[ad_1]

On this article

This text is offered by Aven. Learn our editorial tips for extra data.

As a home-owner, determining one of the best ways to entry your house fairness could be a sophisticated course of, filled with sophisticated jargon, lengthy processes, scary waits for value determinations, and doubtlessly costly hidden prices.

Right here’s a have a look at the tradeoff between HELOCs and cash-out refinances—the 2 most typical and common methods to faucet into your house fairness whereas sustaining and holding the possession of your house.

HELOCs vs. Money-Out Refinances

First, right here’s a have a look at what every of those are.

HELOCs are revolving credit score traces secured by your house fairness, permitting you to borrow funds as wanted as much as your accepted credit score restrict, and also you usually pay curiosity on the quantity you employ. It’s typically added as a second or third lien on your house.

A cash-out refinance includes changing your current mortgage with a brand new one with a better mortgage quantity, typically at a brand new rate of interest.

Greatest Causes to Get a HELOC

So why would you get a HELOC? Listed here are a number of the prime causes.

Flexibility of borrowing & reimbursement

HELOCs present the flexibleness to borrow funds as wanted, avoiding the upfront lump sum obtained in a cash-out refinance. This flexibility is especially useful for tasks or bills that unfold over time.

Decrease general price

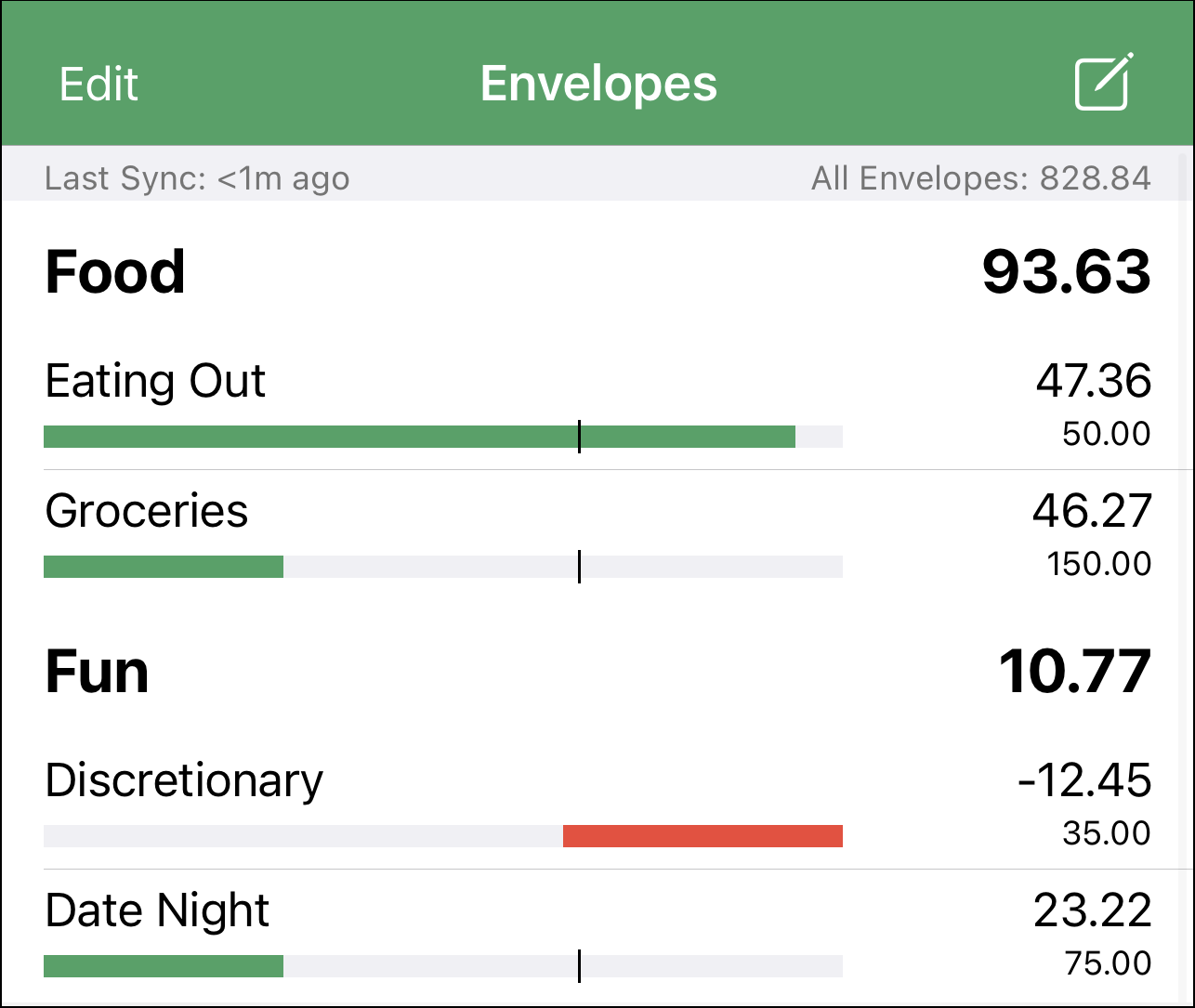

Regardless that your HELOC might have a barely greater rate of interest than your mortgage, in a cash-out refinance, many occasions, the brand new mortgage may have a better rate of interest than the older mortgage you’re changing, thereby typically inflicting you to pay extra curiosity general. That is defined on this picture:

Decrease closing prices & charges

A cash-out refinance will usually price as a lot as 2% to six% of the mortgage quantity. Often this contains an appraisal ($500 to $1,000), origination charge (1% to three% of mortgage quantity), credit score report charge ($25 to $50), title insurance coverage ($1,000 to $2,000), and recording charges ($50 to $100). As compared, some HELOC suppliers like Aven.com will typically have a $0 charge HELOC choice, with no recording or notarization charges.

