[ad_1]

Enterprise leaders regularly ask, “How a lot does it price to attain digital transformation?” It’s a good query. Sadly, the reply is – similar to you’ll be able to’t purchase love, well being, or happiness – firms can’t “purchase” digital transformation: it’s the results of a methodical, multi-tiered technique of steady enchancment. In different phrases, it’s a journey, and which means there are some guideposts to navigate.

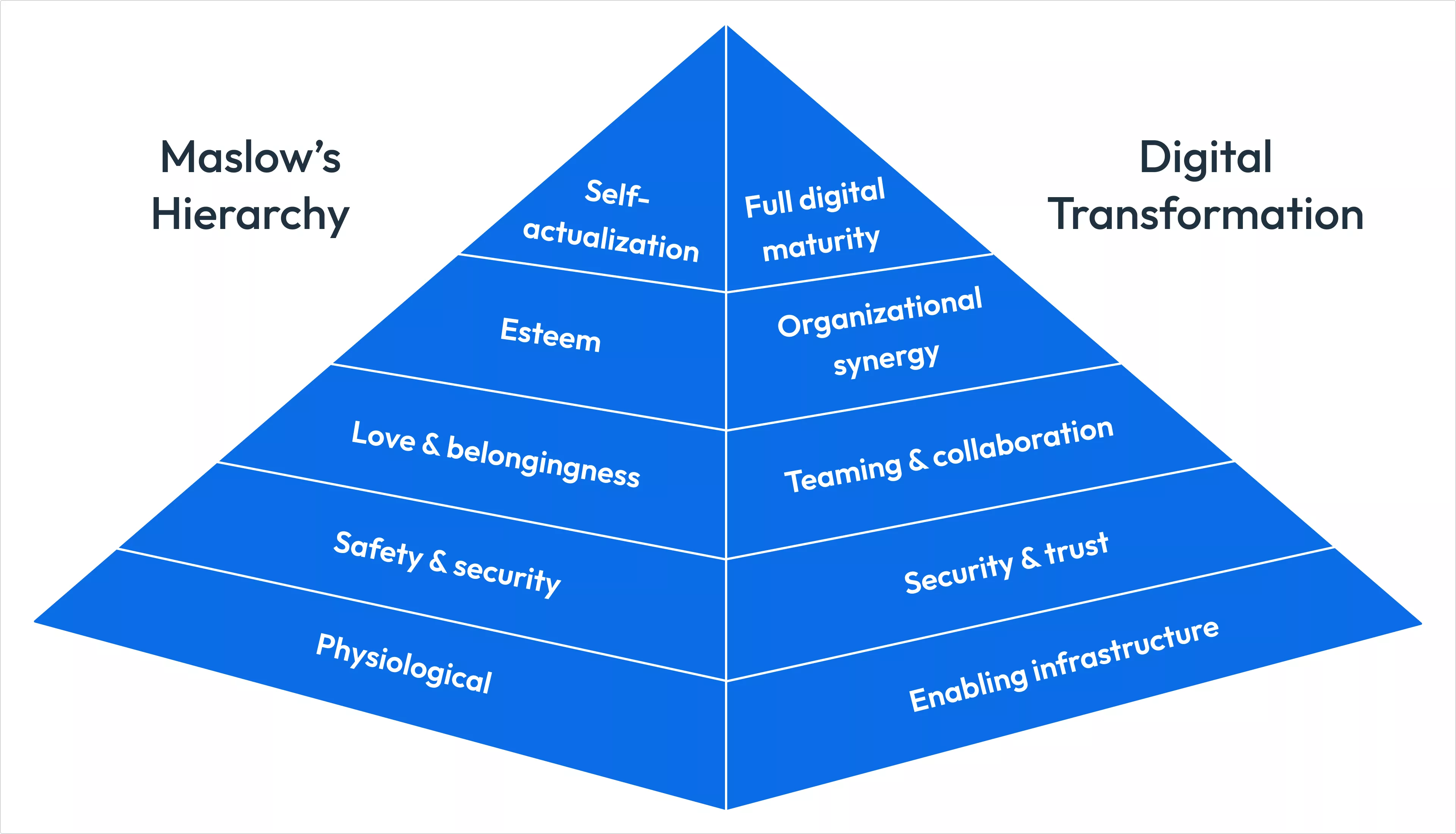

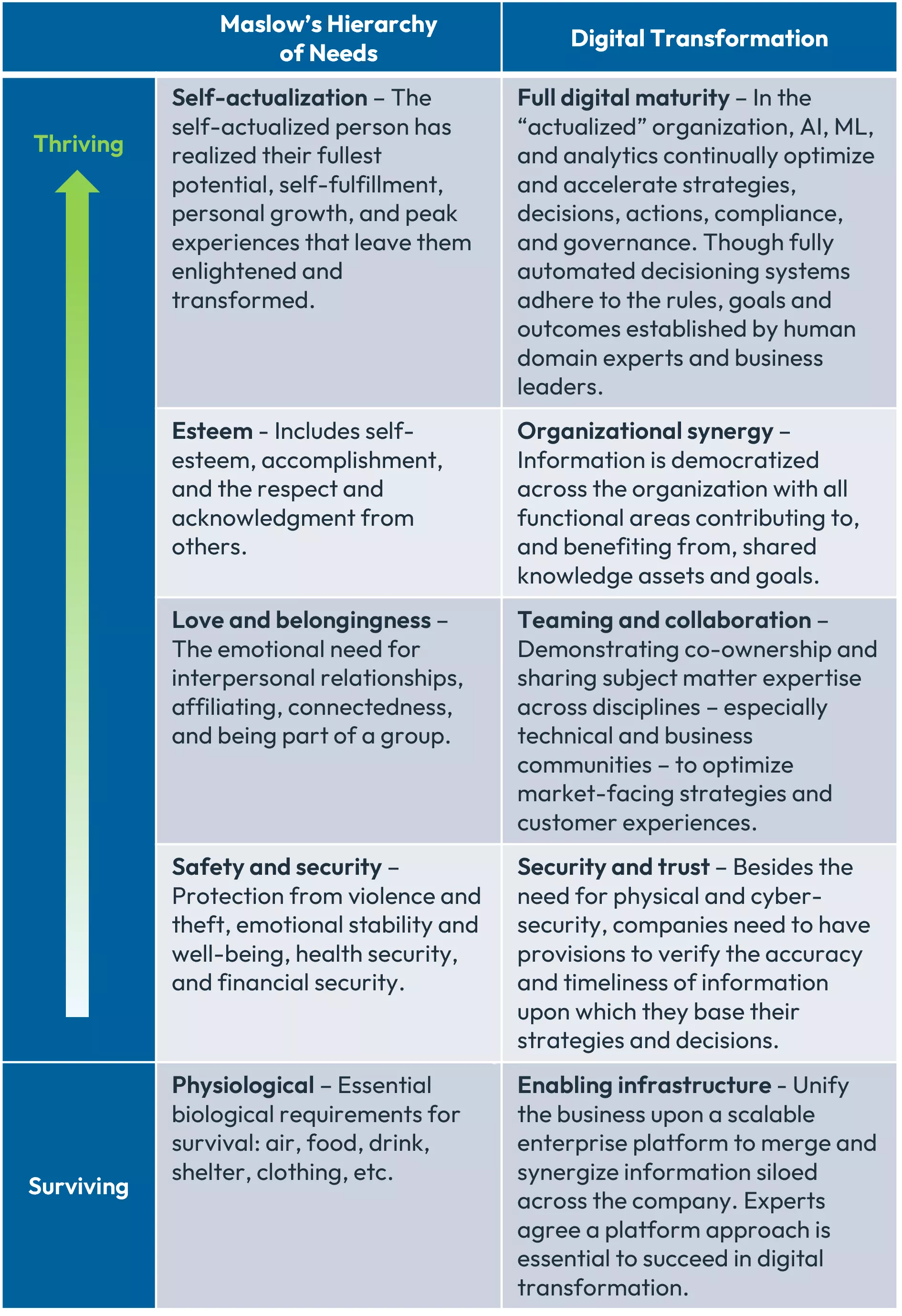

It’s not in contrast to Maslow’s Hierarchy of Wants. Anybody who’s ever taken a psychology course is accustomed to Abraham Maslow and his well-known five-level pyramid: the height of efficiency is “self-actualization,” which represents your fullest potential – a uncommon and troublesome state to unlock.

