[ad_1]

Yuichiro Chino/Second through Getty Pictures

Zscaler (NASDAQ:ZS) is in a chief place for the subsequent era of risk actors, as the corporate’s platforms pose because the gateway between outdoors site visitors breaching an organization’s information. I consider that the agency is well-positioned within the period of GenAI and, via M&A, will place itself for the long run quantum risk actors within the close to future. Although the corporate’s top-line development is nearing a sub-30% development price, as administration guided, I do consider that the agency nonetheless stays value-rich as administration seeks to bolster its gross sales and advertising and marketing division to push full platform adoption. I present ZS shares a BUY suggestion with a value goal of $286.20/share.

Operations

Zscaler reported a robust q1’24, kicking off the brand new fiscal 12 months working on all cylinders. Because the agency seeks to develop right into a single-platform safety firm as do its rivals, Zscaler is emphasizing its three product pillars, ZIA, ZPA, and ZDX, with ZIA and ZPA being the core-adopted merchandise with ZDX because the cross-sell merchandise. ZDX seems to be Zscaler’s resolution that is similar to Datadog (DDOG) or SolarWinds’ (SWI) community monitoring function for SaaS utility optimization for a greater person expertise. Along with these, Zscaler is bringing ahead its information safety function, CASB/DLP, as corporations start leveraging some type of AI/ML within the office. Differentiated from different cybersecurity platforms, Zscaler’s core focus is throughout the internet API safety realm through which their merchandise safe information site visitors between the community infrastructure and the skin world, whether or not it is a cloud platform or fundamental web shopping.

Zscaler skilled a robust go-to-market in q1’24, with almost 50% of latest emblem prospects buying their three core merchandise, ZIA, ZPA, and ZDX. I consider this single-company resolution development will proceed going ahead as CIOs successfully search to scale back a number of vendor exposures and, in flip, scale back prices whereas sustaining effectiveness. This may be seen throughout the agency’s federal publicity, with their merchandise being present in 12 of the 15 cabinet-level businesses. As of q1’24, Zscaler ZIA, ZPA, and ZDX have been every deployed throughout 100,000 customers at this federal stage. As alluded to of their q1’24 earnings name, Zscaler’s DoD publicity nonetheless has a protracted runway as their publicity continues to be quite restricted. This could be a enormous potential for the agency when it comes to authorities contracts.

As for the GenAI ramp, Zscaler might have a serious alternative with its core merchandise as a technique to protect outdoors site visitors from an organization’s delicate information. Being opportunistic, Zscaler upsells its AI-driven options by 20% above its customary superior bundle. Administration famous of their q1’24 earnings presentation that their merchandise have secured over 2b AI transactions monthly, posing the dangers concerned in GenAI and thus proving that its AI-driven options are vital for the rising know-how. This will also be a chance for Zscaler to emphasise gross sales for his or her DLP and CASB options. As extra corporations are probably exposing their information to the general public area, Zscaler’s product suite can successfully analyze information transfers, predict potential threats, and preemptively act earlier than a risk actor assaults.

The agency’s newest product, Risk360, has hit the bottom working with 10+ closed offers and an extra 10+ enterprises evaluating the options. Risk360 is the agency’s AIML product that actively quantifies and mitigates dangers in actual time. As mentioned of their q1’24 earnings name, Risk360:

supplies essential insights to CISOs when reporting on cybersecurity threat technique and governance, significantly in gentle of latest SEC laws.

Jay Chaudhry

This product could be a essential software for CISOs to make sure their GRC posture is up-to-date and successfully being enforced.

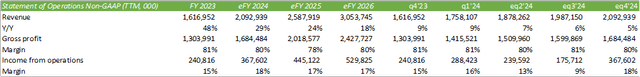

Financials

Administration alluded to the identical problem different safety corporations are going through when it comes to billings. As the price of borrowing has remained elevated for the reason that Fed pinned rates of interest between 5.25-5.50%, contract period has come down, with fewer corporations signing longer-term 3-year offers. Although this does not essentially influence income, it does add a sure stage of threat for future intervals as contract renewal takes place.

Company Studies

Regardless of these challenges, billings nonetheless grew 34% y/y, although dropped by -37% sequentially. Regardless of these challenges, the agency did develop prospects over $100k in ARR and over $1mm in ARR, every by 4%. Clients over $1mm in ARR have considerably slowed from earlier intervals the place it averaged 9% in 2h23. I do not consider that that is essentially an indication of a slowdown per se; nonetheless, it sheds some gentle on administration’s steerage for the rest of eFY24.

