[ad_1]

In a siloed group every division or operate has their very own processes. Nevertheless, when confronted with a typical goal comparable to onboarding a brand new buyer, merely layering in these processes has a draw back. Clients are repeatedly requested to offer the identical info, resulting in redundancy, pointless bills as superfluous checks are carried out, and a lack of knowledge sharing that would threaten fraud prevention. These points collectively contribute to poor buyer expertise and elevated dangers and prices.

Shared Workflows

Traditionally, every lender operates distinct workflows to handle credit score danger and detect fraud. Every course of is run end-to-end with little oversight into all the onboarding expertise. Nevertheless, the combination of those workflows may end up in vital advantages, comparable to lowered time to completion and decreased prices related to verification checks.

Think about, as an example, a brand new applicant who requires each a credit score verify and an id verification. If the suitable threshold for one isn’t met, there isn’t any level in making a pricey name to third-party information sources for the opposite. The place workflows stay separate each checks nonetheless occur. In a shared workflow a thought-about determination is made concerning the order of checks; if the brink for the primary verify isn’t met, the appliance could be promptly halted with out incurring further price or inner sources. This streamlined strategy enhances effectivity and ensures a cheaper and customer-centric onboarding course of.

Leverage the Software Supply to Improve Buyer Expertise and Scale back Danger

In lots of circumstances, the preliminary phases of the appliance course of begin with restricted info accessible. When you have entry to software information, essential particulars explaining the motivation and supply of the appliance are sometimes not accessible to these assessing credit score or fraud danger. Processes could be streamlined and more practical when the supply of an software turns into a parameter that determines the checks required.

As an illustration, when an software originates from a long-standing buyer, the degrees of id and anti-fraud checks are decrease than for an software from an applicant new to the group. Clients who responded to a focused advert marketing campaign by the monetary establishment could be thought-about a decrease danger from each a fraud and credit score danger perspective in comparison with candidates with no prior interactions who usually tend to be fraudsters.

By breaking down this silo and sharing this pertinent info you’ll be able to understand tangible advantages. This strategy permits you to establish lower-risk candidates to automate and expedite their software processing, considerably enhancing their buyer expertise. Conversely, it lets you detect particular functions carrying greater danger of fraud that require extra rigorous scrutiny, thereby concentrating your efforts on mitigating potential dangers.

Achieve Insights into the Buyer Onboarding Course of

The journey from preliminary software to efficiently onboarded buyer is a vital one, however not all candidates make it to the end line. Software processes can falter at numerous phases for a large number of causes. To boost this course of, it is crucial to prioritize conversion charges as a key efficiency indicator for all concerned. This lets you detect and rectify bottlenecks within the onboarding course of.

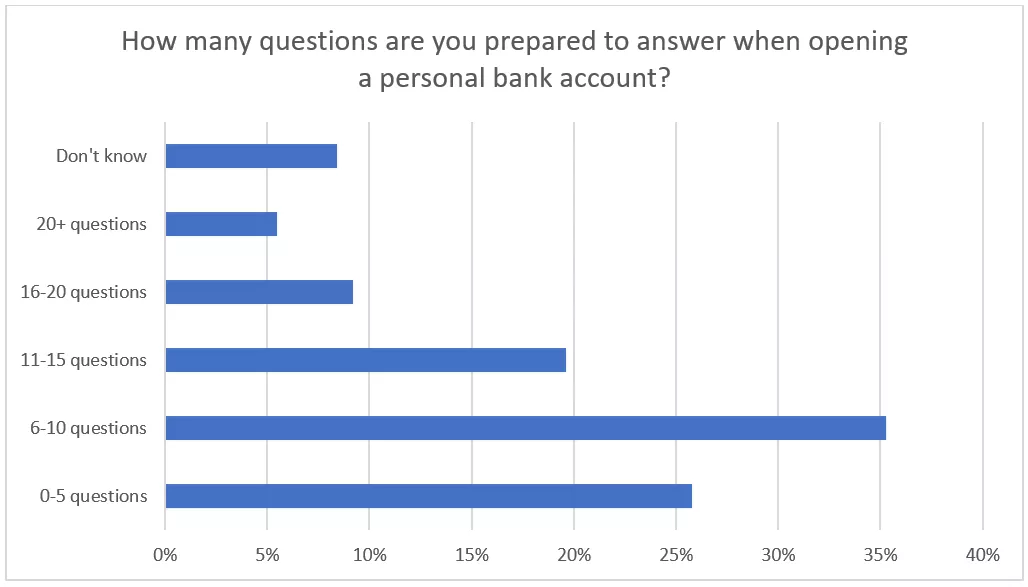

Terminating functions for professional causes due to compliance considerations or unacceptable credit score or fraud danger is important, but it surely’s very important to succeed in this determination with out incurring pointless prices. Nevertheless, a good portion of functions are deserted as a result of buyer dissatisfaction. In accordance with FICO analysis, a staggering 57% of people embarking on opening a checking account are solely keen to reply lower than 10 questions. Moreover, 30% will abandon a checking account software if the id fraud checks are too onerous or time-consuming.

Clearly, a extra profound understanding of when and why clients determine to desert their functions can yield substantial advantages and be sure that the specified candidates develop into valued clients. To attain this, figuring out factors the place clients routinely abandon the origination course of is essential. In these situations, we will consider and adapt by contemplating the next:

Timing and Presentation: Can the query be requested at a special stage or in a special method? As an illustration, is it info that may very well be gathered post-book, to streamline the appliance course of?Avoiding Redundancy: Are you asking questions that duplicate info gathering? For instance, in the event you’ve already obtained the applicant’s date of delivery, there isn’t any have to request their age as properly.Are you attracting the appropriate buyer in your services or products? When the client profile would not align together with your providing, they’re extra inclined to terminate their engagement as soon as they understand it isn’t a match. When you may view this as a constructive final result, it is necessary to acknowledge that you have already invested advertising funds and sources in getting them up to now and also you’ve left them with a poor expertise of your group.

By proactively addressing these points, you’ll be able to optimize the client onboarding course of, cut back drop-offs, and be sure that extra candidates efficiently transition into glad clients.

Eradicating Siloes: Individuals, Course of and Know-how

This submit is the second in my sequence; within the first I mentioned a number of the issues siloes create, and the individuals practices that may cut back siloes. In my remaining submit I’ll discover the position know-how together with AI and machine studying performs in fostering collaboration and efficient working for monetary establishments concerned in each credit score danger and software fraud administration.

[ad_2]

Source link