Maslow’s Hierarchy is a becoming metaphor for attaining your digital transformation: 91% of firms –nearly all monetary establishments and most insurers, telcos, retailers, and leaders in different industries — have a digital transformation technique in place. However only a few declare to have actualized their digital transformation potential: they get caught someplace alongside the best way to the highest because of the complexity of digital banking and insurance coverage. Give it some thought this fashion:

In both case, failure to achieve the highest of the pyramid is the results of not mastering lower-level levels alongside the best way. Simply as you’ll be able to’t obtain self-actualization for those who lack security and safety, monetary establishments and insurers can’t obtain digital transformation if workers can’t collaborate, construct synergy, and make buyer experiences their shared prime precedence for compelling digital banking and insurance coverage methods. This stumbling block is why fintech and insurtech upstarts are thriving.

From “Digital Transformation” to “Digital Actualization”

Within the case of digital transformation, monetary companies and insurance coverage firms should begin on the backside stage and solidify their capabilities earlier than they will graduate to the following stage. And so they can’t purchase their means there: IDC projected that firms would make investments $10 trillion in digital transformation by 2025, however the composite estimate from McKinsey, Boston Consulting Group , KPMG and Bain & Firm discovered that simply 18% would obtain their digital transformation targets.

The top targets of digital transformation within the banking business are to extend income and enhance effectivity ratio in banking (and improve income and enhance mixed ratio in insurance coverage.) This happens once they achieve making a customer-centric tradition that aligns individuals, processes, and expertise from throughout the enterprise, and focuses them on the frequent purpose: creating compelling, hyper-personalized buyer experiences that draw upon the group’s full portfolio.

When achieved, this shared utilized data is usually referred to as an “enterprise intelligence community,” the enterprise equal of self-actualization. If you’re new to the idea of an enterprise intelligence community within the context of digital transformation, right here’s what every of these phrases imply:

Enterprise: All data throughout your group and past is synergized and mobilized for customer-centric motion in real-time, wherever, each time, and nevertheless it’s wanted.Intelligence: Synthetic Intelligence, machine studying, analytics, and enterprise data contextualize, optimize, and memorialize each shred of knowledge, leading to iteratively smarter, personalised buyer choices.Community: At each node of interplay between everybody from inside workers to your entire buyer touchpoint throughout all channels, making certain pre-validated next-best-actions are standing by to make sure pleasant person experiences, elevated satisfaction, higher retention, and a better share-of-wallet.

Thus, an enterprise intelligence community empowers monetary companies and insurance coverage corporations to make ever-smarter, ever-faster, and ever more-profitable enterprise choices, wherever and each time information might be leveraged to achieve sustained aggressive benefit… the last word purpose of digital transformation.

It empowers these in monetary companies and insurance coverage corporations to foretell, analyze, and optimize buyer interactions; giving them the flexibility to make higher buyer choices in real-time, leveraging information from throughout the enterprise utilizing superior analytics, choice modeling, and AI… all working synergistically in an open and extensible platform to concurrently rework the client expertise and advance the corporate’s purpose of accelerating time-to-value in digital banking and insurance coverage in a fashion that fintech and insuretech rivals can’t.

Executed in correct sequence, the steps described above present a superb course heading for these chargeable for planning their firm’s digital transformation technique within the banking business or insurance coverage. Every firm’s start line, journey, and end line is as distinctive as a fingerprint… however with planning and persistence, each firm has a path to the apex.

And getting there’ll do wonders in your self-actualization.

Study How FICO Platform Can Energy Your Digital Transformation

[ad_2]

Source link