[ad_1]

In 2020, FICO, the corporate behind the FICO credit score scores, launched the most recent fashions of their line of credit score scoring algorithms: the FICO Rating 10 and the FICO Rating 10 T.

In 2020, FICO, the corporate behind the FICO credit score scores, launched the most recent fashions of their line of credit score scoring algorithms: the FICO Rating 10 and the FICO Rating 10 T.

The “T” within the latter scoring mannequin stands for “trended,” which displays the incorporation of trended information—your credit score information over time—into the algorithm.

Thanks not solely to the inclusion of trended information but additionally a number of different main modifications, the corporate claims that the brand new scoring fashions are superior to all earlier FICO scores.

Though nearly all of customers aren’t more likely to see a dramatic change of their credit score scores, some teams of customers might expertise extra excessive shifts. In the end, the brand new FICO scores are predicted to widen the hole between customers with good credit score versus these with horrible credit.

Nevertheless, the widespread implementation of FICO 10 and 10 T is probably going nonetheless a number of years away.

Preserve studying to get all of the information on FICO 10, together with what makes it totally different from earlier FICO rating variations, the impression it can have on credit score scores, and once we will begin to see lenders adopting it. Most significantly, we’ll inform you how one can get a superb credit score rating with FICO 10.

Why Did FICO Come Out With a New Credit score Scoring Mannequin?

The aim of a credit score rating is to speak a shopper’s stage of credit score threat to lenders in order that lenders could make much less dangerous choices when granting credit score. Lenders wish to keep away from extending credit score to debtors who’re more likely to default on a mortgage as a result of defaults signify losses for the corporate.

So, the extra correct a credit score scoring mannequin is at predicting shopper credit score threat, the extra helpful it’s to lenders. With a predictive credit score scoring mannequin, lenders could make extra knowledgeable lending choices, which helps their backside line.

Because of this, the aim of every new credit score rating is to make it higher than the final model at predicting credit score threat, and that’s precisely what FICO 10 is designed to do.

Client Debt Is on the Rise—However So Are Credit score Scores

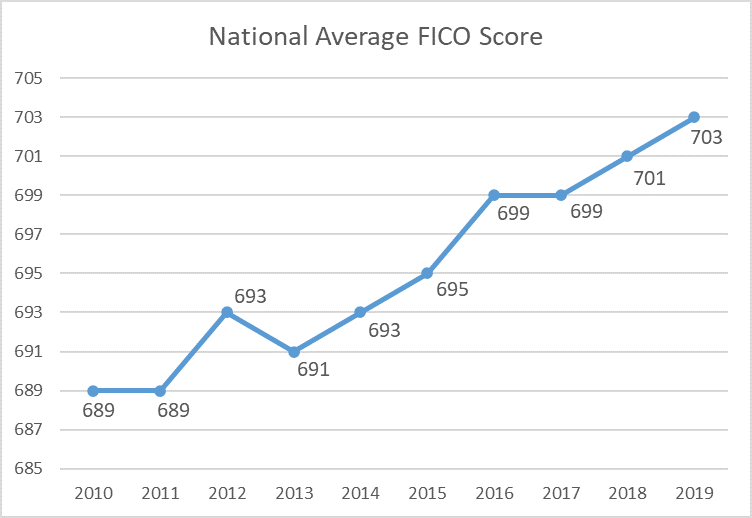

In accordance with a latest report from FICO, shopper debt has elevated to file ranges, and but the common credit score rating in the USA has elevated to a file excessive of 718 as of April 2023. This may be attributed partly to modifications within the financial system and altering credit score reporting insurance policies, however there’s one other main issue that has the banks fearful.

The nationwide common FICO rating has been on the rise for the previous decade, surpassing the 700 mark in 2018.

Sufficient time has handed for the reason that Nice Recession of 2008 that all the delinquencies and derogatory marks on customers’ credit score experiences from that interval of economic hardship have been faraway from their information. Due to this fact, collectors can now not see how customers dealt with the recession and whether or not they have been capable of pay all of their payments when the financial system went south.

Couple this with the concern of one other attainable financial recession on the horizon, and you’ll perceive why lenders have began to really feel involved that delinquencies and defaults might quickly start to rise to a stage that’s not mirrored in customers’ excessive credit score scores.

