information schemas and simply ingest new information.

2. Higher Utility Fraud Controls

Utility fraud controls are sometimes an afterthought for a lot of monetary establishments. The modifications in scams regulation and particularly the 50/50 legal responsibility cut up present a possibility for fraud groups to current a robust enterprise case for ramping up controls. For example, think about the reputational influence of one of many metrics listed on the UK’s APP Fraud Efficiency Report: worth of APP fraud acquired per £ million of transactions. Gone are the times when your software fraud management points might be swept underneath the rug. The transparency of the regulatory reporting implies that it is seen to everybody — not solely opponents, prospects and regulators, but additionally the fraudsters. The fraudsters could have direct perception into which banks have the laxest software fraud controls.

3. Instruments to Construct & Deploy Scams-Centered Fashions

As everyone knows, transactional fraud fashions are very efficient instruments in combatting account takeovers, CNP fraud, and different customary fraud varieties. Nonetheless, they start to be much less efficient when making an attempt to detect scams, as a result of scams have a tendency to bop within the very gray space between fraud and real habits. That is largely as a result of it’s the buyer making that transaction, from the gadget that they belief, from their common location – issues don’t essentially look as misplaced as a real transaction.

For that reason, your group wants to contemplate using fashions that concentrate on rip-off detection to enhance the usual fraud fashions. One of the best mixture to tackling this downside is a consortium-based mannequin that advantages from a wider sight of threats that maybe haven’t materialized at your establishment but, in addition to instruments that permit you to simply construct and deploy a self-built mannequin specializing in all of your buyer’s information accessible solely to you.

4. Bespoke Communication

FIs incessantly use a one-size-fits-all method to buyer communications. In reality, a bespoke method ought to be half and parcel of an efficient technique to fight scams.

The normal method of sending a SMS to verify whether or not a transaction was requested by a shopper just isn’t efficient in getting a buyer to ‘break the spell of a scammer’ — in different phrases, getting the client to consider what precisely it’s that they’re doing earlier than they authorize a transaction. In addition to the message that’s being delivered, the communication channel also needs to be thought-about. Not each buyer has the identical preferences concerning how they wish to be communicated to. Successfully combatting scams requires giving your prospects the power to state their communication preferences and point out what channels they belief essentially the most; the system also needs to be taught from prospects’ previous behaviors to determine the channels with the most effective response charges.

Standing nonetheless and hoping that the issue of scams will go away just isn’t an possibility. Exploring these 4 suggestions additional and figuring out how your group could profit from pursuing a few of these enhancements to your present fraud prevention methods will set you on the appropriate path to arrange your self for the regulation to come back.

In an upcoming collection of weblog posts, we are going to proceed delving deeper into the challenges and greatest practices for efficient scams and software fraud administration, in addition to taking a better have a look at how the scams regulation drive is affecting particular areas world wide.

How FICO Helps You Detect and Forestall Scams

[ad_2]

Source link