[ad_1]

Wang He/Getty Photos Information

Would you ever purchase an organization with these traits?

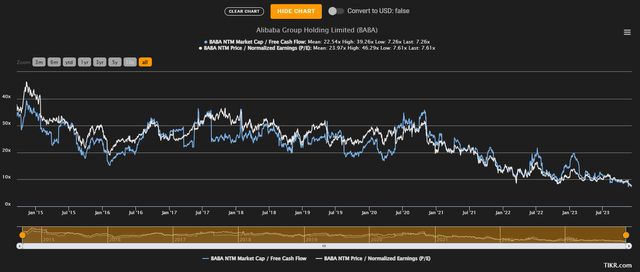

5-year free money move development of 11%; free money move margin of 19.60%. 5-year income development of about 20%. Internet debt of -$51.48 billion and market capitalization of solely $184 billion. NTM Market Cap / Free Money Circulation of seven.26x; NTM Value / Normalized Earnings (P/E) of seven.61x.

In all probability, if this firm was headquartered in New York now you’ll all run to purchase it. Sadly, it’s positioned on the opposite facet of the world, in Hangzhou, China. It’s precisely this side that I wish to leverage on this article because the problems with this firm will not be in regards to the enterprise itself however in regards to the nation by which it resides. As you may need guessed, I’m speaking in regards to the much-discussed Alibaba (NYSE:BABA).

Context

Earlier than assessing the present scenario, I feel it’s helpful to offer a quick recap of what has occurred to this point since November 2020, which is when Alibaba’s meltdown started. In these three years, nearly the whole lot has occurred.

On the finish of October 2020, there was nice optimism round Alibaba and it was steadily buying and selling round $280-$300 per share. On the time, it was just about executed for the IPO of Ant Group, which is the corporate that owns the world’s largest cell fee platform, Alipay. Alibaba owns 33% of the group, so it had each curiosity in making the most important IPO of all time undergo. Nonetheless, when the whole lot gave the impression to be going proper, some statements by Jack Ma in regards to the Chinese language monetary system caught the eye of the Chinese language authorities and after just a few days, the IPO was cancelled. In response to the authorities’ statements, the explanation was that Ant Group’s construction didn’t mirror the anti-monopoly guidelines. After years of turbulence, the worst appears to be behind us, however not with out penalties:

Ant Group was fined $985 million, one of many highest fines ever imposed by Chinese language regulators. The possession construction has been utterly turned the wrong way up: Jack Ma owned 53.46% of the voting shares, as we speak solely 6.20%. Thus, no shareholder, alone or in settlement with different events, can have management.

Total, after these three years, Ant Group comes out weakened, and not directly so does Alibaba. Be that as it could, this was solely the primary hiccup.

Following the suspension of the IPO, Chinese language regulators fined the nation’s main large tech corporations for antitrust violations: in 2021 Alibaba was fined $2.80 billion. As well as, just a few months later, the corporate stated it will take part in frequent prosperity initiatives by investing $15.50 billion by 2025. The purpose was to learn from the financial development of the complete nation:

Alibaba is a beneficiary of the sturdy social and financial progress in China over the previous 22 years. We firmly imagine that if society is doing properly and the economic system is doing properly, then Alibaba will do properly.

Former Alibaba CEO Daniel Zhang

Evidently, the market noticed these investments as yet one more advantageous to pay, and from that time on, the inventory started to sink. Though by 2022 the fines have been over, the S&P 500 (SP500) in a downward development was yet one more excuse to gasoline Alibaba’s collapse. From $319 per share in October 2020 as we speak the inventory is buying and selling at about $72 per share: an absolute catastrophe.

Coming so far, in spite of everything this information, chances are you’ll be questioning why Alibaba is a robust purchase. The reason being that the present value per share is so low that in my view, it has already discounted essentially the most damaging state of affairs ever. Over the previous three years, the whole lot was a pretext to promote Alibaba and we now have reached a degree the place it’s actually exhausting to make issues worse. Making an analogy with the U.S. economic system, that is Alibaba’s 2008 and it’s a lot simpler to restart from right here than to sink additional.