Due to these financial components, the credit score scoring system wanted an overhaul that will consider the altering financial local weather in addition to altering shopper habits and permit for higher predictions of credit score threat and default charges.

FICO 10: Extra Correct Predictions of Credit score Threat

FICO predicts that FICO 10 will decrease defaults on auto loans by 9% and defaults on mortgages by 17%.

Because of the modifications made to the scoring mannequin that we mentioned above, particularly the inclusion of trended information for the FICO rating 10 T, FICO claims that the brand new scores carry out higher than all earlier FICO scores by considerably reducing shopper default charges.

Right here’s what else FICO has to say about their new merchandise:

“By adopting the FICO® Rating 10 Suite, a lender may scale back the variety of defaults of their portfolio by as a lot as ten % amongst newly originated bankcards and 9 % amongst newly originated auto loans, in comparison with utilizing FICO® Rating 9. The discount in defaults is even larger for newly originated mortgage loans, at 17 % in comparison with the model of the FICO Rating utilized in that trade. These enhancements in predictive energy might help lenders safely keep away from sudden credit score threat and higher management default charges, whereas making extra aggressive credit score affords to extra customers.”

How Is FICO 10 Totally different Than Earlier FICO Scores?

Though FICO routinely updates their credit score scoring algorithms each 5 years or so, this would be the first time that they’re releasing two totally different variations of the identical basic scoring mannequin: FICO 10 T, which makes use of trended information; and FICO 10, which doesn’t use trended information.

Each FICO 10 and FICO 10 T will likely be drastically totally different than the earlier FICO rating, FICO 9. FICO 9 was designed to be very forgiving to customers, which led many to imagine that it produced credit score scores that have been larger than they need to have been.

With FICO 9, for instance, medical collections got much less weight than different sorts of collections, which was a profit to customers battling medical debt.

Moreover, FICO 9 utterly ignored paid assortment accounts, that means that for those who had a set in your credit score report however then paid the stability, it could now not have an effect on your credit score rating. Many felt that this modification contributed to FICO 9 overestimating the creditworthiness of customers, which in flip led to the scoring mannequin not being accepted by many industries.

In distinction, the FICO 10 scores signify a swing again in the wrong way. It’s designed to be much less lenient towards customers with dangerous credit score behaviors as a way to keep away from understating customers’ credit score threat. In that sense, it’s most likely extra just like FICO 8 than to FICO 9. Nevertheless, FICO 10 additionally rewards customers who’ve efficiently managed their credit score.

To perform this, FICO made some important modifications in creating their newest set of credit score scoring algorithms.

Trended Knowledge

The brand new FICO 10 T rating is the primary FICO rating to have a look at trended credit score information.

The FICO 10 T rating will incorporate trended information, which implies that it’ll not simply think about your credit score profile as a “snapshot” in time, however moderately, it can consider your credit score habits over the earlier 24 to 30 months and the way your credit score profile has modified in that point.

VantageScore 4.0, a competing credit score scoring mannequin, has been utilizing trended information because it debuted in 2017. Now, FICO is following swimsuit with their 10 T rating.

Due to the temporal information FICO 10 T has to attract from, it’s much more predictive of a borrower’s credit score threat than the essential FICO 10 rating, which might solely see a “snapshot” of your credit score report at a given cut-off date.

For customers, the trended information issue is very important for the credit score utilization portion of your credit score rating. In fact, credit score scores already checked out your cost historical past from the previous seven to 10 years, however till now, they solely checked out your credit score utilization ratios at a given cut-off date.

Because of this with most credit score scoring fashions, even for those who max out your bank cards one month and your credit score rating suffers because of this, so long as you pay down your playing cards once more by the following month, your rating can nonetheless bounce proper again to the place it was earlier than you maxed out the cardboard.

With FICO rating 10 T, nonetheless, it might not be really easy to recuperate from excessive balances, as a result of a file of being maxed out may stick round for the following 24 to 30 months.

As well as, in case your balances have been climbing larger over the past two years or you probably have been looking for credit score extra aggressively, you would be penalized by FICO 10 T, as a result of this sort of habits signifies the next threat of you defaulting sooner or later.

However, you probably have been managing your credit score properly and your debt ranges have been reducing over the previous two years, you can be rewarded for that habits.