Rewards and comfort

Fashionable HELOC suppliers will generally have nice rewards applications—for instance, Aven.com offers a 2% limitless money again program on their card, which entry their HELOCs. Determine and others present reductions (25bps to 50bps) for turning on autopay. These can typically add as much as significant financial savings.

Pace

HELOCS are sometimes quicker to get since they don’t seem to be changing your full mortgage and don’t require a full appraisal, so they’ll typically use AVMs and mechanically underwrite you. Nonetheless, HELOCs will typically require a better credit score normal.

Greatest Causes to Get a Money-Out Refinance

What a couple of cash-out refinance? Listed here are some benefits.

Massive borrowing quantity

If you’re borrowing a big sum of money (say, over $300,000), then despite the fact that your new rate of interest is greater than the earlier mortgage, the decrease APR in comparison with a HELOC can offset the upper closing prices and costs for a cash-out refinance.

Greater price however decrease month-to-month funds

As a result of nature of a mortgage being 30 years, despite the fact that you pay extra curiosity in complete over a protracted period, your month-to-month funds could also be a bit decrease because of the long term size. This, nevertheless, means you’re typically paying extra in precise curiosity expense over that point interval.

Last Ideas

There are some nice choices for every one. Fashionable HELOC suppliers like Aven.com additionally present rewards like 2% limitless money again on their merchandise.

This text is offered by Aven

Aven is a expertise firm inventing new methods to avoid wasting individuals cash. Our first product is the Aven Dwelling Card, the world’s solely bank card backed by house fairness. It really works like another bank card the place you may make on a regular basis purchases and earn limitless 2% money again – however affords the bottom fee of any bank card, assured.

Aven additionally affords Aven Advisor, a mobile-first monetary advisor, and the Aven Auto Card, a bank card backed by auto fairness.

Be aware By BiggerPockets: These are opinions written by the creator and don’t essentially characterize the opinions of BiggerPockets.

[ad_2]

Source link