In the mean time the most important issues with Chinese language regulators are behind us, however I do not doubt that there could also be new issues sooner or later, and that’s what worries the market. Whereas I perceive traders’ concern, I additionally imagine that one shouldn’t be overly pessimistic both. I doubt that it’s in China’s curiosity to destroy considered one of their greatest corporations ever. Tencent (OTCPK:TCEHY) and PDD Holdings (PDD) have additionally been fined, however they’ve already made up among the misplaced floor.

My impression is that sentiment remains to be extraordinarily damaging for Alibaba in comparison with the opposite Chinese language large tech corporations, which is why it must show one thing extra to draw traders. Nonetheless, it actually took little or no to go from being top-of-the-line corporations on the planet to being one of the vital averted: Mr. Market is commonly too emotional.

Evaluation of the Chinese language economic system

As already anticipated, since Alibaba’s efficiency is affected by any information that has to do with China, I feel the very first thing to investigate is the macroeconomic setting.

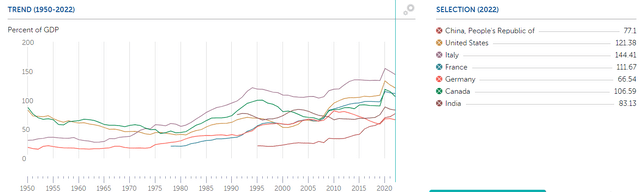

World Financial institution

Because the mid-Nineteen Sixties China’s financial development has been unrestrained and GDP used to extend in double digits. Since 2010, year-on-year development has slowed down however stays increased than European and U.S. development. The Chinese language authorities’s purpose is to develop on common between 4.50-5% per yr, which has failed lately attributable to a lot of points.

The primary was the pandemic. In China, the lockdowns lasted longer and have been additionally far more stringent. The second is that China’s actual property market is dealing with a troublesome time, which is extraordinarily related because it contributes about 30% of GDP. China’s housing increase appears to have come to an finish and is now paying for the extreme borrowing and development executed over the previous many years. The inhabitants has stopped rising because it did up to now, and demand for brand spanking new housing has dropped dramatically to the purpose the place it has created ghost cities.

The start of the actual property disaster dates again to 2021 when the China Evergrande Group (OTC:EGRNQ), as soon as the second-largest actual property developer within the nation, declared chapter. Later, it was the flip of different distinguished actual property builders reminiscent of Nation Backyard (OTCPK:CTRYF). In any case, we now have been speaking about this disaster for no less than two years, and in my view, the Chinese language fairness market has already discounted this concern. That is nothing new.

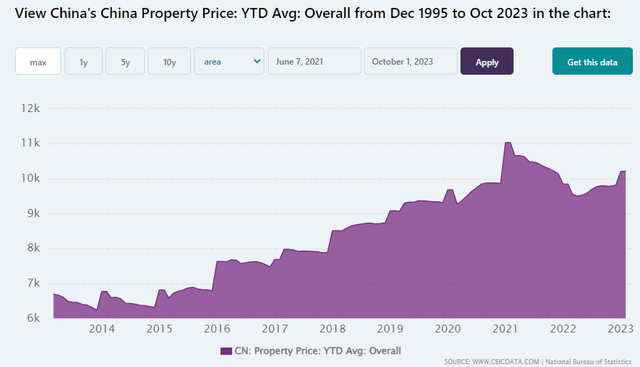

Federal Reserve Financial institution of St. Louis

In actual fact, it has been since 2021 that the worth of Chinese language residential property has been plummeting, however as of mid-year, there appears to be a foundation for a restoration. Proportionally, the droop lately has been better than through the nice monetary disaster.

CEIC Information

Furthermore, having a look on the common value of Chinese language properties in RMB/sq m, after a violent droop beginning in 2021, a brand new bullish development has already begun because the starting of the next yr. In brief, I imagine that total the worst of the actual property bubble has now already been discounted by the market and China has confronted its 2008. We regularly overlook that the Cling Seng (HSI) has collapsed greater than 50% from its all-time excessive: how a lot additional down can it go?

