[ad_1]

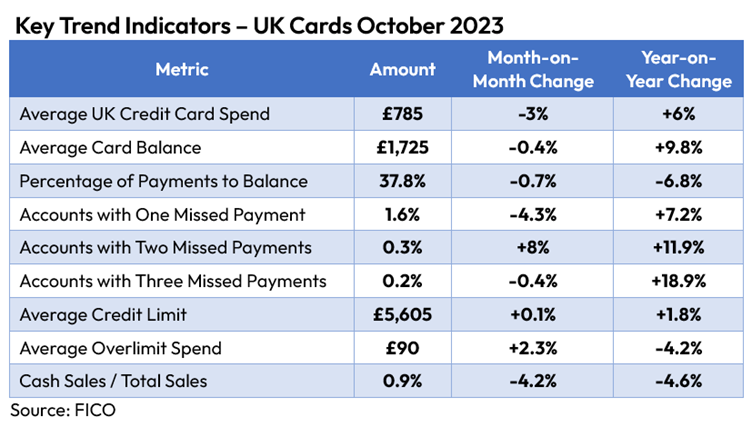

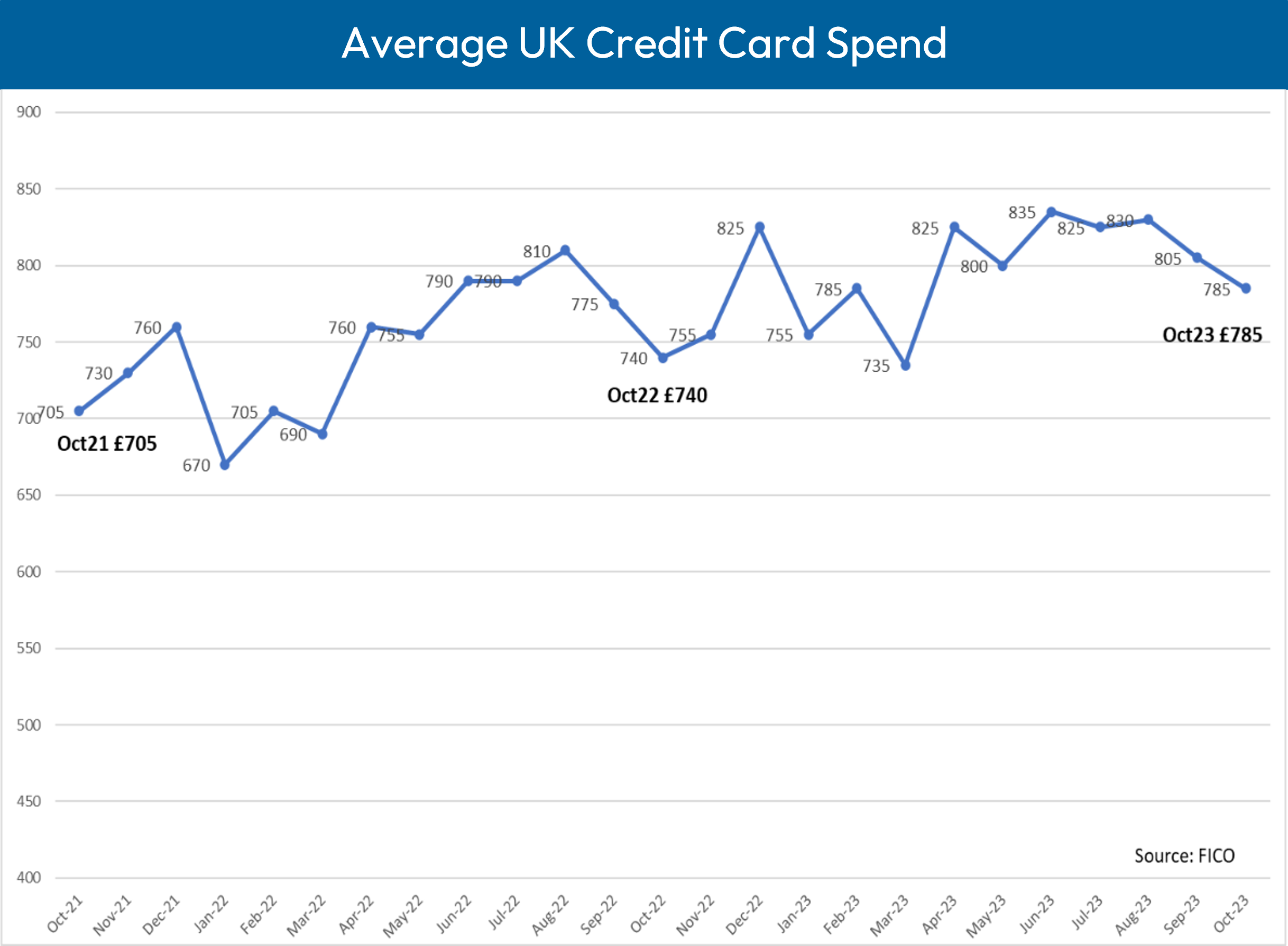

UK shoppers typically spend much less within the autumn as they put together for the upper spending in the course of the vacation season. The FICO UK Credit score Card Market Report for October 2023 displays this pattern, exhibiting that spending dipped in October by 3% month-on-month. Nonetheless spending was nonetheless greater than October 2022, in all probability due not less than partially to greater costs.