Private loans from on-line lenders have exploded in recognition, nevertheless it’s finest to keep away from them if you wish to get a excessive FICO 10 credit score rating.

Private Loans Will Be Penalized

The vice chairman of scores and analytics at FICO, Joanne Gaskin, has mentioned that probably the most important change to the scoring algorithm is the best way it treats private loans.

Private mortgage debt has grown sooner than every other sort of shopper debt over the previous decade, even bank cards. Customers are turning to private loans to consolidate bank card debt extra continuously than prior to now, and the proliferation of economic expertise firms has made private loans simpler to qualify for and extra accessible.

With older FICO fashions, private loans are handled the identical as every other installment mortgage. Because the balances of installment accounts don’t have an effect on credit score scores as a lot because the utilization ratios of your revolving accounts, with most scoring fashions, taking out a private mortgage to consolidate bank card debt (primarily changing revolving debt into installment debt) would profit a shopper’s credit score rating.

Nevertheless, many customers who take out private loans to repay revolving debt don’t change the spending habits that obtained them into debt within the first place. Consequently, after getting a private mortgage and paying down their bank cards, they could run up their playing cards once more and discover themselves even deeper in debt.

In accordance with FICO, the credit score threat of such customers is larger than you’d suppose primarily based on their credit score scores utilizing earlier FICO fashions. To account for this, FICO 10 is treating private loans as their very own class of credit score accounts and is doubtlessly penalizing customers for taking out private loans.

With FICO 10 T, latest missed funds will matter much more than they already do with different FICO rating variations.

Due to this fact, with FICO 10, the technique of consolidating bank card debt with a private mortgage may not assist your credit score rating as a lot as you hope and may even damage it. Nevertheless, the damaging impression of taking out a private mortgage will be mitigated by steadily working to cut back your total debt stage.

However, in case your total debt load stays the identical or continues to extend after you’re taking out a private mortgage, that might damage your credit score rating as a result of it exhibits lenders that you’re getting deeper into debt and never managing your credit score properly.

Latest Missed Funds Will Be Penalized Extra Closely

Fee historical past has all the time been an important a part of a FICO credit score rating, however it’s much more vital with FICO 10 T, the trended information rating.

Utilizing historic information, it will possibly assign late and missed funds much more weight primarily based in your habits prior to now 24 months. For instance, for those who’ve been getting progressively farther behind on funds over time, the damaging impression in your credit score rating could possibly be even better than it could with a earlier FICO rating.

When you have delinquencies which are at the very least a yr outdated, although, then these older damaging marks in your credit score report gained’t damage your rating as a lot, in line with MSN.

How Will the FICO 10 Scoring Mannequin Have an effect on Credit score Scores?

Total, it’s predicted that the brand new FICO 10 scoring fashions may have a polarizing impact on customers’ credit score scores, which implies that some customers who’ve horrible credit scores may even see them drop even additional, whereas those that have good credit score scores as a result of they’re heading in the right direction could also be rewarded with even larger scores.

40 million customers are more likely to expertise a credit score rating drop of 20 or extra factors with FICO 10 in comparison with earlier fashions. This might push some customers over the sting right into a decrease credit standing class.

FICO has estimated that roughly 100 million customers will most likely expertise minor modifications of lower than 20 factors to their scores. The corporate additionally estimates that about 40 million customers will see their credit score scores drop by 20 or extra factors, whereas one other 40 million may see their scores improve by the identical quantity.

You might be more likely to see a credit score rating drop for those who took out a private mortgage to consolidate debt however then stored accruing extra debt as an alternative of paying it off, or you probably have bank card debt that you’re not paying down.

You might be most probably to see a credit score rating improve you probably have been penalized for having excessive balances occasionally for the reason that temporal information from FICO 10 T will assist to common out the peaks in your utilization fee.

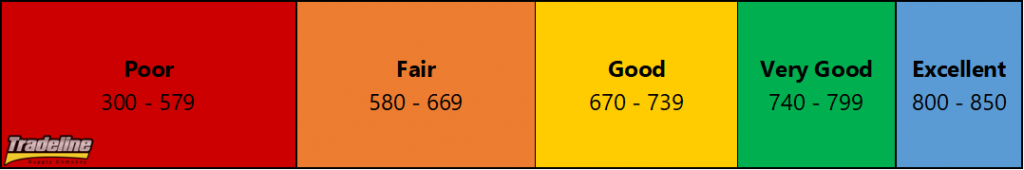

Whereas a lower of 20 factors in your credit score rating isn’t catastrophic, it could possibly be sufficient to make a distinction in your possibilities of being permitted for credit score or the rates of interest you would qualify for. That is very true for these whose credit score scores sit close to the decrease border of a credit score rating class.