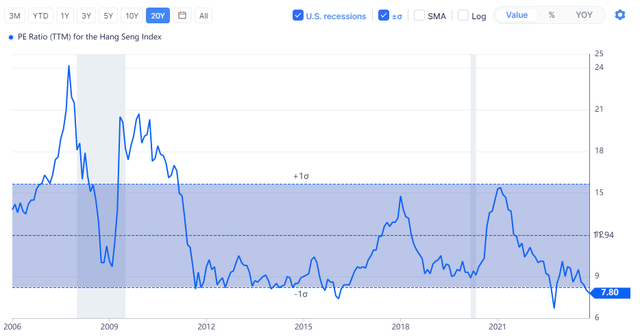

GuruFocus

The median of the Cling Seng P/E ratio is 10.20x, as we speak we’re at solely 7.80x, multiple customary deviation beneath. Within the final 20 years hardly has this index been so depressed.

So, along with the issues with Chinese language regulators, Alibaba’s value per share has additionally been affected by the tightening of the Chinese language financial setting, which is why I feel it has additionally discounted a possible recession in China. Basically, at present costs, I feel the Chinese language inventory market is far more engaging than the U.S. inventory market, and Alibaba might be one of many corporations that can profit most from China’s financial rebound.

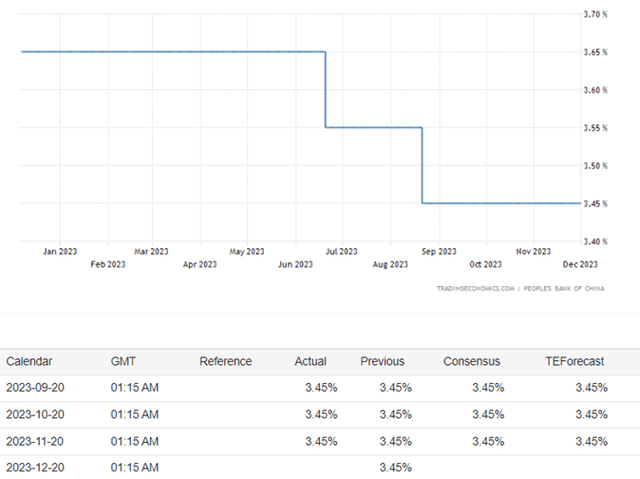

Whereas the US is scuffling with excessive rates of interest, rising default charges, and banks reluctant to lend cash, China is at present within the reverse scenario: rates of interest are declining and the Chinese language authorities can be poised to extend fiscal spending.

TRADING ECONOMICS

The Prime Charge Mortgage has already decreased twice because the starting of the yr and China’s funds deficit ratio can be raised to about 3.80% of GDP following the issuance of CNY 1 trillion sovereign bonds ($137 billion).

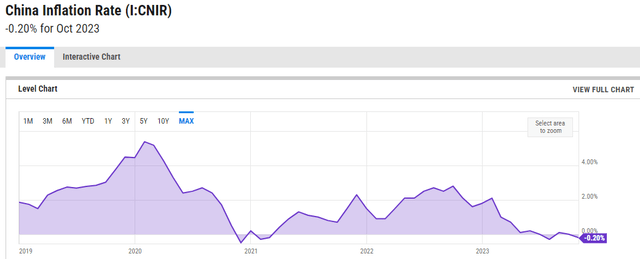

YCharts

Since China is at present preventing deflation, I might not be stunned if charges have been lowered additional and monetary spending elevated. Through the 2008 disaster, the Chinese language authorities made instant efforts to keep away from a monetary meltdown, and about two months after the Lehman Brothers chapter it had a stimulus bundle price CNY 4 trillion prepared.

Worldwide Financial Fund

Since China stays one of many fundamental financial powers with the bottom debt-GDP ratio, about 77%, I anticipate that in case of a worse-than-expected actual property disaster, a call can be made to extend financial stimulus: there may be room to take action. Lastly, no less than in the interim, GDP development estimates in 2023 and 2024 are sound, 5.20% and 4.10%, respectively.

In gentle of all these concerns, I imagine that the Chinese language inventory market has already discounted the worst and as early as subsequent yr might start its comeback. Usually, the market backside is reached when the next circumstances happen:

Pessimism is excessive. There are deflationary pressures. The federal government begins to stimulate the economic system. Rates of interest fall.

China at present meets all of the circumstances; the U.S. doesn’t even have one since it’s coming from years of sturdy enlargement. Due to this fact, I might not be stunned if in 2024 the efficiency of those two international locations is reverse: Cling Seng rising and S&P500 declining.

