[ad_1]

As we usher within the New 12 months, many people mirror on the previous and set resolutions for the longer term. A decision is simply an over difficult time period we use for a GOAL. The highest 10 resolutions (targets) typically made on the new 12 months are:

ExerciseLose weightGet organizedLearn a brand new skillLive life to the fullestSave cash/Spend lessQuit smokingSpend time with household & FriendsTravel moreRead extra

Whereas train tops the listing, I’d argue it’s equally vital to contemplate monetary well-being. One space that performs a vital position in our monetary well being is credit score and simply know generally credit score restore is a necessity. On this weblog submit, we’ll discover the connection between credit score and New 12 months’s resolutions, providing sensible suggestions that can assist you obtain a credit-worthy 12 months forward.

Be within the Proper Headspace:

It’s the American strategy to need quick gratification. That is usually why we don’t observe by with these New 12 months’s Resolutions we make. Some recommendation when sitting down to write down out your targets is to simply accept the actual fact gradual change might be finest. Enable your self some room for error. In any case, we’re human, and it’s our nature to go astray every now and then. Chart your progress and rejoice mini milestones (inside motive).

Set Real looking Credit score Objectives:

As an alternative of imprecise targets, set clear and achievable credit score targets for the 12 months. The acronym we use is SMART:

S: SpecificM: MeasurableA: AttainableR: RelevantT: Time Delicate

Whether or not it’s paying down bank card debt, rising your credit score rating, or establishing an emergency fund, having particular targets will provide you with a roadmap to observe. Ensure the aim is motivating to you. It is a private journey of YOURS! Break down these targets into smaller, manageable duties to trace your progress all year long.

At The Phenix Group, our dedication extends far past the scope of mere credit score restore; we embody the imaginative and prescient of being “Extra Than Credit score Restore.” Central to our mission is a dedication to credit score training, pushed by the idea that knowledgeable people are empowered people. As you embark on the journey of setting and reaching your targets, contemplate embracing the SMART standards—Particular, Measurable, Achievable, Related, and Time-Delicate. Let these rules act as a roadmap, guiding you in the direction of well-defined aims and making certain a extra strategic and profitable consequence.

Create a Finances:

A well-structured price range is the muse of monetary stability. Take the time to investigate your earnings and bills and allocate funds in the direction of paying off money owed and constructing financial savings. Having a price range not solely helps you management your spending but in addition means that you can prioritize debt reimbursement, contributing positively to your credit score profile.

Perceive Your Credit score Rating:

Step one in the direction of enhancing and/or repairing your credit score is knowing it. Get hold of your credit score report and assessment it completely. Be aware of any discrepancies and be sure that all the data is correct. Your credit score rating is a snapshot of your creditworthiness, influencing all the things from mortgage approvals to rates of interest. Realizing the place you stand is essential for making knowledgeable monetary choices.

Prioritize Debt Compensation:

You probably have excellent money owed, prioritize paying them off. Begin with high-interest money owed like bank cards and loans. Take into account consolidating money owed to streamline funds and doubtlessly decrease rates of interest. Common and well timed funds are essential for sustaining and enhancing your credit score rating.

Construct Emergency Financial savings:

Sudden bills can derail even one of the best monetary plans. Constructing an emergency fund is a decision that may defend you from the monetary influence of unexpected circumstances. Goal to avoid wasting at the very least three to 6 months’ price of residing bills in a separate account to offer a monetary security web. Keep in mind, financial savings aren’t to be touched for something wanting an emergency-those new footwear can wait!

Monitor Your Credit score Frequently:

Make it a behavior to watch your credit score report recurrently all year long. This lets you catch any errors or fraudulent actions early on. We advocate you make the most of Experian.com as a baseline to watch. They provide FICO primarily based credit score scores that are similar to these collectors shall be using. Credit score Karma is an effective software for quick notification of recent inquiries and accounts, however the Vantage scoring mannequin doesn’t relate to something a creditor will typically use.

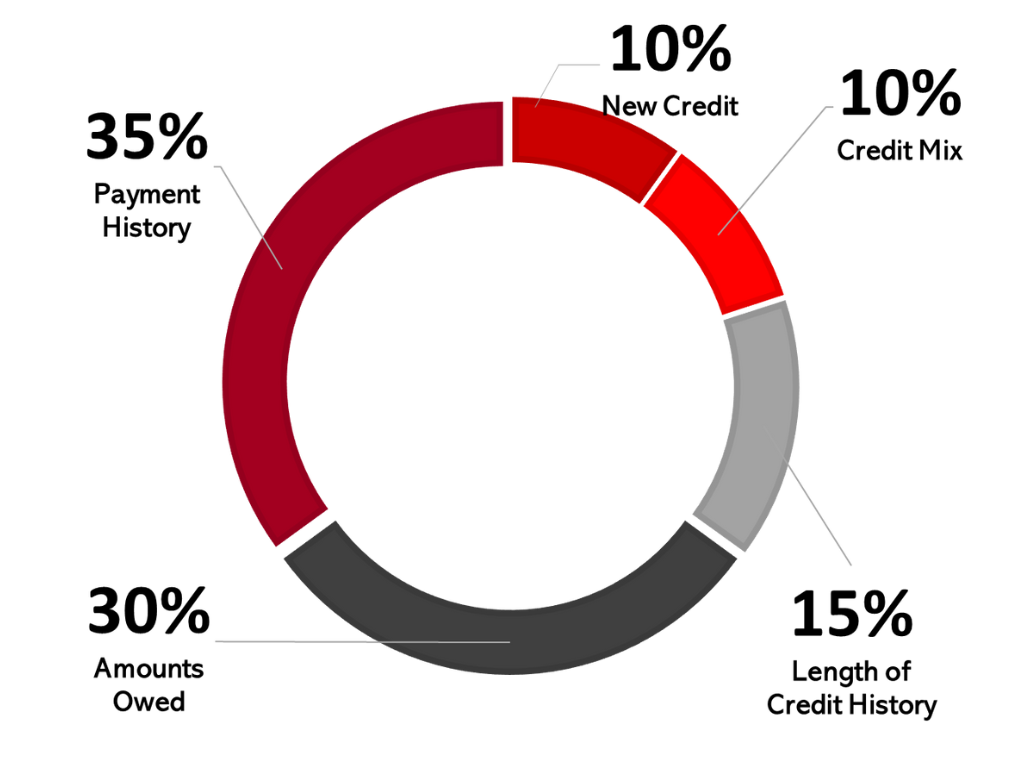

Educate Your self About Credit score:

Monetary literacy is vital to creating knowledgeable choices about credit score. Take the time to teach your self about credit score scores, rates of interest, and the influence of monetary selections in your creditworthiness. Understanding the elements that affect your credit score can empower you to make higher monetary choices.

As you embark on a brand new 12 months full of hope and resolutions, don’t neglect to incorporate your monetary well-being in your plans. By setting real looking SMART credit score targets, making a price range, prioritizing debt reimbursement, and staying knowledgeable, you may pave the way in which for a financially match and credit-worthy 12 months forward. In case you want any assist or steering along with your credit score attain out to The Phenix Group for assist. Right here’s to a affluent New 12 months!

[ad_2]

Source link