For instance, somebody with a credit score rating of 595 with FICO 8 is taken into account to have truthful credit score. If FICO 10 gave them a credit score rating that’s 20 factors decrease, their credit score rating can be 575, which is taken into account horrible credit. That might very properly make or break your possibilities of getting permitted for a mortgage or a bank card.

However, the inverse is true for many who stand to realize 20 factors. If a 20-point improve pushes a shopper over the sting from truthful credit score to good credit score, for instance, this might actually be useful when making use of for credit score.

It’s estimated that 80 million customers will see a major change of their credit score scores with FICO 10, which can transfer them into totally different credit score rating ranges.

Much less Extreme Rating Fluctuations

As it’s possible you’ll recall from Select a Tradeline, the extra information there’s contributing to a median, the harder it’s to have an effect on that common.

Since FICO 10 T appears at your credit score utilization for an prolonged time frame as an alternative of simply the present month, it’s probably that your credit score rating is not going to change as drastically from month to month primarily based in your utilization ratios on the time.

In different phrases, your utilization information from the previous 24 to 30 months may have a stabilizing impact in your rating that can defend it from being closely penalized for those who often have excessive balances. For instance, for those who spend further in your bank cards in December to arrange for the vacations, your rating that month gained’t be damage as a lot as it could with out the trended information (so long as you pay it off shortly).

Larger Emphasis on Traits and Latest Knowledge

FICO 10 T will particularly reward customers who’ve a development of bettering their credit score over time.

The inclusion of trended information with FICO Rating 10 T and additional emphasis on latest information signifies that your credit score rating isn’t primarily based solely on what your accounts appear to be at this time, however as an alternative, it can give extra significance as to if your credit score is getting higher or getting worse.

Hypothetically, it’s attainable that two customers with the identical quantity of debt and derogatory gadgets may have totally different credit score scores primarily based on the development of their debt ranges.

If one shopper has $10,000 of bank card debt, however they’ve been making progress on paying that down from a place to begin of $20,000 of debt, then their credit score rating can be helped by FICO 10 T as a result of their debt stage is demonstrating a development of enchancment over time.

If the opposite shopper additionally has $10,000 of bank card debt, however they used to solely have $1,000 of revolving debt, that development exhibits that they’re getting deeper into debt, and their FICO 10 rating can be damage by that sample of accelerating debt.

A Polarizing Impact on Credit score Scores

One of many main results of FICO 10 is that it’s probably going to polarize the pool of customers’ credit score scores. In different phrases, these close to the highest of the credit score rating vary will get even larger, whereas these with low credit score scores will sink even decrease alongside the dimensions.

In accordance with CNBC, customers with scores of decrease than 600 will expertise the most important reductions of their credit score scores with FICO 10. These with scores of 670 and above may probably acquire as much as 20 factors.

This creates a distribution of credit score scores that’s extra concentrated on the two extremes, versus most customers’ credit score scores being concentrated across the common.

Sadly, which means the damaging results of the brand new FICO scores will disproportionately impression customers who’re already battling debt. This can make it even tougher for customers to get out of debt and will pressure them to hunt out pricey, predatory loans, which solely accelerates the downward spiral of debt.

This perpetuation of inequality within the credit score scoring system isn’t new, however evidently FICO 10 will solely serve to extend credit score inequality moderately than enhance it.

In the end, FICO’s shoppers are the banks, and their merchandise are designed to provide banks the higher hand, not customers.

When Will the New FICO Rating Be Rolled Out?

By widening the divide between customers with good credit score and people with horrible credit, evidently FICO 10 will exacerbate credit score inequality.

In accordance with FICO, the FICO Rating 10 Suite of merchandise will likely be obtainable in the summertime of 2020. The vice chairman of scores and predictive analytics at FICO, Dave Shellenberger, instructed The Steadiness that Equifax will likely be adopting the brand new rating shortly thereafter.