Alibaba was among the many hardest hit corporations within the Cling Seng Index, so I anticipate it will likely be one of many corporations to learn essentially the most when the development reverses. In any case, its fundamentals are nonetheless strong.

Alibaba will not be useless

When an organization loses 77% in three years, we anticipate on the very least that its core enterprise has been disrupted for the more severe. Different occasions collapses of this magnitude increase assumptions of chapter or everlasting harm to the corporate. Within the case of Alibaba, the corporate has merely encountered two years of stagnation after a decade of sturdy development. Even one of the best corporations on the planet have troublesome occasions to beat: check out Apple between 2012 and 2014.

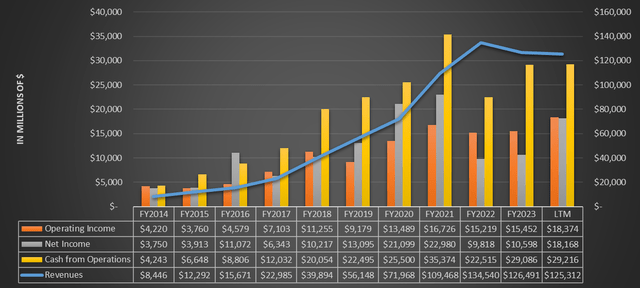

Chart based mostly on Searching for Alpha information

As we will see, till FY2021 development by no means had any issues; they began the next yr. As already extensively mentioned, pandemic, fines, and actual property disaster made FY2022 and FY2023 hell, and but Alibaba got here out with its head held excessive. The corporate within the final 12 months generated a internet earnings of $18.16 billion, money from operations of $29.21 billion, and revenues declined minimally. As well as, it ought to be famous that these figures have been impacted by an unfavorable trade price impact. Because the Fed is implementing a restrictive financial coverage and China’s central financial institution an expansionary financial coverage, the CNY/USD trade price has modified considerably. In any case, efficiency over the previous 12 months has been considerably higher than in FY2022 and FY2023, suggesting {that a} comeback is underway.

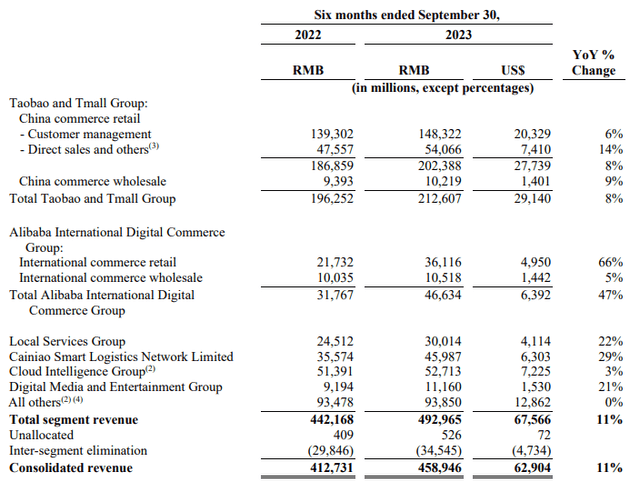

Particularly, the primary six months of FY2024 are exhibiting enchancment in all enterprise segments.

Alibaba Group September Quarter 2023 Outcomes

Taobao and Tmall generated revenues of RMB 212.60 billion, up 8% from the earlier yr. This may occasionally look like a barely disappointing end result, however one should contemplate the macroeconomic setting by which Alibaba is working. It’s not straightforward to develop throughout a deflationary interval; in actual fact, even competitor JD (JD) has struggled.

Worldwide commerce had sensational development, +47% or RMB 14.86 billion greater than final yr. This development comes primarily from the retail section. That is in my view a robust end result and a proof of the benefit with which Alibaba is increasing abroad by AliExpress.

Native Companies, Digital media, and Cainiao all grew greater than 20% over H1 FY2023.

Cloud had solely 3% development and generated revenues of RMB 52.71 billion; Alibaba continues to have the third largest cloud computing platform globally. The market didn’t take administration’s resolution to surrender the spinoff properly, however I personally discover it an accurate selection. How a lot capital may Alibaba have gotten from a enterprise section rising at low-single digits as we speak? In the meanwhile, the main target is to get the Cloud rising once more and solely then to consider the IPO.