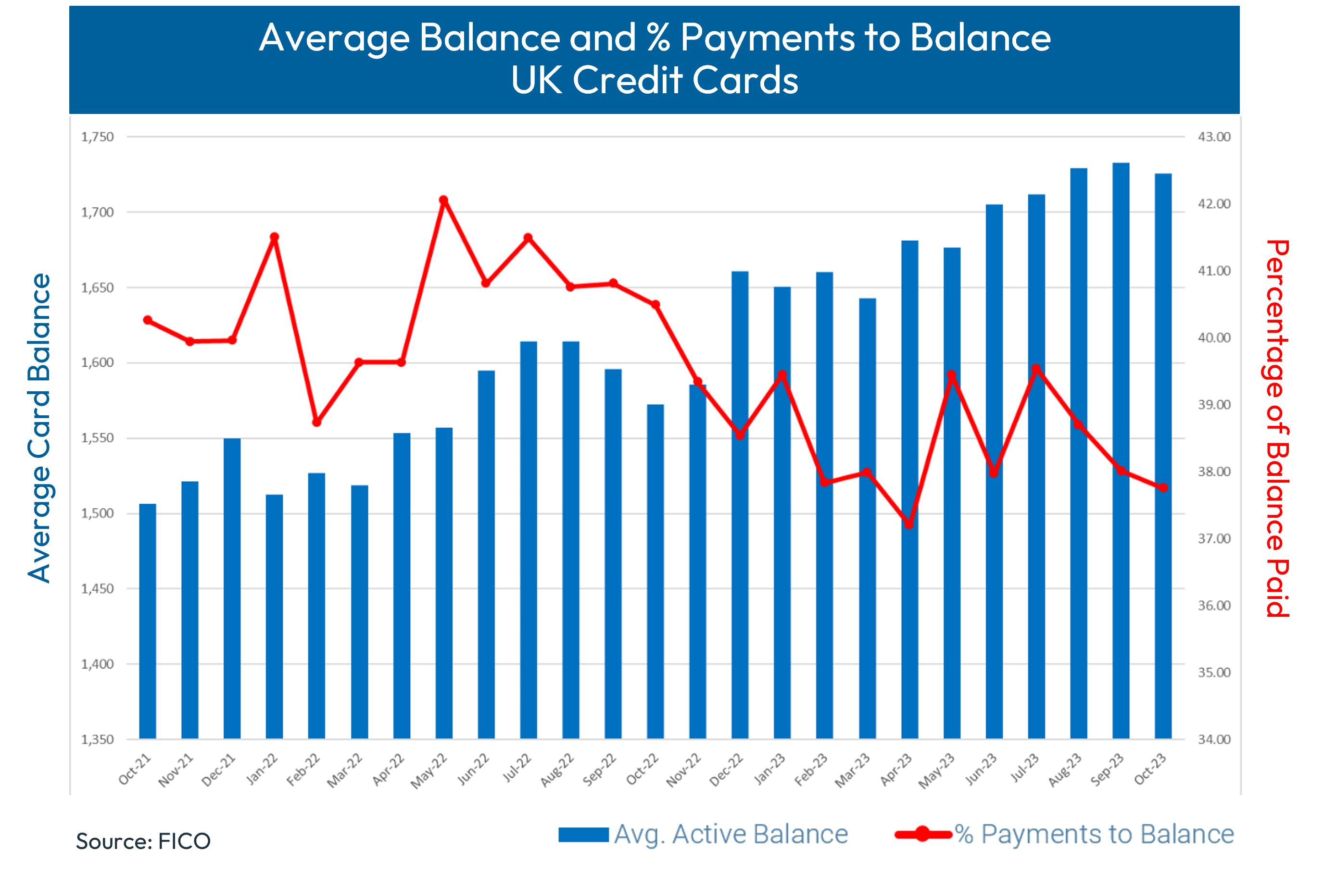

The monetary pressures going through many UK households are additionally evidenced in falling month-to-month and annual funds to steadiness as extra shoppers lean on credit score to satisfy their life-style wants.

UK Credit score Card and Client Spending Highlights

Gross sales transactions dropped 3% from September, however are nonetheless 6% greater than October 2022Average card balances fell barely month-on-month, down 0.4%, however stay 9.8% greater than the earlier yearOnce once more the share of funds to steadiness fell, now standing at 37.8percentConsumers lacking one cost decreased month-on-month by 4.3percentThe variety of shoppers lacking two card funds rose by 8%.The typical steadiness the place one cost has been missed continued on an upward pattern, rising 1% from September and 5.5% year-on-year, now standing at £2,180

excellent balances, whereas the common card steadiness decreased 0.4% month-on-month, the steadiness for purchasers who’ve missed card funds is trending upwards and the share of funds to steadiness has decreased for 4 months in a row.

37.8% of card balances have been paid in October, a discount of 0.7% month-on-month and 6.8% year-on-year. 2022 noticed the same discount, earlier than elevated funds in January 2023, nonetheless it’s possible this determine will proceed to fall over the subsequent couple of months attributable to continued monetary hardship and elevated spend over the festive interval.