As to when lenders will truly begin to use the brand new credit score scoring system, that could be a totally different query.

Lenders Are Gradual to Adapt to New Credit score Scoring Techniques

The monetary trade adapts very slowly to systemic modifications. As we mentioned in “Do Tradelines Nonetheless Work in 2020?”, there are a lot of, many various variations of FICO, and nearly all of lenders are nonetheless utilizing variations of the rating which are years and even a long time outdated.

Earlier than FICO 10, the most recent model had been FICO 9, which has largely gone unused by lenders.

FICO 8 is the credit score scoring mannequin that’s at the moment being utilized by the three main credit score bureaus and it’s also probably the most broadly used mannequin amongst lenders at this time. FICO 8 debuted in 2009, which implies it has now been round for over a decade.

There are specific industries that rely closely on FICO rating variations which are even older than FICO 8. Within the mortgage trade, the most well-liked FICO scores are variations 2, 4, and 5, the earliest of which debuted within the early Nineteen Nineties. Auto lenders might use FICO scores 2, 4, 5, or 8, whereas bank card issuers use fashions 2, 3, 4, 5, and eight.

Moreover, many industries and even some massive lenders have their very own proprietary FICO scoring fashions which have been custom-made for that specific establishment and the patron base they serve.

Lenders have amassed enormous troves of information primarily based on a particular credit score scoring mannequin. Having dependable information is essential to minimizing threat through the underwriting course of. If lenders have been to vary to a brand new scoring mannequin, all the credit score scoring data they’ve collected thus far would now not be relevant, because it was calculated utilizing a unique algorithm.

It’s probably that the FICO 10 T rating will take longer to implement than the essential FICO 10 rating as a result of FICO 10 T would require companies to coach staff to make use of a brand new set of purpose codes.

They might primarily be ranging from scratch, which might imply taking over extra threat till they’ve examined the brand new mannequin for lengthy sufficient to know the way it works for his or her companies. Due to this, lenders are sometimes reluctant to improve to a more moderen scoring mannequin and sluggish to implement it.

Due to this fact, we will make an informed guess that it’ll most probably take at the very least a number of years for FICO 10 to realize traction with lenders on a big scale. In accordance with Shellenberger of FICO, it might take “as much as two years” earlier than lenders begin utilizing the brand new mannequin, though primarily based on previous examples, it appears probably that it may take considerably longer than that.

FICO 10 T Will Be Extra Difficult for Lenders to Undertake

In accordance with FICO, the usual FICO 10 rating makes use of the identical “purpose codes” as older FICO scores.

Motive codes, additionally known as “adversarial motion codes,” are the codes that lenders should present if they’ve rejected your software for credit score primarily based on data out of your credit score report. These codes often encompass a quantity and a short assertion of one thing that’s impacting your rating in a damaging approach, similar to revolving account balances which are too excessive in comparison with your revolving credit score restrict.

As a result of FICO 10 shares the identical purpose codes with earlier variations of FICO scores, this implies will probably be appropriate with lenders’ present methods, at the very least with regard to purpose codes.

In distinction, FICO 10 T comes with a brand new set of purpose codes, which implies will probably be a extra in depth enterprise for banks to implement the brand new rating and prepare staff on how one can use it.

Because of this, it appears probably that the essential model FICO 10 may even see widespread use amongst lenders earlier than FICO 10 T does.

Get a Good FICO 10 Credit score Rating

Though some important modifications have been made to the FICO 10 credit score scoring merchandise, the general ideas of managing credit score stay the identical. Most significantly, make your entire funds on time, each time, and attempt to hold your credit score utilization low.

Nevertheless, there are a number of particular factors to bear in mind if you wish to get a superb credit score rating with FICO 10.

Suppose twice about taking out a private mortgage

Since private loans will likely be extra closely penalized with FICO 10 scores, you’ll wish to keep away from taking out a private mortgage except it’s completely crucial. As a substitute of counting on private loans to assist your spending, attempt to save up for giant purchases upfront, and begin funneling some money from every paycheck into an emergency fund in case you run into monetary hardship.

In case you do find yourself needing to make use of a private mortgage, attempt to pay it down as shortly as you’ll be able to. As well as, don’t run up the balances in your revolving accounts once more, as a result of the FICO 10 T algorithm doesn’t reward this habits, and your credit score rating will replicate that.