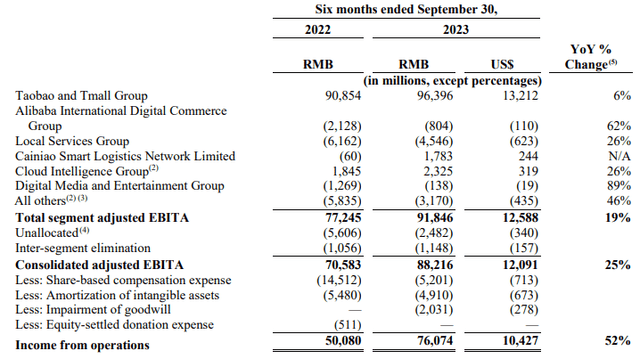

Alibaba Group September Quarter 2023 Outcomes

Anyway, when it comes to profitability the Cloud has improved: in comparison with H1 FY2023 EBITA improved by 26%. Cainiao is now not at a loss and Native Companies and Digital Media have considerably lowered losses. Total, earnings from operations improved by 52%.

In gentle of those outcomes, it’s clear that Alibaba will not be a dying firm opposite to what the worth per share would have you ever imagine.

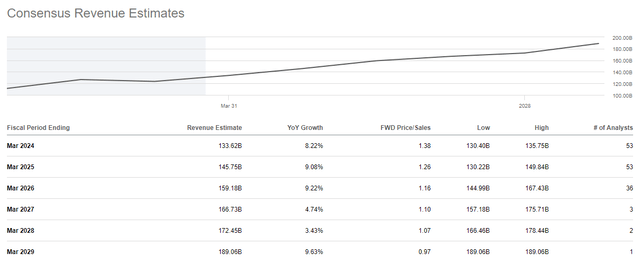

Searching for Alpha

Avenue Estimates, regardless of pessimism towards this firm, are in favor of regular development sooner or later, albeit not on the similar price as up to now decade. In any case, Alibaba as we speak is a behemoth and logically can’t maintain the expansion charges of the previous.

Lastly, the final side I wish to cowl on this part is shareholder remuneration.

Alibaba has additionally formally turn out to be a dividend firm since a dividend of $2.50 billion can be issued in 2024. The present dividend yield could be very low, only one.38%, however consider its development potential. This firm can simply generate an annual free money move of $30 billion over the following few years, so its development price may very well be substantial. The rise in dividend per share can be fueled by the massive buybacks that administration is implementing. Within the final quarter, treasury inventory price $1.70 billion was bought and one other $14.60 billion stays available.

Personally, on shareholder compensation, I barely disagree with administration’s selections: that $2.50 billion I might have most popular if it had been used to extend the buyback. In any case, I perceive that this selection was made extra to draw new traders than anything. I anticipate the buyback to be leveraged as a lot as attainable on the present value.

Valuation

We got here to the centerpiece of the article, which is the valuation of Alibaba. I’ve written a whole bunch of articles on Searching for Alpha however truthfully, I’ve by no means discovered an organization so undervalued. On the present value, Alibaba doesn’t make sense and now I’ll clarify why.

Initially, internet debt is -$51.48 billion and free money move for the previous 12 months was $24.51 billion (and Alibaba has not but totally recovered). Subtracting internet debt from the present market capitalization of $184 billion, in 5 and a half years free money move (assuming 0% development) manages to cowl the complete capitalization. For comparability, it’s as if Apple (AAPL) have been buying and selling at $35 per share.

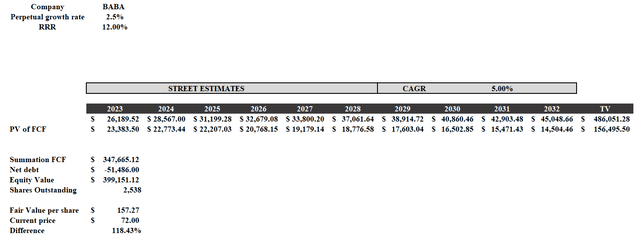

By creating a reduced money move mannequin this undervaluation is much more evident. This mannequin takes under consideration the next assumptions:

2023-2028 free money move was calculated from earlier Avenue Estimates and multiplied by the free money move margin for the final 12 months, 19.60%. From 2029-2032 I utilized a CAGR of 5% and eventually a perpetual development price of two.50%. The low cost price used is 12%. Utilizing the CAPM the speed would have been below 10%, so to make my estimate extra conservative I arbitrarily elevated it.