Administration guided ~31% top-line development for eq2’24 and ~29% for eFY24. This can be a vital slowdown from earlier years, with development of 62% in FY22 and 48% in FY23. Regardless of this slowdown, I consider that this is not essentially a priority because the agency’s platforms are reaching robust enterprise saturation and are reaching a extra normalized development price. I consider that we will discern that the corporate’s “land” development has reached its peak development price and the agency is now extra closely specializing in the “increase” development price as corporations search to work with fewer distributors on extra of a platform format.

Company Studies

Contemplating operations, administration talked about that the agency will likely be open to M&A exercise, not for income development however to purchase rising applied sciences that may bolster the agency’s platforms.

I feel you’ll not see us attempting to purchase income via an M&A. They are going to see us shopping for progressive, disruptive applied sciences that may assist us get to market sooner; quicker is essential.

Jay Chaudhry

My expectation from this verbiage is that administration is not fairly able to steer the corporate into the mature section of development however continues to be looking for to boost its platforms for a broader cross-selling cycle. I consider that this strategy to M&A will profit the Zscaler in the long term as cybersecurity is an evolving entrance and securing know-how that is still one step forward of the risk actors and is important for the survival of a safety platform. As administration at Palo Alto Networks (PANW) had talked about on their q1’24 earnings name, quantum safety stays a methods off however stays a priority for corporations as this rising know-how takes form. After GenAI, I consider this would be the subsequent focus for Zscaler, because the agency’s platforms act as the online gateway for enterprises. I might anticipate the subsequent offers to be both centered on GenAI or that subsequent step ahead into quantum safety.

On the word of M&A, administration talked about that gross margins are anticipated to fall throughout the vary of 78-82% going ahead. Administration had talked about that new releases and rising applied sciences may have a decrease margin as they scale, making a slight headwind to general margins. Although I can not forecast when the subsequent deal will happen, I do anticipate that Zscaler will likely be looking out for brand new applied sciences to amass throughout the subsequent 12 months or two as GenAI continues to turn out to be extra standard within the office and additional as quantum computing advances to manufacturing.

Company Studies

When it comes to future margins, administration talked about that they are going to be bolstering their gross sales and advertising and marketing workers, which I consider will create some margin compression within the coming quarters. I consider this issue will permit for income to stay wealthy in development because the agency seeks to promote throughout a number of nodes versus one-off elements.

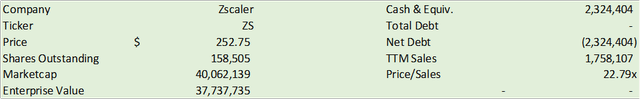

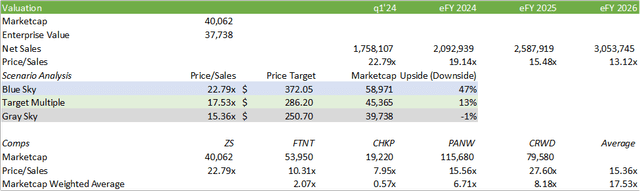

Worth and Shareholder Worth

Company Studies

ZS shares presently commerce at 22.79x gross sales, modestly above most of their cohort however considerably under high-grower CrowdStrike (CRWD). With Zscaler’s moderating top-line development efficiency, I do consider a extra average pricing a number of will likely be vital when valuing the agency. Utilizing a market cap weighted strategy, the typical value/gross sales a number of is 17.53x trailing gross sales. I consider this will likely be a extra acceptable goal for ZS shares going ahead because the agency stays between excessive development and maturing operations. My suggestion for the inventory is a BUY with a value goal of $286.20/share at 17.53x eFY25 income.

Company Studies

Technical Evaluation

On a tactical foundation, I consider that ZS shares might expertise a pullback within the close to time period earlier than setting course in direction of my elementary value goal of $286.20. Given the inventory’s sharp upward route since June 2023, a retracement ought to be anticipated and will pull the share value again to ~$186/share. I do consider the inventory will route again upwards in time because the market digests this vital value enhance. For an energetic dealer, my suggestion is to think about lowering one’s place and shopping for again in at this decrease, sub-$200 value.

TradingView

[ad_2]

Source link