Think about organising computerized funds for your entire accounts so that you simply by no means by accident miss a cost.

Avoiding late or missed funds is of the utmost significance with any credit score rating, however it’s much more vital with the brand new FICO scoring system. Late and missed funds could also be assigned extra weight primarily based in your latest credit score historical past, particularly missed funds that occurred inside the previous two years.

To keep away from lacking any funds, arrange your entire accounts to mechanically deduct at the very least the minimal cost out of your checking account earlier than your due date every month. Additionally, it’s a good suggestion to get into the behavior of checking your accounts usually to verify there haven’t been any errors or points with processing your computerized funds.

In case you do by accident miss a cost, pay the invoice as quickly as you discover and think about asking your lender to waive the late payment. In case you handle to catch up earlier than 30 days have passed by, then you’ll be able to keep away from getting a derogatory merchandise added to your credit score report.

Within the occasion that you end up with a 30-day late (or worse) in your credit score report, then you have to to be further vigilant about making funds on time for at the very least the following one to 2 years in order for you your rating to recuperate.

Repay your bank cards in full each month

Paying off your bank cards in full is all the time a good suggestion usually as a result of that approach, you’ll be able to keep away from losing cash on curiosity charges. As well as, paying off your full stability every month prevents your credit score utilization from growing from month to month, versus carrying over a stability after which including extra to it every month.

With trended information enjoying a big position in your FICO 10 T rating, consistency is essential, and paying your payments in full each time will assist enhance your rating.

If you wish to get a superb credit score rating with FICO 10 and FICO 10 T, attempt to hold your revolving debt low by paying off your bank cards in full each month.

Decrease your credit score utilization ratios

With FICO 10 T, will probably be extra vital than ever to be vigilant about sustaining a low credit score utilization ratio. Because the trended scoring mannequin accounts for patterns in your credit score utilization over the previous 24 months, it gained’t be really easy to get away with maxing out your bank cards one month after which shortly paying the stability down to enhance your rating once more the following month.

Excessive credit score utilization at any level prior to now two years could possibly be factored into your credit score rating, particularly in case your utilization has been growing over time.

Because of this, in case your credit score is being scored with the FICO 10 T mannequin, you’ll get one of the best outcomes in case your credit score utilization has been persistently low or if it has proven a sample of reducing over time.

Nevertheless, simply since you repay your bank card in full each month doesn’t imply it can report a zero stability. The stability that experiences to the credit score bureaus is the stability that you’ve got on the finish of your assertion interval. In case your stability occurs to be excessive on that date, then it may negatively have an effect on your rating, even for those who repay the stability quickly after.

One simple credit score hack to get round that is to pre-pay your bank card invoice earlier than your due date and your assertion time limit. That approach, the stability will likely be low when the cardboard experiences to the credit score bureaus, which is healthier to your credit score rating.

One other useful credit score hack is to unfold out a number of smaller funds all through the month in order that the stability by no means climbs larger than it needs to be to start with.

Learn extra about how one can get one of the best credit score utilization ratio in our article, “What Is the Distinction Between Particular person and Total Credit score Utilization Ratios?”

Requesting a credit score line improve will be a simple approach to enhance your utilization fee, however this technique needs to be used with warning for those who suppose it’d encourage you to rack up extra debt.

Enhance your credit score restrict

One solution to simply decrease your utilization fee is to extend your credit score restrict. Spending $1,000 on a card with a credit score restrict of $5,000 is so much higher to your utilization ratio than spending the identical quantity on a card with a credit score restrict of $2,000.

Growing your credit score restrict is likely to be simpler than you suppose. It could possibly be so simple as calling up your card issuer on the telephone or making use of for a credit score line improve on-line. In reality, most individuals who ask for the next credit score restrict get permitted.

Nevertheless, this technique isn’t inspired for customers who could also be tempted by the upper credit score restrict to spend much more on the cardboard.

For recommendations on how one can get a bigger credit score restrict, in addition to some pitfalls to be careful for earlier than requesting a credit score line improve, take a look at “ Enhance Your Credit score Restrict.”

Work to enhance your credit score well being over time

With FICO rating 10 T together with extra details about your credit score historical past over the previous 24 months, will probably be vital to show an enchancment in your credit score over time. Customers who’ve been working to handle their credit score responsibly and who’ve diminished their quantity of revolving debt over time will likely be rewarded.