Discounted money move

With these assumptions, Alibaba’s honest worth is $157.27 per share, greater than double the present value. However there may be extra.

For the honest worth to align with the present value, the RRR must be about 25%, successfully making Alibaba virtually 10x in 10 years. Thus, investing $1,000 as we speak in 2033 will turn out to be $10,000. Anyway, 10x or not, until the financials are distorted (and I’ve no cause to imagine that) at as we speak’s value Alibaba I feel is a cut price, doubtlessly one of the best in 2024.

With Alibaba, we will have enjoyable making even essentially the most absurd assumptions, however there isn’t any approach to make it overvalued.

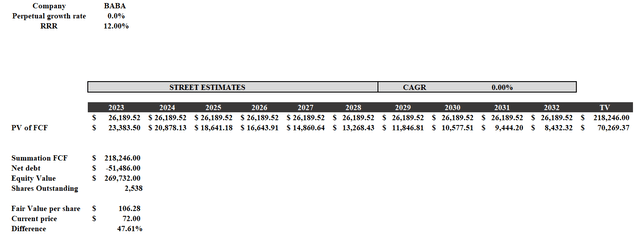

Let’s assume that each one analysts are flawed and Alibaba won’t ever develop once more for some unusual cause. So, the anticipated free money move in 2023 can have a development price of 0% and a perpetual development price of 0%.

Discounted money move

Once more, Alibaba is undervalued because the honest worth is $106.28 per share, a 47% distinction from the present value. All this, nonetheless contemplating an RRR of 12%, is so fairly excessive.

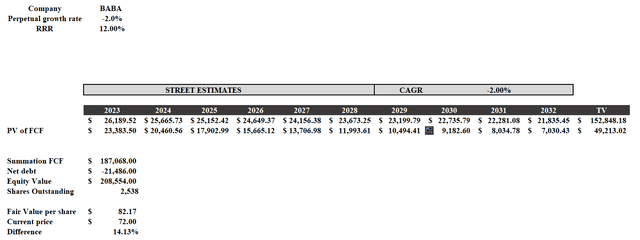

Allow us to now assume that Chinese language regulators get up one morning and determine for no cause to advantageous Alibaba $30 billion. Additionally, allow us to assume that the expansion price is -2% in addition to the perpetual development price.

Discounted money move

As soon as once more, Alibaba is undervalued since its honest worth can be $82.17 per share. In brief, even within the face of a doomsday state of affairs, this firm continues to be undervalued. Primarily based on its monetary outcomes there may be mainly no method for it to be overvalued.

TIKR.com

In any case, that is to be anticipated provided that its valuation ratios are extremely low. No firm with such excessive development prospects and margins is buying and selling at an NTM market cap/FCF of seven.26x; the identical goes for the NTM P/E of seven.61x. Their common values since 2015 are 22.54x and 23.97x, respectively, 3 occasions as excessive as they’re as we speak.

An uncommon comparability

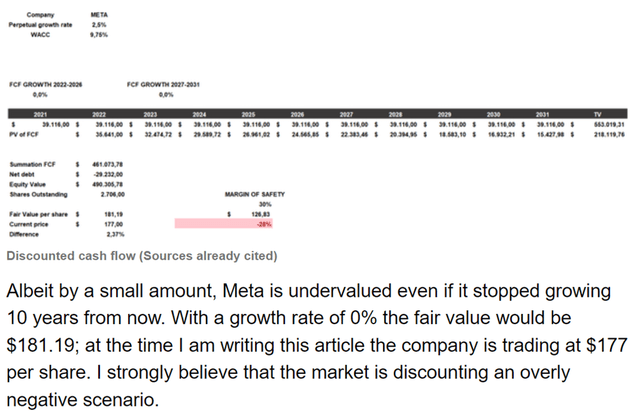

With due variations, when it comes to valuation, the present scenario of Alibaba jogs my memory of that of Meta (META) final yr. Since mid-2022, I began writing a collection of sturdy purchase articles on Meta regardless that the worth stored collapsing. The rhetoric on the time was that Meta was losing cash on the Actuality Labs section and that nobody was utilizing Fb anymore. That distorted notion of actuality is what left many panicked traders with out earnings. Even, staying on the Meta/Alibaba parallel, in considered one of my articles I hypothesized a 0% development state of affairs for Meta, simply as I did earlier with Alibaba.