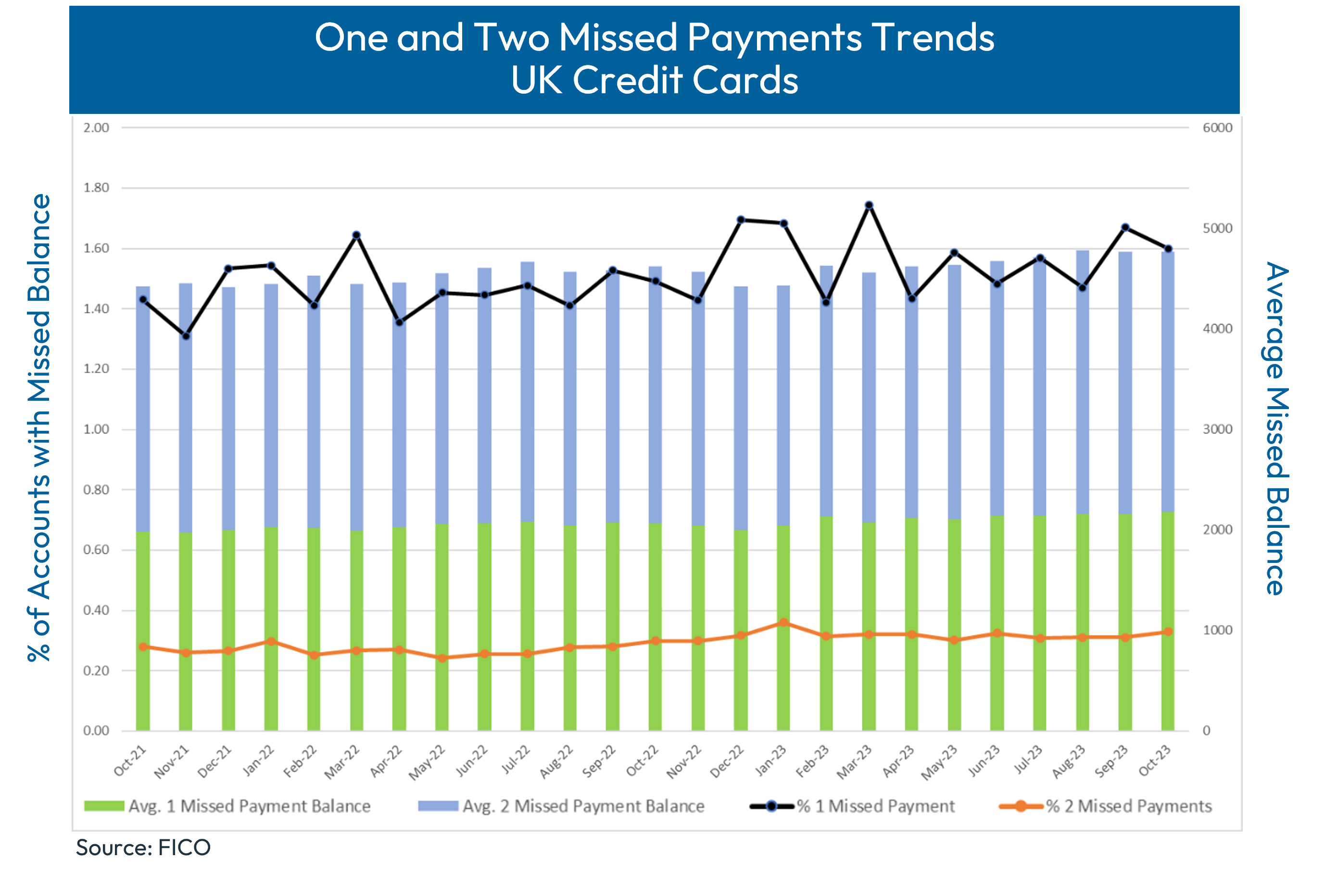

The variety of clients lacking one cost decreased by 4.3% from September to October, which was anticipated after the 13.5% enhance seen in September. The September enhance has rolled forwards and subsequently there was a bigger enhance in clients now lacking two card funds in October — an 8% enhance month-on-month. Clients lacking three funds have skilled extra stability, dropping by simply 0.4% on the earlier month. Nonetheless, the variety of clients lacking one, two or three funds stays considerably greater year-on-year.

The typical steadiness for purchasers lacking card funds has continued to pattern upwards throughout 2023, with the common steadiness for one missed cost growing 1% month-on-month to £2,180 and 5.5% year-on-year. An identical sample is seen for the common steadiness for 3 missed funds, growing 0.4% month-on-month to £2,950 — a 2.4% enhance year-on-year. Nonetheless, clients lacking two funds have seen their common steadiness cut back by 0.7% to £2,585, though that is nonetheless 1.3% greater than the identical month in 2022.

Though the common missed cost steadiness has been growing all through a lot of 2023, when evaluating the ratio of missed cost balances to the general bank card steadiness, this has been pretty secure. This means missed cost balances haven’t elevated at a sooner fee than the general steadiness. Nonetheless, this ratio has elevated by 1.48% month-on-month for the common one missed cost steadiness. With elevated seasonal spend anticipated over the approaching months, danger groups ought to monitor this carefully.

These card efficiency figures are a part of the information shared with subscribers of the FICO® Benchmark Reporting Service. The info pattern comes from shopper studies generated by the FICO® TRIAD® Buyer Supervisor answer in use by some 80% of UK card issuers. For extra info on these developments, contact FICO.

How FICO Can Assist You Handle Credit score Card Danger and Efficiency

[ad_2]

Source link