However, these whose credit score well being has been declining attributable to growing debt ranges or a sequence of missed funds will see their credit score scores take a dive.

For assets on how one can enhance your credit score, take a look at the credit score articles and infographics in our Information Heart, similar to “The Quickest Methods to Construct Credit score,” “Simple Credit score Hacks That Will Truly Get You Outcomes,” and “ Get an 850 Credit score Rating.”

Will the New FICO 10 Rating Have an effect on the Tradeline Trade?

First, keep in mind that it’s probably that it’s going to take at the very least a number of years for FICO 10 to be broadly adopted by lenders (if lenders select to make use of it within the first place, which they could not), which signifies that nothing is altering for the tradeline trade within the close to future.

Secondly, many lenders might select to undertake solely FICO 10 and never FICO 10 T as a result of will probably be technically simpler to implement. For lenders utilizing FICO 10 with out the trended information, there shouldn’t be a change to how approved person tradelines work.

Nevertheless, issues get extra fascinating when contemplating the impression of FICO 10 T, the trended model of the brand new rating, on consumers and sellers of tradelines. Till FICO 10 T is adopted by main lenders, we will solely speculate as to the modifications that can consequence, however right here is one risk.

What If FICO 10 T Reveals a Tradeline’s Steadiness Historical past?

One concern that customers might have is that FICO 10 T may expose a tradeline’s earlier excessive stability if it had one at any level through the previous 24 to 30 months. That could be true, however we additionally know that FICO 10 T locations loads of significance not simply on the numbers themselves, however on how they modify over time.

The entire tradelines on our tradeline checklist are assured to have a utilization ratio of 15% or decrease. If a tradeline had the next stability sooner or later prior to now two years or so, then it could present a development of the stability reducing, for the reason that stability would have been introduced all the way down to beneath 15% as a way to take part within the tradeline program.

FICO 10 T rewards downward tendencies in utilization, so evidently approved person tradelines would nonetheless present worth even when larger balances will be seen prior to now.

If a tradeline has not had a excessive stability prior to now two years, then which means it can present a sample of persistently low utilization over time, which can be useful.

Conclusion: What Does the New FICO 10 Credit score Rating Imply for Customers?

A number of hypothesis and daring claims have been circulating in regards to the new FICO scores, FICO 10 and FICO 10 T. Naturally, customers and tradeline sellers alike are involved with the query of how the brand new scoring algorithms may have an effect on approved person tradelines.

It’s true that FICO has made some important modifications to their newest credit score scoring mannequin, and it’s additionally probably that some customers might expertise marked will increase or decreases of their credit score scores in comparison with earlier FICO scoring fashions. Fortuitously, nonetheless, there isn’t a must panic.

Observe the final tips of excellent credit score to get a excessive rating with any credit score scoring mannequin.

First, let’s keep in mind that FICO 10 isn’t in use but, and it’s most likely going to take a number of years or extra for almost all of lenders to undertake it.

As well as, the scoring mannequin that individuals are most involved about, FICO 10 T, will take even longer than FICO 10 to achieve mainstream recognition because it requires lenders to discover ways to begin utilizing a brand new set of purpose codes.

Because of this, customers don’t want to fret about lenders seeing the previous two years of their credit score histories simply but. Nevertheless, figuring out that widespread use of trended information could also be on the horizon, it’s possible you’ll wish to begin making ready your credit score now. That approach, when trended information credit score scores turn into extra in style, your credit score will likely be robust and able to face up to the modifications.

To obtain a excessive credit score rating with FICO 10 and FICO 10 T, keep away from taking out private loans for those who can, as they are going to be penalized extra closely than prior to now. It’s additionally vital to show both an enchancment in your credit score over time or persistently good credit score habits, which will likely be rewarded.

Apart from these particular issues, FICO 10 and FICO 10 T nonetheless rely totally on the identical credit score rating components you’re already conversant in: your cost historical past, credit score utilization, size of credit score historical past, credit score combine, and new credit score. Whereas the peripheral particulars of various scoring fashions might differ, the core parts all the time stay the identical.

In the end, for those who work on creating good credit score practices in these basic areas, your credit score will likely be in nice form regardless of which scoring mannequin is used.

[ad_2]

Source link