My article on Searching for Alpha

Even then Meta was undervalued, but the worth collapsed one other 50% earlier than recovering all of the misplaced floor in a couple of yr. I additionally wrote sturdy purchase articles when the worth was round $100 per share, however at that time, pessimism was at its peak and few needed to purchase.

With these remarks, I don’t wish to create false hope since Meta and Alibaba are totally different corporations, however I wish to level out how out there “nonsense costs” generally exist and may have an effect on even established and internationally dominant corporations. For my part, Alibaba’s present value per share is totally irrational, simply as Meta was at $90 per share. Generally the market takes large oversights, and when the numbers are on our facet it could be the correct time to benefit from them.

Dangers and closing concerns

The truth that Alibaba appears undervalued based mostly on its numbers doesn’t essentially imply that it will likely be a cut price and everybody can purchase it. It’s apparent that there are dangers to be evaluated and, on this case, they’re fairly excessive given the potential returns.

Definitely, there may be competitors that might make future efficiency much less rosy. JD is the principle competitor, however if you spend money on a Chinese language firm you need to do some totally different considering. Usually, we’re used to considering that the rivals are simply different corporations, however on this case, there may be primarily the Chinese language authorities to consider.

Chinese language large tech corporations don’t have the identical flexibility as Western ones and have to stick to a algorithm designed for the frequent good. For instance, beforehand we noticed that Alibaba, along with being fined, determined to speculate $15.50 billion in frequent prosperity out of skinny air. Though sensible, this selection appears relatively questionable. Simply think about if Apple had executed the identical: shareholders wouldn’t have been completely happy.

So, investing in Alibaba means being conscious that from in the future to the following information may flip the corporate the wrong way up and that shareholders is not going to at all times be put first. On the similar time, nonetheless, you might be shopping for an organization that has no debt, generates $24 billion a yr in free money move, and has a PE of about 8x. In different phrases, you will need to settle for some compromises if you wish to purchase top-of-the-line corporations on the planet at a ridiculous value: there are not any free meals in finance. Lastly, the extent of the actual property disaster inside the nation remains to be unknown, and this might lead the Chinese language inventory market to break down additional. In my estimation, even within the occasion of income decline Alibaba is undervalued, however this doesn’t detract from the truth that the scenario ought to be monitored.

In gentle of those concerns, it’s clear that Alibaba will not be an funding for everybody however solely for individuals who imagine in China’s long-term development with out being influenced by the day by day information. If you happen to frequently watch the efficiency of your portfolio and volatility scares you, Alibaba is the final firm to spend money on. Above all, you want some confidence within the Chinese language authorities’s selections and that it’s going to not restrict the expansion of its large tech an excessive amount of. The dividend concern may appeal to new traders, however even then, you want a long-term view because the dividend yield remains to be too low.

I understand that many individuals will not be prepared to simply accept that an organization operates in such a posh setting, however so far as I’m involved Alibaba is so undervalued that I’m prepared to move on it at $72 per share: I feel the potential upside is unquestionably better than the potential draw back. After all, one shouldn’t make the error of overweighting it inside the portfolio. For the extra risk-averse, it would make sense to contemplate some ETFs the place Alibaba occupies one of many distinguished positions. In any case, China’s purpose is generalized development and an ETF would tremendously cut back particular dangers whereas nonetheless remaining uncovered to the nation’s development. There isn’t a proper or flawed selection a priori, all of it will depend on how a lot you might be prepared to danger and what your purpose is.

Editor’s Notice: This text was submitted as a part of Searching for Alpha’s High 2024 Lengthy/Quick Choose funding competitors, which runs by December 31. With money prizes, this competitors — open to all contributors — is one you don’t wish to miss. In case you are considering changing into a contributor and participating within the competitors, click on right here to search out out extra and submit your article as we speak!

Editor’s Notice: This text discusses a number of securities that don’t commerce on a serious U.S. trade. Please concentrate on the dangers related to these shares.

[ad_2]

Source link